Image source: Realty Income

Simulated Dividend Growth Newsletter portfolio idea Realty Income delivered a solid first quarter 2018 report that included impressive occupancy rates, steady adjusted funds from operations growth, and ongoing dividend expansion.

By Kris Rosemann

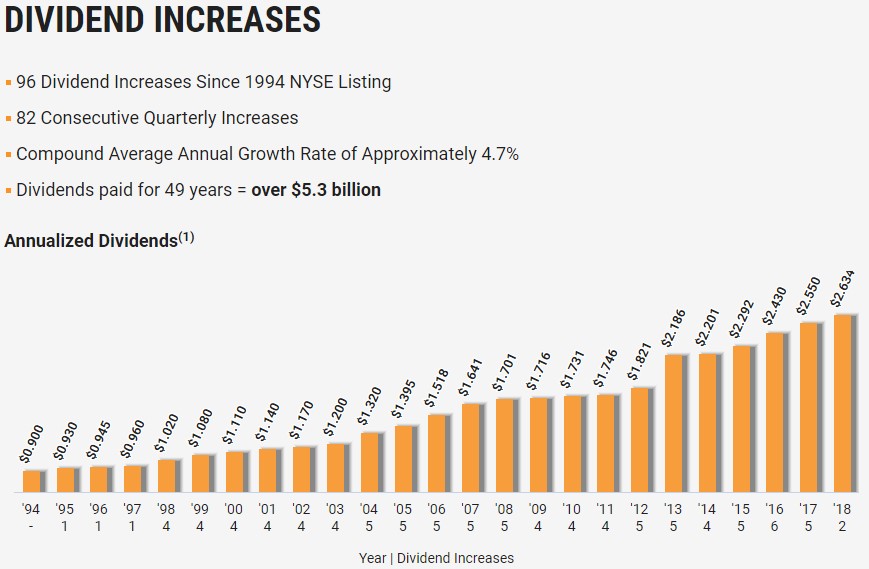

As concerns over what the long-term outlook for retail truly is weigh on many retail REITs, Realty Income (O) is not slowing down. Instead, the company is focused on finding the right tenants in the highest quality spaces, and it may just pay off for the REIT as it ended the first quarter of 2018 with its highest quarter-end occupancy rate in more than ten years at 98.6%. To put some context behind that figure, a mere 75 of its 5,326 properties were vacant at the end of the quarter. However, perhaps most notable for some REIT investors is the quarter marking its 82nd consecutive quarter of growth in the quarterly dividend–and the 96th dividend hike since its IPO in 1994–as management raised the quarterly payout more than 4% over the comparable period of 2017.

Realty Income turned in solid adjusted funds from operations (AFFO) growth in the first quarter as AFFO per share advanced nearly 4% on a year-over-year basis to $0.79, and management reiterated its full-year AFFO per share guidance of $3.14-$3.20. Rental revenue increased more than 7% in the quarter from the year-ago period as same-store rents increased 1%, and it was able to generate a positive recapture spread on re-leased properties in the quarter. The REIT also invested nearly $510 million in 174 new properties and properties under expansion in the first quarter.

The properties Realty Income acquired in the first quarter are indicative of its focus on high-quality tenants as the traditional retail environment continues to feel the disruption created by the proliferation of online retailers. These properties are 100% leased with a weighted average lease term of ~14 years, and roughly 85% of rental revenue from the properties is from investment grade tenants, which brings Realty Income’s rental revenue generated from such tenants to more than 50% of total rental revenue.

Since it is a REIT, Realty Income’s dividend health is dependent on adequate access to the capital markets, a dynamic we do not expect to be an issue in the near-term as Realty Income boasts a solid investment grade credit rating. Moody’s upgraded its rating to A3 in late 2017 thanks to its track record of maintaining conservative balance sheet metrics, ability to obtain low-cost long-term financing, and its geographically diverse net-lease portfolio that has provided stable operating performance through various real estate cycles. The REIT claims to be the only the only net-lease REIT with an “A” credit rating.

We expect to continue highlighting Realty Income in the simulated Dividend Growth Newsletter portfolio for the foreseeable future, even if it is at a relatively low weighting, but we are not discounting concerns surrounding the broader retail environment and rising interest rates, both of which have played a role in the stock’s volatility thus far in 2018 despite its impressive occupancy rate performance. We currently value Realty Income at $56 per share, and its stock yields just over 5% as of this writing.

REITs – Retail: CONE, COR, DDR, DLR, FRT, GGP, KIM, MAC, O, REG, RPAI, SKT, SLG, SPG, SRC, TCO, WPC

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.