Image Source: GotCredit

As a subscriber to Valuentum’s Best Ideas Newsletter, you receive email updates if we plan to make any changes to the portfolio before the release of the next edition of our newsletter. If you are not receiving these alerts by email, please contact us.

<< About Our Best Ideas Newsletter

View excerpts from the email transaction alerts previously delivered to subscribers in this article:

December 27, 2024

Summary of the Changes

Pepsi (PEP): 4%-6% à 0%

McDonald’s (MCD): 4%-6% à 0%

Amazon (AMZN): 0% à 4%-6%

Nvidia (NVDA): 0% à 4%-6%

Alert: Changes to the Newsletter Portfolios

June 5, 2023

Summary of the Changes

UnitedHealth Group (UNH): 0% –> 4%-6%

Booking Holding (BKNG): 0% –> 4%-6%

Chipotle (CMG): 1%-2% –> 6%-8%

Technology Select Sector SPDR (XLK): 0% –> 4%-6%

ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

March 13, 2023

Summary of the Changes

Johnson & Johnson (JNJ): 4%-6% à 0%

Exxon Mobil (XOM): 4%-6% à 0%

Chevron (CVX) 3%-5% à 0%

Dollar General (DG): 3%-5% à 0%

Korn/Ferry (KFY): 1%-2% à 0%

ALERT: We’re ‘Raising Cash’ in the Newsletter Portfolios

November 9, 2022

October 18, 2022

Removing META, Adding to XLE, Adding MCD and PEP >>

August 19, 2022

Summary of the Changes

PYPL: 6%-8% –> 0% (removed)

META: 8%-10% –> 3%-5% (trimmed)

GOOG: 8%-10% –> 10%-12% (increased)

V: 8%-10% –> 10%-12% (increased)

Cash: +8%-10% (approximate)

October 4, 2021

Markets Look Vulnerable, Adding “Protection”

June 27, 2021

January 27, 2021

ALERT: Raising Cash in the Newsletter Portfolios

January 12, 2021

ALERT: We’re Still Bullish! Some Portfolio Tweaks

October 28, 2020

ALERT: Removing Intel (INTC) from the Newsletter Portfolios

We are removing Intel from both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Intel has been a part of both newsletter portfolios for a long time. The stock was included in the September 2011 edition of the Best Ideas Newsletter with a ~2% weighting in the portfolio at $19.89 per share, and it was included in the inaugural edition of the Dividend Growth Newsletter (January 2012) with a large 7% weighting at $24.25 per share.

August 20, 2020

ALERT: Newsletter Portfolio Changes; Investing Is Simple, Not Easy

BRK.B: 8-13% à 3.5%-5%

AAPL: 4.2%-6% à 6.5%-8%

MSFT: 4.2%-6% à 6.5%-8%

June 12, 2020

*ALERT* Scribbles and More Newsletter Portfolio Changes

We’re putting the proceeds from the removals yesterday, less the new put option “partial hedge,” back into Microsoft (MSFT) and Apple (AAPL), allocating the remaining proceeds equally to both in both newsletter portfolios to go back to “fully invested” (both Microsoft and Apple will now be in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio). Our thoughts on re-adding Apple and Microsoft to the newsletter portfolios are rather simple. Aside from our liking them on a firm-specific basis, if the economy heads south, they’ve shown an ability to hold up better than most. If we see interest rates lower for longer, their dividend growth potential is enormous, which is a big catalyst for income/yield seekers, and if we do see a strong economy and market, they will participate, and perhaps even lead. One can say we should have never removed them, but we now know much more about COVID-19 than we did many months ago.

June 11, 2020

*ALERT* Newsletter Portfolio Changes

We’re making a couple tweaks to the simulated newsletter portfolios today. It has been one of the strongest bull markets we’ve ever seen off the March 23 bottom, and while we continue to be optimistic about some of our favorite ideas, we are now re-positioning the newsletter portfolios after taking advantage of the surge. In the Dividend Growth Newsletter portfolio, we are removing Cracker Barrel (CBRL) and Bank of America (BAC). Cracker Barrel no longer fits the criteria for the Dividend Growth Newsletter portfolio, and we expect the banks to continue to suffer as the economy muddles along and as Fed policy may offer headwinds to net interest margin expansion. In the Best Ideas Newsletter portfolio, we are removing the Vanguard Real Estate ETF (VNQ) and the SPDR S&P Aerospace and Defense ETF (XAR). We think the REITs may continue to face pressure as rents become more difficult to collect in a COVID-19 world, and we think the aerospace industry has largely bounced back to fair value, in many individual cases. We are also adding a 1% put option weighting on the S&P 500 SPDR (SPY) to both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio (August 21 expiration, $295 strike). Much like the protection we have in the High Yield Dividend Newsletter portfolio with the SJB, we think this move is prudent to “hedge” against downside risks.

