By Kris Rosemann

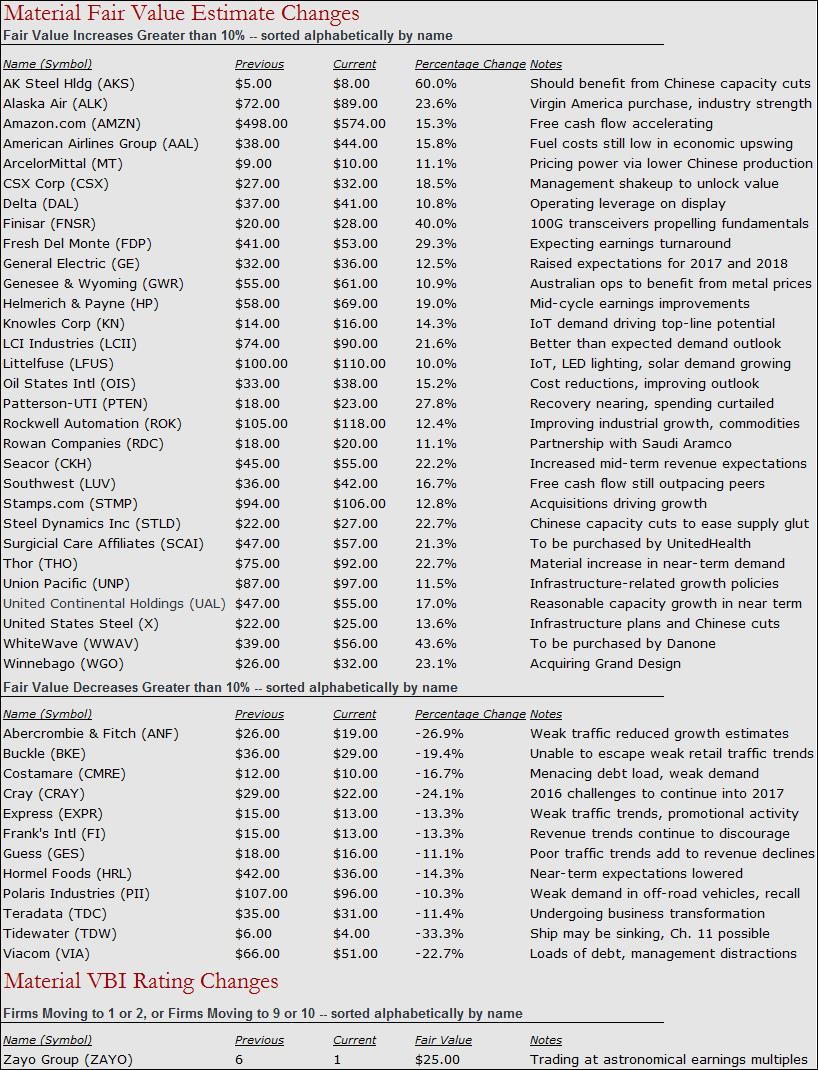

Let’s begin this edition of ‘Recent Material Fair Value Estimate Changes’ with a discussion of some of the highest-profile names that made the list. If you require background reading on why we make changes to our valuation models, please see: What Causes Fair Value Estimates to Change?

We’ve raised our fair value estimates for two of the holdings in the newsletter portfolios, General Electric (GE) and Union Pacific (UNP). The sprawling and evolving industrial portfolio of General Electric is one of the more exciting portions of our portfolios, as the industrial giant boasts assets with authoritative positions in areas from the rapidly expanding Industrial Internet of Things to the rebounding energy services space. An increase in near-term expectations was the basis of our most recent increase in our fair value estimate for shares, but we expect its next-generation industrial operations to continue propelling fundamentals higher for the foreseeable future. The potential for the rebalancing of multiple commodity markets (energy resources and industrial metals) in 2017 adds to our near-term optimism, and we like the renewed focus that should come as a result of its portfolio transformation being largely complete. Management did a nice job monetizing its financial operations, in our opinion, and shares are trading below the lower bound of our fair value range as of this writing.

