Citigroup is finally out-earning our estimate of its cost of capital with a return on tangible common equity (ROTCE) of 12.4% in the quarter, and the shares have rallied substantially more recently as a result. Management lowered expectations for the degree of return on tangible equity improvement going into 2020, but continued improvements would be welcome, nonetheless.

By Matthew Warren

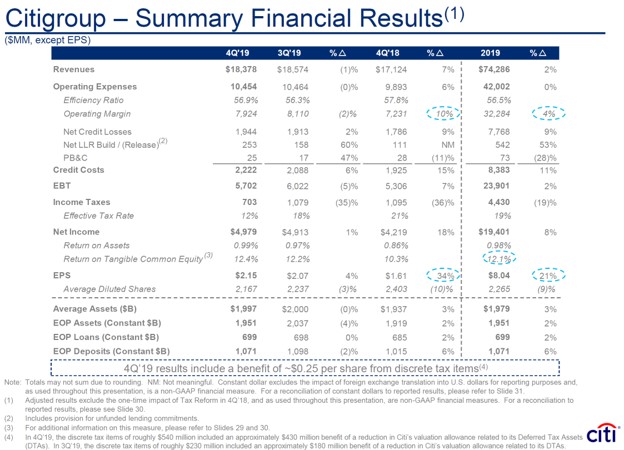

Citigroup (C) posted impressive fourth-quarter results January 14 with revenue up 7% and earnings per share up a whopping 34% given significant share buybacks, beating analyst consensus estimates on both the top and the bottom lines. Fixed income trading grew substantially against a weak quarter last year. As you can see in the below graphic, Citi’s revenue growth accelerated in the quarter, and a lower tax rate and lower share count really boosted per-share results.

Image Source: Citigroup Earnings Presentation

Citigroup is finally out-earning our estimate of its cost of capital with a return on tangible common equity (ROTCE) of 12.4% in the quarter, and the shares have rallied substantially more recently as a result. Management lowered expectations for the degree of return on tangible equity improvement going into 2020, but continued improvements would be welcome, nonetheless.

Citigroup is doing several things right. The bank is controlling expense growth to stay below the pace of revenue expansion, which it has succeeded at doing for the past few years. It has also been very successful at cross-selling to its very large US credit card customer base. In fact, it gathered $6 billion of deposits, proving that scaling business in credit cards can help scale up retail banking across the country, too, even though its footprint doesn’t cover the nation. This has been extremely hard to do for Internet-only banks, proving that a solid existing product relationship is a key wedge to growing the broader holistic relationship.

We are raising our fair value estimate to $90 per share to reflect the fundamental improvement at Citigroup and higher expectations for through-the-cycle return on tangible equity. [This fair value estimate change will be reflected in Citigroup’s table upon the regular data update at the end of this upcoming weekend.]

Wells Fargo Remains an Inefficient Bank Despite Regulatory Overhang >>

JPMorgan’s Quarter Shows Higher Sustainable Growth Potential >>

Related: XLF, VFH, XFO

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.