April 29, 2020

ALERT: Going to “Fully Invested” — The Fed and Treasury Have Your Back

We’re taking the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio to “fully invested,” scaling up our existing positions to reflect that status. We plan to consider put options to hedge against downside risk, if or when the time comes. Moral hazard continues to run rampant, and the Fed and Treasury may have no choice but to continue artificially propping up this market, even buying stocks through certain vehicles, if necessary. Having warned members about the impending “Great Crash of 2020” and identifying savvy opportunities near the bottom, we are now withdrawing our S&P 500 target range as we move now to focus more on individual ideas through this turbulence. We expect to continue to identify opportunities for relative outperformance. 2019 was one of the best years in the Best Ideas Newsletter portfolio yet. In the Exclusive, we just registered our 25th consecutive monthly short idea in a row that has worked out. The markets may go much lower from here before we go higher again, but the Fed and Treasury won’t let this market go down in the longer run, in our view–even as we navigate a Depression-type economic environment in the near term. Stay the course.

March 12, 2020

Closing ‘Crash Protection’ Again, Circuit Breakers Tripped Again, Too >>

On March 11, the Trump administration announced a ban on travel from Europe to the U.S. for 30 days, but containment efforts in this regard may be too little too late. COVID-19 is already in the United States and spreading aggressively. Containment efforts on travel bans into the United States were the right move weeks ago, but perhaps politically difficult to achieve. Director of the National Institute of Allergy and Infectious Diseases Dr. Anthony Fauci noted the following regarding the possible number of eventual deaths from COVID-19 in the United States: “if we are complacent and don’t do really aggressive containment and mitigation, the number could go way up and be involved in the many, many millions.” The World Health Organization expects a global death rate from COVID-19 of about 3.4%. The markets were disappointed in the expected fiscal stimulus response, announced March 11, that focused on proposals regarding deferred tax payments and payroll tax relief, items that will not move the needle in addressing what ails the United States, a novel virus that is highly contagious and far more deadly than the seasonal flu.

March 6, 2020

ALERT: Re-establishing “Crash Protection” >>

Our prior “crash protection” worked out wonderfully, and we think adding back the protection with a portion of the “house’s money,” so to speak, makes sense. In our prior put-option idea, we went out to September 18, 2020 with a $250 strike. This time, we’ll go to June 30, 2020, with the same strike price ($250), a 0.5%-1% weighting in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Please note that most options expire worthless, but such a move offers valuable portfolio protection, in our view.

March 2, 2020

ALERT: Closing Put Option Position >>

I wanted to thank each of you so much for the kind words expressed this week about our service and how once again we were ahead of the herd with respect to “crash protection.” Today, we are now removing that “crash protection,” and closing the put option position in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio for a solid double ($6.50)…

February 24, 2020

ALERT: Adding Market Crash ‘Protection,’ Removing MSFT, BKNG >>

We’re adding out-of-the-money put options to both the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio. We’re removing Microsoft from the Dividend Growth Newsletter portfolio, and we’re removing Booking Holdings from the Best Ideas Newsletter portfolio. We reiterate that, had the Dow Jones Industrial Average already swooned a couple thousand points on news of the COVID-19 outbreak, we might have considered some undervalued stocks with strong momentum potential “buying opportunities.” However, to this point in time, the markets have largely ignored COVID-19, with major US indices still sitting near all-time highs. We could be in for a wild ride in the coming weeks and months, and an outright market crash is not out of question. For those looking for short-idea considerations, please consider the Exclusive publication here. We remain fully-invested in the High Yield Dividend Newsletter portfolio given its yield and income focus.

January 13, 2020

ALERTS: Big Changes to the Portfolios; Goodbye Apple! >>

Best Ideas Newsletter portfolio

Remove: AAPL (7%-12%), GM (2.5%-4%) = 9.5%-16%

Add to PYPL (increase weighting by 3%, to the range of 5.5%-7%), add DIS (2.5%-4%), add XAR (4%-5.5%) = 9.5%-14%

August 14, 2019

April 18, 2019

April 17, 2019

Removing Chipotle for a huge gain…adding more to Apple.

February 14, 2019

December 26, 2018

December 21, 2018

Parting with Altria on News of its Stake in JUUL

April 26, 2018

Best Ideas: Reiterating ~$240 Fair Value on Facebook; Adding Chipotle

February 8, 2018

December 26, 2017

Tweaking the Newsletter Portfolios…

August 18, 2017

July 31, 2017

July 19, 2017

June 20, 2017

May 25, 2017

May 17, 2017

Alert: Adding Protection! Finally Acting on Netflix Idea

May 15, 2017

April 13, 2017

January 6, 2017

August 26, 2016

June 24, 2016

April 29, 2016

Adding Protection, Gilead Hits Speed Bump

April 20, 2016

Alerts: Adding More High-Quality Exposure

February 17, 2016

We added to the positions in Priceline and Cisco and initiated a new position in Kinder Morgan in the Best Ideas Newsletter portfolio. The email can be accessed here.

