Image Shown: Public Storage, a self-storage REIT that is included as an idea in our High Yield Dividend Newsletter portfolio, is a stellar cash flow generator with a bright growth outlook. We are huge fans of the self-storage REIT industry, particularly in the US, due to the ability of companies operating in this space to fully cover their total dividend obligations with their free cash flows. Image Source: Public Storage – March 2022 IR Presentation

By Callum Turcan

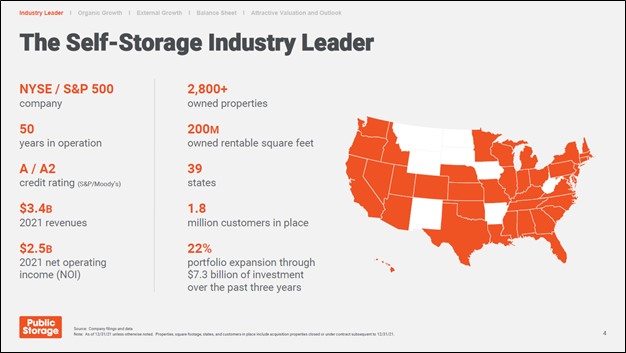

The self-storage industry is an attractive space for investors seeking income generating opportunities, particularly real estate investment trusts (‘REITs’) with a sizable presence in the U.S. market. The self-storage REIT owns economic interests in 2,800+ self-storage properties across the US. Public Storage is a cash flow generating powerhouse that historically has fully covered its total dividend obligations with its free cash flows. Its promising growth outlook and strong financial position underpins the REIT’s dividend strength. Shares of PSA yield ~2.2% as of this writing.

Overview

Beyond its self-storage property holdings in the U.S., Public Storage also offers management services for third-party self-storage properties. At the end of December 2021, this management platform covered over 90 properties with ~60 additional facilities under contract (including properties that were under construction) that will eventually be managed by this program. More recently, Public Storage has placed a great emphasis on growing this part of its business as having a sizable third-party management program provides REITs like Public Storage with a large potential acquisition pipeline along with key insights into how self-storage facilities are performing in different markets.

At the end of last year, Public Storage owned a ~41% equity stake in PS Business Parks Inc (PSB), a REIT focused on multi-tenant industrial, industrial-flex, and corporate offices in the U.S. (in the West Coast, East Coast, and in Texas). Public Storage also owned a ~35% interest in Shurgard Self Storage SA at the end of December 2021, which owned and operated 250+ self-storage facilities in Western Europe under the Shurgard brand.

Some of Public Storage’s other operations include a small specialty reinsurance business. Its self-storage customers have the option of taking out insurance policies from third-party insurance firms that protect those customers from certain losses of goods stored at Public Storage’s owned and operated self-storage facilities and those managed by its third-party program. A wholly-owned subsidiary of Public Storage fully reinsures those policies, though Public Storage has entered into insurance agreements with third-parties to limit its exposure to potential losses on this front under certain conditions. Public Storage also sells relevant merchandise such as cardboard boxes and locks at its stores.

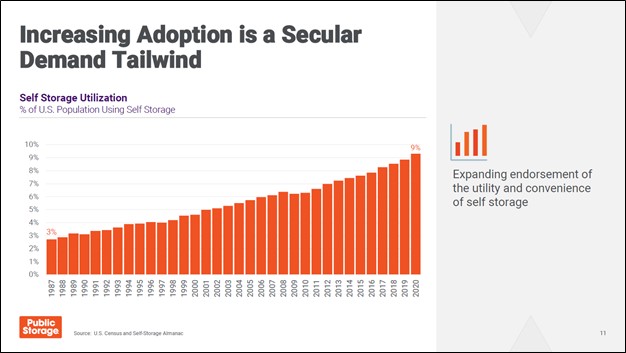

Secular Tailwinds

Growth in U.S. housing prices and rents has encouraged a greater number of households to maximize their living space in an economical manner in recent decades, a trend that in our view has long legs. The percentage of the US population using self-storage services grew from 3% in 1987 to 9% in 2020, according to third-party data from the U.S. Census and Self-Storage Almanac cited by Public Storage. By capitalizing on a powerhouse secular tailwind, Public Storage’s growth runway has become immense.

