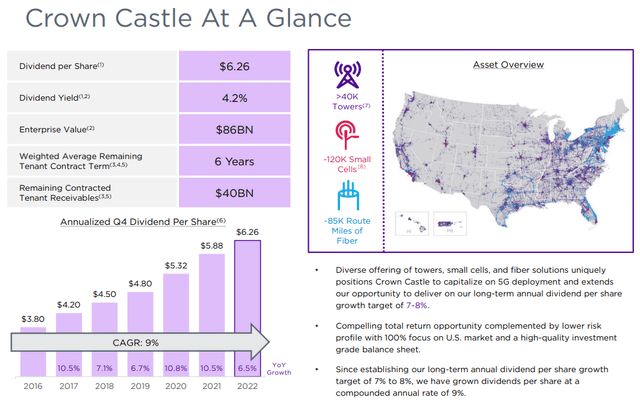

Image: Crown Castle has grown its dividend payout at a compound annual growth rate of ~9% during the past several years. Image Source: Crown Castle

By Brian Nelson, CFA

Cell towers and self-storage. That’s the way we like it when it comes to REITs. In the self-storage space, Extra Space Storage (EXR) is expected to tie the knot with Life Storage (LSI), while cell tower operators continue to benefit from robust demand for the increased connectivity and the rollout of 5G. Tower operator Crown Castle (CCI) reported first-quarter 2023 results April 19 that showed site rental revenues advance 3% on a year-over-year basis in the quarter, while adjusted funds from operations per share bumped 2% higher during the period. The REIT remains well-positioned to benefit from small cell recurring rental revenue growth driven by continued robust mobile data demand, which continues to cause wireless congestion across major U.S. networks.

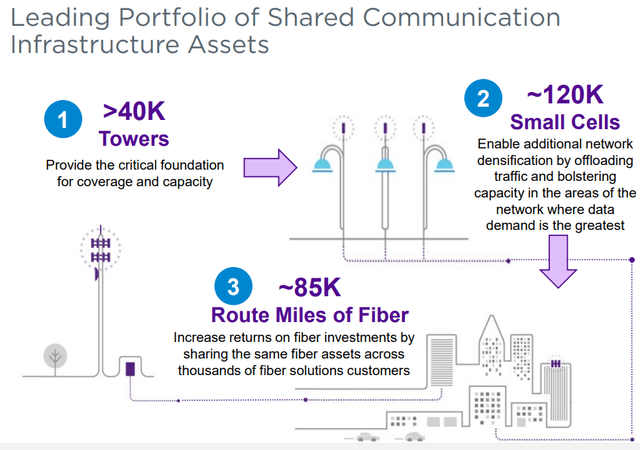

Image: Crown Castle has a strong communications infrastructure asset portfolio that throws off lots of operating cash flow. Image Source: Crown Castle

Mobile usage continues to be the big story when it comes to communications infrastructure entities such as Crown Castle, American Tower (AMT), and SBA Communications (SBAC). These companies lease space on their towers under long-term contracts and strive to add more tenants to each of their towers over time in order to drive increased cash flow with little need for incremental investment. The tower operator business model is fantastic in this regard, as operating cash flow is robust while capital spending isn’t as intensive. Maintenance capex for towers is less than 1% of revenue and about 1% of revenue for small cells.

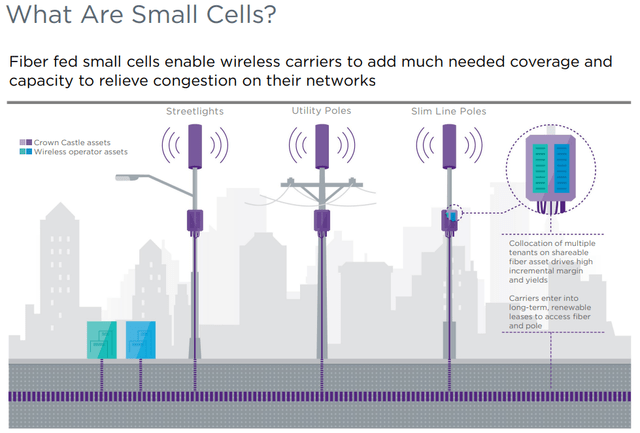

According to Crown Castle, wireless data demand in the U.S. is anticipated to advance at a 25% annual clip through 2027 as major U.S. carriers such as T-Mobile (TMUS), AT&T (T) and Verizon (VZ) Wireless add more spectrum and densify their networks with additional small cell sites. Small cells help to offload data from the towers in major congested areas and can often be found on utility poles and streetlights. As consumers continue to use more and more data on their devices in major metropolitan areas–whether for mobile entertainment, remote working, tele-health and the like–the need for more macro towers and more small cells becomes a natural extension.