January 29, 2016

Valuentum made a number of changes to its Best Ideas Newsletter portfolio, including the removal of shares of eBay and Gilead and the addition of Facebook and Johnson & Johnson. The email transaction alert can be accessed here.

January 6, 2016

In this email transaction alert, we removed Alibaba from the Best Ideas Newsletter portfolio at $78.34 per share. We also removed Rio Tinto from the Best Ideas Newsletter portfolio at $26.82 per share.

November 5, 2015

October 6, 2015

We added 143 shares of the Energy Select Sector SPDR (XLE) at $67.14 per share. For more information, please select the following link: http://www.valuentum.com/articles/20151006_1

August 27, 2015

We added 46 shares of Michael Kors (KORS) and 10 shares of Buffalo Wild Wings (BWLD)–explanation in email alert.

August 21, 2015

We removed 54 shares of Apple (AAPL) at 108.92 per share for a very large gain–explanation in email alert here.

February 26, 2015

We added a brand new 2% position to the Best Ideas portfolio in highest-rated Economic Castle Priceline (PCLN) today. Specifically, we added 3 shares at the open price, $1,248.97.

November 14, 2014

We added Cisco (CSCO) to both the Best Ideas portfolio and Dividend Growth portfolio. We’re adding 100 shares to each portfolio at $26.15 each. More >>

October 22, 2014

We added 34 more shares of Gilead at $105.62 per share. We added 39 more shares of Alibaba at $93.20 per share. More >>

October 10, 2014

Closing Put Option Contracts >>

September 30, 2014

We sold out of the positions in Ford (F), Precision Castparts (PCP), and Buffalo Wild Wings (BWLD). These companies have been fantastic performers for members, and we trust you are happy with the tremendous gains. Ford: $14.82 per share; Precision Castparts at $238.02 per share; Buffalo Wild Wings: $136.05 per share.

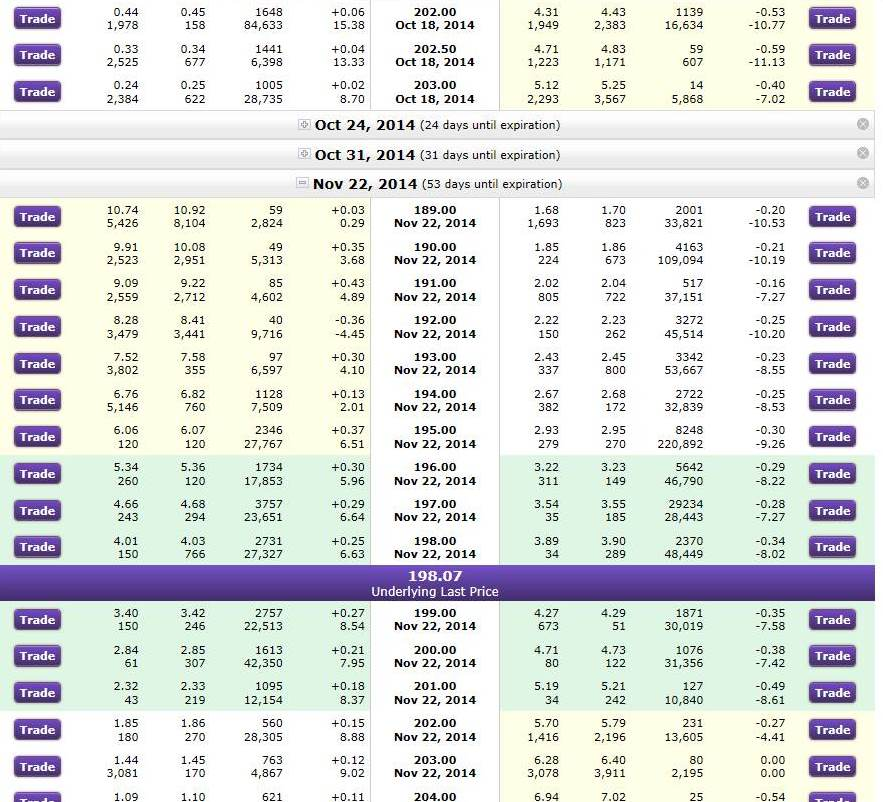

We added protection in the form of 5 put option contracts on the S&P 500 (SPY), with Nov 22 expiration at 195.00 strike ($295 each). The options positions are hedges to the portfolio, and may or may not be of interest to you. They can expire worthless.

September 19, 2014

We opened a 2% position in new issue Alibaba (BABA) on its open today. We think shares are worth more than $100 each. The firm was priced at $68 per share. View its 16-page report >> Transaction: 39 shares at $92.70 each.

We added to the position in Google (GOOG). We’re allocating an additional 2% to the company in the portfolio. View Google’s landing page >> Transaction: 6 shares at $596.48 each.

