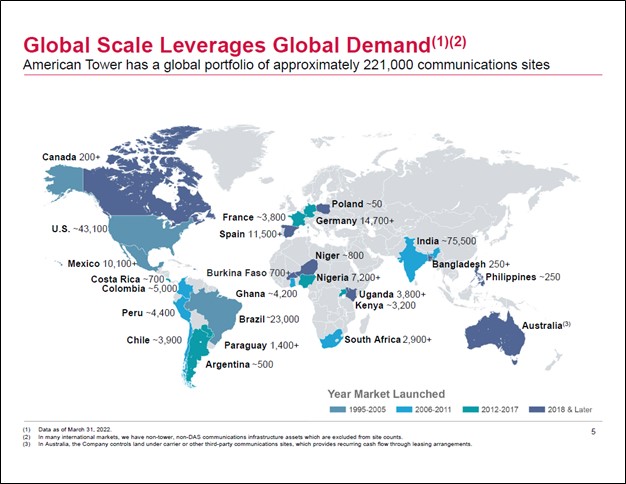

Image Shown: An overview of American Tower Corporation’s global asset base. Image Source: American Tower Corporation – First Quarter of 2022 IR Earnings Presentation

By Callum Turcan

American Tower Corporation (AMT) is a real estate investment trust (‘REIT’) with a global portfolio of ~221,000 multi-tenant communications properties. We include American Tower as an idea in the High Yield Dividend Newsletter portfolio as its dividend growth track record and outlook are rock-solid. Shares of AMT yield ~2.3% as of this writing. Historically, the REIT has generated substantial “excess” free cash flows (after fully covering its total distribution obligations). Looking ahead, American Tower should continue to be a cash flow cow, highlighting one of the reasons we are big fans of the REIT.

Financial Overview

In 2021, American Tower generated $3.4 billion in free cash flow and spent $2.5 billion covering its total distribution obligations (‘distributions to noncontrolling interest holders’ plus ‘distributions paid on common stock’), allowing for over $0.9 billion in excess free cash flow. The REIT also generated excess free cash flows in 2019 ($1.1 billion) and 2020 ($0.9 billion). Please note that American Tower is a highly-acquisitive entity and spent around $26.1 billion in total on acquisitions from 2019-2021.

A combination of the REIT’s meaningful total distribution obligations, sizable net debt load, and growth ambitions makes American Tower a capital-market dependent entity. The REIT had $43.5 billion in total debt on hand, inclusive of short-term debt, at the end of March 2022 along with sizable total operating lease liabilities as well.

Its $1.9 billion in cash and cash equivalents position on hand at the end of March 2022 along with the undrawn portion of its $6.0 billion multi-currency revolving credit facility due June 2025 (had $5.2 billion drawn against it at the end of March 2022) and $4.0 billion revolving credit facility due January 2027 (had $2.6 billion drawn against it at the end of March 2022) provides American Tower ample access to liquidity to meet its near-term funding needs.

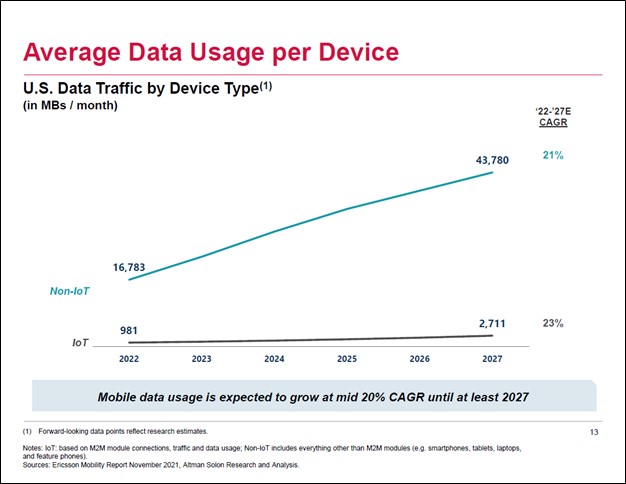

In our view, American Tower should retain access to capital markets at attractive rates going forward. The REIT has a strong cash flow profile and an investment grade credit rating (Baa3/BBB-/BBB+) with stable outlooks. American Tower’s growth outlook is quite bright due to the secular tailwinds supporting data consumption demand growth around the globe, which is reflected in part in its recent guidance boost.

