Image Shown: Life Storage Inc is committed to rewarding income seeking investors. Image Source: Life Storage Inc – January 2022 IR Presentation

By Callum Turcan

We recently added Life Storage Inc (LSI), a self-administered and self-managed real estate investment trust (‘REIT’) focused on self-storage properties in the US, as an idea to the simulated High Yield Dividend Newsletter portfolio (more here). Life Storage owns 1,000+ self-storage properties across 30+ states and has received an investment grade credit rating (Baa2/BBB) from two of the ‘Big Three’ rating agencies. The REIT also operates a third-party management platform for self-storage properties. Back in 2016, Life Storage rebranded from Sovran Self Storage and changed its ticker to LSI from SSS.

Impressive Dividend Strength

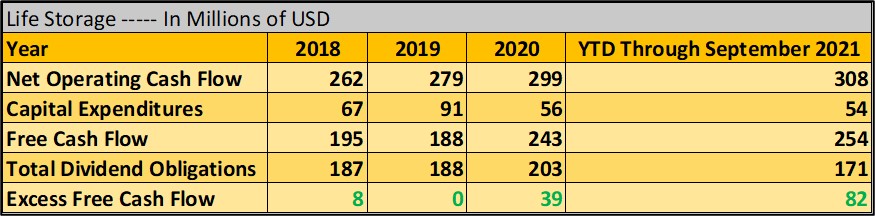

The REIT raised its quarterly dividend by 16% sequentially in January 2022, bringing its quarterly payout up to $1.00 per share or $4.00 per share on an annualized basis. As of this writing, shares of LSI yield ~3.1% and we view its dividend strength as solid given its ability fully cover its total dividend obligations (‘dividends paid – common stock’ plus ‘distributions to noncontrolling interest holders’) with its traditional free cash flow. In the upcoming graphic down below, we highlight Life Storage’s ability to generate “excess” free cash flows after covering its total dividend obligations.

Image Shown: Life Storage is a tremendous cash flow generator. Historically, the REIT has fully covered its total dividend obligations with its free cash flows, allowing for modest “excess” free cash flow generation. Image Source: Valuentum, with data provided by Life Storage (I, II)

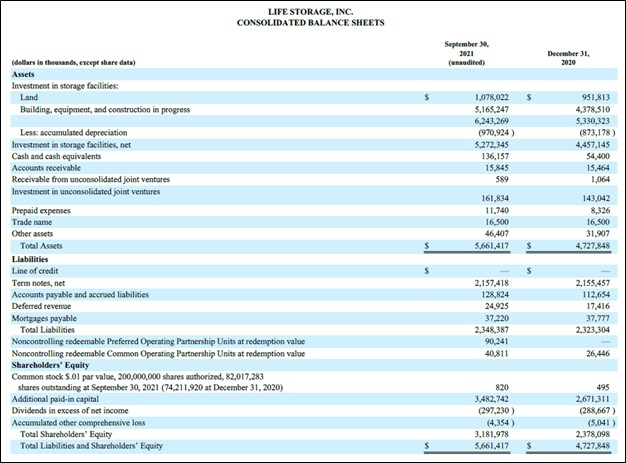

As with virtually all REITs, Life Storage has a large debt load. At the end of September 2021, Life Storage had $2.3 billion in total debt (inclusive of short-term debt) that was only modestly offset by $0.1 billion in cash and cash equivalents on hand. Its $2.2 billion net debt load at the end of this period is manageable given its strong free cash flow generating abilities and its apparent ability to tap capital markets for funds at attractive rates to refinance maturing debt, something that we will cover in just a moment.

Image Shown: Life Storage has a sizable net debt load on the books. Image Source: Life Storage – 10-Q SEC filing covering the third quarter of 2021

While the company’s total dividend obligations are well-covered by its traditional free cash flow, acquisitions of additional self-storage properties have primarily been funded by a combination of debt and equity issuances. Life Storage spent roughly $1.0 billion from 2018-2020 on acquisitions with an additional $0.8 billion spent during the first nine months of 2021.