Image Shown: Citing third-party sources, Public Storage showcases the growing adoption of self-storage services by the US population from the 1980s to 2020. There is ample room for this trend to continue going forward, in our view, especially in the wake of booming housing prices and rents in recent years. Image Source: Public Storage – May 2021 Investor Day Presentation

Self-storage services represent a relatively small portion of the average monthly household budget while providing an incredibly valuable service. Raising the rental rates of these services without running into major customer churn problems is a relatively easy endeavor, as compared to raising the prices of goods or services that represent a much larger slice of the average household’s monthly budget (such as housing/rent costs or grocery expenses).

Innovation

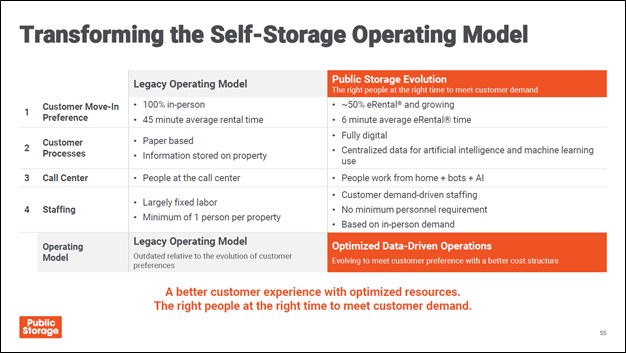

Public Storage sees ample room to improve its operations and ultimately its financial performance by taking advantage of its digital initiatives. For instance, Public Storage’s eRental program was launched in November 2021 and offers its customers contactless move-in options where most of the administrative tasks are completed online (including signing the digital lease). Investing in digital property access systems so customers can use their smartphones to enter self-storage facilities and developing a comprehensive mobile app (that was launched in December 2020) to keep everything under one platform supported Public Storage’s efforts on this front.

Looking ahead, Public Storage is working on further optimizing its customer care and customer relations operations. That includes rolling out remote customer care centers at its self-storage properties with digital interfaces that can assist in a variety of tasks while also enabling customers to video conference with remote customer service personnel. AI and chatbot investments are being pursued to answer customer questions online to limit the need to run large and often expensive call center operations.

Image Shown: Public Storage has placed a great emphasis on its digital initiatives in recent years. Image Source: Public Storage – March 2022 IR Presentation

Pivoting to its marketing strategies, Public Storage expects ~95% of its marketing budget will now go towards digital advertising campaigns. Targeted digital advertising should enable Public Storage to get more bang for its buck.

These initiatives should free up time for Public Storage’s workforce to perform other endeavors. Shifting towards customer processes that are fully digital speeds up move-in times, according to Public Storage, and better enables the company to match its staffing levels with actual demand. If done properly, there is room for Public Storage to reduce its workforce requirements while improving the customer service experience. Over time, these digital initiatives and other operational improvements should steadily improve Public Storage’s cost structure around the margins, which in turn supports the outlook for its same-store net operating income (‘NOI’) growth.

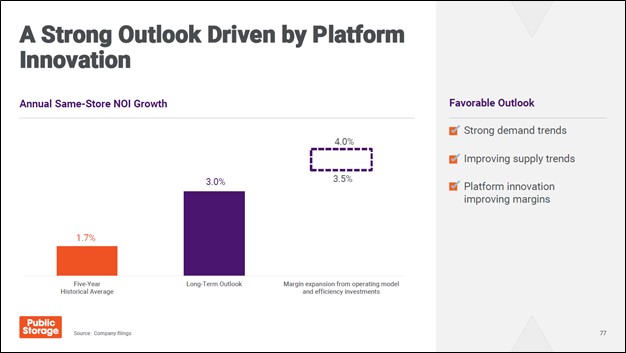

Image Shown: Public Storage is leaning on its digital initiatives to improve its operations and ultimately its bottom-line. Image Source: Public Storage – May 2021 Investor Day Presentation

Growing adoption of self-storage services, favorable supply-demand dynamics, and efforts to use digital initiatives to improve productivity and enhance the customer experience are forecasted to drive Public Storage’s same-store NOI higher 3.0% annually over the long haul with room for upside. The REIT notes that “margin expansion from operating model and efficiency investments” could lead to its long-term annual same-store NOI growth climbing to 3.5%-4.0% according to its May 2021 investor day presentation.

