Image Shown: Digital Realty Trust is one of our favorite ways to indirectly play several secular growth trends at once. The data center real estate investment trust (‘REIT’) pays out a nice dividend that’s supported by its investment grade credit ratings, a solid cash flow profile, and a promising growth trajectory.

By Callum Turcan

Happy Holidays!

Callum here. I hope you are all enjoying some quality time off with your loved ones. This year, my family is happy to announce that we will be celebrating this Thanksgiving with my sister’s newborn daughter, her first major holiday. These are exciting times, and as always, feel free to check out our Best Ideas Newsletter portfolio (link here) and Dividend Growth Newsletter (link here) portfolio by clicking those links or going to the front page of our website (the links are listed under ‘Newsletters/Portfolios’ on the right hand side of the screen).

Digital Realty Trust Inc (DLR) has been a resilient performer in both the Dividend Growth Newsletter and High Yield Newsletter portfolios, and we continue to like the name. Due to the data center REIT’s impressive dividend growth profile, a product of the double-digit annual growth rate in its funds from operations (‘FFO’) since 2005, shares of DLR yield a nice ~3.6% as of this writing. At the end of 2013, Digital Realty paid out a quarterly dividend of $0.78 per share, which has since grown to $1.08 as of 2019. Historically, Digital Realty has preferred to increase its payout at the start of each new year, and we expect that the REIT will keep pushing through mid-single digit annual dividend increases going forward.