Union Pacific stands to benefit from Trump’s infrastructure-centric stimulus plans, as well as hopes for a revival in traditional energy sources such as the beleaguered coal industry. The potential for infrastructure-related spending plans to be pushed into 2018 does not significantly impact our thesis on the company, and we continue to have high hopes for its operating ratio improvement initiatives. Pricing strength remains a meaningful lever for the company, but a rebound in volumes would work wonders for its top line. We don’t see much valuation opportunity in shares at this point in time as they are trading in line with our fair value range, but Union Pacific’s dividend remains solid. We’ve also raised our fair value estimates for rail rivals CSX (CSX) and Genesee & Wyoming (GWR), due in part to the potential for improving volumes, as both should benefit from North American infrastructure growth and Genesee & Wyoming’s Australian operations hope to benefit from a potentially recovering iron ore market. CSX’s hunt for a rejuvenated management has had its stock buzzing of late.

Perhaps the biggest name in this edition of ‘Recent Material Fair Value Estimate Changes’ is e-commerce giant Amazon (AMZN), whose free cash flow generation has been accelerating nicely thanks to the success of Amazon Web Services (AWS). Though we’ve increased our fair value estimate for the company based on the improving trajectory of its free cash flows, we still feel shares are overpriced. Material uncertainty remains in estimating the firm’s true long-term operation margin potential, something we’re not comfortable with, nor can anybody with experience in forecasting ever be when it comes to the e-commerce player. Should AWS hit any sort of speed bump, we’re not sure Amazon has another answer to its past profitability issues. For our latest take on the overvalued equity of Amazon please read, “Amazon’s Future May Be Rich, But So Is Its Valuation.”

We also raised our fair value estimates for a number of major airlines, a business model we remain extremely cautious on through the course of the economic cycle. However, airlines such as American Airlines Group (AAL), Delta (DAL), Southwest (LUV), and United Continental (UAL) are riding the current, prolonged economic recovery, and Warren Buffett’s reversal of opinion on the stocks has brought excitement to the arena (not to mention the ongoing relief from falling jet fuel prices). Near-term revenue and earnings assumptions have been increased, and some industry observers are still holding out hope that the group may finally be getting a grip on how to handle capacity and demand growth. We’re not holding our breath, but the increased near-term expectations were enough to drive our fair value estimates higher. Our fair value estimate increase for Alaska Air (ALK), the most material of the bunch, was largely based on its value-creating acquisition of Virgin America, in our view, coupled with the aforementioned industry-wide strength. The US Department of Justice backing off its price collusion investigation helps matters as well.

A number of players in the steel industry made their way onto our list of material fair value estimate changes thanks to expectations for more Chinese iron and steel capacity reductions in 2017, though reports have since surfaced that such cuts may not be material if they are in fact truthful. It is as difficult as ever to trust any data coming out of the People’s Republic of China, to nobody’s fault, and we’re keeping our eyes peeled for any incremental report that may come out surrounding the situation. US-based industry participants should also benefit from Trump’s infrastructure growth plans, even if such plans are pushed out into next year, especially after considering the President’s hopes to use US-produced steel for the stimulus plans.

Our list of fair value estimate reductions was heavily weighted toward the apparel retail industry, populated by the likes of Abercrombie & Fitch (ANF), Buckle (BKE), Express (EXPR), and Guess (GES). The common theme across the industry was severely weakened traffic trends, and the broader retail space has yet to find an answer to such challenges. Most retailers are working to adapt their capital spending plans to optimize efficiency, but store count increases in recent years at Buckle, for example, have helped adversely impact average sales per square foot numbers. Shares of some beaten-down retailers may be looking attractive to value-hungry investors, but we warn of material value trap potential as this may only be the beginning of the top-line erosion we will see across retail. E-commerce is not going away.