Image Source: J&J

By Kris Rosemann

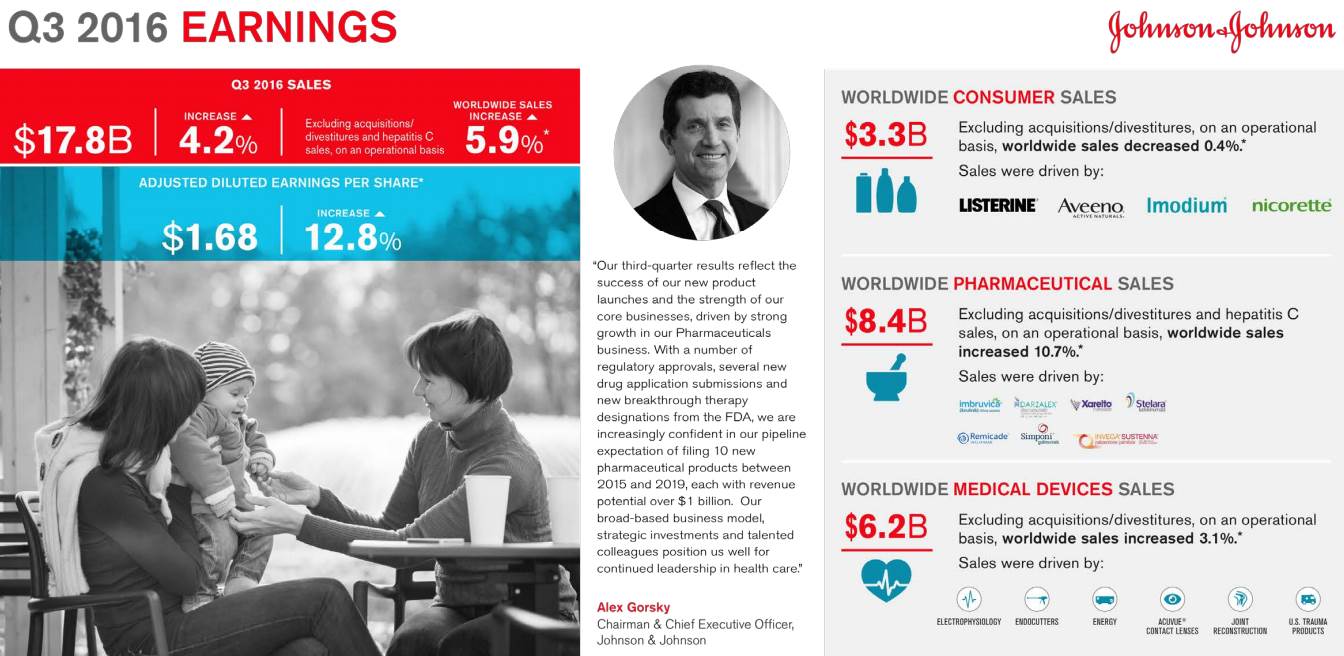

Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio holding Johnson & Johnson’s (JNJ) third quarter report October 18 was an impressive display of the success of its new product launches and the strength of its ‘Pharmaceutical’ business, which it expects is only just heating up. Johnson & Johnson is a long-time holding in the Dividend Growth Newsletter portfolio and was recently added to the Best Ideas Newsletter portfolio in January 2016 as a diversified pharma replacement for the more speculative Gilead (GILD), “Alerts: High-grading! GILD–>JNJ; EBAY–>FB (January 2016),” “The J&J-Gilead Trade-off Update (July 2016).” We see no reason to adjust our positions in Johnson & Johnson in either newsletter portfolio following the solid report.

Johnson & Johnson reported 4.2% sales growth on an as reported basis in the second quarter of 2016 from the comparable period in 2015 thanks to domestic sales growth of 6.7%. Excluding the impact of acquisitions, divestitures, and hepatitis C sales, on an operational basis, worldwide sales advanced nearly 6% from the year-ago period, while domestic sales jumped more than 7%. The firm’s ‘Pharmaceutical’ business (~47% of total sales in the quarter) turned in sales growth of more than 9% as reported on a year-over-year basis as strength in domestic sales (nearly 12% growth) led the segment higher. The company’s ‘Consumer’ and ‘Medical Devices’ segments reported sales increases of 1.6% and 1.1%, respectively, from the third quarter of 2015.

Strong execution coupled with solid top-line expansion resulted in notable bottom-line performance for J&J. Adjusted diluted earnings per share increased nearly 13% to $1.68 after accounting for one-time items in the quarter and the comparable period of 2015. Management raised its adjusted earnings per share guidance for 2016 yet again; it has increased its earnings guidance range after each quarter thus far in the year. It now anticipates adjusted earnings per share to be in a range of $6.68-$6.73, compared to initial guidance of $6.43-$6.58 issued in January 2016. We like the earnings momentum.