We opened a 2% position in Gilead Sciences (GILD). We may add to it if it reaches our originally-intended entry point in the mid-$90s. Transaction: 34 shares at $107.89 each.

July 29, 2014

This email pertains to a holding in the Best Ideas portfolio. If you are a dividend growth investor, the Dividend Growth portfolio can be accessed here. If you are interested in higher-yielding equities, please inquire about the Dividend100 product.

On August 1, 2013 (roughly a year ago), Baidu (BIDU) was entered into the Best Ideas portfolio, 20 shares at $133.60 each. Consistent with the Valuentum Buying Index, the firm had registered a pristine 10 at the time.

Following the firm’s second-quarter results, shares surged to our fair value estimate of ~$225 per share. Consistent with the time length for ideas to work out ~12-36 months, today, we are removing shares from the Best Ideas portfolio at $221.49 each.

The gain is approximately 66%.

For more information on Baidu, please click here >>

For followers of the Best Ideas portfolio, we trust that you have done incredibly well with Baidu. We expect to allocate proceeds to a number of new additions to the Best Ideas portfolio in coming months. When we make any further changes/additions to the Best Ideas portfolio, we will promptly notify you via email.

Dividend Growth investors, please be sure to stay up-to-date with the Dividend Cushion ratios of your dividend portfolio holdings.

May 23, 2014

We removed our full position of DirecTV (DTV) in the Best Ideas portfolio. at $84.15 per share for a substantial gain.

May 15, 2014

In the May edition of the Best Ideas Newsletter, we removed Intuitive Surgical (ISRG) from the Best Ideas portfolio. Specifically, we sold 7 shares at $365.87 per share.

March 18, 2014

We added the Utilities Select Sector SPDR (XLU) to the Best Ideas portfolio, starting with a 2% position. Specifically, we added 83 shares at $41.12 each.

March 17, 2014

From March edition of Best Ideas Newsletter: “Though we continue to be cautious on the overall future direction of the markets, we still believe that there are some very attractive ideas out there. Altria has been one of the best performers in the Best Ideas portfolio, and we are excited every time the tobacco (and alcohol) giant pays its hefty quarterly dividend. There’s been some interesting news with respect to industry consolidation that you should know about, and we think it will serve as a fantastic catalyst for the company’s shares to leap past $40.

We also added to portfolio holding General Electric. The industrial giant plans to spin off one of its riskier financial units in coming months, and we like what it means for the company’s overall risk profile. Few firms in the industrials sector are operating better than GE at this juncture. We increased both positions by 25%.”

Transaction Details: added 75 shares of GE at $25.25 per share; added 63 shares of Altria at $36.25 per share.

October 21, 2013

We were absolutely blown away by General Electric’s (GE) fantastic third-quarter earnings and have added a 5% position in the firm in the portfolio of our Best Ideas Newsletter. We expect valuation upside above $30 per share (at the high end of our fair value range) and think its burgeoning orders in the third quarter and record backlog bode well for future outperformance and increased earnings estimate revisions down the road. Specifically, we added 300 shares of GE at $26.18 per share.

We also added an out-of-the-money call option on Facebook (FB). We are growing more and more fond of the social-networking behemoth’s equity pricing opportunity. Specifically, we bought 5 Mar-2014 dated call options, $80 strike for $1.90 (or for a total of $950). Though this position can expire worthless, we think the likelihood of Facebook experiencing significant equity price appreciation from here has increased exponentially as of late.

August 16, 2013

We took some profits on one of our biggest winners in the past year or so, Visa (V). Though we will retain a fairly sizeable position after this move, we sold about 20% of our position in the firm, or 13 shares at $172.92 each. We still very much like the company’s business model, and Visa will retain its best-ideas status as a holding in our Best Ideas portfolio, but we think prudence is in order, and we are taking some profits. In this case, Visa stands more than 60% above our cost basis.

That said, we wouldn’t hesitate to add back to our position on a stronger, firmer technical position, and we are still very excited to hold shares of the entity. We think the company is worth nearly $200 per share, but the road to that level has become increasingly murky given increased regulatory uncertainty. We view the move today as a form of prudent risk management within the Valuentum process.

August 1, 2013

We opened a new position in Chinese Internet search giant Baidu (BIDU). Though we continue to be cautious on the economic environment in China, Baidu will benefit from the ongoing boom in China’s Internet space. The country has the world’s largest Internet user population–and a long way to go to reach penetration levels of developed countries. We think Baidu will remain at the forefront of such secular expansion for many years to come.

We think shares are worth $178 each (click here to download the 16-page report), and we even expect further upside from those levels. The company was the cheapest firm in our coverage universe prior to its most recent quarterly performance (read results here), and it registers a very rare 10 on our Valuentum Buying Index.