Part of that growth forecast includes the expected uplift from Public Storage’s $0.6 billion ‘Property of Tomorrow’ program that seeks to modernize its property portfolio by investing in “LED lighting, solar power generation, low-water irrigation, higher-efficiency offices, enhanced digital security, and plenty of easily recognized orange signage” according to its 2021 annual shareholder letter. By 2025, the Property of Tomorrow program is expected to be completed.

Image Shown: Public Storage forecasts that its annual same-store NOI growth rate will come in quite strong going forward. Image Source: Public Storage – May 2021 Investor Day Presentation

Financial Update

In 2021, Public Storage reported a 15.0% annual increase in its same-store NOI as the REIT benefited from a 10.5% increase in its same-store revenues and a reduction in its direct same-store operating expenses. For reference, Public Storage reported a 2.1% annual decline in its same-store NOI in 2020 during the initial phases of the coronavirus (‘COVID-19’) pandemic as its same-store revenues declined 1.0% and its direct same-store operating expenses rose by 2.9%. The REIT’s financial performance snapped back in 2021 in a big way, which we appreciate.

Public Storage’s core funds from operations (‘FFO’), an industry-specific non-GAAP metric that can be useful in gauging the trajectory of a REIT’s financial performance, rose 22% year-over-year in 2021 to reach $12.93 per share. The REIT’s annual payout sits at $8.00 per share, where it has been over the past several years, indicating Public Storage had a payout ratio (dividends per share divided by core FFO per share) of ~62% in 2021. In our view, there is ample room for Public Storage to grow its dividend in a sustainable manner while continuing to invest in the business going forward.

Last year, Public Storage generated $2.0 billion in free cash flow while spending $1.6 billion covering its total dividend obligations. The REIT spent $5.0 billion on acquisitions in 2021, activities that were primarily funded by the balance sheet. We caution that Public Storage, while a stellar free cash flow generator, remains a capital market dependent entity. Public Storage needs to maintain constant access to debt and equity markets (ideally at attractive rates) to refinance maturing debt and to fund its growth story while continuing to make good on its total dividend obligations. At the end of December 2021, Public Storage had a net debt load of $6.7 billion (inclusive of short-term debt).

Its ‘A-rated’ investment grade credit rating, rock-solid financials, bright growth outlook, and the strong performance of its equity of late indicates Public Storage should be able to continue tapping capital markets at attractive rates going forward. Recent capital market activities have also been quite favorable. According to its 2021 annual shareholder letter:

In 2021, [Public Storage] issued $5.1 billion of unsecured notes (including $828 million dollar equivalent of euro-denominated notes) at an average rate of 1.4% to fund external growth. We also issued $1.2 billion of preferred equity at an average rate of 4.0% to refinance $1.2 billion of existing preferred equity at 5.1%. Our profile and track record allow us to raise capital on attractive terms and our balance sheet is well positioned to fund considerable growth into the future.

At the end of December 2021, Public Storage had $0.7 billion in cash and cash equivalents on hand providing it with ample liquidity to meet its near term funding needs. The REIT also has a $0.5 billion revolving credit line that matures in April 2024 to assist in its funding needs, which was undrawn and had a negligible amount of letters of credit posted against it as of the end of last year.

Image Shown: Public Storage’s financial obligations are manageable. The REIT was at the lower end of its long-term leverage target at the end of December 2021. Image Source: Public Storage – March 2022 IR Presentation

Guidance

During Public Storage’s fourth quarter of 2021 earnings call, management commented on the favorable guidance for 2022 that the REIT issued out in conjunction with the related earnings update (emphasis added, lightly edited):

“We introduced 2022 core FFO guidance with a $15.20 midpoint, representing 17.5% growth from 2021. We’re anticipating another year of strong customer demand for self-storage… leading to same-store revenue growth of 13.5% at the midpoint, roughly in line with second half ‘21 growth levels.

