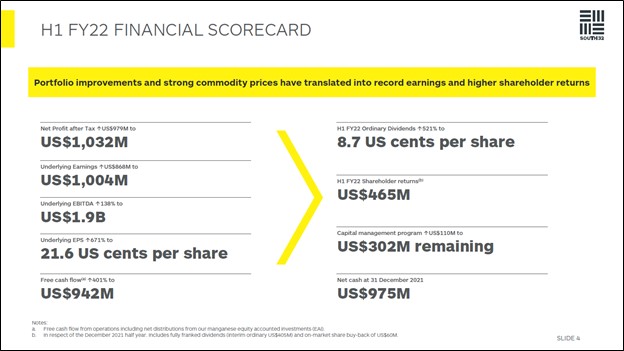

Image Shown: South32, an idea in our ESG Newsletter portfolio and one of our favorite miners, put up tremendous financial performance during the first half of fiscal 2022 as it capitalized on surging realized prices for its commodities sales. Image Source: South32 – First Half of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

Shares of the American depository receipts (‘ADRs’) of one of our favorite miners, South32 (SOUHY), have put up tremendous performance during the past year. According to data provided by Yahoo! Finance, shares of SOUHY are up over 50% during the past year on a price only basis while the S&P 500 (SPY) is up ~9% on a price only basis during this period as of late February 2022.

Back in September 2021, we wrote up our thoughts on South32 for our website (link here), and in November 2021, we covered our thoughts on its acquisition of a sizable economic interest in a Chilean copper and molybdenum mine known as the Sierra Gorda mine (link here). We include South32 as an idea in our ESG Newsletter portfolio (more on that publication here) due to its pivot away from thermal coal and towards commodities that are well-suited to capitalize on the “green energy revolution.” In June 2021, South32 completed its exit from the thermal coal space save for a marginal amount of exposure via operations that primarily produce metallurgical coal (used for steelmaking).

Looking ahead, South32 is focused on building up a portfolio around high-quality nickel, aluminum, alumina, manganese, and zinc assets (these are metals and minerals that are essential for building things such as lithium-ion batteries and electric vehicles) while retaining a meaningful presence in the metallurgical coal space. Please note that includes assets involved in mining and smelting activities. South32 is also moving into the copper mining space for the first time via a pending acquisition and is actively contemplating developing a new mine in Arizona that would produce silver, zinc, and lead. We view South32’s recent portfolio optimization efforts quite favorably.

First, some quick housekeeping items. South32’s fiscal year ends in June and the company reports its financials in accordance with IFRS accounting practices. South32 is based in Perth, Australia, and each ADR represents five ordinary shares, and the company has a variable dividend policy that we caution is influenced by foreign currency movements. Let’s now dig in.

Earnings Update

On February 17, South32 provided an update on its half-year results for fiscal 2022 (period ended December 2021) along with its near term guidance. The company’s revenues grew 32% year-over-year, hitting $4.6 billion, and its underlying EBIT almost quadrupled year-over-year, hitting $1.5 billion during the first half of fiscal 2022. South32 benefited from a huge increase in commodities pricing for minerals and metals, particularly for metallurgic coal, aluminum, alumina, manganese ore, and nickel. Its financial performance also benefited from the firm shedding uneconomical assets in the recent past (such as thermal coal mining operations in South Africa and its economic interest in various non-core smelting operations).

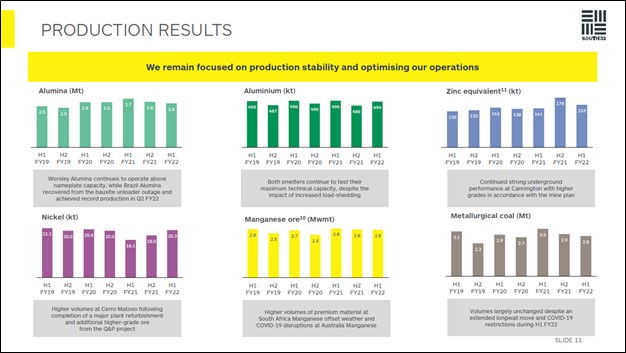

Keeping portfolio optimization activities in mind, South32’s production base was relatively stable on a net basis during the first half of fiscal 2022 versus the same period the prior fiscal year. We appreciate the stable nature of South32’s production base and appreciate the stellar operational execution the Australian miner has put up of late in the face of adverse weather events and headwinds created by the coronavirus (‘COVID-19’) pandemic, including economic lockdown measures enacted to contain the pandemic in regions where South32 operates.