For those interested in digging further into this valuation opportunity, please click here to download our institutional valuation model (.xls) on the firm. Specifically, we are purchasing 20 shares at $133.60 each for roughly a 1%-2% position.

July 24, 2013

We added to our position in Apple (AAPL). We think the shares are significantly undervalued, and we’re seeing some re-affirming market action following its strong quarterly report. Specifically, we added 7 more shares at $442.16 per share. In aggregate, Apple will be roughly a 6%-7% position in our Best Ideas portfolio.

We replenished a portion of our position in Intuitive Surgical (ISRG) in the portfolio of our Best Ideas Newsletter in anticipation of a price rebound following its disappointing quarterly performance recently. We continue to like the company’s recurring revenue model and view its fair value substantially higher than where shares are trading today. Specifically, we added 2 shares at $382.97 per share. Intuitive Surgical will remain one of the smallest positions in our Best Ideas portfolio after this move.

We started a new position in the portfolio of our Best Ideas Newsletter in Teva Pharma (TEVA). We continue to think the generic pharma space offers significant opportunities for participants, and we like Teva’s global market position (click here for our generic pharma overview). We’re particularly big fans of its ‘first-to-file’ position in the US generics market and think Teva’s shares offer significant valuation upside potential (to the mid-$50s). Specifically, we added 77 shares at $41.22 per share.

We started a new position in Union Pacific (UNP) in the portfolio of our Best Ideas Newsletter. We expect the firm’s operating ratio to be among the best in the railroad industry by the end of this decade, and we like its exposure to growth in Mexico as well as future export expansion on the West Coast. The firm is levered to coal, though we note its mix is more of the Powder River Basin variety, which should continue to take share from Central Appalachian coal in the domestic market. The firm also boasts a strong Valuentum Dividend Cushion score and a decent annual yield. The high end of our fair value range suggests upside above $200 per share. Specifically, we added 20 shares at $159.34 per share.

June 14, 2013

We’ve made an absolute killing for our members on Astronics (ATRO) in our Best Ideas portfolio. This has been a holding for us since inception of the portfolio, May 2011. And for subscribers that remember our call on EDAC Tech, our exposure to the aerospace sector has been an unbelievable value-add for members. But the time has come for us to take even more profits in the space. We’re still big fans of Astronics on a fundamental level, but its shares have finally eclipsed the high end of our fair value range, and we’re very happy with nearly a 90% gain over our cost basis. We plan to sell our entire position at $39.19 per share! We’re keeping the firm on our watch list, however, should Mr. Market give us another opportunity. We still hold Precision Castparts (PCP) as our remaining aerospace play at this time.

We’re taking some profits in eBay (EBAY). This has been a huge winner for members as well — almost a 70% gain on cost. We’re selling half of our position, or 100 shares, at $51.59 per share. We’re expecting upside in eBay to roughly $80 per share, but we’re taking a little off the table right now. We have a few other ideas that we’d like evaluate for addition to the portfolio during the next few weeks, and we just can’t be disappointed in taking some profits.

May 23, 2013

We opened a small put position on the broader equity market index, the SPDR S&P 500 Trust (SPY), for added portfolio protection. Specifically, we added one put option ($160 strike, Dec 2013 expiration) for $6.36 per contract ($636).

April 15, 2013

On Monday, April 15, we released the April Edition of our Best Ideas Newsletter via email. In the newsletter, we included a transaction alert for DirecTV (DTV). We added 55 shares at $55.02 per share, representing roughly a 2% position of the portfolio.

March 18, 2013

We closed our position in EDAC Technologies (EDAC) in the portfolio of our Best Ideas Newsletter during the trading day Monday. This was a result of the firm’s merger with Greenbriar Equity Group for $17.75 per share. Our initial cost in EDAC Technologies was $4.08 per share (June 6, 2011), representing a 330% gain (more than 4x cost) from when shares were originally added to the portfolio.

October 23, 2012

We put some of our cash balance to work amid the recent market sell-off, which we had been expecting since publishing the previous edition of our Best Ideas Newsletter (October 15). We sold out of our position in Ancestry.com (ACOM) and added a number of put option ideas to create a better long-short balance to our portfolio as we position for next year.

First, we started building a new position in Google (GOOG), a firm that scores a rare 10 on our Valuentum Buying Index. Though the firm’s recent quarterly results weren’t as good as we would have liked, we’re fans of the significant valuation upside the company offers and view the firm’s stock-price pull back to support levels as an opportunity rather than any technical breakdown to worry about. Specifically, we purchased 4 shares at $683.49 per share. Going forward, we plan to opportunistically add to this position over time. We currently value shares at over $900 each.

Second, we added to our current small position in Intel (INTC). We think Intel is tremendously undervalued and are big fans of both its dividend-yield (4%+) and technical support at current levels. Though recent results weren’t great, we think shares are worth $35 each, offering substantial upside potential. Specifically, we purchased 50 shares at $21.67 each.

