Image Source: Salesforce Inc – Fourth Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

Salesforce Inc (CRM) was founded in 1999 as software-as-a-service (‘SaaS’) company built around customer relationship management (‘CRM’) software, initially a version created by its co-founders Marc Benioff, Parker Harris, Frank Dominguez, and Dave Moellenhoff. The firm is headquartered in San Francisco, California.

The company offers software that assists its customers with marketing, customer service, sales, digital commerce, business development, collaboration, analytics, recruitment, and numerous other activities. These offerings aim to improve workplace productivity by streamlining certain functions and automating others. Salesforce provides a comprehensive suite of software solutions designed for businesses and government entities across its Customer 360 platform, while using analytics and AI to discover insights to further generate value for its customers.

Over the two-plus decades Salesforce has been operating, the company has grown into a tech powerhouse by investing heavily in the business and continuously pursuing major acquisitions. Some of Salesforce’s bigger deals (by enterprise value) include acquiring Slack for $27.7 billion in a cash-and-stock deal that closed in July 2021, and buying Tableau for $15.7 billion through an all-stock deal that closed in August 2019.

Currently, co-founder Benioff is CEO and Chairman of Salesforce. The company’s former co-CEO, Keith Block, stepped down from the top job in February 2020 though the press release announcing the move noted Keith Block would remain an advisor to Salesforce’s CEO. Other than Benioff, co-founder Harris still sits on Salesforce’s board of directors and is part of the company’s executive team. Harris “drives technology vision and architecture across Salesforce” according to the firm’s website.

Earnings and Guidance Update

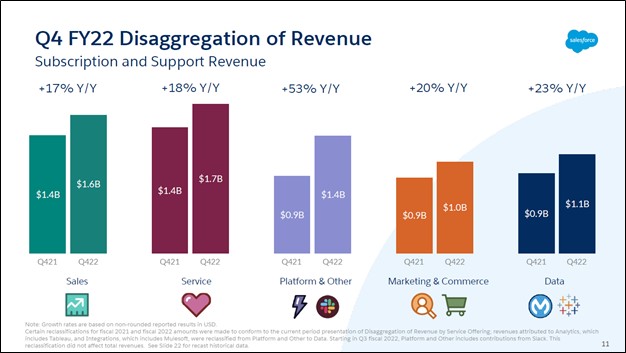

On March 1, Salesforce reported fourth quarter earnings for fiscal 2022 (period ended January 31, 2022) that beat both consensus top- and bottom-line estimates. Geographically speaking, Salesforce reported strong revenue growth across all of its markets as demand for its services remains widespread. The firm generated $7.3 billion in GAAP revenue (up 26% year-over-year) though its GAAP operating income came in negative last fiscal quarter as Salesforce continues to spend heavily on growing its workforce, driving up its operating expenses (R&D, G&A, marketing and sales). Salesforce posted a negligible GAAP net loss last fiscal quarter. The company’s subscription revenue grew nicely across its suite of solutions as one can see in the upcoming graphic down below.

Image Shown: Salesforce experienced strong demand for its software across the board last fiscal quarter. Image Source: Salesforce – Fourth Quarter of Fiscal 2022 IR Earnings Presentation

For all of fiscal 2022, Salesforce generated $26.5 billion in GAAP revenue (up 25% year-over-year) and $0.5 billion in GAAP operating income (up 20% year-over-year), supported by customer wins, robust growth at its subscription sales, and recent acquisitions. Customers are flocking to Salesforce’s offerings to modernize their internal operations. Salesforce’s GAAP net income came in at $1.5 billion last fiscal year, down sharply year-over-year due to a smaller net gain on investment and a corporate tax provision versus a benefit seen in fiscal 2021.

The company’s underlying business has performed exceptionally well of late. Salesforce notes that its adjusted non-GAAP operating margin stood at 18.7% in fiscal 2022, though we caution that this figure involves the firm adding back stock-based compensation along with other adjustments.

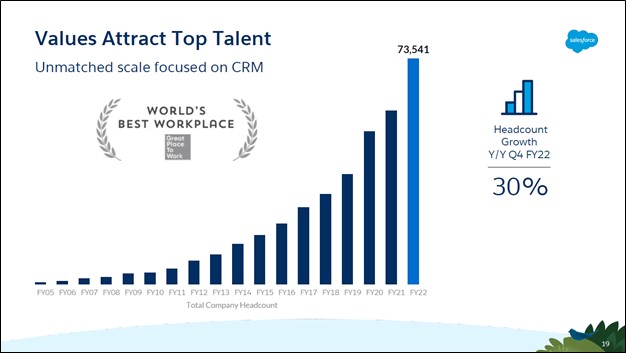

Salesforce’s headcount has grown tremendously in recent years and competition for tech talent in Silicon Valley and elsewhere remains fierce. In turn, Salesforce’s operating expenses have been and will likely continue to grow like a weed for some time. That being said, Salesforce expects its revenue growth will remain robust in the near term. Over the long haul, the company’s growth outlook is underpinned by secular tailwinds, its ability to develop and roll out new offerings, and its pricing power.