International Reach and Footprint Grows Further

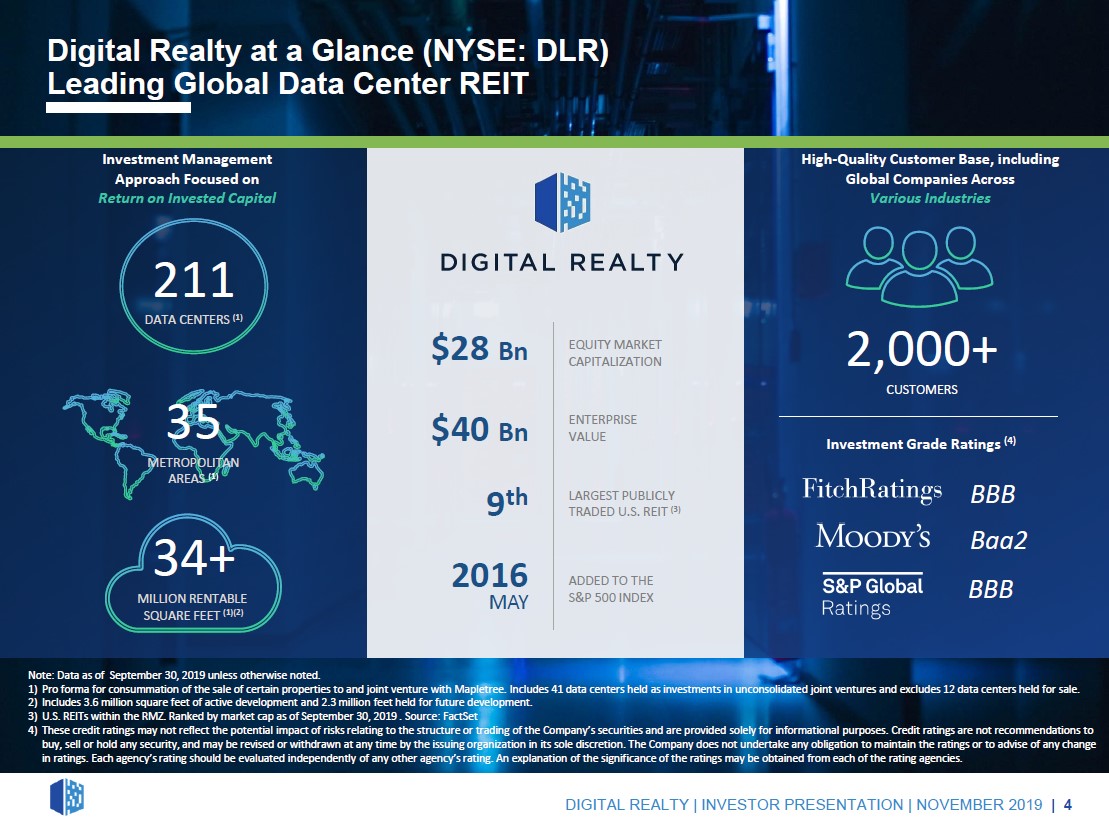

Three of Digital Realty’s biggest strengths come from its investment grade credit ratings (BBB/Baa2/BBB), its strong cash flow profile, and the REIT’s promising growth trajectory (underpinned by its international ambitions). Digital Realty’s net operating cash flows advanced from $0.9 billion in 2016 to $1.4 billion in 2018 and are expected to keep growing substantially as its purchase of a leading data center provider in Brazil closed in December 2018.

Image Shown: Digital Realty’s global reach is impressive. Image Source: Digital Realty – November 2019 IR Presentation

On October 29, 2019, the same day Digital Realty announced its third quarter earnings, the REIT also announced it was merging with European data center provider Interxion Holdings Inc (INXN) in an all-stock deal. For every share of INXN, Digital Realty will exchange 0.7067 shares of DLR in a transaction valued at ~$8.4 billion (including assumed debt) at the time. Shareholders of Interxion would own ~20% of the pro forma company’s outstanding common stock if the deal gets approved. Closing is targeted for 2020, subject to shareholder and regulatory approvals.

This deal is part of a much bigger strategy. Digital Realty sees international markets as the key to maintaining strong growth rates for a REIT of its size, relatively speaking. Beyond the acquisition in Brazil, Digital Realty is moving into South Korea for the first time. Management announced in July 2019 that by 2021, Digital Realty aims to bring a new carrier-neutral data center online near Seoul. We are very supportive of Digital Realty’s international goals. Near-term headwinds aside (the US-China trade war, the Japan-South Korea trade war, Brexit, etc.), the long-term outlook for global data centers looks very promising. Rising cloud computing usage and the emergence of new technologies that heavily rely on cloud computing services underpin this outlook.

