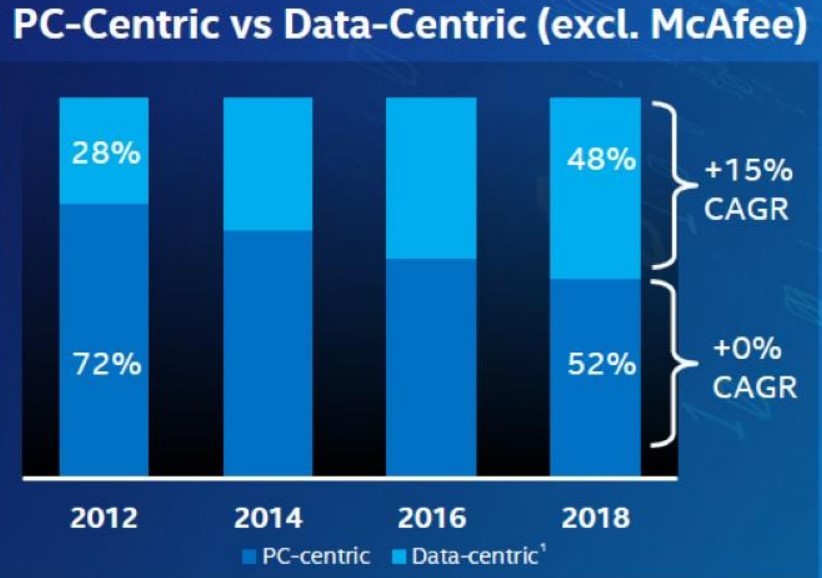

Image shown: Intel’s revenue mix continues to shift towards its data-centric businesses and away from its PC-centric business. Source: Intel fourth quarter presentation

Simulated newsletter portfolio idea Intel disappointed with its fourth quarter 2018 results and guidance for 2019 as multiple headwinds are expected to persist in the near term. Nevertheless, we don’t think the sell-off was entirely justified as the company continues to position itself to take advantage of the high-growth potential of its data-centric businesses.

By Kris Rosemann

Shares of simulated newsletter portfolio idea Intel (INTC) faced material selling pressure following the release of its 2018 fourth quarter results and 2019 guidance, released January 25, but we’re not convinced the sell-off was justified. Our fair value estimate for shares remains $56 each, and the company’s Dividend Cushion ratio currently sits at 2.6, though that may be subject to change as the model is rolled forward with full year 2018 results via the upcoming release of Intel’s 10-K.

Intel’s PC-centric business helped drive company-wide revenue growth of 9% on a year-over-year basis as its top line advanced 10% amid ongoing demand strength for Intel’s high-performance products in commercial and gaming applications. The company’s data-centric businesses, which include its Data Center Group, Internet of Things Group, Memory, and Programmable Solutions Group, collectively grew revenue 9% from the year-ago period thanks in part to 24% revenue growth in its cloud segment of the Data Center Group.

The recent acquisition of Mobileye continues to provide a source of optimism, as the business turned in 43% year-over-year revenue growth in the fourth quarter, and it is building excitement regarding Intel’s participation in autonomous vehicles. The company’s Internet of Things Group revenue took a hit as a result of the divestment of Wind River, and its Memory business turned in record quarterly revenue despite less-than-ideal pricing in the memory space.

While we say that we do not feel the sell-off following Intel’s fourth quarter report was warranted, we understand the market’s reaction to some near-term headwinds that may persist for multiple quarters. Weak demand in China, which is the posterchild for current uncertainty surrounding global trade tensions and growing macroeconomic concerns, is weighing on sentiment and Intel’s outlook, including in its Data Center Group as all three verticals within the group were impacted by China-related softness in demand. Uncertainty over pricing in the memory space, particularly in NAND, is also weighing on expectations.

Management is pointing to a “digestion” period for its cloud service provider customers as another potential near-term headwind as these service providers have moved from building to absorbing capacity, which is weighing on expectations for pricing moving forward. The well-publicized strengthening of rivals such as AMD (AMD) relative to Intel’s delayed 10-nanometer chip launch has become old news at this point, but the competitive threat is still in place, even if the vast majority of the risk related to the situation has been priced into Intel’s share price. These combinations of potential headwinds are impacting near-term guidance on both the top line and operating margin.

In the fourth quarter, Intel’s non-GAAP operating margin was roughly flat from the year-ago period at just over 35% as strong mix and ongoing spending leverage was offset by 10-nanometer chip costs and growth related to adjacent businesses. Non-GAAP earnings per share advanced 18% in the fourth quarter on a year-over-year basis to $1.28 thanks in part to a materially lower tax rate.

Cash flow from operations took a bit of a hit in the fourth quarter at Intel as the measure fell ~4.7% to $6.9 billion, and slightly lower capital spending was not enough to keep free cash flow from falling ~5% from the year-ago period to ~$3 billion, which was still more than enough to cover cash dividends paid of ~$1.4 billion in the quarter. While we think shares offer an attractive valuation proposition based on our fair value estimate of $56 per share, Intel continues to aggressively buy back stock, as it repurchased ~$2.3 billion in the fourth quarter alone. As of the end of 2018, it held a net debt position of $14.7 billion (~$26.4 billion total debt compared to ~$11.7 billion in cash investments) compared to net debt of $12.8 billion a year earlier. Management estimates that it generated ~$14.3 billion in free cash flow in 2018 and returned nearly $16.3 billion to shareholders, only ~$5.5 billion of which was via dividends.

Intel’s modest revenue growth guidance for 2019 highlights the aforementioned near-term headwinds that may very well persist for multiple quarters, but we continue to have confidence in the company’s ability to continue taking advantage of a large and growing market. The company appears to remain on track with respect to its 10-nanometer launch prior to the holiday season, and its data-centric businesses are expected to remain growth drivers.

Management expects 2019 revenue to grow by ~1% to roughly $71.5 billion as its PC-centric business revenue is expected to fall at a low-single-digit rate while its data-centric businesses are expected to grow at a mid-single-digit rate. It expects gross margin weakness in the year as a result of the 10-nanometer production ramp and ongoing growth in adjacent businesses, and non-GAAP operating margin is expected to contract by roughly one percentage point to ~34% as the gross margin weakness will be partially offset by operating leverage and optimized R&D spending. Non-GAAP earnings per share in 2019 are targeted at ~$4.60 (a target that implies shares are trading at just over 10x 2019 non-GAAP earnings) compared to $4.58 in 2018, but perhaps most importantly, Intel expects free cash flow to grow ~12% in 2019 to $16 billion after projected capital spending of ~$15.5 billion. Management also announced a 5% dividend increase along with its fourth quarter results.

Shares of Intel are currently changing hands near the lower bound of our fair value, and we continue to highlight the company in both newsletter portfolios. The company is expecting only modest growth in 2019, but the combination of continued strength in its data-centric businesses, which generally target massive and rapidly-growing markets, coupled with the eventual launch of its 10-nanometer chip prior to the 2019 holiday season should help it return to more noteworthy top-line growth in 2020 and beyond. We think the sell-off following the company’s fourth quarter report was overdone, and the stock currently offers a ~2.7% dividend yield to go along with its solid 2.6 Dividend Cushion ratio. Our fair value estimate currently sits at $56 each, and shares are trading at just over 10x 2019 non-GAAP earnings guidance.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.