Image Shown: Shares of Berkshire Hathaway Inc moved higher on Monday November 4 after reporting a decent third quarter 2019 earnings report on Saturday November 2.

By Callum Turcan

Berkshire Hathaway Inc (BRK.A) (BRK.B) reported solid third quarter 2019 earnings on November 2, and we continue to like Berkshire Hathaway Class B shares as a top holding in our Best Ideas Newsletter portfolio. Our fair value estimate for BRK.B stands at $229 per share with room for upside, as the top end of our fair value estimate range sits at $275 per share.

Third Quarter Overview

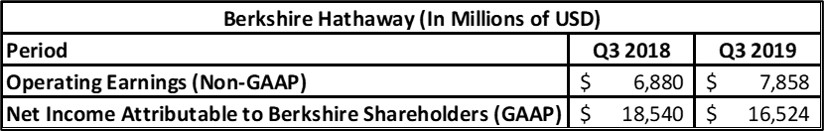

We would like to highlight up front that Berkshire Hathaway’s underlying financial performance improved from the third quarter of 2018 to the same quarter in 2019, as evidenced by the 14% year-over-year increase in the company’s non-GAAP operating earnings. Berkshire Hathaway’s GAAP net income attributable to Berkshire shareholders dropped year-over-year not due to weakness in its underlying businesses, but due to reduced net gains from its investment portfolio. Under GAAP rules, companies are required to report both the after-tax realized and unrealized gains/losses of equity security holdings on a quarterly basis as investment income/losses. That can often distort the appearance of a company like Berkshire Hathaway’s quarterly performance.

Image Shown: Berkshire Hathaway’s underlying non-GAAP operating earnings rose year-over-year in the third quarter of 2019, however, lower net investment gains reduced its GAAP net income attributable to Berkshire shareholders during this period. Image Source: Berkshire Hathaway – 10-Q filing and earnings press release for the third quarter of 2019, table created by the author.

Berkshire Hathaway’s free cash flow profile remained stellar during the first nine months of 2019. During this period, the company on a consolidated basis generated $26.6 billion in net operating cash flow and spent $11.1 billion on capital expenditures, allowing for $15.5 billion in free cash flows. Management, namely CEO Warren Buffett and Vice Chairman Charlie Munger, have long been against having Berkshire Hathaway pay out common dividends. That being said, the company did somewhat recently change its stance towards share buybacks to allow for more leeway when it comes to the timing and scale of potential repurchases. During the first nine months of 2019, Berkshire Hathaway spent $2.8 billion repurchasing its shares, up from $0.9 billion in the same period last year.

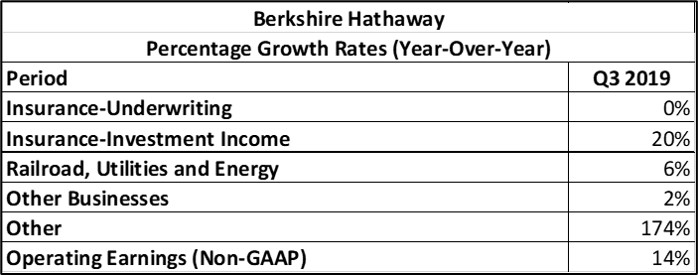

As depicted in the two tables down below, Berkshire Hathaway’s strength was widespread in the third quarter of 2019. Non-GAAP operating income growth by segment came from the company’s insurance-related investment income (different from investment gains on a consolidated basis), industrial holdings, and other businesses portfolio. Operating income relating to its insurance underwriting segment was broadly flat year-over-year in the third quarter.

Image Shown: Berkshire Hathaway experienced growth across the board during the third quarter of 2019 on a year-over-year basis. Image Source: Berkshire Hathaway – Third quarter 2019 earnings press release, table made by the author.

Image Shown: We appreciate Berkshire Hathaway’s strong industrial growth given headwinds the sector has been facing of late. Image Source: Berkshire Hathaway – Third quarter 2019 earnings press release, table made by the author

Utility Investments

Going forward, Berkshire Hathaway is making investments in wind farms, including the $0.2 billion Rattlesnake Ridge Wind development in Alberta, Canada (EWC). That project will add 118 MW of electricity generation capacity to the region and will be owned by BHE Canada, a subsidiary of Berkshire Hathaway Energy. UK-based Renewable Energy Systems is developing the wind farm. Electricity produced from the facility will be sold under long-term power purchase agreements, and a large corporate customer in Canada has already secured the majority of the wind farm’s expected output (according to Bloomberg). Additionally, BHE Canada and Renewable Energy Systems are seeking demand for another wind farm endeavor, the proposed 399 MW Forty Mile Wind Farm that would also be located in Alberta.

As certain government subsidies, particularly those provided by the provincial government of Alberta under the Renewable Electricity Program (which was enacted under a previous provincial government that has since been voted out of office, with the current administration seeking to terminate the program), are set to end, the partnership wants to secure long-term power purchase agreements first before moving forward. Many large corporate customers are seeking to sign such agreements to give the appearance that they are more “forward-thinking” and “green” if you will, meaning economics are taking a back seat to public and government relations. That makes signing long-term agreements without subsidies an easier task.

Furthermore, the levelized cost of electricity from wind turbines has steadily marched lower over the years according to Lazard Ltd (LAZ), and that trajectory is expected to continue according to the US Energy Information Administration. Lower levelized cost of electricity as it relates specifically to utility-scale wind farms makes these endeavors vastly more economical. BHE Canada owns AltaLink, a regulated transmission company that delivers electricity to about 85% of Alberta’s populace. Investing in power generation facilities complements Berkshire Hathaway’s existing energy assets in the region. Back in December 2014, Berkshire Hathaway acquired 100% of AltaLink L.P.’s equity. Going forward, AltaLink has various projects in the works that aim to keep its system modern and to maintain grid reliability.

Concluding Thoughts

We continue to like Berkshire Hathaway as a top holding in our Best Ideas Newsletter portfolio and appreciate the strong underlying performance in the firm’s core businesses. The company offers us exposure to one of the best investment minds in history in Warren Buffett, while the conglomerate offers considerable diversification benefits to the Best Ideas Newsletter portfolio from banking to industrials to insurance and beyond.

Berkshire has made some missteps with Kraft Heinz (KHC), for example, but we continue to be huge fans of the prudence at which Berkshire carries out its affairs, particularly in holding a relatively large cash balance at or near the peak of this decade-plus bull market (it held ~$128 billion in cash equivalents at the end of the third quarter). Once the strength of this bull market begins to fade and weakness in equities takes hold, we expect this large cash balance to come in handy.

From owning some of our favorite companies, including railroad Burlington Northern and aerospace supplier Precision Castparts, to its equity hefty stake in Bank of America (BAC), we expect further upside at Berkshire as the market comes to fully valuing its investment portfolio. Volatile investment gains aside, Berkshire Hathaway reported solid results in its third quarter 2019 earnings update.

Data Sheet on Stocks in the Insurance Industry

Tickerized for companies in the SPDR S&P Insurance ETF (KIE)

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.