Image Source: Realty Income Corporation – IR Presentation

By Callum Turcan

Realty Income Corporation (O) is a REIT focused on free-standing, single-tenant commercial properties in 49 US states, Puerto Rico, and now the UK. At the end of the second quarter of 2019, Realty Income had economic interests in almost 6,000 properties. The REIT reported second quarter earnings on August 5, and we liked what we saw. Realty Income is included in our Dividend Growth Newsletter portfolio and shares of O yield 3.9% as of this writing. Please note that the REIT pays out a monthly dividend and has been doing so for 589 consecutive months (~49 years).

Financial Overview

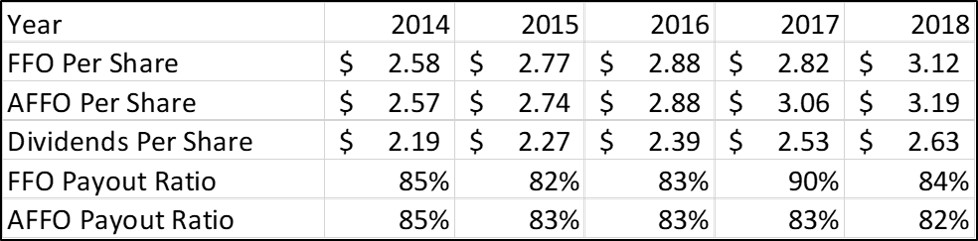

As you can see in the graphic below, Realty Income has consistently kept its core payout ratio in the low-80s, defined as dividends per share divided by adjusted funds from operations (“AFFO”) per share. We would prefer that ratio moves a bit lower over time, but we have faith in Realty Income’s future performance as does its management team. During the first six months of 2019, Realty Income’s AFFO climbed by 2.5% year-over-year to $1.63/share. Management is guiding for the REIT’s 2019 AFFO to come in at $3.28/share-$3.33/share, up 3.5% from 2018 levels at the midpoint. That forecast was reaffirmed during Realty Income’s second quarter earnings report which we appreciate. Funds from operations (“FFO”) is expected to grow to $3.26/share-$3.31/share in 2019.

Image Shown: A look at Realty Income’s financial performance from 2014 to 2018. Note the modest improvement in its payout ratios and consistent AFFO per share growth. Image Source: The table was created by the author using data from Realty Income’s IR website

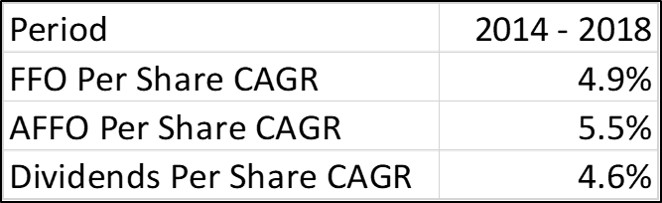

Realty Income has steadily grown its AFFO per share over the past five years, allowing for a nice dividend growth story. Take a look at the compound annual growth rate (“CAGR”) of Realty Income’s FFO, AFFO, and dividends per share from 2014 to 2018 in the graphic down below. As FFO and AFFO growth on a per share basis outpaced dividend growth on a per share basis, Realty Income’s payout ratio marginally improved during this period.

Image Shown: Realty Income’s FFO and AFFO growth on a per share basis over the past five years allowed for mid-single-digit dividend increases on an annualized basis during this period. Image Source: The table was created by the author using data from Realty Income’s IR website

We caution that Realty Income remains capital market dependent just like most REITs outside of the self-storage space. The REIT was consistently free cash flow negative in 2016, 2017, and 2018 as capital expenditures easily outstripped net operating cash flows. Its total debt load stood at $7.1 billion at the end of June 2019, towering over a negligible cash balance. Liquidity needs can be met through Realty Income’s $3.0 billion revolving credit line due March 2023, which was only marginally drawn as of the end of June 2019.

Back in November 2017, Moody’s Corporation (MCO) upgraded the credit rating of Realty Income’s unsecured debt to A3 with a stable outlook, pushing the REIT’s already strong investment grade credit rating even further in the right direction. S&P Ratings gives Realty Income an investment grade A- credit rating according to Realty Income’s IR presentation. Maintaining investment grade credit ratings is essential to Realty Income’s business model, as the firm needs to tap debt and equity markets (like it successfully did during the second quarter) for funds to grow and to cover its dividend payments.

Pushing Into Overseas Markets

During the second quarter, Realty Income moved into UK’s property market through a sale-leaseback transaction with supermarket store operator Sainsbury’s (JSNSF). That deal covered 12 properties in the UK for GBP$429 million and allowed for management to increase Realty Income’s 2019 AFFO guidance to where it stands today. A month later, the deal closed with Realty Income entering into a long-term currency swap to hedge the majority of its future cash flows from foreign currency movements. This is Realty Income’s first international real estate acquisition, and it likely won’t be the last. Debt was issued out in British Pounds to cover most of the transaction as you can see from Realty Income’s press release;

“The sale-leaseback transaction with Sainsbury’s is executed at a 5.31% GBP initial cap rate, includes annual rent increases over the duration of the lease term, and carries a weighted average lease term of approximately 15 years. The transaction is partially funded with proceeds from the private placement of £315 million senior unsecured notes due 2034 with a fixed interest rate of 2.73%. The balance of the purchase price, as well as the majority of net cash flow generated from the transaction, is hedged through a 15-year cross currency swap, which minimizes the company’s exposure to foreign exchange rate fluctuations.”

