Image Source: South32 – October 2021 Sierra Gorda Acquisition IR Presentation

By Callum Turcan

South32 (SOUHY) represents one of our favorite ideas in the mining space, and we include shares of SOUHY as an idea in the new ESG Newsletter portfolio (more on that here). We view both South32’s capital appreciation and income generation upside quite favorably, keeping in mind the firm has a variable dividend policy that is subject to foreign currency movements. On a scale of 1-100 (with 100 being the best), South32 earns a nice ESG rating of 93 (based on our proprietary ESG rating matrix) as the miner continues to pivot towards commodities that will be essential to making the green energy revolution possible.

Before we begin, some quick housekeeping items. South32’s fiscal year ends in June and the company reports its financial results in accordance with IFRS accounting standards. The company provides its financial statements in US dollar terms. Please note that South32’s financial performance is heavily influenced by exogenous factors, including volatile commodities pricing, and the state of the global industrial economy can’t be ignored when evaluating the miner. South32 is headquartered in Perth, Australia, and each ADR represents five ordinary shares of South32.

Copper Mine Acquisition

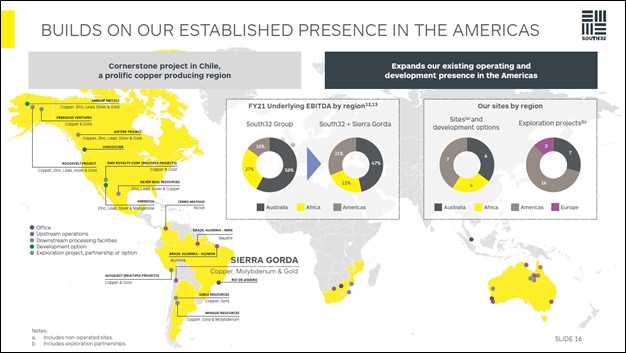

On October 14, South32 announced it had entered into binding agreements with Sumitomo Metal Mining (SMMYY) and Sumitomo Corporation (SSUMY) to acquire a 45% interest in the open-pit Sierra Gorda copper and molybdenum mine in northern Chile. Both Sumitomo Metal Mining and Sumitomo Corp own an economic stake in the mine. The deal is expected to close by the end of calendar year 2021.

South32 is paying $1.55 billion in total cash up front and agreed to total contingent payments worth up to $0.5 billion through 2022-2025 (should certain copper production rates and price thresholds be met) in return for an indirect 45% stake in Sierra Gorda S.C.M., the joint venture that operates the mine. The Sierra Gorda mine is already operational, and on a 100% ownership basis is expected to produce 180 kilotons of copper, 5 kilotons of molybdenum, 54 thousand ounces gold and 1.6 million ounces of silver in 2021. Should the deal go through as planned, South32’s joint venture partner would be the Polish miner KGHM Polska Miedz (KGHPF).

Image Shown: A look at the ownership structure of the Sierra Gorda mining operation should South32’s acquisition proceed as planned. Image Source: South32 – October 2021 Sierra Gorda Acquisition IR Presentation

On a copper equivalent basis, the mine is expected to produce ~214 kilotons this calendar year at an operating cost of approximately $1.29 per pound. Over the medium-term, operating costs at the mine are expected to come in around $1.30-$1.50 per copper equivalent pound produced. This is an incredibly economical endeavor, and South32 expects the acquisition to be immediately accretive to its earnings. As of this writing, copper futures are trading around $4.30-$4.40 per pound on the Chicago Mercantile Exchange (‘CME’), owned by CME Group Inc (CME).

However, please note that KGHM Polska Miedz has the option to purchase the stake it does not already own in the Sierra Gorda mine at the same price South32 agreed to pay Sumitomo Metal Mining and Sumitomo Corp. As of this writing, that does not appear to be KGHM Polska Miedz’s goal currently, but we are keeping an eye out for any updates on this front should things change.