Based on recent financing activities along with Life Storage’s aforementioned financial strength, the REIT should be able to continue tapping capital markets at attractive rates as needed going forward to fund future acquisitions (while staying on top of its debt load and total dividend obligations). In September 2020, Life Storage issued $0.4 billion in 2.200% unsecured senior notes due October 2030, which represents a relatively low cost of debt, keeping in mind interest rates in the US have shifted higher in recent quarters.

Fast forward to September 2021, when Life Storage raised ~$0.35 billion through a secondary equity offering. The REIT also uses its at-the-market (‘ATM’) equity issuance program and its ability to issue both common and preferred operating partnership units to raise funds as needed. For reference, Life Storage is the parent company of Life Storage LP, the operating partnership that owns and operates the company’s self-storage properties. Life Storage Holdings Inc is a wholly-owned subsidiary of Life Storage that acts as the sole general manager of the operating partnership.

At the end of December 2020, Life Storage had a 99.6% ownership interest in the operating partnership.

Earnings Update

As of the third quarter of 2021, Life Storage’s third-party management platform managed almost 360 self-storage properties (including properties where the REIT has a minority interest). Life Storage noted in the related earnings press release that it “continues to aggressively and profitably grow its third-party management platform.” In the third quarter, Life Storage added 30 gross self-storage properties to this platform, though please note that ten of the 29 self-storage properties the REIT acquired during this period were previously being managed by this program.

Here, we would like to stress how important these third-party property management programs are in the self-storage space. These programs allow firms such as Life Storage to build up an enormous acquisition pipeline over time, which in turn supports its growth runway over the long haul.

During the first nine months of 2021, Life Storage generated $3.65 in adjusted funds from operations (‘FFO’) per share, up 26% year-over-year. For just the third quarter of 2021, Life Storage’s adjusted FFO per share was up 36% year-over-year. The REIT noted that in the third quarter, revenue from its “stabilized” self-storage property base (assets owned since the end of December 2019) increased by 17% year-over-year due primarily to its occupancy rates rising roughly 220 basis points and the net impact of a 14% year-over-year increase in its realized rental rates. Life Storage noted in its related earnings press release that it had “achieved double-digit same store revenue growth in each of its 31 major markets” in the third quarter.

The company’s same store property expenses rose just under 4% year-over-year in the third quarter of 2021 due primarily to higher real estate taxes along with rising repair and maintenance costs. Putting this all together, Life Storage’s same store property net operating income (‘NOI’) rose by 24% year-over-year in the third quarter.

We appreciate Life Storage’s immense pricing power. Self-storage offerings, particularly in the US, where housing prices have surged of late, provide households with an economical option to maximize their living space. As these services represent a relatively small portion of the average household’s monthly budget, pushing through substantial rental rate increases is a viable option. During Life Storage’s third quarter of 2021 earnings call, management had this to say regarding the REIT’s pricing power and occupancy rates (emphasis added):

“Though we’ve begun to see somewhat of a return to normal seasonal trends in the past couple of months, we remain highly occupied with average same-store occupancy up 220 basis points compared to the same quarter last year. This elevated occupancy has allowed us to continue to be more aggressive with rates on new and existing customers, which has driven a significant increase in our in-place rates per square foot, which were up 14% year-over-year in the third quarter, representing substantial acceleration from the 8% in the second quarter and the 1% in the first quarter.” — Andrew Gregoire, CFO of Life Storage

Considering Life Storage’s pricing power appears to have grown stronger throughout the first three quarters of 2021 as the US economy recovered from the worst of the coronavirus (‘COVID-19’) pandemic, that speaks quite favorably towards the REIT’s outlook for 2022 and beyond.

