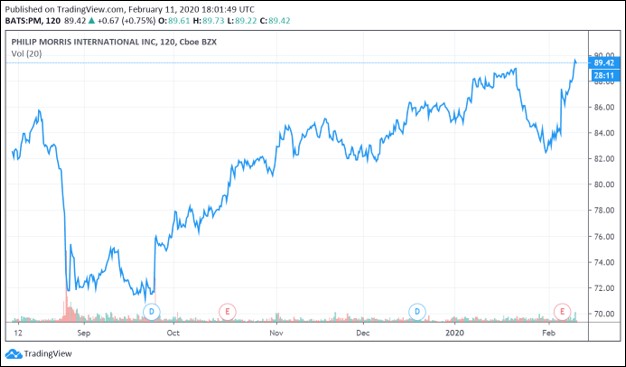

Image Shown: We increased the weighting in shares of Philip Morris International in the High Yield Newsletter portfolio back on November 18, 2019. Shares of PM have rallied aggressively off of their Fall 2019 lows through the middle of February 2020.

By Callum Turcan

One of our favorite high yield ideas out there is Philip Morris International Inc (PM), and please note we increased the weighting of shares of PM in our High Yield Dividend Newsletter portfolio (check out our HYDN here) back on November 18, 2019 (link here covering those portfolio changes), and our timing couldn’t have been better considering shares of PM have aggressively rallied since September 2019 through the middle of February 2020.

There’s still room for Philip Morris International to run higher given its strong technicals, solid fundamentals, and considering the top end of our fair value estimate range sits at $95 per share (decently above where shares of PM are trading at as of this writing). Additionally, please note that shares of PM yield ~5.2% on a forward-looking basis as of this writing, and we like Philip Morris International’s dividend coverage.

Great Cash Flow Profile, Negligible Shareholder Dilution

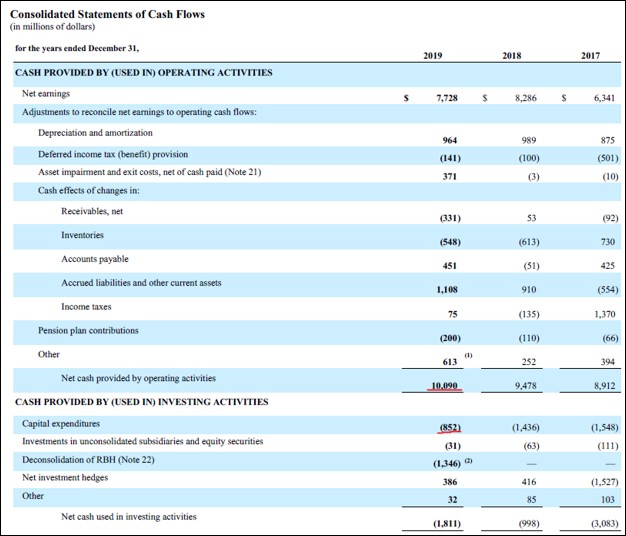

From 2017 to 2019, Philip Morris International generated $8.2 billion in free cash flow on average per year. The company’s dividend obligations averaged $6.9 billion per year during this period, and this is largely why we like Philip Morris International’s dividend coverage. We’ll cover its balance sheet in a moment (the firm has a net debt position), but given the stability of the company’s free cash flow profile (a product of inelastic demand for tobacco products and the firm’s pricing power), Philip Morris International should be able to keep making good on its dividend obligations going forward.

In 2019, the company generated $9.2 billion in free cash flow and spent $7.2 billion covering its dividend obligations. Philip Morris International doesn’t allocate a meaningful amount towards share repurchases, and additionally, doesn’t issue out a meaningful amount of equity per year (on a historical basis). In the two upcoming graphics down below, please note the strength of its cash flow profile.

Image Shown: Philip Morris International’s net operating cash flow and capital expenditures for 2019 are underlined in red to showcase its free cash flow for that year. Image Source: Philip Morris International – 2019 10-K Filing with additions from the author

Image Shown: Philip Morris International’s dividend obligations for 2019 are underlined in red to highlight the firm’s solid dividend coverage. Image Source: Philip Morris International – 2019 10-K Filing with additions from the author

In the upcoming graphic down below, note that equity awards relative to Philip Morris International’s outstanding share count have been marginal over the past several years. Negligible dilution of shareholders via equity issuances, on a historical basis, represents another reason we really like Philip Morris International. Furthermore, the company has no intention of issuing preferred stock according to its 2019 Annual Report.