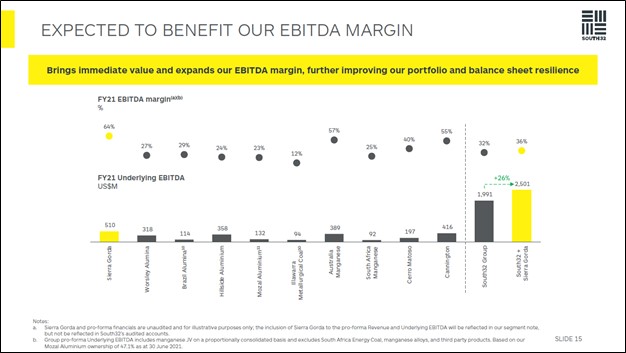

In FY2021, the Sierra Gorda mine had an underlying EBITDA margin (a non-IFRS metric) of 64%, well above South32’s 32% underlying EBITDA margin in FY2021 (when excluding recent divestment activity). Adding this asset to its business profile should significantly improve South32’s profitability levels going forward, keeping in mind the inherent volatility in commodities pricing.

Image Shown: South32’s underlying profitability should improve by adding the Sierra Gorda mining operation to its asset base. Image Source: South32 – October 2021 Sierra Gorda Acquisition IR Presentation

The Sierra Gorda mine was commissioned in 2014 after construction commenced in 2011. With ample access to infrastructure including freight rail, a seawater pipeline, renewable power, and a national highway that connects the mine to Chile’s ports at Antofagasta and Angamos, the mine has all the necessary infrastructure to not only support current production levels but also potential expansion projects as well.

De-bottlenecking projects are underway at the mining site that aims to “lift plant throughput by ~6% to ~50 [metric tons per year] and copper recoveries by ~2% to 85%” over the coming years according to a recent press release. Additionally, a feasibility study is underway that is assessing the potential to process material stockpiled at the mine through a brownfield oxide project.

Image Shown: De-bottlenecking activities are already underway at the Sierra Gorda mine. Image Source: South32 – October 2021 Sierra Gorda Acquisition IR Presentation

Exploration activities at the Pampa Lima deposit and across the regional land package covered by the mining operation offers room for further upside. The mine currently has an expected lifespan of more than 20 years, though there is ample room for that figure to be increased should the joint venture prove successful during future exploration and appraisal endeavors. We are optimistic given the immense resource base and active mining industry in this region of Chile.

South32 intends to use its balance sheet strength (net cash position of just under $0.7 billion at the end of September 2021 according to the miner’s latest quarterly update) and a new $1.0 billion acquisition debt facility to fund the deal. Once the deal goes forward, assuming it does, South32 has communicated that it intends to refinance its acquisition debt facility with longer term funding instruments, most likely long dated bond issuances. South32 intends to maintain its investment grade credit rating during this process.

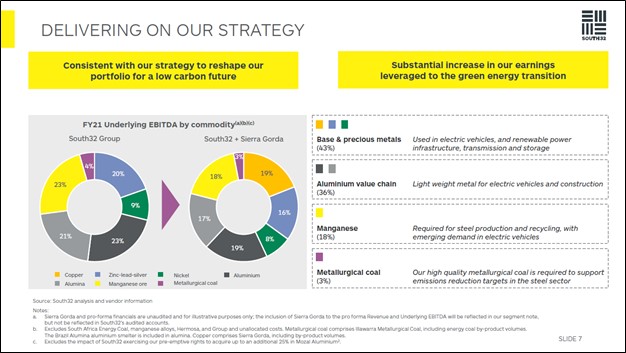

This deal represents South32’s first entrance into the copper space since the firm was spun off from BHP Group Ltd (BHP) in 2015, and we are big fans of the move. Copper prices have been incredibly strong of late and the outlook for copper demand is quite bullish, which lends an enormous amount of support to future copper prices. Rising demand for electric vehicles (‘EVs’), new renewable power generation assets (such as wind and solar), the need for revamped transmission and distribution systems for electricity, and rising global infrastructure investments are all key here (copper is an essential input for all of these activities as a conduit for electricity). South32 has a well-diversified production mix within the mining space.

Image Shown: Should the Sierra Gorda acquisition proceed, copper would represent a sizable chunk of South32’s total production volumes and underlying EBITDA generation going forward. Image Source: South32 – October 2021 Sierra Gorda Acquisition IR Presentation

Growing Aluminum Footprint

As an aside, South32 announced in September 2021 it would acquire an additional stake in Mozal Aluminum from a unit of Mitsubishi Corporation (MSBHF) as did one of South32’s partners in the endeavor. Mozal Aluminum operates an aluminum smelter near Maputo, Mozambique, along with related transport infrastructure. South32 will have a ~64% stake in the venture after exercising its pre-emptive acquisition rights alongside its state-run partner Industrial Development Corporation of South Africa (‘IDC’), which also exercised its pre-emptive acquisition rights according to South32.

