I wanted to update members on eBay (EBAY), but let’s cover some ground on the (V)aluentum (B)uying (I)ndex first.

The Valuentum Buying Index, or VBI, rating system is not the easiest to understand. There are as many stock-selection methodologies out there as there are fund managers and financial advisors. We’re talking tens of thousands, if not more.

What we focus on within the Valuentum Buying Index framework is what matters.

You may hear a fund manager talk about ROE, for example. But what you may not know is that ROE is inferior to ROIC because the former considers an artificial and non-operating boost from the application of financial leverage. We talked about this in the four-part education workshop here. Firms such as American Capital Agency (AGNC), for example, can bolster ROE by adding more and more leverage to its business model, but in doing so, American Capital Agency isn’t adding “economic” value, per se–the company is just taking on more financial risk. ROIC, which we embrace in our work, cuts through these types of shenanigans and only considers the operating performance of the company.

Other methodologies may incorporate economic data into the process. Though it is informative to study the economy, macroeconomic forces, or those driving the broader economy, have shown to be less predictive of future stock-price returns than microeconomic considerations, or earnings and free cash flow, for example. We talked about this extensively in the June edition of the Dividend Growth Newsletter . The Economist magazine’s Growth Paradox article is very informative, yet many a wealth manager continues to “sell” emerging markets exposure and diversification. Of course there’s nothing wrong with emerging markets exposure and diversification, but understand why you’re doing it, which is more to hedge bad bets than to actually grow risk-adjusted portfolio performance.

To get a feel for a fund manager or investment professional, simply ask which is a better measure of returns, ROE or ROIC, or have them explain how the economy influences stock market returns. If they don’t give you a satisfactory answer, your portfolio may not be in trouble today, but it will eventually. These are advanced topics, but it’s your money. You should demand the best. Investors can look at just about everything and come up with a fancy system like a handicapper may do at the race track, but investing is about finding the right information to incorporate into a process, and that’s why we’ve spent so much time developing the Valuentum Buying Index.

The challenge members have to overcome in using the Valuentum Buying Index, however, is that it is not really that intuitive, and changes in the ratings often are difficult to interpret. This is only understandable. If beating the stock market were easy, everyone would already know how to do it. Most rating systems out there are single-factor models. They roll “stuff” into one final output and that output is scaled across a graded spectrum. You may be familiar, in this case, with a rating that moves from a 5-star to a 4-star. It’s very unusual for a stock in a single-factor model rating system to move from a 5-star to a 2-star.

In a three-factor model ratings system like that of the Valuentum Buying Index, large moves can happen. For example, it’s not that uncommon for a Valuentum Buying Index rating of a 6 to move to a 3 in just one update, and then to a 7 or even back to a 3 in the next subsequent update. The reason for this rests on the Valuentum Buying Index’s multi-factor approach; this flow chart explains how every rating is derived from 1 to 10. Understanding what the number means is like getting right inside the head of developer Brian Nelson, CFA. Each number means something about the inter-relationship between a company’s discounted cash flow (DCF) valuation, its relative valuation, and its technical and momentum indicators. Single-factor models, for example, may only consider the DCF in the process. They come up short.

A 9 on the VBI means the company is undervalued on 1) a DCF basis, undervalued on 2) a relative value basis, and 3) showing strong market conviction in the valuation on the basis of its solid technical and momentum indicators. Companies with ratings of 9 have shown to be outperformers. A 2 on the VBI means the company is overvalued on 1) a DCF basis, overvalued on 2) a relative value basis, and 3) showing little market conviction that its intrinsic value is higher than the stock price on the basis of its neutral technical and momentum indicators. Companies with ratings of 2 have shown to be underperformers. An empirical rating case study can be found here.

The problem in explaining the Valuentum Buying Index is that it used in many different ways. For example, in the case study referenced above, the institutional investor broadly used the system across a portfolio of over 500 stocks! For most investors, holding 500 or more stocks doesn’t make any sense. You’d be your own dedicated stock research firm if you had to follow so many. As a result, the Valuentum Buying Index is used differently when selecting a portfolio of 20 or so companies to include in a portfolio, as in the case of selecting stocks in the Best Ideas Newsletter portfolio or Dividend Growth Newsletter portfolio.

