By Kris Rosemann

On September 28, the Organization of the Petroleum Exporting Countries (OPEC) reached an agreement to cut crude oil production levels for the first time since 2008. The cartel reportedly agreed to limit production of member nations to a range of 32.5-33 million barrels per day (bpd) while leaders met at the International Energy Forum in Algiers, Algeria.

As would be expected following such news, the price of crude oil has bounced, bringing market sentiment surrounding energy-related stocks higher along with it. The proposed production could be a reduction of up to 750,000 bpd from OPEC production levels in the month of August, but how the group of nations will reach such a production cut has yet to be determined. Country-specific production limits are expected to be set at the cartel’s November meeting.

Whether the proposed production cut would make a meaningful difference in the global crude oil surplus is up for debate, though many agree that for substantive balance to return to the energy markets, a much larger production cut would be required as currently idle independent US producers ramping production will likely erase any positive impact on crude oil prices from OPEC’s production cut. The issue of considerable crude oil inventories across the globe continues to be a factor in crude oil prices as well. What is truly needed to restore balance to the energy markets is an agreement between OPEC and non-OPEC producers, specifically Russia. The nation has increased its crude production levels to roughly 11 million bpd, easily the highest in its post-Soviet history.

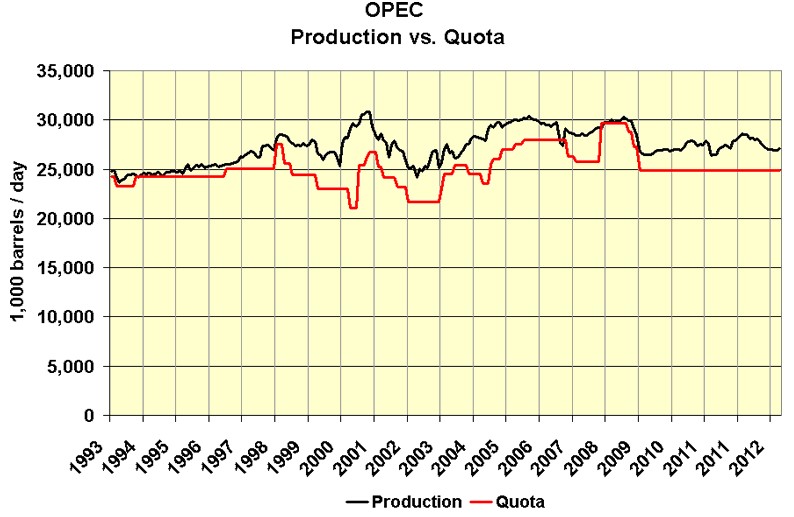

Adding to the questioning of the effectiveness of the proposed production cut is general lack of faith surrounding the true commitment of OPEC to the terms of the agreement. High levels of skepticism are common across many market observers. After all, OPEC has a poor track record when it comes to sticking to production quotas, and the most recent announcement of a production cut could be nothing more than the cartel playing market psychology games as it hopes to provide a degree of near-term relief to some of its members that continue to be hurt by the supply glut.

Image source: energyeconomist.com

So how are we playing the recent developments in the crude oil markets?

We continue to believe that the addition of the Energy Select Sector SPDR ETF (XLE) to both newsletter portfolios in October 2015 was a prudent move, and the addition of Kinder Morgan (KMI) to the Best Ideas Newsletter portfolio in February of this year gives us additional energy exposure should we see a sustained increase in energy resource pricing. We love the inherent diversification qualities of the Energy Select Sector SPDR ETF, as many energy companies are not out of the woods yet in terms of the current crude oil price environment. The production cut by OPEC is by no means a signal that the end of the pain is here, though it is a step in the right direction if adhered to.

We do not see a need to make any moves in either portfolio as a result of the most recent news from OPEC. Similar reports have surfaced in the past surrounding production levels of OPEC member nations, only to never materialize. We’re expecting more crude market manipulation from the cartel leading up to its meeting in November, so more crude oil price volatility is likely to be seen. Such a dynamic is precisely the reason why we are most comfortable sticking with the diversified Energy Select Sector SPDR ETF, which offers all of the benefits of owning an oil producer, including a ~2.8% dividend yield, without taking on material firm specific risk, not the least of which includes ballooning debt levels.

Energy Equipment & Services (Large): BHI, FTI, HAL, NBR, NOV, SLB, TS, WFT

Energy Equipment & Services: CLB, DRQ, FI, HLX, HP, OII, OIS, PDS, PTEN, SPN, TDW

Energy Equipment & Services – Offshore Drilling: ATW, DO, ESV, NE, RDC, RIG, SDRL

Oil & Gas – Major: BP, COP, CVX, PTR, RDS, TOT, XOM

Pipelines – Oil & Gas: BPL, BWP, DPM, ENB, EPD, ETP, EVEP, HEP, KMI, MMP, NS, OKS, PAA, SE, SEP, WES