Image Source: Lockheed Martin Corporation – Second Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

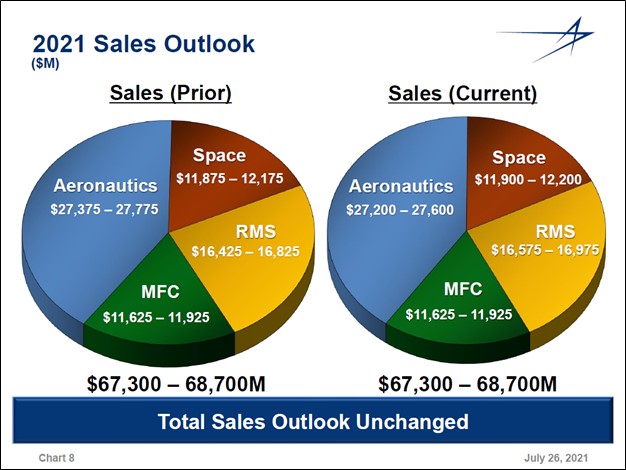

The commercial and military opportunities in the realm of space have been growing at a brisk pace of late, and in our view, the growth runway in this area is immense. Lockheed Martin Corp (LMT) is a giant defense contractor with a sizable space business that caters to national defense, governmental, and commercial needs. We include Lockheed Martin as an idea in the Dividend Growth Newsletter portfolio, and shares of LMT yield ~3.1% as of this writing. The company has four core business operating segments and ‘Space’ is one of those segments, which generates a sizable amount of its annual sales as you can see in the upcoming graphic down below.

Image Shown: Lockheed Martin’s Space segment represents a significant chunk of its annual sales. Image Source: Lockheed Martin – Second Quarter of Fiscal 2021 IR Earnings Presentation

Space Updates

Lockheed Martin recently invested in the San Francisco-based startup Orbit Fab via its Lockheed Martin Ventures wing. Orbit Fab is developing an innovative end-to-end satellite refueling technology known as the Rapidly Attachable Fluid Transfer Interface (‘RAFTI’), which aims to make the refueling of satellites while in orbit an easier task. RAFTI “can also be used as a drop-in replacement for existing satellite fill-and-drain valves” according to Lockheed Martin.

If successful, RAFTI offers satellite owners and operators a way to extend the lifecycle of their assets which could result in major cost structure improvements for those entities, thus supporting the viability of the in-space economy. Lockheed Martin noted that “the RAFTI fueling port has flight heritage, having flown on the company’s Tanker-001 Tenzing in June this year. The tanker is an on-orbit fuel depot.” Big picture, as the in-space economy grows and the use of satellites continues to grow, there will be a great need to efficiently maintain and refuel these operations.

Another interesting realm of the in-space economy Lockheed Martin is catering to concerns upgrading in-space satellite systems. In August 2021, Lockheed Martin announced that its In-space Upgrade Satellite System (‘LINUSS’) been put through environmental testing activities and was ready to get launched into space later this year. The goal here is to “[demonstrate] how small CubeSats can regularly upgrade satellite constellations to add timely new capabilities and extend spacecraft design lives” with each CubeSat being “about the size of a four-slice toaster” according to the press release. Lockheed Martin has also been developing its SmartSat technologies, defined as “transformational on-orbit software upgrade architecture,” to beef up its suite of satellite and space-related solutions.

These endeavors tie into some of the other satellite-related projects Lockheed Martin has been working on, with its partners, of late. Here is a key except from Lockheed Martin’s website (emphasis added):

LINUSS will be able to work in tandem with another of Lockheed Martin’s on-orbit innovations, the Augmentation System Port Interface (‘ASPIN’). ASPIN is a docking adapter that Lockheed Martin will include in its baseline LM 2100 combat satellite bus as a novel way to add new mission capabilities after launch. It allows satellite operators to unlock a new range of upgrade options, including processors, storage and sensors and to replace or retrofit components after launch. Its design was not only focused on power and data, but with plenty of open space to support future refueling interfaces, of which Orbit Fab’s RAFTI could be one.

Together with software-defined platforms like SmartSat, Lockheed Martin’s approach will enable the kind of mission flexibility and network resiliency demanded by the U.S. military for Joint All-Domain Operations (‘JADO’).

For reference, JADO is “a new warfighting concept” that involves “synchronizing major systems and crucial data sources with revolutionary simplicity, MDO/JADO provides a complete picture of the battlespace and empowers warfighters to quickly make decisions that drive action” according to the company’s website. Lockheed Martin’s satellite business is catering to a combination of commercial and national defense needs, and we appreciate the firm’s focus on innovation.