Across a large universe of stocks, we expect 9-10s to outperform 7-8s to outperform 5-6s and so on, on an aggregate bucketed basis. But it is certainly reasonable and perhaps even likely that, across a large enough universe, a company with a rating of a 3 will outperform a company with a rating of a 7, for example. This is only to be expected. Though the VBI works well in sorting the performance of buckets, on an individual stock-selection basis, a further refinement in the form of a qualitative overlay is not only needed but the responsible approach. We don’t want to blindly add all highly-rated companies to the newsletter portfolios. We want to bolster the odds of a selection being a winner even more.

That’s why, when constructing and modifying the newsletter portfolios, the application of the Valuentum Buying Index may not be as simple as selecting a highly-rated stock and adding it. For example, when a company registers a high rating of a 9 or 10, we take a close look at adding it to the newsletter portfolios. If it passes muster, we’ll add it and notify members we have done so. If it doesn’t we keep an eye on it, but not add it.

Once a 9 or 10 is added to the portfolio, its Valuentum Buying Index rating will change just like the ratings of any other stock in our coverage. We don’t lock the added firm’s rating at 9 or 10, even though it may make sense for us to do so. Why would we even think of this? Because if we did so, it would be easier for readers to understand that we continue to believe the company that we’ve added to the Best Ideas Newsletter portfolio or to the Dividend Growth Newsletter portfolio is one of our best ideas. We stand by our calls and are not throwing out random ideas for consideration.

After a company is added to a newsletter portfolio, its Valuentum Buying Index rating may change to a 3 or to a 6 or other, and we’d consider the “big middle,” or ratings between 3 and 8, as equivalent to a “we’d consider holding” rating. After all, it’s exactly what we’re doing – holding the company in the newsletter portfolio. We may add or trim the position in the portfolio if it has a rating between 3 and 8, but we’d only consider removing the company when it registers a 1 or 2, the equivalent of a “we’d consider selling” rating. This is why companies in the newsletter portfolios can have ratings below companies not included in the portfolios.

Read more about how we use the Valuentum Buying Index in this August 2012 piece here.

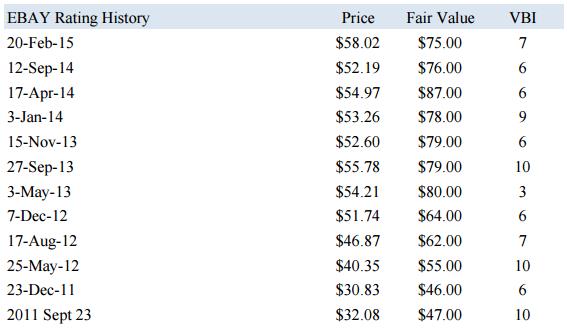

Let’s now talk eBay. Since the company was added to the Best Ideas Newsletter portfolio, few companies have performed better. The stock registered a pristine 10 on the Valuentum Buying Index in September 2011, again in May 2012, and again in September 2013. That’s three calls we’ve made on this e-commerce and online payment-processing giant. The first two calls have worked out great for members, and the third call is just now paying off, with shares surpassing $60 recently. eBay was first added to the Best Ideas Newsletter portfolio in October 2011 (the transaction log of the portfolio can be found here).

We continue to believe eBay is a winner, and its decision to launch Promoted Listings recently will add yet another potential revenue stream to the mix. According to Internet Retailer, “sellers will bid a percentage of the final purchase price, from 1-20%, for the prime positions.” Given the merchandise volume flowing through eBay, we think the development is a needle-mover. The fact that sellers only pay when they sell the item is a no-risk proposition, and one that we think will ensure the endeavor gains traction. We like the move a lot, even if eBay is not the first to do such things. Alibaba (BABA) and Etsy (ETSY) have been doing some form of promoted listings for a while.

Though eBay has had some stumbles the past several months, the biggest perhaps being its tax blunder, the company is back on track. Not only did we like its first-quarter results, released late April, but the separation of eBay and PayPal into independent publicly-traded companies by the third quarter of this year should continue to unlock the value we see in shares. Our fair value estimate for eBay remains at $75, revealing even more upside to come.

Have the skeptics finally been proven wrong? Or is this just wishful thinking?