Third, and as we mentioned earlier, we sold out of our entire position in Ancestry.com (ACOM), as the firm has agreed to be taken private at $32 per share. Specifically, we plan to sell 298 shares at $31.54 per share. Shares are about 50% higher since we notified members that we increased our exposure to the online genealogy firm in our portfolio in September of last year.

And finally, we added two put-option positions to our portfolio (we do not short stocks in our portfolio directly). First, we purchased 5 December 2012, $33 strike options in Urban Outfitters (URBN) for $0.95 per contract. Second, we purchased 2 December 2012, $65 strike put options in PetSmart (PETM) for $1.90 per contract. Urban Outfitters registers a 2 on our Valuentum Buying Index, while PetSmart registers the very worst score of a 1. Both firms are significantly overvalued, in our view, and both firms’ charts reveal that a technical move lower may be in the works soon.

July 26, 2012

We sold one third of our position in Altria (MO) as the tobacco company has advanced considerably since we initially added it to our portfolio in June of last year. We continue to expect modest valuation upside from current levels and remain big fans of the firm’s dividend yield. However, we think it’s prudent to take some profits from a portfolio-management standpoint. Specifically, we sold 126 shares of Altria at $35.75 per share, a 35%+ gain excluding dividends.

We sold one third of our position in EDAC Tech (EDAC). We continue to expect substantial valuation upside in the company – north of $20 per share – but the company’s excellent price performance has driven it to a bloated weighting in our portfolio (again). The firm will continue to be an outsize weighting in our portfolio, as we expect convergence to our fair value estimate through the course of the coming boom in commercial aerospace deliveries. Specifically, we plan to sell 337 shares at $13.35 per share, a 225%+ gain since we added it in early June of last year.

We sold one third of our position in Ancestry.com (ACOM). Just today, the company posted a solid quarter, and recent news indicates the firm is in talks to sell itself to private equity for a price tag in the mid-to-high $30s. Though we think the company remains substantially undervalued at these levels, we are taking profits to re-balance our position in the company and to reduce risk should a deal not go through. Specifically, we plan to sell 148 shares at $32.46 per share, a modest profit from our cost basis, but up 50%+ since we notified that we increased our exposure to the online genealogy firm in September of last year.

May 22, 2012

We added back to our position in EDAC Tech (EDAC) after the firm’s significant and unjustified pullback in recent weeks. We have not identified any fundamental changes in the company and believe the pullback is primarily due to profit-taking after the company’s large upward move this past year. Specifically, we purchased 200 shares of the firm at $9.91 each. We continue to expect valuation upside north of $20 per share (another double from here) and view the large backlogs at the commercial aerospace OEMs (about 7-8 times current annual production) as support for continued fundamental strength at the company through the latter part of this decade.

We opened a new position in Rio Tinto (RIO). The firm has valuation upside beyond $80 per share and has pulled back to long-term support levels in the mid-$40s. Specifically, we purchased 75 shares at $46.40 each.

We added to our position in Visa (V). Specifically, we purchased 30 more shares at $119.13 each. We think the company is worth nearly $150 per share (about 30% upside).

We opened a new position in the Health Care Select Sector SPDR (XLV). We’re big fans of the ETF – it’s undervalued, has an excellent expense ratio, and its technicals are holding up despite the market’s recent sell-off. Specifically, purchased 125 shares at $36.60 each. We expect valuation upside of more than 35% in the ETF from today’s levels.

We added to our position in Ford (F). Specifically, we purchased 200 more shares at $10.33 each. We continue to believe Ford is the best way to play the rebound in demand for autos and peg its fair value in the mid-$20s.

We opened up a small position in Intuitive Surgical (ISRG). Though the firm is trading only slightly below our fair value estimate, the high end of our fair value range is close to $700. The firm has pulled back nicely since its peak to near $600 per share, and we would not be surprised to see the company trade well beyond that in coming years driven by success in its da Vinci. Specifically, we purchased 5 shares at $532.13 each. We’d be looking to build to our position in Intuitive Surgical over time.

April 30, 2012

We sold our entire position in Collective Brands (PSS), which has been an excellent contributor to alpha in our portfolio. Specifically, we sold 442 shares at $20.80 each. Collective Brands will sell itself to Wolverine, as Bloomberg recently reported. Our cost basis for Collective Brands is just over $15, and the investment yielded us roughly a 38% return since July of last year (our initial purchase date).

We also reduced our position in Republic Services (RSG) by half. Specifically, we sold 202 shares at $27.51 per share. Though we think the garbage hauler is significantly underpriced, we didn’t like its first-quarter performance for a number of reasons, which we outline here. We also trimmed our positions in Apple (AAPL) and EDAC Tech (EDAC). We continue to expect substantial valuation upside from these companies but are simply re-balancing our exposure to these companies. Specifically, we sold 4 shares of Apple at $587.85 per share and 90 shares of EDAC Tech at $13.54 per share. These have been huge winners for us in recent months. The trade in Apple represents a 78.5% gain, while the trade in EDAC Tech will yield more than a triple on our initial investment.