Image Shown: Philip Morris International historically hasn’t diluted shareholders via meaningful equity issuances, which we really appreciate, and that is highlighted by the underlined shares outstanding and the red arrow. Image Source: Philip Morris International – 2019 10-K Filing with additions from the author

Balance Sheet Commentary

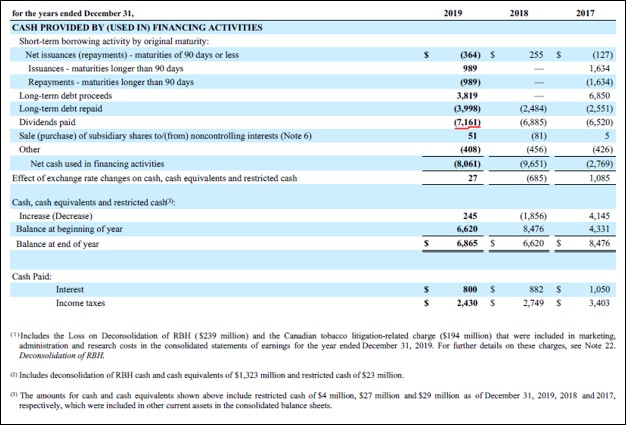

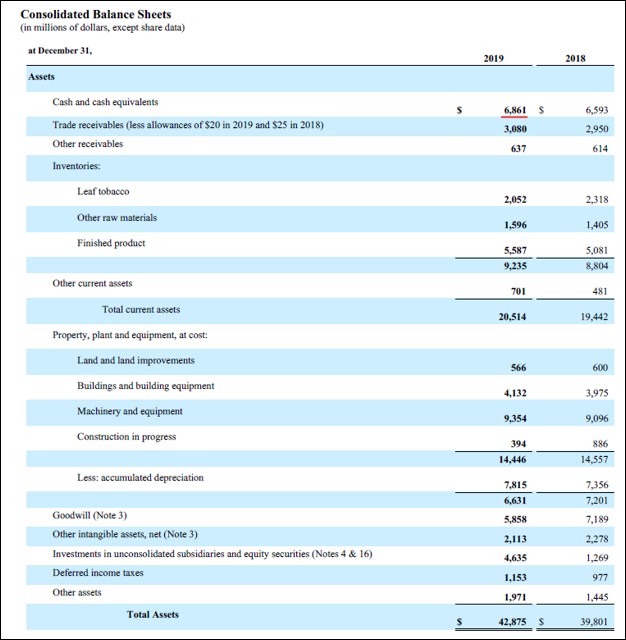

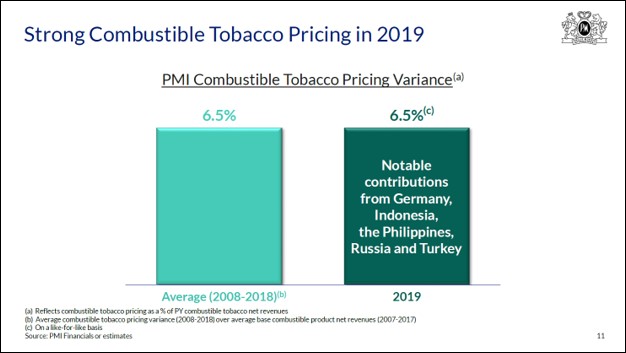

Pivoting now to Philip Morris International’s balance sheet, the company exited 2019 with $6.9 billion in cash and cash equivalents versus $0.3 billion in short-term debt, $4.1 billion in long-term debt maturity in less than one year, and $26.7 billion in long-term debt. Please note that the line item ‘investments in unconsolidated subsidiaries and equity securities’ includes various strategic assets and shouldn’t be considered a part of its cash and cash equivalents balance, per se. At the end of 2019, Philip Morris International had a net debt load of $24.2 billion, down from $25.2 billion at the end of 2018 and we appreciate management cutting the firm’s net debt load down.

