The biotech industry remains one of the most fascinating yet perplexing industries for investors. Anecdotes of the entry-stage biotech with a home-run new therapy are often romanticized, but the reality is the vast majority of molecules fail in various stages of clinical testing. Due to the boom-bust nature of the industry, many are wary of investing in the space, and traditional valuation metrics are not as useful due to a large number of such speculative entities being in the pre-revenue stage. With this in mind, let’s take a glimpse into our thought process when evaluating upstart biotech companies.

By Alexander J. Poulos

Before we dig in, we feel a word of caution is warranted. Entry-stage biotechs (IBB) inherently come with a high degree of risk. We have seen many promising molecules fail even in phase three (the last of the phases) due to unforeseen side effects or other hidden risks. These types of events are generally “unknowable” in advance and add a layer of risk that is not typically present in traditional sectors with more predictable revenue streams such as consumer staples. Junior biotechs are high growth entities that should be viewed as speculative ideas. Please remember that Valuentum cannot and does not provide investment advice, and please always check with your financial advisor if you feel any ideas may be right for you.

Criteria #1 – Total Addressable Market

Total addressable market (TAM) garners the top spot on our criteria list for a number of reasons. Investing in a molecule with a more modest TAM pushes the risk-reward profile to the risk side, while a larger TAM clearly offers more upside. In other words, TAM has a meaningful impact on the distribution of expected values (estimated by discounted future free cash flow generated by a given drug) of prospective drugs.

A recent example of a drug with less-than-ideal TAM value is the approval of Inclusig–developed by ARIAD Pharma, a subsidiary of Takeda Phrama (TKPYY)–for the treatment of chronic myeloid leukemia and Philadelphia chromosome-positive acute lymphoblastic leukemia. Though we highly admire all advances in medicine, the TAM of such a niche product is simply not worthy of an investment, in our opinion, as the revenue generated is not material enough to significantly alter the company’s intrinsic value via a meaningful increase in future free cash flow generating capacity.

On the other end of the spectrum is Incyte (INCY), which is promoting Inclusig in Europe. The company is in the midst of developing Epacadostat, an IDO1 inhibitor that has the potential to be paired with Merck’s (MRK) Keytruda or Bristol Myers Squibb’s (BMY) Opdivo for a combination treatment for various forms of cancer. The TAM for inclusion in combination therapy would render Epacadostat a viable blockbuster with revenue potential north of $1 billion per year.

Criteria #2 – Market Capitalization

Market capitalization looms large for entry-level biotechs as it offers information related to potential M&A activity. The research landscape has changed. Innovation now emanates not from the behemoths of traditional pharma, but increasingly springs forth from the biotech arena, most notably from junior biotechs. The trend is for larger players such as Pfizer (PFE), for example, an acquisition-hungry pharma giant, that may open up the checkbook to acquire an innovative product to bolster its overall product line-up.

Pfizer generates over $50 billion in annual revenue, so even if Pfizer produced a blockbuster product (sales of $1+ billion) internally, it may not have a meaningful impact on top-line performance, so seeking entities with “needle-moving” pipelines could pack more punch. Unlike the upside that may come with speculative biotechs, we view low-growth companies such as Pfizer as reasonably attractive income generators as the revenue stream generated from current marketed products generally assures steady free cash flow generation that can be recycled into new product acquisitions to replace revenue lost from eventual patent expirations.

From our perspective, a market capitalization of less than $5 billion remains the sweet spot for bolt-on acquisitions, and some big pharma executives have issued public comments echoing this notion. A novel therapy that is brought to the market immediately catapults a speculative biotech onto the radar of big pharma, hastening the potential for an acquisition or strategic partnership. Of course we do not advocate relying on acquisitions as a source of capital appreciation for investors (it is highly unpredictable), but material takout premiums have become increasingly common for some entities with an attractive marketable product or impressive pipeline of potentially marketable products.

Criteria # 3 – Strategic Fit

The third criteria to consider in evaluating a biotech, in our view, is a therapy’s strategic fit into the existing product pipeline of the company. An established sales force may have far greater productivity in marketing a given product if it holds familiarity in the treatment area and long-standing relationships with physicians compared to a team working to make inroads in a new treatment area. Sticking with the Inclusig example, Incyte (INCY) is using the product to gain familiarity with physicians in Europe, well in advance of the expected approval of Epacadostat, with the expectation the familiarity built will hasten the acceptance of the product (thus generating additional sales for Incyte).

Introducing Clovis Oncology

Clovis Oncology (CLVS) may be a company that positively fits the three criteria listed above. The company is a junior biotech that has successfully brought the third treatment in the PARP-inhibitor class Rubraca (Rucaparib) to market. Rubraca is currently approved for the indication of BRCA-positive advanced ovarian cancer for patients who have received at least two prior lines of chemotherapy with additional label expansion imminent, and the drug is expected to gain the second line or later maintenance for those afflicted with ovarian cancer, with an expected filling by the end of October 2017.