Lockheed Martin also played a role in the National Aeronautics and Space Administration’s (‘NASA’) ongoing Mars 2020 Perseverance Rover mission by developing the technology used in the aeroshell that protected the rover during the trip in space and down to the Red Planet. Additionally, Lockheed Martin developed the Mars Helicopter Delivery System (‘MHDS’) for Ingenuity, the helicopter that joined the Perseverance rover on its journey to Mars. The MHDS was designed to safely transport and deploy the helicopter during the mission. Perseverance and Ingenuity were launched in July 2020 and have been patrolling Mars since February 2021.

Management Commentary

During Lockheed Martin’s fiscal second quarter earnings call held in July 2021, management had this to say regarding the firm’s Space segment (emphasis added):

“In addition, our Space business area successfully launched two new satellites in support of critical national security space objectives. Our fifth Space Based Infrared System and Geosynchronous Earth Orbit or SBIRS GEO-5 satellite successfully deployed from its United Launch Alliance Atlas 5 rocket and is now communicating with the operations team from the U.S space force.

SBIRS GEO-5 is the latest satellite to join the space forces orbiting early warning missile constellation and [is] equipped with powerful surveillance sensors to support ballistic missile defense, and expand technical intelligence gathering and bolster situational awareness for the guardians that are defending the U.S and its allies. The SBIRS GEO-5 satellite is the first military satellite built on an LM 2100 Combat Bus. That’s a more resilient, modernized and modular space vehicle originally developed using Lockheed Martin internal investment.

Also, the fifth Global Positioning System or GPS III satellite was also successfully launched this quarter. The GPS III Space Vehicle 5 is the 31st operational GPS satellite in the constellation with significant advancements over previous GPS Space Vehicles, including three times better accuracy and improved anti-jamming capabilities. The GPS III and OPIR satellite constellations are both Lockheed Martin’s signature programs and represent key elements of our network centric 21st century warfare concept.

And lastly, our space business area was selected by NASA to build spacecraft for two separate missions to Venus. Lockheed Martin will design, build and operate the VERITAS orbiter to investigate the surface and subsurface of Venus, and the DAVINCI+ vehicle to research the planet’s atmosphere. These missions build on our legacy Magellan program for the exploration of Venus and will represent NASA’s first return to the planet in more than three decades.

These achievements from across the company highlight our focus on providing innovative solutions, and the strength that our broad portfolio gives us to support our customers missions and their all domain objectives.” — James Taiclet, Chairman, President, and CEO of Lockheed Martin

Space Financials

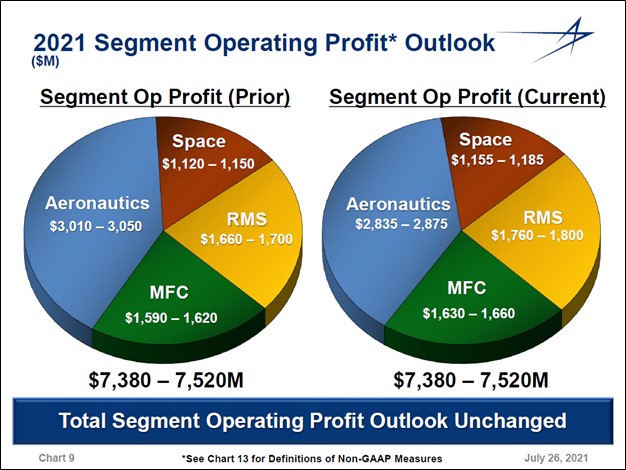

At the end of the second quarter of fiscal 2021 (period ended June 27, 2021), Lockheed Martin’s Space business had a project backlog of $26.8 billion, up from $25.1 billion at the end of December 2020. Its Space operations have been growing at a brisk pace of late with ample room to grow going forward. During the fiscal second quarter, the firm’s Space segment posted 10% year-over-year sales growth and a 33% year-over-year increase in its segment-level operating income. The segment-level operating margin of Lockheed Martin’s Space segment was modestly above its total business segment operating margin in the fiscal second quarter.

