Image Source: Hasbro

Another icon from past decades announced that it may have to liquidate. Though we expect the toy makers to experience a transient impact, we don’t expect it to be lasting. Digital entertainment licensing remains a faster-growing, higher-margin business for them than physical toy sales, and we expect the focus for many toy makers going forward will be on the former, particularly given Disney’s Frozen success.

By Brian Nelson, CFA

There’s nothing like the announcement of a customer’s possible liquidation to send shares of suppliers tumbling. That’s what happened when Toys ‘R’ Us announced that it may have to cease operations as nobody appears to be coming to the rescue. Hasbro (HAS), Mattel (MAT), and JAKKS Pacific (JAKK) may feel some near-term operational discomfort, but we’re not overreacting.

If a rescue deal doesn’t happen for Toys ‘R’ Us, online verticals and big box retailers such as Walmart (WMT) and Target (TGT) may easily fill the void. Target’s CEO Brian Cornell noted, in particular, that his company is “playing to win in toys.” Though we’re viewing the Toys ‘R’ Us announcement as more ‘headline noise’ than anything that may impact the toy makers over the long haul, readers may expect forward near-term guidance to now have a more cautious bent, and that may disappoint some investors.

Rumors of a deal between Hasbro and Mattel haven’t let up from what we can tell, and we think the Toys ‘R’ Us possible liquidation could grease the wheels for further talks, as anti-trust interference may not be that fierce given end market troubles and concentrated online distributor power through the likes of Amazon (AMZN) and eBay (EBAY). We continue to like Hasbro the most out of the toy makers, but we caution management against the temptation to overpay for Mattel’s assets, as the Barbie franchise could very well be in terminal decline, given Disney’s (DIS) Frozen success. We also like that Hasbro continues to pull a variety of levers, the latest an agreement with Netflix (NFLX) to create toys and games from the Super Monsters animated kids series. This follows the Hasbro-Netflix’s joint effort to bring a collection of games to Stranger Things’ fans.

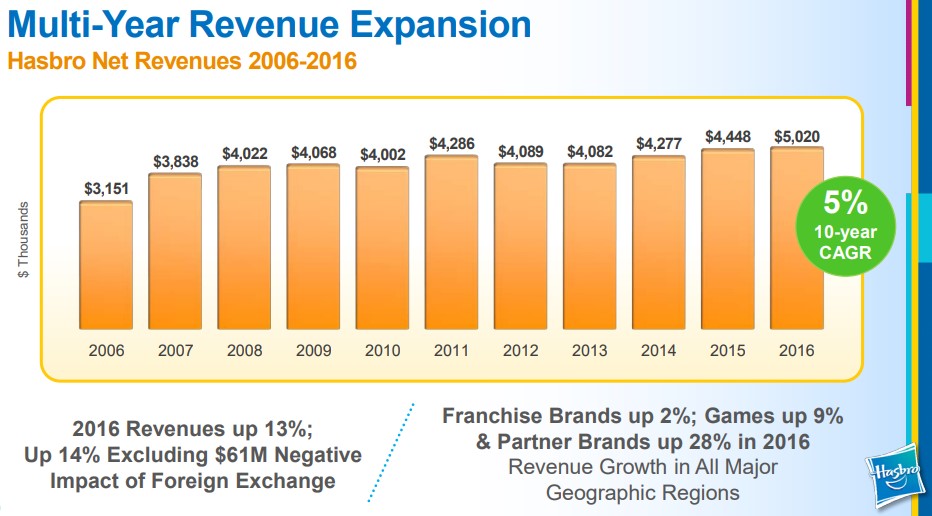

We wrote about Hasbro’s fourth-quarter report, released February 7, and we did highlight that management had pointed “to slower consumer demand for both the company and its industry in November and December,” but we also said that we think “management is confident that its innovative lines that are supported by storytelling and digital initiatives have the company well-positioned for 2018 and beyond.” What we’re watching closely at Hasbro is the long-term trajectory of its ‘Entertainment and Licensing’ business line, where on a full-year basis, operating profit in the segment nearly doubled, to $96.4 million on just ~8% revenue expansion (the division posted a near-34% operating margin). This segment may hold the keys to Hasbro’s future, but even so, Hasbro was able to still drive revenues nearly $1 billion higher during the past 5 years. Physical toy sales are under pressure, but by no means, dead.

Hasbro’s equity has advanced considerably since it graced the inaugural simulated Dividend Growth Newsletter portfolio. Its 10%+ dividend increase, to a quarterly payout of $0.63, on February 7, means shares now have a forward yield of 2.8%. We’re not overreacting to the Toys ‘R’ Us announcement by any stretch, with our fair value estimate of Hasbro hovering in the high-$80s at the time of this writing.

Related: FNKO

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.