South32 expects to pay ~$0.15 billion in cash (before taking closing adjustments into account) to increase its stake to that level (from ~47% before the deal was announced). Mozal Aluminum’s smelting operations “benefits from access to hydroelectric power and key export markets into Europe” according to a recent press release. These deals (involving Sierra Gorda and Mozal Aluminum) represent South32’s push into metals and materials that are an essential part of the green energy revolution and highlight its pivot away from thermal coal.

Clarification

In our September 2021 article South32 Is a Great Miner (link here), we noted how South32 has effectively exited the thermal coal mining space through the divestment of its thermal coal mining and export operation in South Africa. We want to highlight here that its Illawarra Metallurgical Coal operation in the state of New South Wales in Australia, which predominantly produces metallurgic coal used in the steel making process, produces a small amount of thermal coal as well, though this represents a negligible amount of South32’s revenues, bottom line, and total production volumes. Please note that we are not highlighting this insignificant exposure to change our ESG rating for South32 (which still sits at a nice 93 rating), but to clarify that we have already taken this into account.

The miner’s energy coal sales (which are entirely attributed to its Illawarra Metallurgical Coal unit) dropped by 38% from the first quarter of FY2021 (period ended September 2020) to the first quarter of FY2022 (period ended September 2021). For all of FY2022, South32 expects thermal coal production will represent an insignificant amount of its total output. In terms of revenue and income generation, these thermal coal sales are a negligible part of South32’s business.

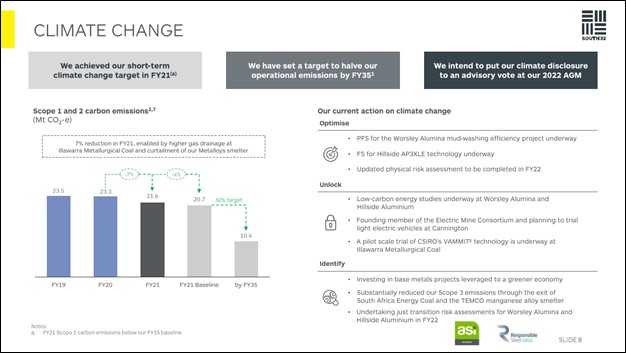

South32 is clearly pivoting towards resources that will make the green energy revolution possible, seen through its existing nickel, aluminum (where South32 is actively growing its footprint), silver, and manganese operations and pending move into copper mining. Looking ahead, South32 is committed to reducing its emissions and has several initiatives in place to accomplish those goals. By FY2035, South32 aims to cut its operational emissions in half versus FY2021 levels (which refers to its Scope 1 and Scope 2 emissions).

Image Shown: South32 is committed to cutting its operational emissions in half by FY2035 using FY2021 as a baseline and has already made meaningful progress on this front in recent fiscal years. Image Source: South32 – FY2021 Financial Results Presentation

Concluding Thoughts

We are big fans of South32. Though the company will see its net cash position flip to a net debt position should the Sierra Gorda acquisition go through, the improvement in its business mix (within the mining space) and the exposure to a high quality copper mining operation (with room for upside) is a worthwhile investment, in our view. South32 generated ~$0.85 billion in free cash flow in FY2021 and should be able to stay on top of its balance sheet and dividend obligations going forward. We also appreciated South32’s decision to grow its footprint in the aluminum space, seen through its deal to grow its stake in the Mozal Aluminum venture.

—–

Mining & Chemicals Industry – APD, DD, EMN, ECL, LYB, PPG, BHP, FCX, NEM, RIO, VALE, WPM, CMP, AA, KALU, MLM, VMC, NUE, CSL, SON, ALB, FUL, ATR, GGG, SHW

Related: SOUHY, SMMYY, SSUMY, KGHPF, MSBHF, CME

Tickerized for BHP, SOUHY, ELEMF, TMQ, TSLA, RIO, VALE, FCX, BVN, HBM, GLCNF, GLNCY, AAUKF, NGLOY, FQVLF, ANFGF, FSUMF, TECK, AA, X, MT, TX, NUE, STLD, SCHN, TS, CLF, SCCO, CDE, HL, CENX, ARNC, COPX, CPER, JJCTF, JJC, JJN, XLB, SMMY, SSUMY, KGHPF, MSBHF, CME, SMMYY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. South32 (SOUHY) is included in Valuentum’s simulated ESG Newsletter portfolio. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.