Image Source: Valuentum

By Brian Nelson, CFA

On February 18, global brick-and-mortar retail bellwether Walmart (WMT) reported mixed fourth-quarter fiscal 2020 results (ends January 31, 2020) that showed revenue advancing 2.1% and non-GAAP earnings per share of $1.38 missing the consensus forecast. We await the filing of the firm’s 10-K to roll our valuation model forward, but we do not expect to make any material changes to our fair value estimate at this time, which stands at $109 per share. The stock is trading hands at ~$118 per share at the moment.

Walmart’s US comparable store sales growth, on a two-year stacked basis, came in at 6%, which is solid in our view, but the most recent quarterly pace (+1.9%) came in below the consensus forecast (2.4%). Perhaps the disappointment wasn’t too surprising, however, given Target’s (TGT) lower-than-expected comp for the November/December period, released January 15. Both Walmart and Target lapped impressive comp performance in the respective prior-year periods, so the comparisons were difficult.

The highlight of Walmart’s fourth quarter was the firm’s US e-commerce business, which advanced an impressive 35% on a year-over-year basis (comparable digital sales were up 19% in the November/December period at Target). Management noted that Walmart.com had “its highest quarterly growth rate of the year,” as much of the strength in e-commerce at Walmart during the period came from grocery pickup and delivery. Target also noted strength in same-day fulfillment services (Order Pick Up, Drive Up and Shipt), which advanced more than 50% during the November/December period.

Sam’s Club recorded comparable sales growth of 0.8% (excluding fuel) during the fourth quarter, and management pointed to tobacco sales as a big headwind, perhaps a read-through to the major US players, including Altria (MO). Sam’s Club and Walmart changed their tobacco sales policy in the US and are no longer selling tobacco products to consumers under the age of 21, which went into effect on July 1, 2019. Additionally, Sam’s Club and Walmart are no longer selling certain vaping products, particularly fruit flavored vaping products that are popular with teenagers. This policy change was in response to pressures from consumer advocacy groups and federal regulators.

The impact on High Yield Dividend Newsletter portfolio holding Philip Morris (PM), however, which operates exclusively outside the US (with the majority of its revenue coming from the European Union and Asia/Australia) is minimal, given that Sam’s Club is primarily US focused. Read our latest update on PM at the following link: “Philip Morris International Moving on Upwards (Feb 12).” Net sales at Walmart International clocked in at $33 billion in the quarter, up 2.3%.

Looking ahead to fiscal 2020, Walmart expects consolidated net sales growth of ~3% in constant currency driven by expectations for comp sales growth at Walmart US of 2.5%+ (excluding fuel), offsetting ongoing headwinds at Sam’s Club due primarily to weakness in tobacco-related sales. Walmart US e-commerce net sales expansion is targeted at 30% on the year, while Walmart International net sales growth is expected to be ~4% in constant currency. Earnings per share is targeted in the range of $5.00-$5.15, up 1.5%-4.5% compared to fiscal 2020 adjusted numbers. The fiscal 2021 EPS target came in below the consensus forecast.

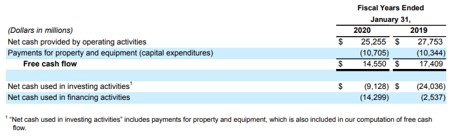

Image Source: Walmart’s Fourth-Quarter 2020 Earnings Press Release. Free cash flow trends weakened in fiscal 2020.

Walmart ended fiscal 2020 with $9.5 billion in cash and cash equivalents and $49.7 billion in short and long-term debt, revealing a material net debt position. Cash flow from operations fell in fiscal 2020, as well, while capital spending increased, putting a squeeze on free cash flow, which fell to $14.6 billion on the year, down $2.9 billion from last year’s tally. Big picture, Walmart’s financials are showing signs of “fatigue” so late into this decade-long economic expansion, in our view, as free cash flow weakened and its debt load remains bloated.

Concluding Thoughts

Walmart’s modest 1.9% dividend hike to $2.16 per share (1.8% forward annualized yield) may not be enough to appease dividend growth investors, especially given the rather lackluster valuation opportunity in shares. Big-box brick-and-mortar retail and grocery continues to evolve, as Amazon’s (AMZN) entry into the space with its purchase of Whole Foods and Berkshire Hathaway’s (BRK.B) new purchase of Kroger (KR) shares will only make the competitive environment more intense, in our view. Not only does Walmart have to contend with strengthening rivals, but the coronavirus outbreak may ultimately come to impede 2021 performance. We like Walmart (the company), but we’re not interested in its stock at these levels.

Food Retailers: CASY, COST, CVS, KR, SYY, TGT, WBA, WMT

Related: SHOP, EBAY, GRUB, UBER, POST, JSTLF, TKAYF

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.