Image Shown: Though Newmont Corporation’s third quarter earnings disappointed, the gold miner remains very shareholder friendly. Image Source: Newmont Corporation – Third Quarter of 2021 IR Earnings Presentation

By Callum Turcan

One of our favorite mining plays is the gold miner Newmont Corporation (NEM), which has producing assets around the world including in Australia (EWA), Argentina, the Dominican Republic, Ghana, Mexico (EWW), Peru, Suriname, Canada (EWC), and the US. Newmont has a robust development pipeline in those countries via new producing mines and expansion projects (roughly 88% of Newmont’s reserves are in the Americas and Australia), along with potential upside in Japan, Ethiopia, Colombia, and elsewhere.

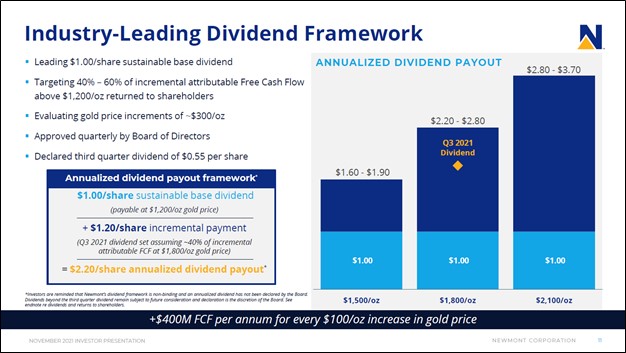

The company’s management team is incredibly shareholder friendly (its quarterly payout has grown from $0.14 per share in 2019 to $0.55 per share currently and the firm is actively buying back its stock), and Newmont’s free cash flow generating abilities are impressive. We like Newmont as an idea in the Dividend Growth Newsletter portfolio. As of this writing, shares of NEM yield a nice ~4.1%.

Earnings Update

Newmont reported third quarter 2021 earnings on October 28 that missed consensus top- and bottom-line estimates. The miss was attributed in part due to a mechanical failure at its Nevada joint venture along with weather and other reliability issues in Australia and labor supply issues seen around the world (according to recent management commentary). Additionally, a softening of gold prices (GLD) versus year-ago levels also created headwinds for Newmont’s performance last quarter.

Barrick Gold Corporation (GOLD) is Newmont’s partner at the Nevada Gold Mines joint venture, which was formed back in 2019 to drive efficiencies across their combined mining operations to boost output and reduce costs. Newmont updated its full-year guidance for 2021 to take recent operational issues into account, which will see its gold production come in softer than previously expected this year (this in turn drove up Newmont’s expected per unit production costs for 2021).

Putting near-term headwinds aside, Newmont’s financials remain rock-solid. During the first nine months of 2021, Newmont generated $1.8 billion in free cash flow and spent $1.3 billion covering its dividend obligations to common shareholders along with an additional $0.2 billion on share repurchases. Newmont also spent $0.2 billion on ‘distributions to noncontrolling interests’ and received $0.1 billion in ‘funding from noncontrolling interests’ during this period.

At the end of September 2021, Newmont had $4.8 billion in cash, cash equivalents, and short-term investments on hand. Stacked up against $0.5 billion in short-term debt and $5.0 billion in long-term debt, Newmont had a relatively modest $0.7 billion net debt position at the end of this period.

The company’s GAAP operating income stayed broadly flat versus the year-ago period at $1.9 billion during the first nine months of 2021. However, its GAAP operating margin shifted lower on a year-over-year basis during this period as Newmont contended with unexpected costs along with expenses related to ramping up its production as coronavirus (‘COVID-19’) lockdown measures eased up. As Newmont fixes problems at its Nevada joint venture and its Musselwhite mine in Canada (which will also benefit from the completion of a materials handling project), and ramps up production at mines negatively impacted by the COVID-19 pandemic, its unit costs should start trending lower (as economies of scale and operational efficiency gains start to kick in).

During the third quarter of 2021, Newmont’s attributable gold production was broadly flat versus second quarter levels but down 6% versus year-ago levels. Production of copper (CPER), silver (SLV), lead, and zinc in ‘gold equivalent ounces’ terms was up 15% on a combined basis from year-ago levels in the third quarter.

While Newmont’s operational issues are concerning, management was confident that Newmont would be able to put these problems behind it, noting during the firm’s latest earnings call that “looking ahead to 2022… [Newmont’s] gold production is expected to improve by around 5% compared to 2021” which we appreciate.

Concluding Thoughts

We are keeping a close eye on Newmont. Gold prices remain strong, though they have softened somewhat of late from 2020 levels. On the flip side, Newmont is benefiting from stronger pricing for copper, lead, and zinc. Silver prices are also down from 2020 levels, though still up sharply from levels seen in previous years. Newmont’s future financial performance is heavily influenced by exogenous forces (i.e., gold and other metals pricing) and we want to see its operational performance improve going forward.

In regions where Newmont has been less severely impacted by weather events and the COVID-19 pandemic in recent months, such as at its Peñasquito gold mine in Mexico, the company is delivering on its cost reduction goals. At the Peñasquito gold mine, which Newmont acquired via its 2019 merger with Goldcorp, the company has improved the free cash flow performance at this asset by $375+ million since 2019 (exceeding its initial guidance). Before the COVID-19 pandemic stymied its efforts, Newmont was well on its way to realizing $500 million in annual synergies from its Goldcorp merger (up from its target of $365 million in annual synergies previously).

A core part of our thesis on Newmont is that meaningful operational improvements in the wake of its Goldcorp merger and the formation of its Nevada joint venture will lead to reductions in its unit costs, supporting its ability to generate sizable earnings and free cash flows in any gold pricing environment. Once the ship has been righted, investors should warm back up to the name. Should Newmont show signs that its operational troubles won’t get fixed anytime soon, we may remove shares of NEM from our Dividend Growth Newsletter portfolio. For now, Newmont’s financials remain rock-solid and its juicy yield is compelling.

One miner that has performed exceptionally well of late is South32 (SOUHY), an idea included in our new ESG Newsletter portfolio (more on that here) and a past idea highlighted in our Exclusive publication (more on that here). Interested members should check out our September 2021 article South32 Is a Great Miner (link here) to read more about our thoughts on the company.

—–

Mining & Chemicals Industry – APD, DD, EMN, ECL, LYB, PPG, BHP, FCX, NEM, RIO, VALE, WPM, CMP, AA, KALU, MLM, VMC, NUE, CSL, SON, ALB, FUL, ATR, GGG, SHW

Tickerized for NEM, GLD, EWA, EWW, EWC, GOLD, CPER, SLV, SOUHY, EGO, KGC, AUY, AEM, KL, AU, AGI, HMY, GFI, GDX, GDXJ, NUGT, SIL, GGD, DUST, AGQ, USLVF, SLVP, UGLDF, IAG, PHYS, WPM, NGD, SGOL, CDE, SAND, EXK, FSM, AG, FNV, SCCO, JNUG

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Albemarle Corporation (ALB) and South32 (SOUHY) are both included in Valuentum’s simulated ESG Newsletter portfolio. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.