As we look at the components of revenue, occupancy is likely to fall as we move through the year but remain above 2019 levels. Rate will be the strongest driver of performance going forward. Continued strength from move-in rents and existing tenant increased contribution.

Notably, the long-running rent restrictions expired in Los Angeles, adding circa 1.5% to 2% on the full company same-store revenue outlook. Los Angeles is our largest market poised to accelerate with our industry-leading portfolio and team as well as our recently completed capital investments in this market through our Property of Tomorrow program.

On expenses, our expectations are for 6% to 8% expense growth [at its same-store properties], driven primarily by property tax and payroll growth. That leads to [same-store] NOI growth at the midpoint of 15.7%, roughly in line with 2021 strong performance.” — Tom Boyle, SVP and CFO of Public Storage

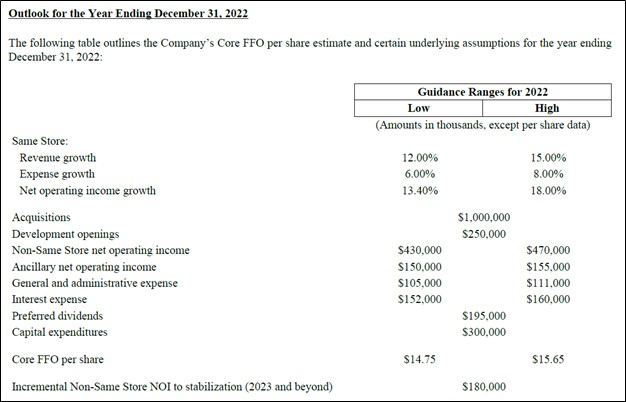

We appreciate that Public Storage expects its strong same-store NOI performance to carry on into 2022 after putting up banner performance in 2021. A combination of pricing strength and managed operating expense growth are forecasted to drive Public Storage’s same-store NOI significantly higher this year, which will positively impact its core FFO per share performance and ultimately its free cash flow performance as well. The upcoming graphic down below highlights Public Storage’s guidance for 2022. Public Storage expects its core FFO per share will climb higher roughly 16% at the midpoint of guidance this year versus 2021 levels.

Image Shown: Public Storage’s outlook for 2022 calls for strong same-store revenue and NOI growth, building on the momentum seen in 2021. The REIT’s core FFO per share is expected to climb higher by double-digits in 2022 versus 2021 levels. Image Source: Public Storage – Fourth Quarter of 2021 Earnings Press Release

Management recently noted that the REIT’s occupancy rates may fall this year versus recent levels but would be above 2019 levels. Last year, Public Storage’s same-store weighted-average occupancy rate on a square foot basis stood at 96.3%, up from 94.5% in 2020. As of the end of December 2021, Public Storage’s same-store occupancy rate on a square foot basis stood at 94.8%, up from 94.2% at the end of December 2020. Please note that it takes time for new or recently upgraded self-storage facilities to achieve “normalized” occupancy rates, which is why looking at the REIT’s same-store performance is key here.

Concluding Thoughts

Public Storage is a tremendous enterprise. Our fair value estimate for Public Storage sits at $356 per share with room for upside as the top end of our fair value estimate range sits at $445 per share. Public Storage’s guidance for 2022 indicates the self-storage REIT expects to keep firing on all cylinders going forward. At the midpoint of its 2022 guidance, the REIT expects to have a dividend payout ratio of ~53% of its core FFO per share at its current annualized payout (which has been kept flat since 2017 as Public Storage stepped up its investments in the business).

The company’s unadjusted Dividend Cushion ratio sits above parity at ~1.35 and its adjusted Dividend Cushion ratio, which takes its ability to tap capital markets into account, sits well above parity at 2.1 earning the REIT a “GOOD” Dividend Safety rating. Public Storage’s Dividend Cushion ratio factors in our expectations that it will resume its payout growth story in the coming years. We continue to be huge fans of Public Storage.

—–

Real Estate Investment Trusts (REITs) Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Tickerized for PSA, PSB, VNQ, and various other REIT-related ETFs and stocks.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Categories Member Articles