Image: Additions of small cells will help alleviate congested wireless networks. Image Source: Crown Castle

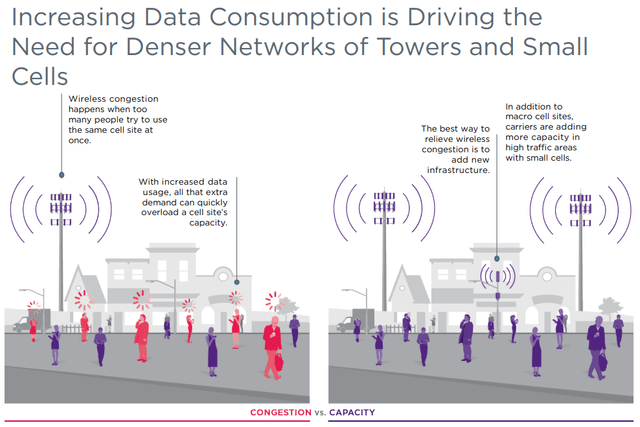

According to the CTIA Annual Survey per Crown Castle, growth for U.S. outdoor small cells could equate to 15%-30% per annum. Not only does Crown Castle benefit from favorable long-term secular growth trends in this regard, but the REIT also has contracted price escalators on the majority of its revenue, too. For towers, this escalator runs at ~3% per year, while it stands at ~1.5% per year for small cells. The following image is illustrative of how new macro cell sites and small cells are added to address wireless congestion. In the most simplistic sense, more towers and more small cells required by major U.S. carriers translates into more monthly rental revenue for Crown Castle.

Image: More towers and more small cells translate into more recurring rental revenue for Crown Castle. Image Source: Crown Castle

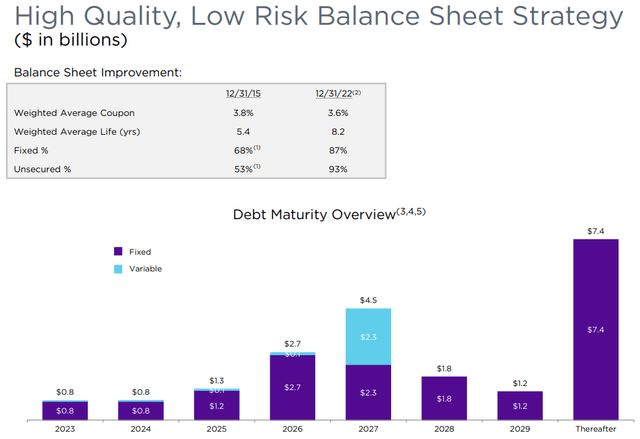

Crown Castle continues to work through the challenges of a higher interest-rate environment and Sprint cancellations (non-renewals) that resulted from the T-Mobile/Sprint network consolidation years ago. The impact from the Sprint cancellations will continue into 2024 and 2025, but the REIT’s reaffirmed full-year 2023 outlook remains strong.

Site rental revenues are expected to increase 4% in 2023 at Crown Castle, while both adjusted EBITDA and adjusted funds from operations per share are expected to jump 3%, the latter to $7.63 at the midpoint of the REIT’s guidance range. This implies meaningful coverage of its dividend payout, which stands at $6.26 per share on an annualized basis.

The executive team noted that Crown Castle’s dividend growth in the coming years may be less than its 7%-8% annual target due to a difficult operating environment, but C-suite believes its diversified portfolio is well positioned to achieve its payout growth targets in the longer run. According to Crown Castle, “the addition of one small cell tenant, or 2-3 small cell nodes per mile, supports (its) long-term annual dividend per share growth target of 7%-8% (Company Overview, February 2023).”

Image: Crown Castle has a massive net debt position, but as long as operating cash flow remains robust, its asset-light operating model speaks to the REIT’s financial strength. Image Source: Crown Castle

Crown Castle has a rather large $22.1 billion net debt position, but its adjusted free cash flow generation is phenomenal. During the first quarter of 2023, Crown Castle hauled in $606 million in operating cash flow, while it shed $341 million in capital expenditures, with only $15 million sustaining (or maintenance) capital spending (the balance being discretionary). Crown Castle remains one of our favorite income ideas thanks in part to its free-cash-flow rich, asset-light, contractual recurring revenue business model that is tied to long-term secular growth trends in mobile device data usage. The REIT’s forward estimated dividend yield stands at ~5%.

NOW READ: What Causes Fair Value Estimates to Change?

—–

Did You Know? The Dividend Cushion ratio has done a fantastic job both in identifying strong dividend paying companies and anticipating dividend cuts, “Efficacy of the Dividend Cushion Ratio.

Energy pipeline MLPs have significantly reduced their capital-market dependency risks during the past several years. Read more here: Energy Pipelines: What a Difference A Few Years Have Made!

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.