Image Shown: South32’s production base was relatively stable on a net basis during the six month period ended December 2021 versus the same period the prior year. Image Source: South32 – First Half of Fiscal 2022 IR Earnings Presentation

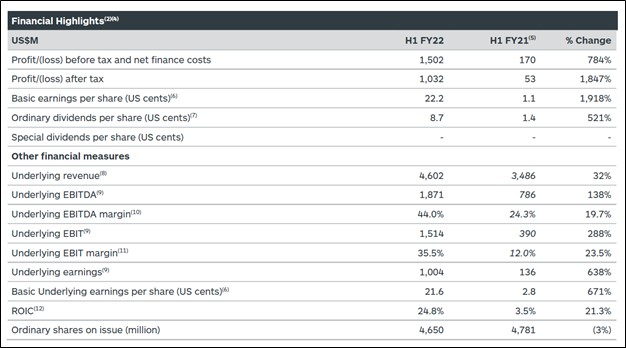

The miner contended with meaningful inflationary headwinds during the first half of fiscal 2022, though the uplift from higher realized sales prices more than offset those hurdles. South32 posted a 33.5% company-wide underlying EBIT margin during the first half of fiscal 2022, up from 12.0% in the same period in fiscal 2021. As calculated by the company, South32’s return on invested capital (‘ROIC’) hit 24.8% during the first half of fiscal 2022 (up sharply year-over-year), an impressive feat. South32 provided a snapshot of its recent financial performance that can be viewed in the upcoming graphic down below.

Image Shown: South32’s bottom-line grew materially during the six month period ended December 2021 versus the same period the prior year, aided by huge increases in commodities pricing. Image Source: South32 – First Half of Fiscal 2022 Earnings and Outlook Update

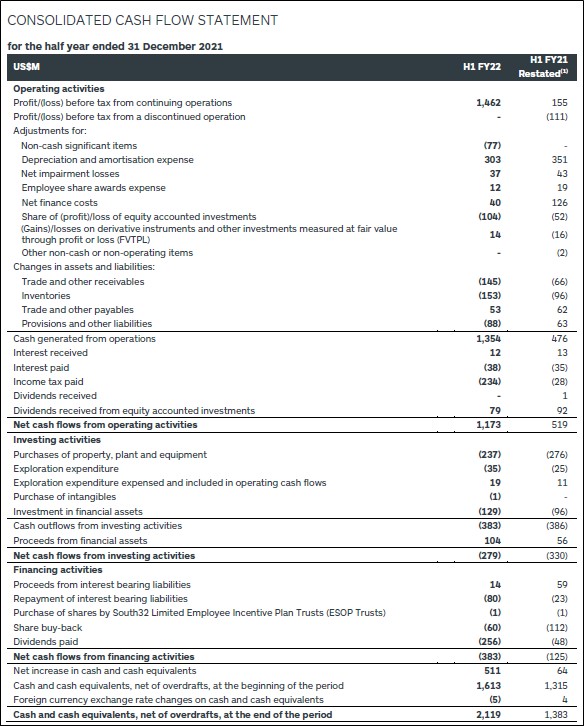

Cash Flow Powerhouse

South32 remained a free cash flow cow during the first half of fiscal 2022. The miner generated $1.2 billion in net cash flow from operations while spending $0.3 billion on its capital expenditures (‘purchases of property, plant and equipment’ plus ‘exploration expenditure’ less ‘exploration expenditure expensed and included in operating cash flows’), which allowed for $0.9 billion in free cash flow during this period. South32’s free cash flows fully covered $0.3 billion in dividend obligations and $0.1 billion in share repurchases during the first half of fiscal 2022.