Image Shown: Salesforce’s workforce is growing at a rapid pace. Image Source: Salesforce – Fourth Quarter of Fiscal 2022 IR Earnings Presentation

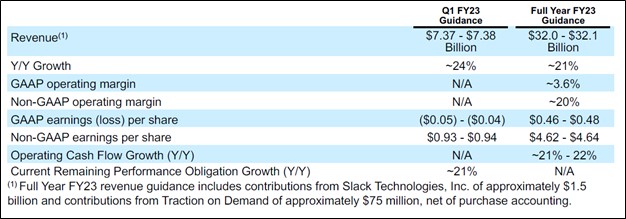

Within the firm’s latest earnings press release, Benioff cited “tremendous demand from customers” when announcing that the company was raising its guidance for fiscal 2023. At the midpoint, Salesforce is now guiding to generate about 21% annual revenue growth this fiscal year with a GAAP operating margin of ~3.6% and a non-GAAP operating margin of ~20%. Its sales growth guidance for the current fiscal quarter indicates the firm is expecting slightly stronger revenue growth in the near term, likely due in part to the uplift provided by its recent acquisition of Slack.

Customer acquisition activities at Slack have progressed quite well of late, with Salesforce’s management team noting that “the number of customers spending $100,000 annually with Slack increased by 46% year-over-year” last fiscal quarter during the firm’s latest earnings call. Integration efforts are ongoing.

Salesforce aims to generate $4.62-$4.64 in non-GAAP adjusted EPS in fiscal 2023, down from $4.78 in fiscal 2022 and $4.92 in fiscal 2021. The historical decline is primarily due to explosive growth in Salesforce’s workforce driving up its operating expenses and moderate increases in its outstanding share count, and a similar story can be said for its forecasted adjusted EPS performance.

Over time, we forecast that Salesforce’s GAAP operating margin will expand meaningfully as there is ample earnings leverage in this business (revenue growth leading to margin expansion via economies of scale). Its GAAP gross margin stood at 73.6% in fiscal 2022. Eventually, Salesforce will see its operating-expense growth cool off as its headcount growth inevitably slows down, though this is not the stated goal in the near term.

Image Shown: Salesforce expects its revenues will continue to grow at a rapid clip in fiscal 2023. Image Source: Salesforce – Fourth Quarter of Fiscal 2022 Earnings Press Release

Pristine Financial Position

What makes Salesforce a rock-solid enterprise is its large recurring revenue streams, with ‘subscription and support’ sales representing ~93% of its total revenues in fiscal 2022. Recurring revenues create cash flow streams that are highly visible, making forecasting the future financial performance of an entity like Salesforce an easier task (and providing a greater amount of confidence in those forecasts), particularly as it concerns the near term trajectory of the company. At the end of fiscal 2022, Salesforce had $22.0 billion in current remaining performance obligations (‘RPOs’) and $43.7 billion in total RPOs, which the company should steadily convert into revenue going forward.

Salesforce generated $5.3 billion in free cash flow in fiscal 2022 (up 29% year-over-year), aided by its modest capital expenditure requirements to maintain a given level of revenues. As an asset-light company, Salesforce is better positioned to generate sizable free cash flows in almost any operating environment, a process that is further strengthened by its enormous subscription revenues. Last fiscal year, Salesforce spent $1.2 billion on ‘repayments of Slack convertible notes, net of capped call proceeds’ but did not repurchase a significant amount of its common stock or pay out a dividend. Salesforce still does not have a dividend program though it has the financial capacity to sustainably fund a payout, as it prefers to invest in the business and pursue acquisitions.

At the end of January 2022, Salesforce had $10.5 billion in cash, cash equivalents, and short-term investments on hand versus $10.6 billion in long-term debt and no short-term debt on the books. The firm’s net debt load is negligible even after Salesforce completed its relatively large acquisition of Slack last fiscal year, which we appreciate.

Management Commentary

During its latest earnings call, Salesforce’s management team noted the following regarding the company’s strong underlying financial performance and customer wins (emphasis added):

“Our portfolio of relevant products serving a broad set of customers and customer needs continues to drive our business performance. A few key highlights from the quarter… our core business continues to perform very, very well. Sales Cloud and Service Cloud are both $6 billion businesses. And in Q4, they grew 17% and 18% year-over-year, respectively.

Our progress in the enterprise continues with our largest deals getting even larger. The number of 7-figure deals signed in Q4 grew 34% year-over-year. And in Q4, the number of 8-figure deals more than doubled.