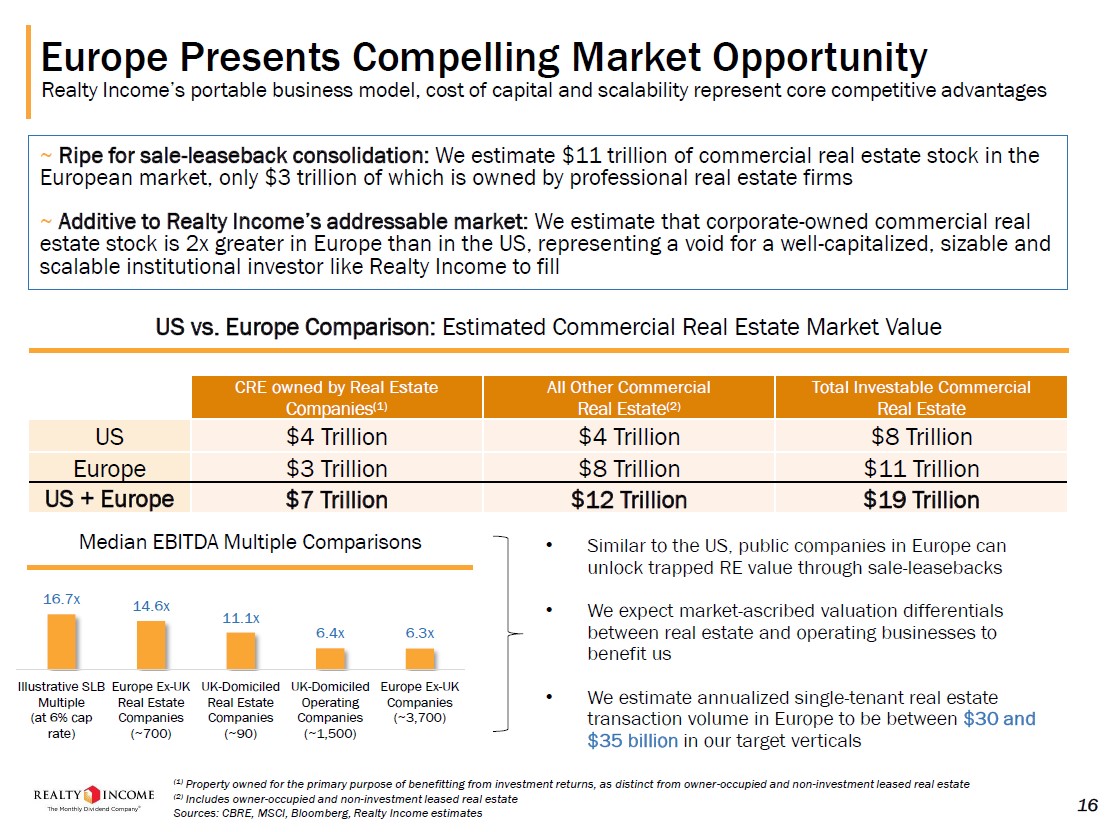

Going forward, Realty Income is very optimistic on Europe’s commercial property market as it represents an $11 trillion opportunity in total investable commercial real estate. Only $3 trillion of that is thought to be owned by “professional real estate firms,” indicating Realty Income thinks there could be a lot of European demand for sale-leaseback and other transactions, demand that isn’t being properly catered to. We caution that entering new markets overseas represents Realty Income stepping outside of its core competencies and that there will be a learning curve when it comes to dealing with a different set of rules, regulations, taxes, currencies, and other considerations.

Image Shown: Realty Income sees Europe’s commercial property market offering the REIT an enormous long-term growth runway. The REIT entered the UK commercial property market during the second quarter of 2019, its first international real estate acquisition. That represents the beginning of what could be an impressive growth story during the 2020s. Image Source: Realty Income – IR Presentation

Concluding Thoughts

We liked what we saw in Realty Income’s second quarter 2019 earnings report, and we appreciate management reiterating guidance for the full year. While Realty Income’s payout ratio could be a tad lower, its consistent financial performance and solid investment grade credit ratings indicate its dividend is secure for the time being. A lower interest rate environment should provide a nice tailwind to Realty Income’s near-term financial performance and long-term growth story by reducing its cost of debt. Shares of Realty Income are trading above the upper end of our fair value estimate range due to excitement over the prospect of a period of interest rate cuts initiated by the US Fed. We recently removed shares from the High Yield Dividend Newsletter portfolio, but the entity remains an holding in the Dividend Growth Newsletter portfolio.

Retail REIT Industry – CONE COR DDR DLR FRT KIM MAC O REG RPAI SPG SITC SLG SRC SKT TCO WPC

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.