Our Best Ideas portfolio now has a relatively large cash position, and in coming weeks, we will be looking to add to existing holdings and pursue new attractively-priced ideas that score high on our Valuentum Buying Index (VBI)–click here to learn more about our VBI. Our Best Ideas watch list can be found on page 17-18 of the April edition of our newsletter.

February 8, 2012

We took some profits in Collective Brands (PSS), a nice winner for us (a 20% gain) in the past couple of months. Specifically, we reduced our position by about one third, and sold 220 shares at $18.22 each. Though we think the firm has upside above $20 per share based on reports about a number of bidders for the firm, we think the risk/reward is somewhat neutral at these levels. Also, we took some more profits in Buffalo Wild Wings (BWLD) on the heels of a strong price move following the company’s excellent fourth-quarter results. Specifically, we sold 25 shares of Buffalo Wild Wings at $80.54 each (a 23% gain).

January 9, 2012

We took some more profits in Astronics (ATRO), a nice winner for us (a 34%+ gain) in the past couple of months. Specifically, we reduced our position by about half, and sold 140 shares at $33.42 each. We continue to believe Astronics has further upside from today’s levels (our fair value estimate is $47 per share), but we wanted to reallocate a portion of our profits to round out our porfolio’s exposure to different sectors (namely financials) and pursue more attractively-priced ideas.

We also took some profits in Buffalo Wild Wings (BWLD), EDAC Tech (EDAC), and Precision Castparts (PCP). Specifically, we sold 50 shares of Buffalo Wild Wings at $67.39 per share (a modest gain), 200 shares of EDAC Tech at $10.49 (a 150%+ gain), and 25 shares of Precision Castparts at $169.97 per share (an 11%+ gain). Though we continue to like these firms in our portfolio, we think it is prudent to raise some cash ahead of fourth-quarter earnings season, as our outlook was muddied at the time by a number of poor pre-announcements (for more information about our outlook, please see the December edition of our Best Ideas Newsletter). After the sale, Astronics still represents roughly a 4%-5% holding, Buffalo Wild Wings a 5%-6% holding, EDAC Tech a 9%-10% holding, and Precision Castparts a 6%-7% holding.

We used the proceeds of these sales to open a new position in the SPDR S&P Bank ETF (KBE) and the Financial Select Sector SPDR Fund (XLF). We view these positions as a nice way to round out the diversification of our portfolio by increasing our exposure to the hard-hit financials sector (which we believe may be poised to rebound in 2012) while limiting firm-specific risk to any one bank. For instance, at the time, the SPDR S&P Bank ETF had about 40 holdings with an average price/book ratio of 0.80, while the Financial Select Sector SPDR Fund had about 80 holdings with an average price/book ratio of 0.9.

Specifically, we purchased 100 shares of the SPDR S&P Bank ETF at $21.07 per share and 150 shares of the Financial Select Sector SPDR Fund at $13.46 per share. Though we remain cautious on fourth-quarter earnings season, the market continues to converge to our long-held opinion that the US will avoid a double-dip recession and that global financial leaders stand to act to thwart the potential onset of any global financial crisis stemming from sovereign credit issues in Europe. Broadly, we think the banks will benefit the most from the market’s convergence to our opinion as the group has been hit the hardest during Europe’s ongoing sovereign credit malaise. We believe diversifed exposure to the group is the best risk-adjusted approach to profit from the space in the year ahead. Our entire portfolio weighting to the financials sector, excluding Visa (V), will be roughly 4% following these transactions.

November 30, 2011

We took some profits in Astronics (ATRO) for a 42%+ gain. Specifically, we reduced our position by about 30%, and sold 120 shares at $35.65 each. We continue to believe Astronics has further upside from today’s levels, but we wanted to rebalance our weighting of the company in our portfolio, given the stock’s rapid rise in recent weeks. After the sale, Astronics will still represent roughly a 9% holding in our portfolio, among the largest positions.

We used the proceeds of this sale and cash on hand to open a new position in Visa (V), which at the time represented our only financial exposure in the portfolio. We like Visa’s premium brand, nearly impossible-to-replicate network, and expected double-digits earnings growth in future periods. We think shares are a bargain at today’s levels, which reflect just 16x our 2012 earnings projection and a modest yield of nearly 1% (still better than short-term treasuries). Specifically, we purchased 30 shares of Visa at $95.78 per share. The new position in Visa is relatively small (about 3% of the portfolio), and we’ll look to build to it over time.

November 8, 2011

We took some more profits in EDAC Tech (EDAC), a huge winner for us (a 140%+ gain) in the past couple of months. Specifically, we reduced our position by about 10%, and sold 125 shares at $9.84 each. We continue to believe EDAC Tech has further upside.