Our industry products also continued to perform very well. In fact, our largest deal ever, as measured by incremental ARR [annualized recurring revenue], was a financial services win that we signed during the quarter, and 8 of our top 10 deals included an industries product.” — Amy Weaver, President and CFO of Salesforce

Additionally, Salesforce had this to say on MuleSoft, a company that provides integration software during the earnings call (emphasis added):

“I also want to provide an update on MuleSoft, which grew 24% year-over-year during Q4. We continue to realize the benefits of the go-to-market organizational changes we implemented last year. We’re happy with the progress. However, we do not anticipate seeing the full benefit of these changes until the back half of fiscal ’23.” — President and CFO of Salesforce

Salesforce acquired MuleSoft through a $6.5 billion cash-and-stock deal that closed back in May 2018. We appreciate Salesforce’s willingness to shake up its internal structures to drive efficiency gains and potentially improve its financial performance. Historically, Salesforce has done a solid job rolling new companies into its broader operations, though there is always room for improvement.

Additionally, we really appreciate that the company’s revenues are getting “stickier” according to management during Salesforce’s latest earnings call:

“…[During] Q3, we drove attrition — our attrition rate to below 8% for the first time in company history. Now for the second quarter in a row, our attrition is again at an all-time low. Ending Q4 revenue attrition was between 7% to 7.5%.” — President and CFO of Salesforce

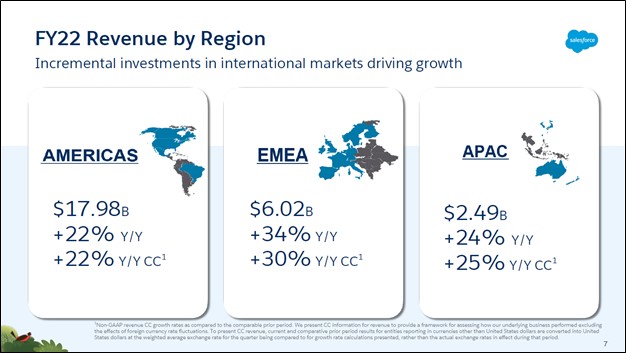

Salesforce was able to boost its guidance for fiscal 2023 during its latest earnings update in part due to its improving ability to retain business. Customers want the comprehensive suite of solutions Salesforce offers as they seek to adapt to obstacles created by the proliferation of e-commerce globally, the transition to hybrid work arrangements, and the lingering effects of the coronavirus (‘COVID-19’) pandemic along with the desire to improve their financial and operational performance by utilizing Salesforce’s software. Everything is going digital, it seems, and Salesforce is well-positioned to meet the complex and evolving needs of its customer base in markets all across the globe, as one can see in the upcoming graphic down below.

Image Shown: Salesforce’s offerings are in high demand. Image Source: Salesforce – Fourth Quarter of Fiscal 2022 IR Earnings Presentation

Concluding Thoughts

We assign Salesforce a fair value estimate of $262 per share based on our discounted cash flow process, well above where shares of CRM are trading at (~$192) as of this writing. Shares of large cap tech companies have sold off alongside broader equity markets in recent weeks in the wake of the Ukraine-Russia crisis, crushing inflationary headwinds (as energy prices surge higher), and rising interest rates.

However, Salesforce remains an attractive entity with stellar free cash flow generating abilities, a decent balance sheet, and a bright growth outlook. At its core, Salesforce runs a lucrative business with ample pricing power, and we see the firm being able to adeptly navigate inflationary headwinds by pushing through meaningful price increases at or above the rate of inflation.

The company’s M&A activity needs to be constantly monitored, and there is always a risk that Salesforce will pursue deals that destroy shareholder value for the sake of growth. Historically, the company’s M&A activity has led to material synergies across its operations and its leadership team has a deep bench. Growth in Salesforce’s workforce will continue to pressure its profitability for the foreseeable future, though its free cash flows should continue to swell higher as it grows its subscription revenues.

There is a lot to like about Salesforce. Its business model is rock-solid, and its recurring revenues are getting even “stickier” as customers are increasingly choosing to stick with Salesforce over its competitors.

Our newsletter portfolios are already overweight large cap tech names with bright growth outlooks, “moaty” characteristics, large free cash flows, and strong balance sheets, so while we think Salesforce can make for a great idea at current levels, the name in the “on deck” circle, so to speak, and we won’t be adding it as an idea to the simulated Best Ideas Newsletter portfolio at this time.

Nevertheless, we think investors should have Salesforce on their radar.

—–

Tickerized for ZEN, FIVN, CRM, NOW, ZM, SNOW, PANW, ZS, CRWD, TENB, VRNS, FTNT, TLS, MNDT, CYBR, WKME, TEAM, WDAY, ADSK, DDOG, VEEV, OKTA, NET, DOCU, HUBS, ZI, PAYC, BILL, CFLT, XM, RNG, DT, NLOK, PTC, FICO, XROLF, CDAY, S, BSY, PCTY, COUP, DBX, AVLR, ASAN, GTLB, MNDY, PCOR, ESTC, PEGA, SMAR, NEWR, PLAN, WK, NTNX, FRSH

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of FB and XLE and is long call options on FB. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portf