Image Source: Visa Inc – 2018 Annual Report

By Callum Turcan

One of our favorite holdings in the Best Ideas Newsletter portfolio is Visa (V), which has been included in the portfolio since November 2011 (see BIN transaction log here). Visa’s growth story is straightforward. The company is a secular growth play on the emergence of a global cashless society, one that is increasingly relying on debit and credit cards for most transactions. We think there’s still an enormous amount of room left to go on this front, especially in emerging and developing markets. We assign Visa a fair value estimate of $182/share (updated in the middle of August) and the top end of our fair value estimate range sits at $218/share. While Visa’s share price has been volatile of late, we still like the company.

Great Financial Performance

Unlike American Express (AXP) and Discover Financial Services (DFS), Visa does not take on credit risk as it doesn’t issue credit cards. The payment processor issues Visa-branded cards from banks that do issue credit cards.

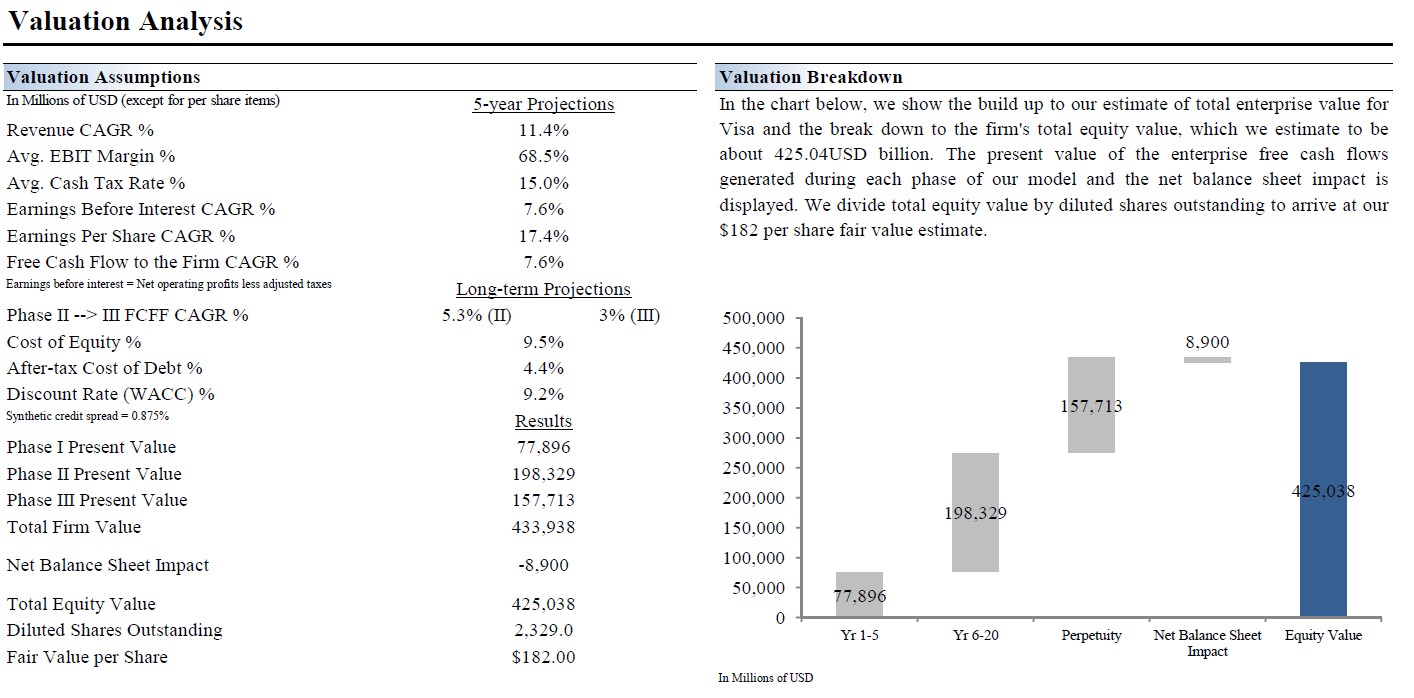

Back in 2016, Visa completed its acquisition of Visa Europe and consolidated the business. In June 2019, Visa paid an additional €$1.1 billion as part of that deal (the firm was required to pay an additional €1.0 billion three years after closing, compounded at an annual 4% interest rate, which was agreed to when Visa acquired Visa Europe). In the graphic below we highlight our enterprise cash flow analysis for Visa, which we cover further in the company’s 16-page Stock Report that can be accessed here.

