No changes to simulated newsletter portfolios.

By Brian Nelson, CFA

You’ve got to know when to hold ’em

Know when to fold ’em

Know when to walk away

And know when to run

— Kenny Rogers, The Gambler

Facebook (FB) just reported solid fourth-quarter results (here are the slides). Was there really any doubt Facebook would come roaring back? After all, Facebook is 10-rated on the Valuentum Buying Index. Net balance sheet health and free cash flow generation are so important in determining when to “hold ’em” and when to “fold ’em.” When it was obvious that Kinder Morgan (KMI) and General Electric (GE) were in a lot of trouble and needed to be discarded, how can one truly sour on a company such as Facebook that has a boatload of net cash and tremendous free cash flow generation. Net cash on the balance sheet and free cash flow generation are what we call cash-based sources of intrinsic value, and these two items matter immensely.

What makes all of this so sweet, too, is not only that Facebook’s “cost basis” in the simulated Best Ideas Newsletter portfolio is in the mid-$130s, but that we even “added” to the position on December 27 at a price lower than that when we went to “fully invested” in both simulated newsletter portfolios! We value shares of Facebook at a whopping $226 each, and the company is trading at just under $170 per share in after hours. View its stock page here. We would expect some profit taking to weigh on its equity price in the near term, but we still believe Facebook is on its way to new highs. How ’bout that Valuentum Buying Index (VBI) rating!

The 10 rating on the VBI remains, too! We’ll have a more comprehensive write-up on the website in the coming days, but we couldn’t wait to get the good news to you. From the heavy cash “weighting” in 2018 to going “fully invested” near the December lows to Xilinx (XLNX) soaring to Facebook breaking out big after hours, this is turning out to be among the most exciting couple months in a long time. 2019 is shaping up to be a great year for Valuentum members! In case you missed our last email, we’ve been busy updating reports and writing-up earnings, and pasted below are some links to our latest work:

Novartis Closes Out Busy Year; Proposes Dividend Hike

Apple’s Services Growth on Track; Weakness to Persist in China

Our Reports on Stocks in the Integrated Circuits Industry

Caterpillar Crushed by Expectations for No Growth in China

Today’s Recorded Website Walk Through

Intel Disappoints with 2019 Guidance; Sell-off Overdone

Our Reports on Stocks in the Alcoholic Beverage Industry

Our Reports on Stocks in the Software Industry

Our Reports on the Retail REIT Industry

Our Reports on Stocks in the Metals and Mining (Aluminum) Industry

Thank you!

Brian Nelson, CFA

President, Investment Research

brian@valuentum.com

——————–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

—–

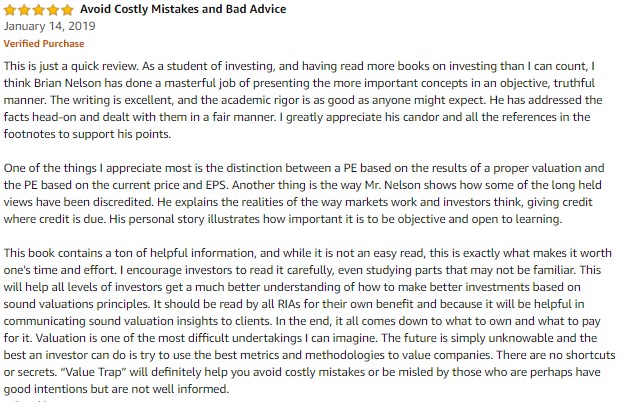

Pasted below is the first review of Value Trap on Amazon. Please be sure to leave yours here. The more buzz you create, the better.