Image Shown: Philip Morris International historically has kept a nice cash balance on hand, providing the firm a nice liquidity buffer that supports its dividend coverage. Image Source: Philip Morris International – 2019 10-K Filing with additions from the author

Image Shown: Philip Morris International carries a net debt position, which needs to be monitored, but we view that burden as quite manageable given its strong free cash flow profile. From the end of 2018 to the end of 2019, Philip Morris International’s net debt load fell which we appreciate. Image Source: Philip Morris International – 2019 10-K Filing with additions from the author

Deconsolidation of RBH

Within the big tobacco space, lawsuits are to be expected. A subsidiary of Philip Morris International lost a big case in Canada back in May 2015, which culminated in its Canadian subsidiary Rothmans, Benson & Hedges Inc (‘RBH’) seeking creditor protection in 2019 after the massive legal ruling (~$12 billion that was to be paid out by RBH and a couple other tobacco companies, with RBH held liable for $2.3 billion) was upheld on appeal last year. Here’s more on that from Philip Morris International’s 2019 Annual Report (emphasis added):

In the first class action pending in Canada, Conseil Québécois Sur Le Tabac Et La Santé and Jean-Yves Blais v. Imperial Tobacco Ltd. (IMBBY), Rothmans, Benson & Hedges Inc. and JTI-Macdonald Corp. (JAPAY), Quebec Superior Court, Canada, filed in November 1998, RBH and other Canadian manufacturers (Imperial Tobacco Canada Ltd. and JTI-Macdonald Corp.) are defendants. The plaintiffs, an anti-smoking organization and an individual smoker, sought compensatory and punitive damages for each member of the class who allegedly suffers from certain smoking-related diseases. The class was certified in 2005. The trial court issued its judgment on May 27, 2015. The trial court found RBH and two other Canadian manufacturers liable and found that the class members’ compensatory damages totaled approximately CAD 15.5 billion, including pre-judgment interest (approximately$11.7 billion). The trial court awarded compensatory damages on a joint and several liability basis, allocating 20% to our subsidiary (approximately CAD3.1 billion, including pre-judgment interest (approximately$2.34 billion))…

….As a result of the Court of Appeal of Quebec’s decision in both the Létourneau and Blais cases… our subsidiary, Rothmans, Benson & Hedges Inc. (“RBH”), and the other defendants, JTI Macdonald Corp., and Imperial Tobacco Canada Limited, sought protection in the Ontario Superior Court of Justice under the Companies’ Creditors Arrangement Act (“CCAA”) on March 22, March 8, and March 12, respectively. CCAA is a Canadian federal law that permits a Canadian business to restructure its affairs while carrying on its business in the ordinary course. The initial CCAA order made by the Ontario Superior Court on March 22, 2019 authorizes RBH to pay all expenses incurred in carrying on its business in the ordinary course after the CCAA filing, including obligations to employees, vendors, and suppliers…

…The administration of the CCAA process, principally relating to the powers provided to the court and the court appointed monitor, removes certain elements of control of the business from both PMI and RBH. As a result, PMI has determined that it no longer has a controlling financial interest over RBH as defined in ASC 810 (Consolidation), and PMI deconsolidated RBH as of the date of the CCAA filing. PMI has also determined that it does not exert “significant influence” over RBH as that term is defined in ASC 323 (Investments-Equity Method and Joint Ventures). Therefore, as of March 22, 2019, PMI accounted for its continuing investment in RBH in accordance with ASC 321 (Investments-Equity Securities) as an equity security, without readily determinable fair value.

Following the deconsolidation, the carrying value of assets and liabilities of RBH was removed from the consolidated balance sheet of PMI, and the continuing investment in RBH was recorded at fair value at the date of deconsolidation. The total amount deconsolidated from PMI’s balance sheet was $3,519 million, including $1,323 million of cash, $1,463 million of goodwill, $529 million of accumulated other comprehensive earnings, primarily related to historical currency translation and $204 million of other assets and liabilities, net. While PMI is accounting for its investment in RBH as an equity security, PMI would recognize dividends as income upon receipt. However, while it remains under creditor protection, RBH does not anticipate paying dividends.