Guidance

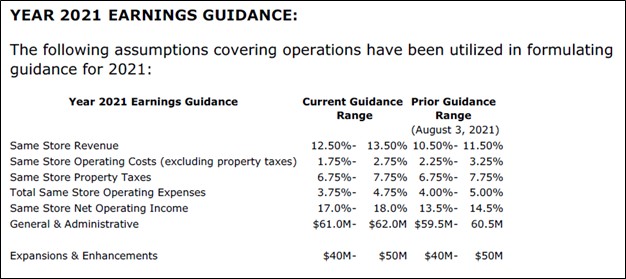

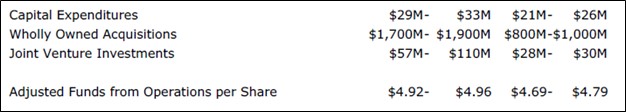

Life Storage increased its full-year guidance for 2021 when reporting its third quarter earnings report. The REIT also increased its full-year guidance during its first and second quarter earnings updates as well. Life Storage’s guidance as of its third quarter earnings update can be viewed in the upcoming two graphics down below. It is guiding for substantial same store property revenue and NOI growth in 2021 versus 2020 levels.

Images Shown: Life Storage expects that its core business grew robustly in 2021 versus 2020 levels, aided by its pricing strength. Images Source: Life Storage – Third Quarter of 2021 Earnings Press Release

Concluding Thoughts

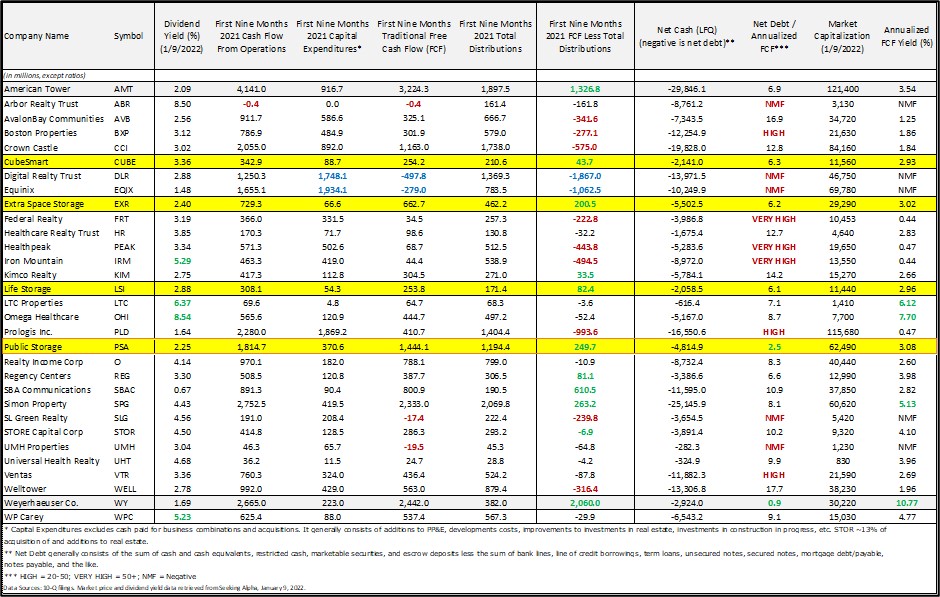

We are huge fans of Life Storage and the self-storage industry. The company’s financials are rock-solid and recent guidance increases speak favorably toward its near term outlook. Adding Life Storage to the High Yield Dividend Newsletter portfolio provides it with even greater exposure to the self-storage industry as we also include CubeSmart (CUBE) and Public Storage (PSA), two other high-quality self-storage REITs, in that simulated newsletter portfolio.

After the market closes on February 24, Life Storage intends to report its fourth quarter 2021 earnings and will host a conference call a day later to discuss those results. We will have more to say on the REIT soon.

Image Shown: Unlike many other REITs, the self-storage industry is full of companies that generate substantial excess free cash flows after covering their total dividend obligations, which represents a core reason why we are huge fans of the industry. Image Source: Valuentum

—–

Real Estate Investment Trusts (REITs) Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Related: LSI, VNQ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in FB and XLE. American Tower Corporation (AMT), CubeSmart (CUBE), Life Storage Inc (LSI), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.