Image Shown: We are impressed with South32’s free cash flow generating abilities. Image Source: South32 – First Half of Fiscal 2022 Earnings and Outlook Update

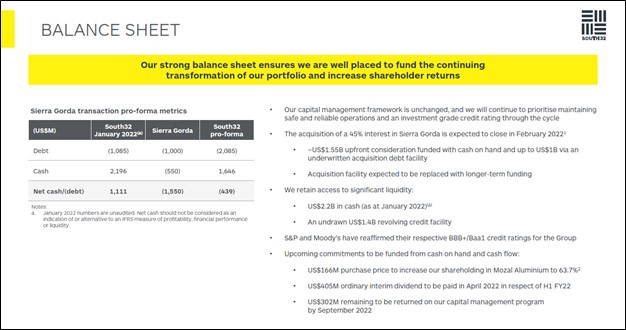

At the end of December 2021, South32 had $2.1 billion in cash and cash equivalents on hand versus $0.4 billion in short-term debt and $0.7 billion in long-term debt. However, as South32 is in the process of acquiring a sizable economic interest in a Sierra Gorda mine in Chile for an upfront cash payment of ~$1.55 billion (along with up to $0.5 billion in future contingent payments if certain milestones are met), the miner’s net cash position will soon flip to a net debt position.

Considering South32’s stellar free cash flow generating abilities and disciplined capital allocation strategies, the miner should be able to quickly rebuild its financial strength, especially in the current commodities pricing environment. According to South32, on a pro forma basis the firm had a net debt position of ~$0.4 billion in January 2022 assuming the Sierra Gorda deal closes as planned, as one can see in the upcoming graphic down below.

Image Shown: After South32’s acquisition of a 45% stake in the Sierra Gorda mine is completed, the miner expects to have a modest net debt position. Image Source: South32 – First Half of Fiscal 2022 IR Earnings Presentation

On a side note, South32 noted in November 2021 that KGHM Polska Miedz (KGHPF) does not intend to exercise its pre-emptive rights to acquire a greater interest in the open-pit Sierra Gorda copper and molybdenum mine in northern Chile. This means that South32’s deal with Sumitomo Metal Mining (SMMYY) and Sumitomo Corporation (SSUMY) to acquire a 45% economic interest in the mine (by acquiring a 45% stake in the joint-venture that operates the mine) is progressing in the right direction. KGHM Polska Miedz will be South32’s joint-venture partner at the Sierra Gorda mine. The transaction is now expected to close in February 2022.

Near Term Guidance

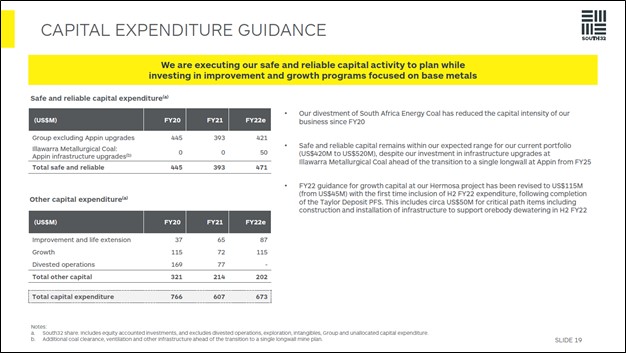

Looking ahead, South32 is guiding for a moderate increase in its capital expenditures in fiscal 2022 versus fiscal 2021 levels and broadly flat versus fiscal 2020 levels. Please note that South32 increased its capital expenditure guidance for fiscal 2022 versus its previous assumptions in conjunction with its latest half year earnings update.

The capital expenditure expectations boost is due in large part to South32 getting closer to sanctioning the development of its Hermosa project in Arizona, something we covered in detail in our February 2022 article (link here). As the company’s cash flows have swelled higher of late and will likely remain elevated going forward in the current pricing environment, South32 should be able to retain its free cash flow cow status. Divesting its thermal coal business in South Africa and effectively exiting the thermal coal space significantly improved South32’s cash flow profile by reducing its capital intensity.

