We are increasing our fair value estimate of Bank of America to $40 per share, as we view the market share gains at the bank and steady loan and deposit growth to be more sustainable than we had previously envisioned. We like the bank’s solid franchise, the management team, and we like the shares here as it tries to catch up with larger peer JPMorgan.

By Matthew Warren

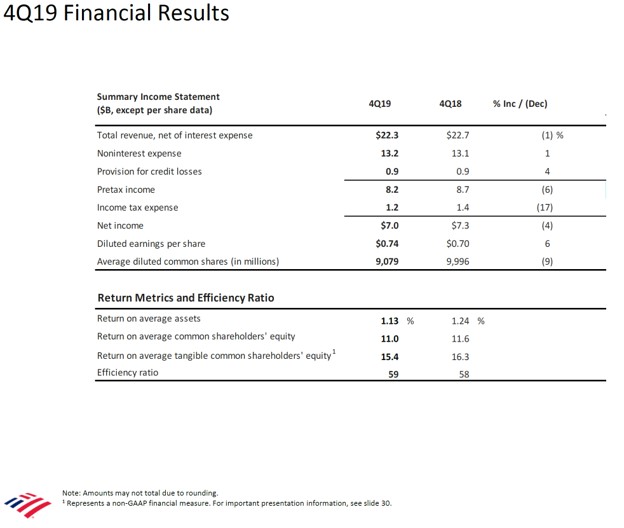

While Bank of America (BAC) put up middling results for the fourth-quarter, report released January 14 , they did come in better than analyst expectations on the top- and bottom-lines. Total net revenue was down 1% in the quarter and net income was down 4%, but large share buybacks meant that diluted earnings per share was actually up 6% in the quarter–not terrible considering the downturn in rates in the second half of last year, which pressured net interest margins. As you can see in the below graphic, return on tangible equity was an impressive 15.4% in the quarter, albeit down from last year’s levels.

Image Source: Bank of America Earnings Presentation

Bank of America’s efficiency ratio was slightly worse than last year at 59% as investments in physical plant, technology, and people outpaced efficiency savings generated by previous investments.

Looking forward, management was clear that the net-interest-margin pressure should ease up in the second half of 2020 as the firm laps lower interest rates (assuming rates do not take another leg lower.) This should allow for continued revenue growth ahead of flat expenses, allowing for operating leverage and better efficiency ratios yet again.

Underlying franchise growth was solid in the quarter as total deposits grew 5%, and loans and leases in business segments grew 6% as compared to last year. These are impressive levels for such a large bank and imply ongoing market share gains from the likes of Wells Fargo (WFC) and the long tail of small, underperforming banks in this country.

Regarding valuation, we are taking up our fair value estimate to $40 per share, as we view the market share gains at Bank of America and steady loan and deposit growth to be more sustainable than we had previously envisioned. We like the bank’s solid franchise, the management team, and we like the shares here as it tries to catch up with larger peer JPMorgan (JPM).

Bank of America was recently added to the Dividend Growth Newsletter portfolio.

—–

Citigroup Succeeding at Cross-Selling >>

Wells Fargo Remains an Inefficient Bank Despite Regulatory Overhang >>

JPMorgan’s Quarter Shows Higher Sustainable Growth Potential >>

Related: XLF, VFH, XFO

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.