Given Philip Morris International’s strong performance in 2019 and its expansive international presence, this news didn’t derail our thesis on the stock. We wanted to bring this to our members attention to highlight that the company is putting the RBH saga behind it, albeit slowly, and while its 2019 performance took a ding from the ruling being upheld by the Court of Appeals of Quebec, Philip Morris International remains a free cash flow cow with a nice outlook. Please keep in mind RBH retains a large cash balance that can be used to help cover its legal expenses. On a non-GAAP adjusted diluted EPS basis, Philip Morris International posted 2% annual growth in 2019 which rises to 10% when excluding foreign currency headwinds.

Operational Update

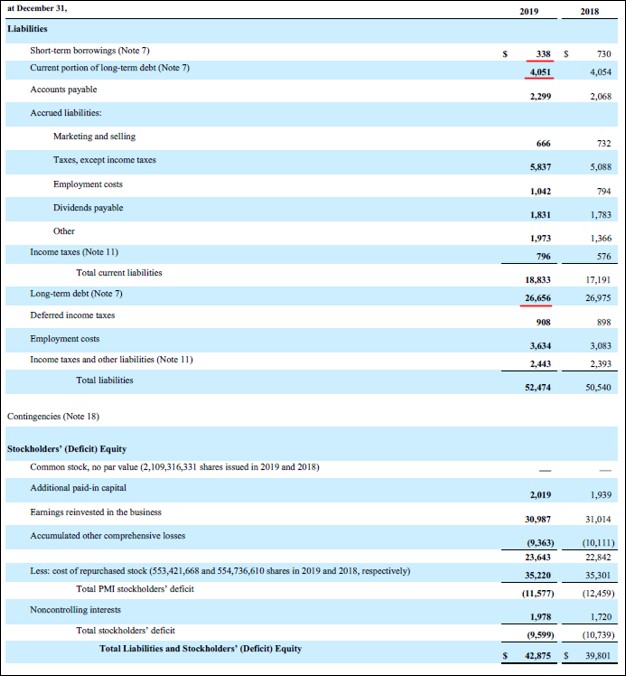

In 2019, Philip Morris International’s ‘cigarette and heated tobacco unit shipment volume’ fell by 2.0% year-over-year as its cigarette shipment volume fell by 4.5%, which was offset by a surge in heated tobacco unit shipment volume which grew by 44.2% during this period. On an adjusted basis, total shipments fell by 1.4%, which was well below the industry average as you can see in the graphic below. Please note price increases are utilized to offset lower shipment volumes of its traditional tobacco products.

Image Shown: Philip Morris International offset ongoing declines at its traditional tobacco business with sales of its heated tobacco products. Image Source: Philip Morris International – Fourth Quarter and Full Year 2019 IR Earnings Presentation

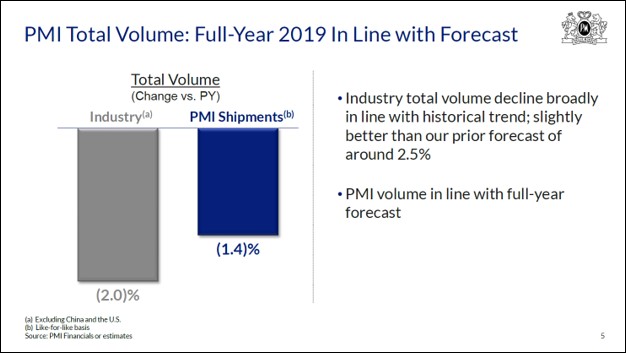

In the graphic below, Philip Morris International showcases its pricing strength as the firm has been able to push through mid-single-digit pricing increases for more than a decade. This is something that makes the tobacco space very appealing from a high-yield perspective, as barriers to entry and brand power enable firms to offset structural declines in conventional tobacco demand with material price increases on an ongoing basis. As tobacco products have inelastic demand curves, consumers continue to purchase Philip Morris International’s products in relatively large quantities (keeping structural demand declines in mind, of course).

