By Brian Nelson, CFA

I think we need to admit that adding Gilead (GILD) to the Best Ideas Newsletter portfolio several months ago when we did was a bit tardy, but we think we have made up for that miscue when we swapped out its shares completely with Johnson & Johnson (JNJ), which has experienced steadily-advancing returns since that trade. Certainly we took a loss in the Best Ideas Newsletter portfolio on Gilead, and we’re not happy about it, but the alpha of this J&J-Gilead trade is now at 15 percentage points. As investors, we understand that we’re not going to get everything right all of the time, and we continue to showcase to readers that it is okay to change your mind about investments in your portfolio. Had we not acted on this particular trade, for example, we would have compounded one error with another.

Johnson & Johnson reminded us July 19 in its second-quarter report why the company is a staple in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. The company’s shares are now approaching $125 each at the time of this writing, and it continues to boast a very healthy 2.6% dividend yield. We currently estimate the high end of the company’s fair value range at $145 per share, and we would not be surprised to see the market bid the company’s equity to those levels. As of the last dividend report update, J&J still sports a very robust Dividend Cushion ratio of 2.7, revealing that the company not only will be adding to its 50+ years of annual consecutive dividend increases for some time to come but that it can effectively double its annual dividend payment and still cover it with future free cash flow generation and net cash on the books (over our measurement period). Here’s what we wrote in J&J’s dividend report found on the company’s landing page.

Key Strengths

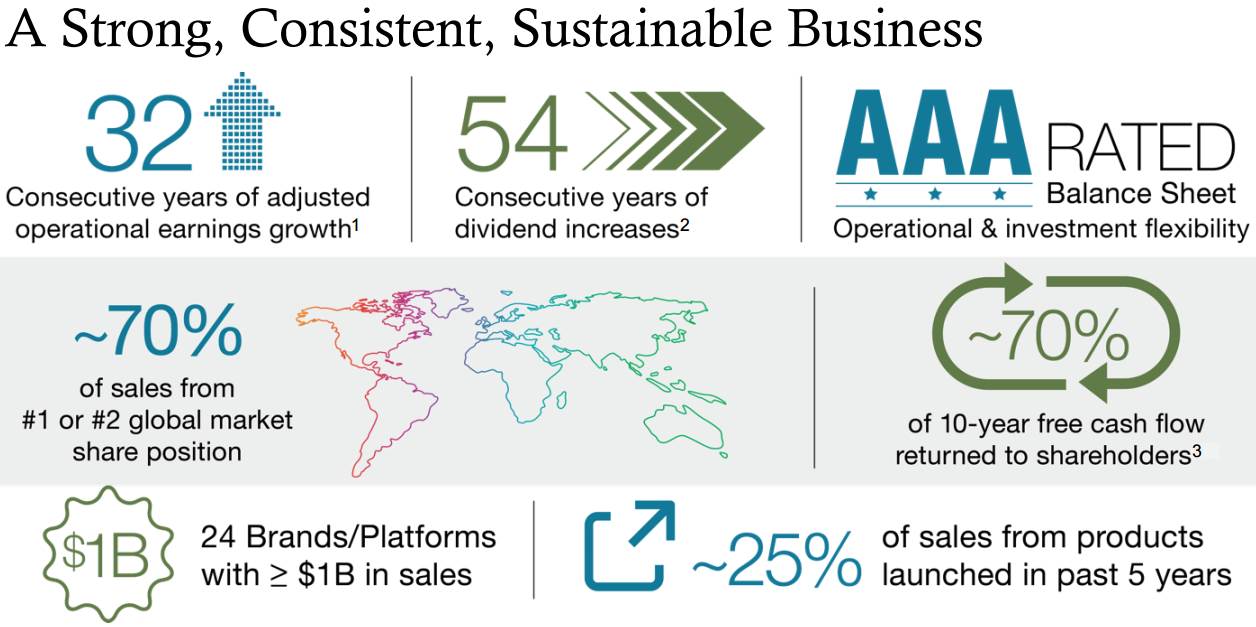

Dividend Aristocrat Johnson & Johnson is in a class by itself. Founded in 1886, everybody seemingly has come into contact with its brands in one way or another; 70% of sales are generated from #1 or #2 global leadership positions across its markets. J&J has driven 30+ years of adjusted earnings increases and more than 50+ years of annual consecutive dividend increases! We like its diversified presence, and generally view its consumer portfolio as the core foundation and its pharmaceutical pipeline the icing on the cake; the US MedTech market is also growing nicely. Free cash flow has averaged ~$14.7 billion during the past three years (2013-2015), well in excess of its yearly run-rate cash dividend obligations (~$8.2 billion).

Potential Weaknesses

There’s a lot embedded in J&J expectations. Management expects to file 10 new drugs through 2019 that have potentially as much as $1 billion in annual sales, individually. Its top-notch positions across the consumer spectrum act as a solid foundation for payout sustainability, but any large disappointments from its pharma pipeline could influence the pace of long-term dividend expansion. R&D will eat up some profits as J&J continues to invest in its business and the company remains acquisitive, but we have no qualms with either. Share repurchases will be ongoing, but a net-cash rich balance sheet offers considerable incremental flexibility to grow the payout, in our view.

But how about that second-quarter report, J&J?

Well, on an operational basis, which adjusts for a number of items, global sales leapt 7.9% thanks to an 8.8% increase domestically and a 6.9% advance internationally. Earnings performance could have been better (adjusted diluted earnings per share increased ~2%), but management’s commentary was encouraging, pointing to its “robust pipeline” in its ‘Pharmaceuticals’ business and its “market leadership” in its ‘Consumer’ business. J&J’s ‘Pharmaceuticals’ business, for example, experienced impressive worldwide sales growth of ~13% in the quarter, almost equally balanced between domestic and international expansion. Upside in this area should be expected, in our view, and we maintain that J&J’s pharma pipeline (see here) is one of the best in the industry.

Momentum continues to build at the company. In J&J’s second-quarter earnings release, the consumer goods and pharma giant raised its full-year sales and earnings guidance yet again, to $71.5-$72.2 billion (was $71.2-$71.9 billion) and $6.63-$6.73 per share (was $6.53-$6.68), respectively. We’re excited about potential news flow coming out of its pharma pipeline, and its diversified operations offer considerable resilience under any economic conditions. We’ll come out and say it: We love this dividend growth giant in a big way! Our sights are set on the high end of J&J’s fair value range, and we’re expecting years and years of future dividend growth at the company. We won’t be parting with shares anytime soon, if at all.

Image Source: Johnson & Johnson, page 235