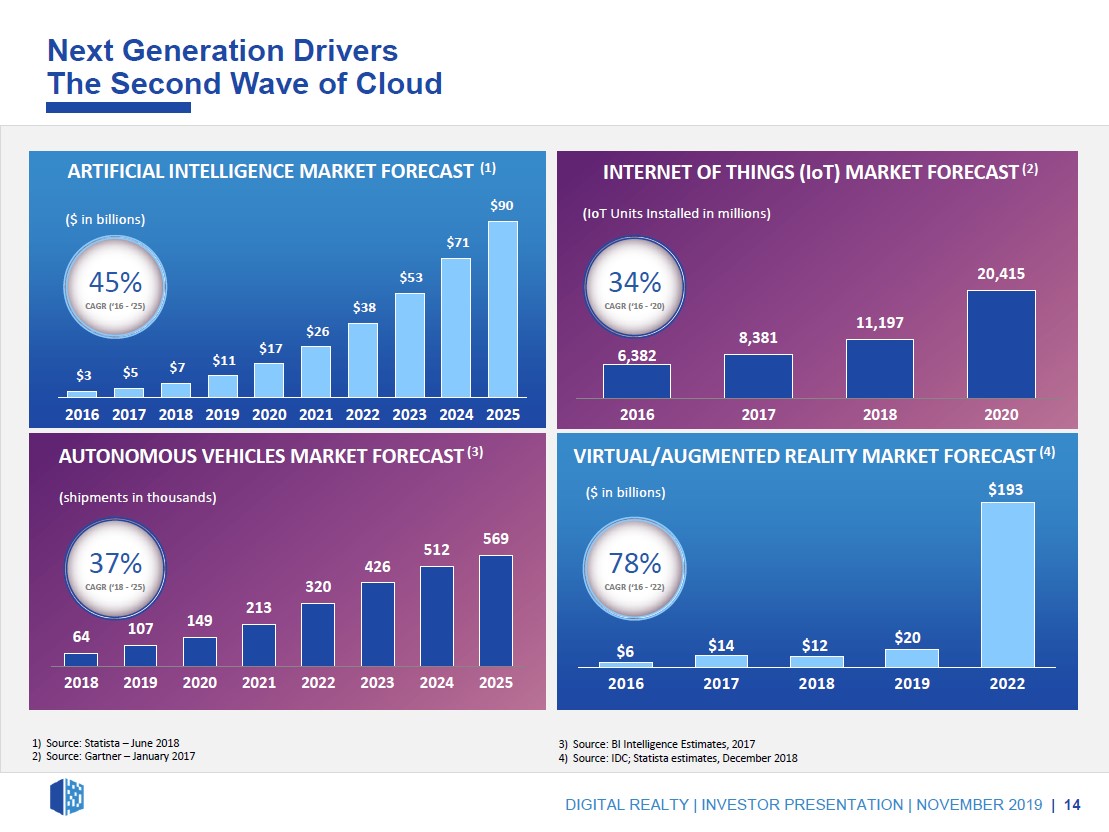

Secular Growth Trends

Demand growth forecasts for cloud computing services (and thus data centers) are underpinned by several secular growth tailwinds including; the emergence of commercial-level autonomous and semi-autonomous vehicles, the Internet of Things (‘IoT’), artificial intelligence (business analytics, predictive maintenance, sales forecasting, etc.), and virtual reality offerings. In the graphic below, Digital Realty highlights the macro background that supports its growth trajectory.

Image Shown: Digital Realty cites several third-party market research services when highlighting why management is optimistic on Digital Realty’s growth trajectory. Image Source: Digital Realty – November 2019 IR Presentation

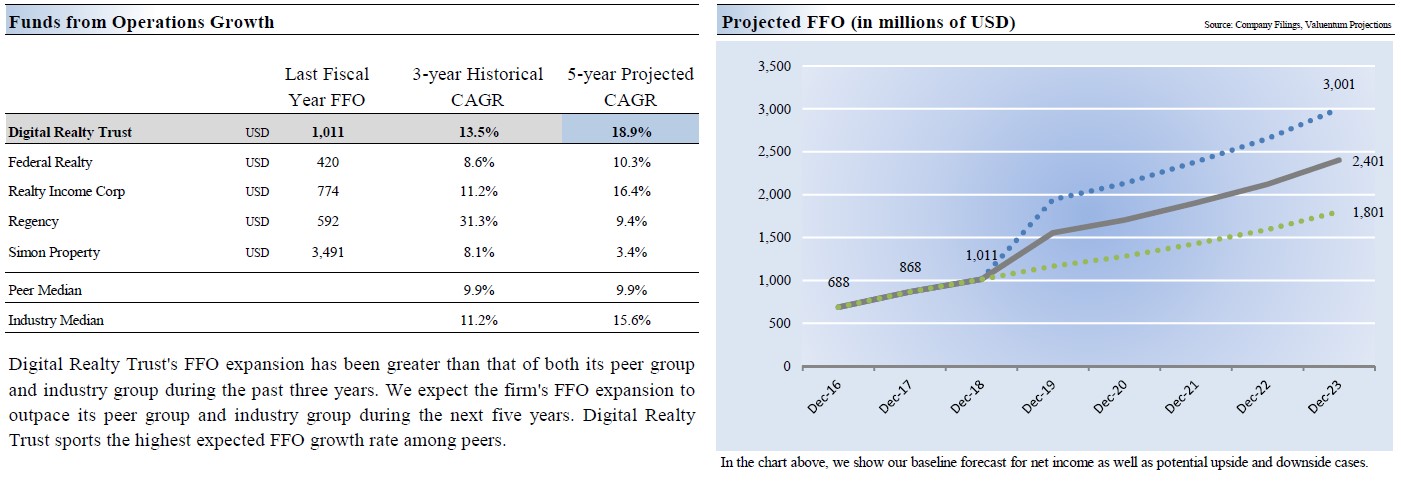

Having a greater presence in East Asia, Brazil and Latin America, and European markets better positions Digital Realty to capitalize on these secular growth trends. In the graphic down below, from our 16-page Stock Report covering Digital Realty (can be accessed here), we cover our FFO growth expectations over the medium-term. Please keep expected equity dilution in mind (which historically has been very material), as Digital Realty uses a combination of debt and equity issuances to fund its growth story.