Label expansion looks to be a key to growth for Rubraca and the entire PARP class as the potential exists for widespread utilization in combination with PD-1’s for the treatment of a multitude of cancers. The currently available PD-1’s outside of Renal cell carcinoma and Melanoma generate an overall response rate (ORR) of less than 20%, presenting a golden opportunity for combination therapy to boost the ORR significantly.

Image Source: Incyte’s June 5th, 2017 Investor Presentation

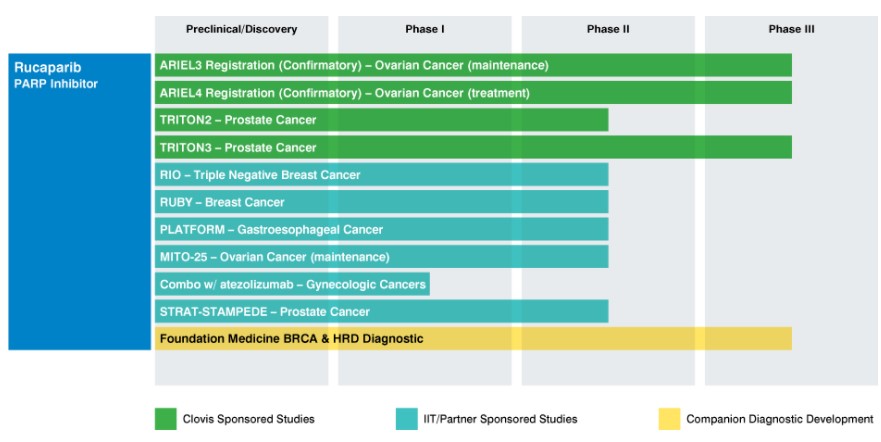

Rubraca remains the only asset in Clovis’ arsenal, and the entirety of its research budget is focused on label expansion into additional areas of treatment for Rubraca.

Image Source: Clovis Oncology

Clovis Total Addressable Market and Market Cap

The label expansion potential for Rubraca more than satisfies our first criteria concerning the TAM potential of the treatment. We feel the product has the hallmarks of a multi-billion dollar annual sales generating asset as Clovis navigates the product through the various stages of clinical trials. The patent estate protecting Rubraca is rock solid with patent protection through 2025.

Clovis’ current market cap remains under the $5 billion threshold at the time of this writing, satisfying the second criteria. As an added caveat, at the time of this writing Clovis remains in “go it alone” mode regarding the fate of Rubraca. Clovis retains full control of the asset, but it has entered into collaboration with Bristol-Myers for a combination therapy that would utilize Opdivo in conjunction with Rubraca.

Under the terms of the collaboration, clinical trial duties will be split, with Clovis the lead investigator of the ovarian cancer trials and Bristol taking the lead in prostate and breast cancer trials. The collaboration can be considered a necessary component for the product in reaching its full potential in the shortest period of time as clinical trials are extremely costly endeavors.

Strategic Fit

The PARP class should prove to be a necessary compliment with existing PD-1 therapies in the forming of a potent combination across various types of cancer. At the moment, the most logical fit for a combination is Bristol-Myers as it is conducting trials with Rubraca and generating confidential data on the potential of the product well in advance of the official clinical data read.

However, the collaboration with Bristol does not preclude an additional entity such as Merck and its PD-1 therapy from entering the fray to purchase a PARP if it feels the product is essential to its oncology franchise. It is not productive to speculate as to whom the potential acquirer may be, but time may be worth spending on determining if a credible path exists. In the case of Clovis, assuming the clinical data from Rubraca remains favorable, it is a distinct possibility that the asset will one day reside in the product portfolio of a big pharma player.

The timing of such a transaction remains unknowable in advance of course, hence the often-volatile share price action on rumors of a potential takeout. Such volatility can sometimes create attractive buying opportunities for investors that wish to speculate on junior biotechs, though we’re not big fans of doing so. Clovis’ price chart dating back to late 2012 can be seen below. The most recent sizable gap up in the chart (mid-June 2017) was a result of its announcement of positive results from a phase three study regarding a potential label expansion for Rubraca.

Concluding Cautions

The biotech sector is not for all investors. Junior biotechs such as those discussed above are highly speculative. The inherent boom or bust characteristics of the space can offer attractive capital appreciation potential, but late-stage pipeline disappointments are not uncommon and can result in significant levels of capital erosion. Complete capital loss is possible. Please remember to check with your financial advisor if any ideas surfaced here are right for you.

Disclosure: Independent Healthcare & Biotech Contributor Alexander J. Poulos is long Incyte and Clovis Oncology.

Tickerized for stocks included in the IBB.