This article was originally published August 26, 2021.

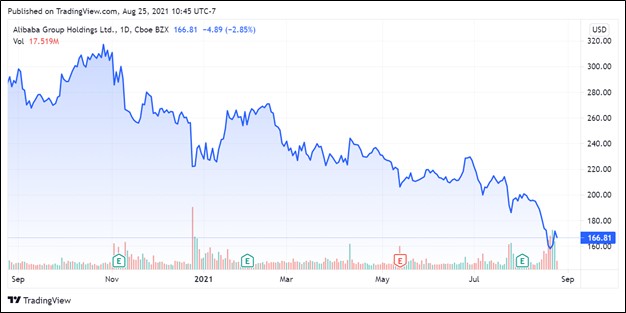

Image Shown: Shares of Alibaba Group have plummeted over the past year in the wake of Beijing’s crackdown on China’s domestic tech and fintech titans.

By Callum Turcan

Many would argue that the key event that kicked off Beijing’s ongoing crackdown on its domestic tech giants started back in October 2020 when the once domestically revered entrepreneur Jack Ma, the founder of e-commerce, fintech, payment solutions, and cloud computing giant Alibaba Group (BABA), gave a speech critical of Chinese regulators. A WSJ article published August 20, Jack Ma’s Costliest Business Lesson: China Has Only One Leader, covered the situation in great detail. Mr. Ma noted at the time that he viewed Beijing’s regulatory apparatus as stymieing financial innovation.

How the Crackdown Began

In the wake of this speech, Mr. Ma disappeared from public view for a while, the planned IPO of Ant Group (which operates the popular Alipay payment platform that played a key role in facilitating the rise of Alibaba as an e-commerce giant and at one point operated the largest money-market fund in the world) was scrapped, Alibaba was fined $2.8 billion by the Chinese government, and Ant Group was forced to become a financial holding firm, an entity that is heavily regulated. Furthermore, China’s State Administration for Market Supervision (‘SAMR’) is now investigating Alibaba for alleged monopolistic practices, and it is possible that a major restructuring of its various businesses along with additional fines are in the cards.

Mr. Ma later reappeared in a video addressed to rural teachers in January 2021, though the disappearance of a once praised entrepreneur at the very least raises some difficult questions. China’s current leadership has shifted towards placing a great emphasis on “common prosperity” as anger towards the country’s immense wealth inequality continues to grow, and away from the pro-market mentality laid out by previous Chinese leaders, most notably Deng Xiaoping. That pivot includes China recently forcing food delivery firms operating in the country to pay the local minimum wage, while also calling out instances of “excessive” income. China, under President Xi Jinping, is once again undergoing a major cultural and economic shift, one that likely has profound consequences for both the global economy and the investing community.

More Chinese Companies Face Scrutiny

Alibaba is not the only firm caught in the crosshairs of Beijing. DiDi Global (DIDI), which offers ride hailing services in a similar fashion to Uber Technologies (UBER) or LYFT (LYFT) though DiDi’s main markets are in China, had its corporate offices raided by Chinese authorities this past July. Like Uber, DiDi also offers food delivery services, the kind of services that recently were forced to ensure workers receive the minimum local wage in the relevant jurisdiction in China.

Furthermore, DiDi’s app was removed from digital marketplaces to prevent it from being downloaded in July to prevent it from adding any new users, though existing users could still use the service. The Cyberspace Administration of China launched a review of DiDi’s data handling practices and was part of the regulatory apparatus cracking down on the firm. We highlighted DiDi as a short idea consideration in the Exclusive publication back in July 2021 when its stock was trading at north of $12 per share, an idea that quickly worked out for members. Shares of DIDI are trading just below $8.30 as of this writing (click here to learn more about the Exclusive publication).

Chinese authorities alleged DiDi was not handling its customer data properly and furthermore, accused the firm of mishandling data with critical national security importance. This is one of the many instances that eventually prompted China to pass the Personal Information and Protection Law (‘PIPL’) in August, one of the most restrictive personal data security laws in the world. Among other things, there are now strict requirements for transferring data on Chinese citizens outside of the country, and the new law will come into force starting this upcoming November.

More Laws and Regulations

China’s new Data Security Law will come into force starting this upcoming September. This new law was passed this past June and creates a three-tiered hierarchy of data importance, a classification system for virtually all types of data and digital information generated in the country and forbids the transferring of data and any related information to overseas authorities without the express consent of the relevant regulatory body. These new pieces of legislation come on the heels of China’s Cybersecurity Law that came into force back into 2017 and will form the backbone of the country’s now much more restrictive digital regulatory regime going forward. Not adhering to the relevant regulations can have very severe consequences, least of all large fines.

Beyond data privacy and protection, China has also placed a much greater importance on going after firms viewed as monopolistic or engaging in monopolistic practices (even if the firm in question is not necessarily a monopoly). SAMR recently published new rules targeting potential monopolies, primarily geared towards private tech giants (with a heavy focus on those operating in the internet platform economy).

We’re Sticking with US Tech Giants

These actions have created shockwaves that since reverberated around global equity markets over the past several months, though most of the selloff has been directed towards tech giants based in China and Chinese equities more broadly. Here we would like to stress that the share prices of tech giants based in the US, including Alphabet (GOOG) (GOOGL), Facebook (FB), Microsoft (MSFT), and Apple (AAPL), have continued to march higher this year.