Image Shown: We expect Digital Realty to post one of the strongest FFO growth rates in the REIT industry over the coming years.

Furthermore, please note that while Digital Realty’s adjusted Dividend Cushion ratio sits a 2.9x (earning the REIT a GOOD Dividend Safety rating that too is adjusted), its relatively strong dividend coverage relies heavily on the REIT maintaining access to capital markets. Should credit conditions tighten considerably during the next recession, that could profoundly impact its ability to function going forward. That being said, Digital Realty appears to maintain solid access to capital markets at attractive rates and we expect that should continue being the case going forward.

Modest Stake Sale

In the third quarter of 2019, Digital Realty agreed to sell down its stake in some of its assets as a way to monetize past successes and move into new ventures. Here’s an excerpt covering the deal:

During the third quarter of 2019, Digital Realty entered into definitive agreements with affiliates of Mapletree Investments Pte Ltd [privately-held] and Mapletree Industrial Trust (MAPIF) for the sale of ten Powered Base Buildings® and the establishment of a joint venture on three existing data centers. The Powered Base Buildings® will be sold for a total purchase price of approximately $557 million, representing a 6.6% cap rate on expected 2020 net operating income of $37 million. Separately, an entity jointly owned by Mapletree Investments and Mapletree Industrial Trust will purchase an 80% interest, and Digital Realty will retain a 20% interest, in a joint venture on three fully stabilized hyper-scale facilities located in Ashburn, Virginia.

Mapletree Investments and Mapletree Industrial Trust will acquire its 80% stake for approximately $811 million, valuing these three assets at approximately $1.0 billion. These three facilities are fully leased and are expected to generate 2020 cash net operating income of approximately $61 million, representing a 6.0% cap rate. Digital Realty will continue to operate and manage these facilities, and the transaction will be completely seamless from a customer perspective. The transactions are expected to close in late 2019 or early 2020 and are subject to customary closing conditions.

One part of the deal closed on November 4, with Digital Realty pocketing $0.8 billion in cash in return for selling an 80% stake in three large data centers. The second portion of the transaction is targeted for an early-2020 close. The cash proceeds from these transactions will help Digital Realty maintain its investment grade credit ratings and will also making refinancing debt related to the Interxion deal an easier task.

Please note this transaction prompted management to marginally reduce Digital Realty’s core FFO per share guidance for 2019 from $6.60-$6.70 to $6.55-$6.65. That’s flat versus the REIT’s core FFO per share of $6.60 in 2018, but we expect core FFO per share growth will resume in earnest going forward once the Interxion deal closes. From 2017 to 2018, Digital Realty’s core FFO per share grew by ~7.5%.

Concluding Thoughts

We continue to like Digital Realty as a great way to indirectly play several promising secular growth trends and appreciate its dividend growth outlook. Management remains committed to retaining the REIT’s relatively strong financial position, and we’ll have more to say on the name once its Interxion merger closes in the event that it does (which is quite likely considering Interxion’s CEO David Ruberg has voiced support for the proposed merger).

Additionally, Mr. Ruberg is joining Digital Realty’s team as the Chief Executive of Digital Realty’s Europe, Middle East & Africa operations. Interxion will be rebranded as ‘Interxion, a Digital Realty company’ when the deal closes. These decision will make integrating Interxion’s operations into Digital Realty’s portfolio while maintaining key business relationships an easier task over the coming years.

If you may wish to add the High Yield Dividend Newsletter to your membership, please click here.

Retail REIT Industry – CONE DLR FRT O REG SPG WPC

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) and Digital Realty Trust Inc (DLR) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Digital Realty Trust is also included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.