Image Source: Extra Space Storage

By Brian Nelson, CFA

It would seem that Life Storage (LSI) wants nothing to do with Public Storage (PSA), first refusing to negotiate with Public Storage regarding its proposal to merge, then rolling out a revised severance package for its CEO, CFO and COO on March 17, and now most recently announcing that it would tie the knot with Extra Space Storage (EXR) on April 3. We walked through the background of Public Storage’s overture to merge with Life Storage in the March edition (pdf) of the High Yield Dividend Newsletter, and frankly, we’re a bit puzzled by LSI’s behavior.

We’re not sure what Public Storage’s next move will be at this point – whether they will raise their offer for LSI and stay “hostile” or just walk away – but the rather erratic behavior from Life Storage’s executive suite has been rather puzzling given that a tie-up with PSA seemed to be something to work toward. Regardless, Life Storage’s stock is up nearly 40% so far year-to-date, and we can’t complain. Along with Public Storage, Life Storage’s stock is included as an idea in the High Yield Dividend Newsletter portfolio, but it may not be for much longer.

Image Source: Extra Space Storage

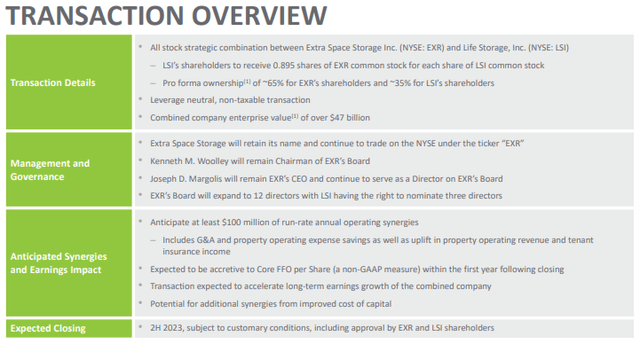

According to the proposed tie-up of Extra Space Storage and Life Storage, shareholders of LSI will receive 0.8950 of Extra Space share for each share of LSI they own, which puts the deal price at ~$146 per share, based on closing prices at the end of the first quarter of this year. At the time that Public Storage made its overture for LSI back in mid-February, the transaction was valued at ~$129 per share, so the EXR proposed take-out price is a rather large premium relative to the original PSA offer. We’re not sure that PSA would up its offer to the high $140s to woo LSI shareholders, and we’re not sure it should either.

If Extra Space Storage does end up winning LSI’s assets at a premium price, we think it’s the quintessential definition of a winner’s curse. Sure, LSI is a great company, but the price that EXR is bidding for their assets is rather exorbitant, and we think LSI shareholders should take the money and run. Right now, LSI’s shares are trading at ~$134 each, a discount to the original offer price due in part to market movements. As for Public Storage, we’re not sure that the LSI saga is done yet, and we can’t rule out possible interest by PSA in other self-storage providers, including CubeSmart (CUBE) and National Storage Affiliates (NSA).

Public Storage recently boosted its dividend payout 50%, to $3.00 per share (PSA shares yield ~4.2% on a forward estimated basis), and the smart move for PSA may be just to walk away from the LSI saga and put it behind the team. Public Storage’s shares are up 5%+ year-to-date, which isn’t bad, and we’ll be looking to remove Life Storage from the High Yield Dividend Newsletter portfolio soon, given its massive share-price run so far in 2023. We continue to follow developments in the self-storage space closely.

NOW READ: The Impact Rising Interest Rates Have on Equity REITs

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.