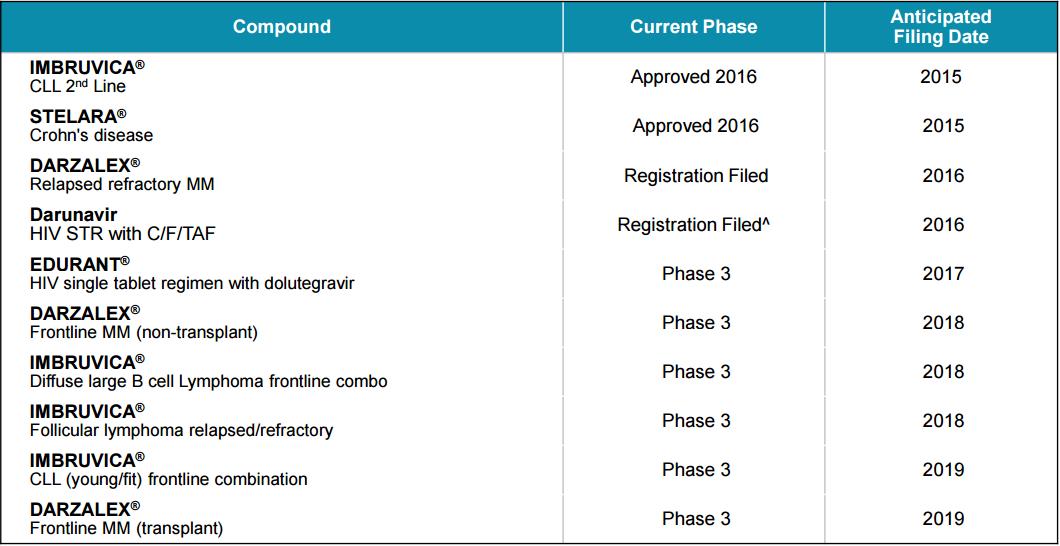

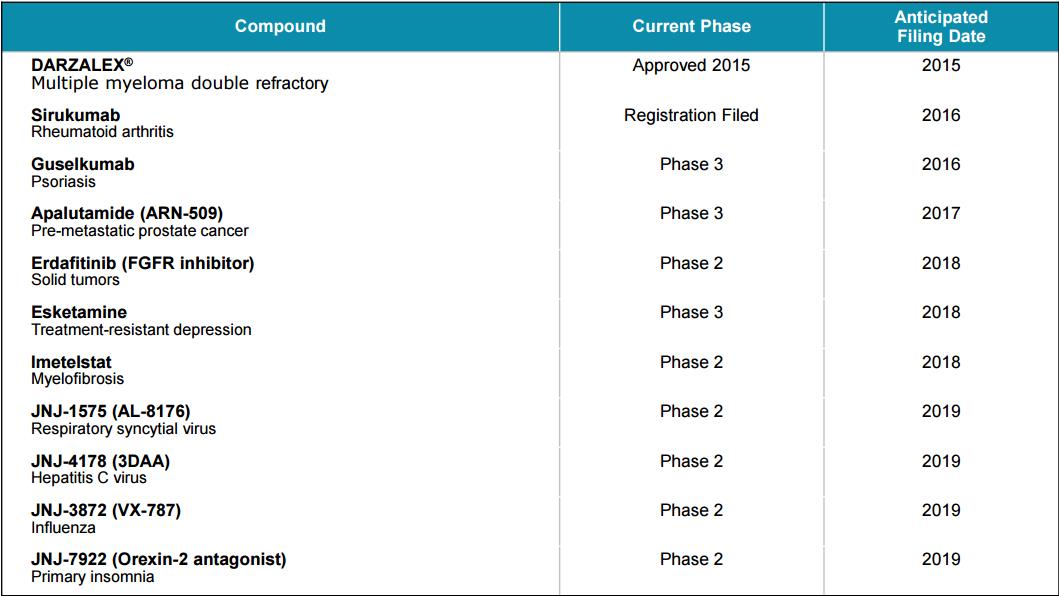

Johnson & Johnson’s ‘Pharmaceutical’ business is the engine behind its growing performance expectations, and it continues to deliver on expectations set out in its latest business review in May 2015. Branded products continue to turn in impressive results and solid volume gains, while additional volume growth and opportunities for line-extensions are prevalent in all core therapy areas. Since May 2015, the firm has filed or gained approval for 16 meaningful line extensions. It believes it has 10 potential line extension filings lined up with $500+ million in individual sales potential, including for established drugs such as Simponi, Stelara, and Xarelto. The company has also launched the first of 10 new molecular entities (NMEs) in its pipeline with $1+ billion individual sales potential, has filed another for approval, and plans to file another by year end. All 10 NMEs are expected to be filed by 2019.

Image above: Johnson & Johnson’s planned line extension filings, each with $500+ million sales potential. Source: J&J presentation

Image above Johnson & Johnson’s planned NME filings, each with $1+ billion sales potential. Source: J&J presentation

Johnson & Johnson’s pharmaceutical portfolio is already one of the strongest on the market, and its pipeline is poised to, at the very least, continue its impressive performance. Oncology continues to be a highlight across the pharmaceutical industry, “Oncology News a Key Driver of Big Pharma (August 2016)” and J&J has heavy exposure to the oncology market–it turned in $1.5 billion in revenue on ~30% sales growth in the third quarter of 2016 in oncology–and expects to continue growing its treatments in the area in part via meaningful line extension filings for Imbruvica. Because of such filings, the firm is confident in its growth prospects through 2019 despite material competition from a growing number of biosimilars entering the market and increasing regulatory scrutiny, particularly on industry-wide pricing practices. The company’s ‘Consumer’ business still boasts a portfolio of well-recognized, steady-performing consumer brands, and its ‘Medical Devices’ segment stands to benefit from the recent acquisition agreement for Abbott’s (ABT) ‘Medical Optics’ business. The clear driver of Johnson & Johnson’s outperformance, however, is its impressive ‘Pharmaceutical’ business.

All in, we’re still huge fans of Johnson & Johnson. At the time of this writing, the company’s shares yield ~2.7%, which mirrors its impressive Dividend Cushion ratio of 2.7. In addition to Johnson & Johnson’s competitive dividend, we like the chances for shares to appreciate toward the upper bound of our fair value estimate, particularly given the levels at which other strong dividend-paying entities are trading in the current market environment and the company’s impressive pharmaceutical portfolio and pipeline. Hey what do you say – we like J&J!