“Business owners across the world know that their business is not more or less valuable because they paid themselves a higher distribution this quarter.” – Brian Nelson, CFA

Image Source: Images Money

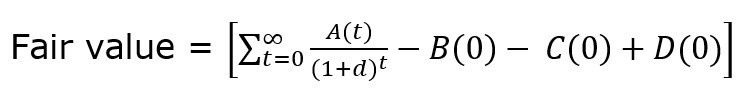

Stocks are generally valued on the present value of all their future free cash flows, which already include future dividend payments. A company’s dividend policy may impact an investor’s eagerness to pay a higher price for shares on the basis of a higher yield, but the dividend is a symptom of future free cash flows (and therefore intrinsic value), not a driver behind it.

where A (t) is an Enterprise Free Cash Flow (1) at year t,

B (0) is a Total Debt at time 0,

C (0) is a Preferred Stock at time 0,

D (0) is a Total Cash at time 0,

d is Weighted Average Cost of Capital (WACC).

By Brian Nelson, CFA

There are generally three primary sources of intrinsic value of a company.

First, the company’s operating activities have value, as measured by the present value of all future enterprise free cash flows that are generated for all stakeholders of the business (debt holders, equity holders, etc), to the entire enterprise (A). Second, the company’s balance sheet can have value (D – B – C, in image above). For example, if a company has $1 billion in total cash and $500 million in total debt and no preferred stock outstanding, if the board should decide to shut down today, shareholders would be entitled to the net cash position, or $500 million ($1 billion less $500 million), adjusted for closing/unwinding expenses. Third, a company’s “hidden” assets such as an overfunded pension or an equity stake in another company that may not be accurately reflected in GAAP accounting statements can have value (this aspect is not included in formula above, but an expanded definition might include it).

With a few exceptions, most everything else, but namely dividends, are already captured within the intrinsic value calculation (dividends are paid out of cash from the balance sheet, including newly-raised debt, or future enterprise free-cash-flow generation). As for other considerations such as a company’s low-cost position, its network effect, its brand strength, or any intangible asset (management, culture, and the like), they can effectively be ‘valued’ by summing up the firm’s ability to translate those strengths into future enterprise free cash flows. If these competitive advantages cannot translate into future ‘value,’ as measured by future enterprise free cash flows, then they might not be valuable competitive advantages, or be competitive advantages at all.

When investors think quantitatively about the concept of value in a financial context, as in the case of future enterprise free cash flows, as opposed to a qualitative subjective context, they are generally better able to cut through a lot of the noise, particularly as it relates to news that may be immaterial and/or the quarterly earnings beat and miss “game.” There are always exceptions to any generalization, of course, as a company’s buying back stock at attractive prices and pursuing value-creating acquisitions can augment intrinsic worth (if interested, please read more on buybacks here), but the case with dividends as already being a part of the company’s value equation is much clearer.

Share Price versus Intrinsic Value

The difference between price and value is paramount for investors to understand. Price and value are almost never the same, and both are moving targets over time. Price is what you pay for something (a stock quote); value is what you get (a claim on the business’ assets, including its future enterprise free cash flows and dividends). A company, for example, is not more or less ‘valuable’ because it pays a higher dividend or has a higher yield, even if shares are bid up by the market as a result of the dividend or yield. In some cases, for example, the company’s higher yield can even reflect greater risk with respect to the sustainability of the dividend and the company’s business model. Two instances in the market with uncomfortably large dividend yields are Stanley Black & Decker (SWK) and Leggett & Platt (LEG). These company’s lofty dividend yields, to us, speak of greater risk than income opportunity.

So as to not over-generalize about a very important concept, a company’s dividend policy can theoretically impact ‘value’ positively if management would have otherwise destroyed value by investing that capital paid out as a dividend elsewhere. Paying money in the form of a dividend to shareholders that otherwise would have been lost through negative-IRR projects or value-destroying (negative economic value added) M&A is a good thing. But a company’s dividend policy can theoretically impact ‘value’ negatively, too. For example, if management’s dividend policy strains the balance sheet, a higher cost of capital that might result could actually hurt an intrinsic value estimate, so paying a dividend can even be value-destroying, a somewhat counter-intuitive thought. Absent these two ancillary conditions, however, a company’s dividend policy will generally always be a symptom of value (a component of the balance sheet or future enterprise free cash flows), not a driver behind it.

The Dividend Is Already Yours — Even Before It is Paid

If there is one truism that you should take away from this article, it is that you already own, via the stock price (through its relationship with estimated intrinsic value), whatever future dividends a company will ever pay you; the dividend is already factored into the valuation equation (either on the balance sheet or in future enterprise free cash flows). Read more about our thoughts about the dividend in our letter to the board rooms of America here. You can also read more about how share prices and intrinsic value are tied together here.

Even though a company’s dividend policy can create excitement around the stock price (remember: price and value are different), a dividend increase does not make the company more valuable. In fact, somewhat counter-intuitively, the payment of a dividend actually reduces intrinsic value, all else equal. Read more about how dividends impact valuation here. Business owners across the world know that their business is not more or less valuable because they paid themselves a higher distribution this quarter. All told, the dividend can be a fantastic source of income, but you should get to know it well, perhaps in a different light. It may not be precisely what you think it is.

———-

Article tickerized for companies in the SDY.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.