We are huge fans of US-based large cap tech companies, including the four mentioned just above, and we do not intend to add direct exposure to Chinese equities to any of our newsletter portfolios at this time given the immense regulatory risks and other risks involved. None of our newsletter portfolios currently have direct exposure to Chinese equities at this time.Growing geopolitical tensions between the US and China have seen several Chinese firms delisted from US stock exchanges in recent years. The US has also threatened to delist other Chinese firms, including several of the tech titans covered in this article, another major concern.

The Sell Off in Chinese Names May Not Be Over

The crackdown on Chinese tech firms and related sell-off prompted NYSE-listed Tencent Music (TME) to announce a $1.0 billion share buyback program in March 2021 that is set to run for 12 months. Later in July, Chinese authorities ordered Tencent Music to end its exclusive music deals within 30 days while also levying fines against the firm. After Tencent acquired China Music Corporation in 2016, it had control of roughly four-fifths of all music tracks in the Chinese markets, something SAMR objected to as being anti-competitive. Tencent Music is the online music division of China’s tech services giant Tencent Holdings (TCEHY).

Baidu (BIDU), which some liken to the “Google of China,” released lackluster near-term guidance when it reported its latest earnings update in August. Though Baidu has largely dodged most of Beijing’s wrath during this latest crackdown, the company is contending with various headwinds as it attempts to grow its AI-oriented businesses. Baidu was still able to tap debt markets recently at reasonable rates.

Chinese authorities have also aggressively cracked down on for-profit education centers (usually geared towards after-school learning) this year, limiting when and for how long the relevant entities can provide such services. This move was primarily aimed at making it easier and cheaper to raise children in a country facing serious demographic headwinds as the population ages (i.e., average age rising, birthrate declining, and a growing retired population), in our view. The recent crackdowns on China’s private sector have been quite severe over the past year, with no signs of letting up.

JD.com May Be the Best Place to Hide in Chinese Equities

Not all news regarding Chinese equities and the Chinese digital economy has been dour of late, however. On August 23, the e-commerce and logistics giant JD.com (JD) reported second quarter results for 2021 that saw its revenues and non-GAAP EPS beat consensus estimates. JD.com’s GAAP net revenues grew by 26% year-over-year, reaching $26.2 billion in US dollar terms, with net product revenues up 23% and net service revenues up 49% year-over-year. Over 60% of its net product sales came from home appliances and electronics in the second quarter.

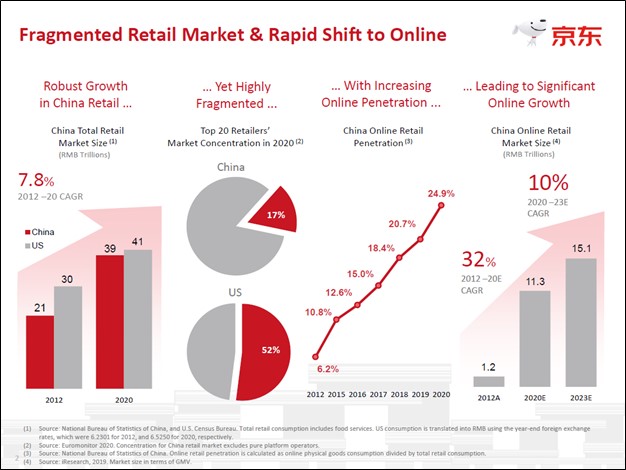

JD.com has grown at a rapid clip over the past several years, aided by strong growth in China’s e-commerce industry, and that trajectory is expected to continue over the next several years. Given the highly fragmented nature of China’s e-commerce landscape and JD.com’s expansive logistics network in the country (including last-mile distribution, warehouses, and other operations), the company views its growth trajectory quite favorably, aided by expected growth in China’s e-commerce industry.

Image Shown: A snapshot of the e-commerce industry in China. Image Source: JD.com – Second Quarter of 2021 Financial and Operation Highlights Presentation

JD.com’s GAAP and non-GAAP operating income both fell sharply year-over-year last quarter, reaching ~$0.05 billion and $0.4 billion, respectively. This was primarily due to its JD Logistics unit flipping from at an operating profit in the second quarter of 2020 to an operating loss in the second quarter of 2021. Wage pressures have been key hurdle on this front, and rising fuel expenses are another concern. JD Logistics (JDLGF) went public last quarter on the Hong Kong Stock Exchange, following in the footsteps of JD Health (JDHIF) which went public in Hong Kong in December 2020. JD.com remains the controlling shareholder of JD Logistics and JD Health according to its latest annual report.

For reference, JD Health offers online healthcare services, has its own in-house doctors, runs a massive e-commerce pharmacy operation (facilitating sales from businesses to businesses, businesses to consumers, and online-to-offline entities), and provides other healthcare-related services and products. JD Logistics provides various logistics services including business-to-business (‘B2B’) services, warehousing, cold storage warehousing, delivery, and other logistics services to JD.com and third-parties. Going forward, JD Logistics aims to grow its business with third parties, though the performance of JD.com will continue to have an outsized impact on its own performance for the time being. Please note just how expansive the operations of JD.com and its various spinoffs are, highlighting the immense