Image Shown: Pricing power is essential to maintaining and improving Philip Morris International’s cash flows. Image Source: Philip Morris International – Fourth Quarter and Full Year 2019 IR Earnings Presentation

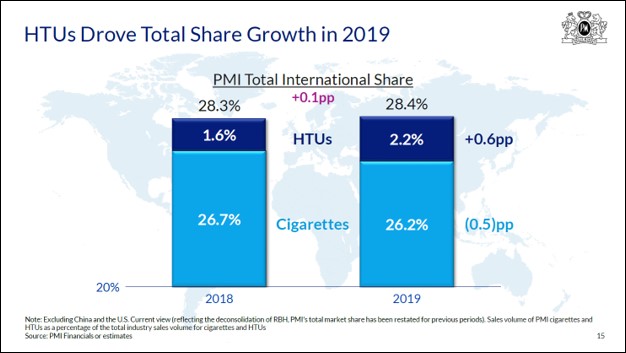

Philip Morris International was effectively able to grow its market share in 2019 on the back of the success of heated tobacco products like IQOS, which we appreciate. IQOS is targeted towards existing smokers by offering those consumers a healthier alternative to cigarettes, and sales of the product have performed quite well. The product is now available in 52 markets worldwide and please note the US FDA has approved the heated tobacco offering (unlike the once popular Juul product), with IQOS sales in the US starting up late last year.

Additionally, Philip Morris International is working with its partner Altria Group Inc (MO) to market the product in the US, and please note IQOS is a fundamentally different product than the embattled Juul offering (IQOS is targeted towards traditional smokers and is much more similar to a traditional cigarette in terms of flavor, functionality, taste, etc., while Juul Labs’ namesake product was aggressively targeted towards a younger non-smoking audience which is why it has caught so much flack of late).

Image Shown: Due to the strength of Philip Morris International’s heated tobacco products, like IQOS, the firm was able to grow its total tobacco market share in 2019. Image Source: Philip Morris International – Fourth Quarter and Full Year 2019 IR Earnings Presentation

The upcoming graphic below highlights the rising success of IQOS, keeping in mind its recent launch in the US should help keep the momentum going. Please note the focus Philip Morris International is placing on converting existing smokers to the IQOS product, instead of trying to win over new smokers. This is how tobacco companies effectively navigate the many regulations and potential public relations pitfalls within the industry.

Image Shown: The IQOS product continues to perform well, and we view this product line as offering the company a prime opportunity to maintain its stellar cash flow profile in a world where conventional tobacco use is declining. Image Source: Philip Morris International – Fourth Quarter and Full Year 2019 IR Earnings Presentation

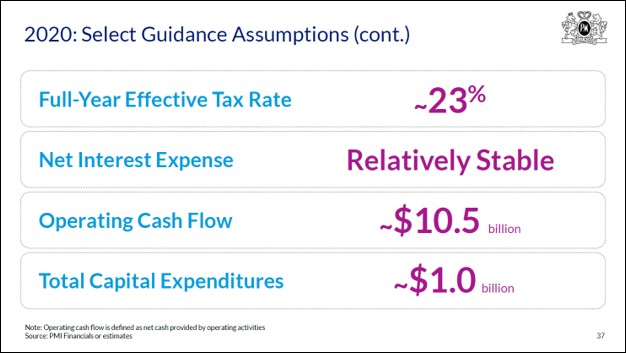

Going forward, the strength of Philip Morris International’s conventional tobacco products (led by its Marlboro brand) in terms of pricing power and rising sales of its heated tobacco products will enable the firm to continue improving its cash flow profile. Foreign currency movements need to be kept in mind, but we appreciate management communicating that Philip Morris International is forecasted to generate ~$9.5 billion in free cash flow in 2020. We view this strong forward guidance as the big reason why shares of PM have performed well recently, as management is expecting low single-digit free cash flow growth on an annual basis off a very high base this year.

Image Shown: Philip Morris International’s free cash flow guidance for 2020 is quite impressive. Image Source: Philip Morris International – Fourth Quarter and Full Year 2019 IR Earnings Presentation

Concluding Thoughts

We continue to like Philip Morris International in our High Yield Dividend Newsletter portfolio, and we remain pleased with our decision to increase the weighting of shares of P