Image Shown: Our base case assumptions for Visa implies a total equity value of $425 billion or $182/share.

What makes Visa so appealing is its impressive long-term growth trajectory (supported by secular trends), strong free cash flow profile (in FY2018 that ended September 2018, Visa generated a whopping $12.0 billion in free cash flows), relatively low net debt load (at the end of June 2019 when Visa’s fiscal third quarter for FY2019 concluded, the firm was sitting on $14.1 billion in cash, cash equivalents, short-term investment securities, and long-term investment securities versus $16.7 billion in total debt), ability to generate shareholder value (we give Visa a Very Attractive Economic Castle rating and an Excellent Value Creation rating), and management’s disciplined capital allocation strategy.

Management prefers to allocate most of Visa’s free cash flows to share repurchases (including $7.2 billion in FY2018), which we see as a good use of capital considering the intrinsic value of V continues climbing higher and given the firm’s modest annual dividend commitment ($1.9 billion in FY2018). In FY2018, Visa paid down debt and that continued in FY2019 when the firm fulfilled its Visa Europe payment obligation (which was a debt-like instrument given it had a 4% interest rate). Using free cash flows to cover capital allocation decisions (instead of relying on capital markets) and steadily trimming down its total debt load highlights Visa’s focus on fiscal sustainability.

In FY2019, Visa continued to be a free cash flow juggernaut. During the first three quarters of FY2019, Visa generated $8.2 billion in free cash flows which covered $6.5 billion in share repurchases and $1.7 billion in dividend payments. Visa has been steadily increasing its per share dividend payout, growing it from $0.12/share in early-2015 to $0.25/share by late-2018 (where it has stayed since, but another payout increase is likely on its way soon). Due to its stellar capital appreciation, Visa only yields 0.6% as of this writing on a trailing twelve-month basis.

Image Shown: Shares of Visa have been on a stellar run over the past few years.

Using M&A to Augment the Growth Runway

Looking ahead, we are interested in seeing how Visa leverages its recent acquisitions to maintain its growth uptrend. The company completed its purchase of Earthport (provides cross-border payment services to banking institutions) in May 2019, announced plans to acquire Verifi (creates technology to reduce chargebacks) in June 2019, and completed the acquisition of Payworks (provides payment gateway point-of-sale software) in July 2019. These deals extend Visa’s reach deeper into the payment processing and financial tech world and are relatively small for a company of its size.

Management is targeting growth worldwide, and during a recent conference Visa mentioned that it had its eyes on Europe. The company noted that while Visa had missed out on certain trends in the European financial tech world like virtual prepaid and mobile initiatives, along with not being able to cater to affluent European travelers as well as it would have liked, Visa was beginning to gain traction on this front. Visa now sees these emerging areas representing significant growth opportunities and the company is very much open to engaging with emerging financial tech players to win new business. The company apparently has had meaningful success here, and thinks there’s plenty of room to keep the momentum going;

“…around that time [of the Visa Europe acquisition] [there] was a pretty significant growth in the FinTech community and a lot of Neo banks, as they refer to [them] in Europe, that were evolving. And we missed a bit of an early growth cycle on some of those higher growth, extraordinarily innovative players that were focused on whole host of mobile initiatives, virtual prepaid, focused on affluent European travelers.

And I think that after, I think, some early losses in some of that new business, organic business, there has been an improvement in our win rates and more of a focus that we’ve had on not just servicing our store clients, but being a lot more open to engaging some of these newer players. And it’s definitely resulting in some increased business for us. And we’ve considered [this] to be a material growth opportunity.

In addition to that, I think, the long lead cycle you’ve got on selling into the credit business, which we’ve had some in Europe, but I think it’s been underdeveloped [and] continues to be a high priority for us. And we’ll continue to look for opportunities to increase our win rate in our growth in credit and commercial products across Europe.”

We see Visa’s recent acquisitions as augmenting its growth runway in Europe by giving it exposure to newer high growth areas while also bolstering its offering as it relates to winning over new credit and commercial customers. We will be watching this space closely to see how these endeavors play out.

Concluding Thoughts

Recent volatility in Visa’s share price aside, the long-term trajectory of this company is sound and shares of Visa trade modestly below our fair value estimate at this time. We like the strong upward momentum in Visa’s share price year-to-date and expect that shares of V could test the upper bounds of our fair value range (as it stands today) over time.

Financial Tech Services Industry – ACIW EPAY FDC FIS FISV FLT GPN MA MELI PYPL V VRSK WU WEX

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and PayPal Holdings Inc (PYPL) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.