Image Shown: South32 expects its capital expenditures will pick up in fiscal 2022 versus fiscal 2021 levels, though we expect that the Australian miner will be able to retain its free cash flow cow status going forward in the current commodities pricing environment. Image Source: South32 – First Half of Fiscal 2022 IR Earnings Presentation

The company also provided updated near-term production and operating-expense guidance in conjunction with its latest half year update that indicated its strong financial performance should continue into the second half of this fiscal year. Headwinds from weather disruptions, variants of the COVID-19 pandemic, and economic lockdowns related to containing the spread of the pandemic are expected to weigh negatively on the production levels of some of South32’s Australian operations in the near term versus its previous guidance (particularly as it concerns its metallurgic coal and manganese output). With that in mind, stronger-than-expected performance at its underground Cannington mine in Australia enabled South32 to raise its near-term production forecasts for this operation (produces zinc, silver, and lead) which will offset some of those headwinds, to a degree.

Rewarding Investors

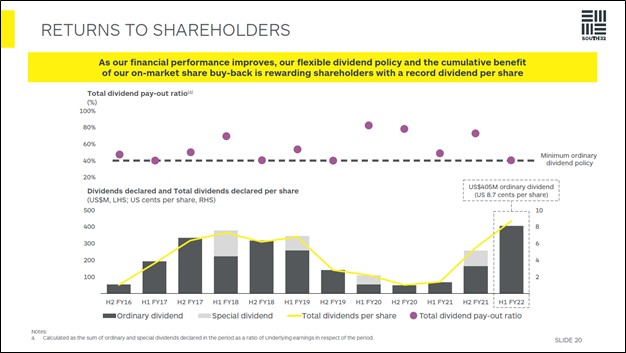

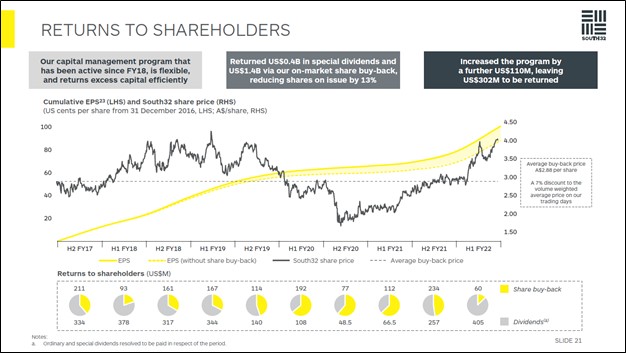

South32 recently increased its capital management program by $0.1 billion to $2.1 billion, which now has $0.3 billion in remaining capacity. The miner is rewarding investors in the current commodities pricing environment by boosting its variable per share dividend, as you can see in the upcoming graphic down below, while steadily repurchasing chunks of its stock. Over the long haul, South32 targets a dividend payout ratio as a percentage of its underlying earnings of at least 40%.

Image Shown: South32’s per share dividend is on the rise, keeping in mind it has a variable dividend policy that is influenced by foreign currency movements. Image Source: South32 – First Half of Fiscal 2022 IR Earnings Presentation

Historically, South32 has preferred to return cash to investors via share repurchases when its stock price is subdued, usually in the wake of a weak economic backdrop for miners, and dividend increases when the economic backdrop for miners is more favorable. This can be seen in the upcoming graphic down below.

Image Shown: South32 returns cash to investors via a combination of share repurchases and through its variable dividend program. Image Source: South32 – First Half of Fiscal 2022 IR Earnings Presentation

Concluding Thoughts

We remain huge fans of South32. The Australian miner is a free cash flow cow that continues to grow its exposure to the minerals and metals that should perform quite well during the green energy revolution, while also shedding its exposure to commodities that are not well-suited for the ongoing green energy transition along with assets deemed uneconomical and non-core to South32’s longer term strategy.

In the view of the company, moving into the copper mining space should improve South32’s company-wide financial performance going forward. Copper prices have been robust over the past year, and we view South32’s push into the copper mining industry quite favorably.

Categories Member Articles