We used the proceeds from this sale and cash on hand to add to our positions in Ford (F) and EBAY (EBAY). Specifically, we purchased 250 shares of Ford at $11.53 each and 100 shares of EBAY at $32.80 each. Both of these firms are significantly undervalued, in our opinion. After these transactions, we held, in total, 450 shares of Ford and 200 shares of EBAY in our portfolio. We also opened up one put option contract on LinkedIn (LNKD) at $10.40, using our $55 fair value estimate as the strike (Aug 2012 expiration). We think LinkedIn is materially overvalued.

October 3, 2011

We took some profits in Apple (APPL), a nice winner for us (15% gain). Specifically, we reduced our position by one third, and sold 10 shares at $379.44 each. We continue to believe Apple has significant upside from today’s levels but decided to take some profits on the name and allocate capital to more interesting opportunities.

Specifically, we used some of the proceeds to open up a put position (one contract) in Chipotle (CMG)–Jan 2012, $300 strike– at $33.70, and a long position in EBAY (EBAY) — 100 shares at $29.13. Chipotle registered a 4 on our Valuentum Buying Index, while EBAY registered a 10 (“Top Pick”).

We think Chipotle’s stock price is way ahead of its fundamentals in this troubled economic environment, and we’re big fans of EBAY’s upside valuation potential of over 40%.

September 23, 2011

On September 23, we added to our position in online genealogical research firm, Ancestry.com (ACOM). Specifically, we purchased 150 shares at $21.60 each. We thought the pullback the stock experienced offered a tremendous opportunity, and we continue to believe that the firm has significant upside from today’s levels. We think the market is severely underestimating the long-term growth potential of the online family history provider and expect a substantial move upward toward the back half of this year and into next as the market begins to anticipate the release of the 1940 US Federal Census (which will be made public April 2012), a huge catalyst for genealogical research. We have roughly a 10% allocation in our portfolio for Ancestry.com after the purchase of these shares.

September 22, 2011

We purchased 100 shares of Republic Services at $26.65. We’re big fans of the trash taker as it is the second-largest owner of landfills in the country, and as a result, we think the company has a significant advantage with respect to pricing power (landfill space is eroding due to political and citizens’ group opposition). Plus, through long-term exclusive contracts with municipalities, Republic operates as a monopoly in nearly 30% of its markets, unveiling its solid competitive position. With the purchase of the additional shares, we’ll have roughly a 10% allocation in our portfolio for Republic.

September 12, 2011

We used some of the proceeds from our recent sale of half our position in EDAC Technologies, a 90% gain, and from closing out of our put positions in the Guggenheim Airline ETF (FAA), Under Armour (UA), and AMR Corp (AMR) — all three of which were doubles — to purchase 200 shares of Ford at $9.94, 100 shares of INTC at $19.89, and 40 shares of Ancestry.com at $30.46. We think all three companies are significantly undervalued and are particularly fond of Intel’s 4%+ dividend yield. The new positions in Ford and Intel are relatively small (about 2% of the portfolio), and we’ll look to build to them over time.

August 30, 2011

We reduced our position in EDAC Technologies (EDAC), a big winner for us during the past couple months. Specifically, we sold half of our position, or 1225 shares at $7.93, which represents a gain of over 90% from our purchase price of $4.08 on June 6. After this sale, EDAC Tech will continue to be a large position in our portfolio at roughly 9%-10%. We continue to be very bullish on the outlook for commercial aerospace and believe EDAC Tech has upside. However, we feel it prudent to scale back our position, as our exposure to aerospace has increased beyond a level where we’d feel comfortable — we also hold aircraft engine-casting maker Precision Castparts (PCP) and aircraft in-flight entertainment provider Astronics (ATRO) in our portfolio.

August 9, 2011

We took profits on our remaining put positions, as we look to re-allocate to the long side of our portfolio and pick up bargains thanks to the market’s slide during the past couple weeks. Specifically, we closed out our Jan 2012 Under Armour puts ($77.50 strike) at $20.60, a gain of about 124%. We also closed out our put position on the Guggenheim Airline ETF (FAA)–Dec 2011, $35 strike–at $7.40, a gain of 100%. We continue to be very bearish on the airline sector, but we cannot ignore the recent slide in crude oil prices, which may serve as a near-term boost to stem airline losses. Given the market’s selloff during the past few trading sessions, we think raising cash to scoop up bargains on the long side is relatively more attractive than holding deep in-the-money puts at this time.

August 4, 2011

We took profits in our Feb 2012 AMR puts (strike $5) at $1.56 per contract, representing a gain of 113%. We continue to believe AMR is destined for failure, but we are reducing our put position in the airline sector with this move. We’re leaving our put option position on the Guggenheim Airline ETF (FAA) on the table, which has nearly doubled as well.

For previous trades, please view the inaugural edition of our Best Ideas Newsletter here.