Lockheed Martin’s Space segment benefited from sales growth relating to national security space programs including activities related to the Next Generation Overhead Persistent Infrared (Next Gen OPIR) platform, strategic and missile defense programs (including hypersonic development programs), and from the UK’s Atomic Weapons Establishment (‘AWE’) program. However, please note that the UK renationalized its AWE program effective June 30, 2021, and this operation will no longer be included in Lockheed Martin’s Space segment starting in the third quarter of 2021. There is a chance the AWE venture (which Lockheed Martin owned a sizable economic stake in) will get a penalty fee from the UK government, though either way, this news does not materially change the growth outlook for Lockheed Martin’s Space segment.

When Lockheed Martin reported its fiscal second quarter earnings, the company increased the bottom end of its fiscal year guidance concerning its expected diluted EPS performance. Now the firm is targeting diluted EPS of $26.70-$27.00 in fiscal 2021, up from $26.40-$26.70 previously, in part due to a reduction in its expected ‘other, net’ expense line-item. Please note this guidance takes into account the renationalization of the AWE program. Back when Lockheed Martin reported its first quarter earnings for the current fiscal year in April 2021, the company boosted its full fiscal year guidance across the board (as we covered in this article here). Lockheed Martin has been firing on all cylinders of late.

Image Shown: Lockheed Martin’s Space segment generates a sizable portion of its operating income. Image Source: Lockheed Martin – Second Quarter of Fiscal 2021 IR Earnings Presentation

Dividend Strength

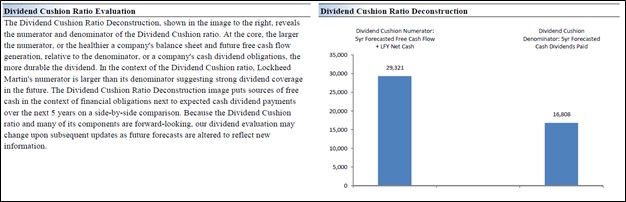

During the first half of fiscal 2021, Lockheed Martin generated $2.4 billion in free cash flow while spending $1.5 billion covering its dividend obligations and another $1.5 billion buying back its stock. Our fair value estimate for Lockheed Martin sits at $420 per share, and we view its share buybacks, in moderation, as a solid use of the firm’s capital. At the end of the fiscal second quarter, Lockheed Martin had a net debt load of $9.4 billion (inclusive of short-term debt), which we view as manageable given its ample cash position on hand ($2.7 billion at the end of this period) and stable cash flow profile.

Our Dividend Cushion ratio for Lockheed Martin sits at 1.7, earning the firm a “GOOD” Dividend Safety rating. This metric incorporates our expectations the company will steadily grow its per share dividend over the coming years, and we give Lockheed Martin a “GOOD” Dividend Growth rating as well.

Image Shown: Lockheed Martin’s dividend coverage on a forward-looking basis is rock-solid which supports our expectations that the firm will steadily grow its per share payout over the coming years.

As an aside, Lockheed Martin is in the process of acquiring Aerojet Rocketdyne Holdings Inc (AJRD) through an all-cash deal with a total transaction value of $4.4 billion (when including net cash) that was announced back in December 2020. We like this deal, and it would grow Lockheed Martin’s exposure to the space economy. However, while the deal has received support from various US lawmakers, there has been some push back against the acquisition. We are keeping an eye on this situation.

Concluding Thoughts

We continue to like Lockheed Martin as an idea in the Dividend Growth Newsletter portfolio. Shares of LMT have faced some selling pressures of late as US geopolitical priorities pivot away from the Middle East and towards East and Southeast Asia, though in our view, the backdrop remains conducive to steady increases in the base US defense budget going forward.

On top of that dynamic, the growth outlook for space spending for activities in the realm of commercial (e.g., satellite-provided internet and space tourism), governmental (e.g., NASA’s Perseverance Rover Mission) and national defense (particularly from Western governments) appears incredibly promising.

Lockheed Martin is one of our favorite dividend growth ideas and the company also offers investors considerable capital appreciation upside as well, given that shares of LMT are trading comfortably below our fair value estimate of $420 per share as of this writing.

—–

Disruptive Innovation Industry – W, ZM, SPCE, ROKU, WORK, MNST, SAM, SPLK, PENN, VRSK, ICE, LULU, ESTY, DOCU, UBER, BYND

Industrial Leaders Industry – MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Related: AJRD, BAESY, DUAVF, LHX, SPR, MAXR, TGI, LDOS, PLTR, KTOS, MANT, SPCE, SPIR, ASTR, MNTS, RDW, ASTS, GSAT

Related ETFs: XAR, ARKX, DFEN, FITE, UFO, ROKT

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT) and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.