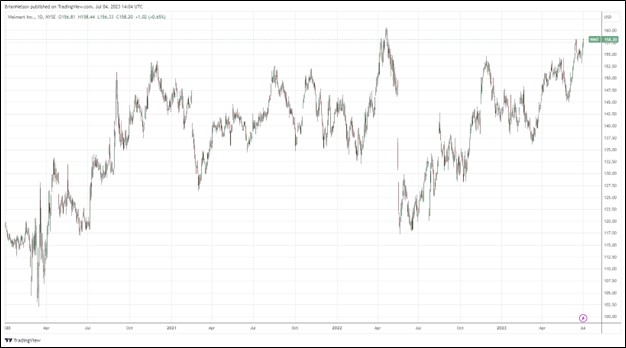

Image: Walmart’s shares have gotten back on track.

By Brian Nelson, CFA

Grocer Aldi may have been the greatest beneficiary of the past 12-18 months due to consumers trading down from lofty grocery prices, but Walmart (WMT) has kept pace, in our view, as Target (TGT) struggles from a public relations nightmare and membership warehouses like Costco (COST) feel the need to cut down on membership card sharing as comparable store sales weaken.

We think Walmart’s ‘Great Value’ brand and position across bargain retail has never been stronger, and its share price reflects a company that is at a sweet spot of consumer demand as rivals continue to struggle. The high end of our fair value estimate range of Walmart stands north of $170, and shares yield ~1.4% at the moment. We’re liking what we see at Walmart these days.

Tickerized for WMT, TGT, DG, DLTR, FIVE, COST, CALM, GIS, CPB

NOW READ: Earnings Roundup: DE, WMT, CSCO, HD, FL

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.