Image Shown: American Tower highlights the forecasted growth in data consumption demand in the US, citing third-party sources, that support its promising cash flow growth outlook. Image Source: American Tower – First Quarter of 2022 IR Earnings Presentation

Earnings and Guidance Update

On April 27, American Tower reported first quarter 2022 earnings that beat both consensus top- and bottom-line estimates. Its GAAP revenues grew 23% year-over-year (total property revenues were up 22%), its non-GAAP adjusted EBITDA rose 13%, and its non-GAAP adjusted funds from operations (‘AFFO’) attributable to American Tower shareholders rose 6%. American Tower benefited from 10% year-over-year total tenant billings growth, including 3% organic tenant billings growth (made possible through its meaningful pricing power).

For reference, this is how American Tower defines its various billings metrics according to its latest earnings press release:

Tenant Billings: The majority of the Company’s revenue is generated from non-cancellable, long-term tenant leases. Revenue from Tenant Billings reflects several key aspects of the Company’s real estate business: (i) “colocations/amendments” reflects new tenant leases for space on existing sites and amendments to existing leases to add additional tenant equipment; (ii) “escalations” reflects contractual increases in billing rates, which are typically tied to fixed percentages or a variable percentage based on a consumer price index; (iii) “cancellations” reflects the impact of tenant lease terminations or non-renewals or, in limited circumstances, when the lease rates on existing leases are reduced; and (iv) “new sites” reflects the impact of new property construction and acquisitions.

New Site Tenant Billings: Day-one Tenant Billings associated with sites that have been built or acquired since the beginning of the prior-year period. Incremental colocations/amendments, escalations or cancellations that occur on these sites after the date of their addition to our portfolio are not included in New Site Tenant Billings. The Company believes providing New Site Tenant Billings enhances an investor’s ability to analyze the Company’s existing real estate portfolio growth as well as its development program growth, as the Company’s construction and acquisition activities can drive variability in growth rates from period to period.

Organic Tenant Billings: Tenant Billings on sites that the Company has owned since the beginning of the prior-year period, as well as Tenant Billings activity on new sites that occurred after the date of their addition to the Company’s portfolio.

The REIT raised its outlook for 2022 in conjunction with its strong earnings report. At the midpoint of its April 2022 guidance, American Tower expects its total property revenue will grow 14.0% year-over-year (versus 13.2% previously), its adjusted EBITDA will grow by 10.5% (versus 9.6% previously), and that its AFFO attributable to American Tower shareholders will grow by 7.6% (versus 7.3% previously). It kept its full year capital expenditure guidance the same at $2.0-$2.1 billion for 2022, up from $1.4 billion in 2021, though still at levels that should enable American Tower to generate substantial free cash flows this year.

Please note that in late December 2021, American Tower completed its ~$10.1 billion acquisition of data center operator CoreSite Realty. The deal increased American Tower’s capital expenditure requirements due to the need to integrate CoreSite Realty’s operations into its own, while also opening up ample growth opportunities as well. American Tower should benefit from the extensive interconnection operations CoreSite Realty had already established before the deal closed.

Its acquisition of CoreSight Realty is partially responsible for its strong guidance for 2022, though there is more to the story here. American Tower forecasts that it will generate approximately 6%-7% total tenant billings growth in 2022 over 2021 levels, including ~3% organic tenant billings growth and ~3%-4% new site tenant billings growth.

Many of its growth opportunities are international, with American Tower guiding for roughly 6% organic tenant billings growth at this part of its business versus just ~1% at its U.S. and Canadian operations on an annual basis. Additionally, American Tower is guiding for around 10% new site tenant billings growth at its international operations this year versus marginal growth at its U.S. and Canadian operations on an annual basis. Please note that the REIT kept its billings guidance the same as its forecasts put out in February 2022.

Concluding Thoughts

On May 19, American Tower announced a 2% sequential increase in its quarterly dividend, maintaining its nice streak of sequential quarterly dividend boosts since becoming a REIT in 2012. For the payout covering the second quarter of 2021, American Tower’s dividend stood at $1.27 per share, which has since grown to $1.43 per share with room for upside.

We are big fans of American Tower’s bright growth outlook, stellar excess free cash flow generating abilities, pricing power, and strong dividend growth track record. There is ample room for American Tower to continue boosting its payout alongside its growing AFFO per share going forward. We continue to like American Tower as an idea in the High Yield Dividend Newsletter portfolio.

—–

Real Estate Investment Trusts (REITs) Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Related: MTNOY, VNQ, UNIT, DBRG, VPN

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. American Tower Corporation (AMT), CubeSmart (CUBE), Life Storage Inc (LSI), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.