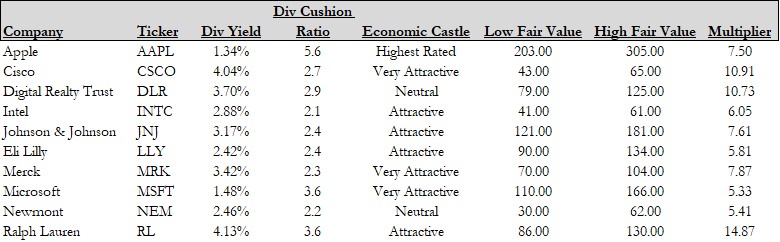

Image Shown: A look at some of the top dividend growth stocks to consider, companies with strong Dividend Cushion ratios and nice payout growth trajectories, in light of ongoing turbulence in equity markets. The ‘Multiplier’ column multiplies a company’s dividend yield by its Dividend Cushion ratio.

Alphabetical order by ticker: AAPL, CSCO, DLR, INTC, JNJ, LLY, MRK, MSFT, NEM, RL

By Callum Turcan

The novel coronavirus (‘COVID-19’) pandemic continues to wreak havoc on global economies, credit and equity markets, and the livelihoods of many. We sincerely hope everyone stays safe during this pandemic. US equities have sold off aggressively during the past month, with the S&P 500 (SPY) down ~25% year-to-date as of this writing, punishing the names of several top quality dividend growth opportunities that we will highlight in this note today. First, however, let’s provide some market context. Here’s what we wrote February 26, a few days after our warning about the impending market crash:

In our Saturday, February 22 note, we said that a contraction of the S&P 500 to a 16x forward multiple on earnings estimates only 10% lower than current forecasts would imply an S&P 500 of 2,566, or a swoon of about 15%-25% from current levels of 3,116 –and that would just get us down to 16x still-respectable forward numbers (the market could still overreact from that point!). How quantitative-driven price-agnostic trading may impact this scenario is not known either… It would not be surprising…if we tripped the circuit breakers at some point. Markets remain severely overpriced in light of current conditions, and panic selling might ensue as fear takes hold.

Most all of what we said would happen has happened thus far; the circuit breakers have even tripped several times. While bear markets are generally short in duration compared to bull markets–according to information from First Trust, the average bear market lasts 1.4 years, leading to an average cumulative loss of ~41% over such a short time–we’ve only been experiencing pain in equities for just the past few weeks. The Great Depression that engulfed the U.S. following the Crash of 1929 sent the markets lower more than 80% over what can be considered, by historical standards, a brief 2.8-year period.

The markets could be falling for some time yet.

Importantly, we are maintaining our fair value range on the S&P 500 of 2,350-2,750, with expectations of panic/forced selling down to 2,000 on the broad market index (it closed at 2,304.92 on Friday, March 20). We believe that savvy investors have been nibbling at this market during the past couple weeks, and may have achieved up to 50%-75% of their equity allocation in a well-diversified portfolio via dollar-cost averaging strategies (with cost roughly at current prices), with expectations of further market declines. While we have provided supplemental lists, our best ideas remain in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio and Exclusive publication.

In case you missed it, we also highlighted a separate list for capital appreciation considerations, “Top Ten Ideas for Consideration Amid COVID-19,” on March 17. The following list in this article focuses more on a dividend-growth bent to idea generation. With that context, let’s dig in.

Apple

Apple Inc (AAPL) is a former long-time holding in both the Best Ideas Newsletter portfolio and the Dividend Growth Newsletter portfolio. We removed shares of AAPL from each portfolio back on January 13 (link here) at over $300 per share after they had run up well above the top end of our fair value range and had shown signs of technical weakness. We let some of our quality overpriced winners run and only remove such expensive equities from our portfolios once their technicals turn negative. Now that shares of Apple have come back down and are trading near ~$249 per share as of this writing, it’s worth taking another look at the firm.

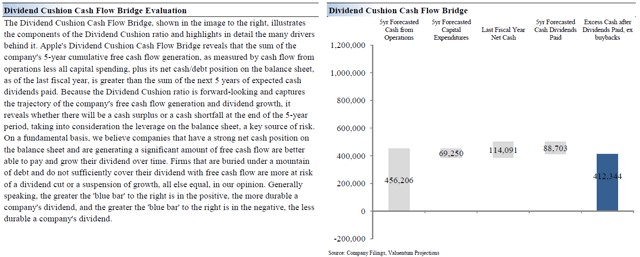

Apple’s push into high-margin services offerings supports the long-term trajectory of its free cash flows and underpins our Dividend Cushion ratio of 5.6 which indicates stellar dividend payout coverage on a forward-looking basis. That allows for a very promising dividend growth outlook, even during these turbulent times. Apple earns both an “EXCELLENT” Dividend Growth and Dividend Safety rating. Furthermore, Apple’s monstrous net cash balance (taking both its short- and long-term marketable securities holdings into account), which stood at $98.8 billion at the end of its first quarter of fiscal 2020 (period ended December 28, 2019), provides for an enormous source of strength during these harrowing times.

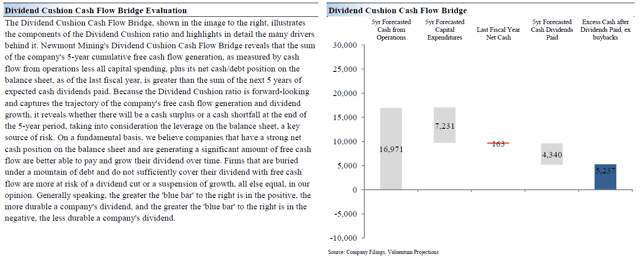

Image Shown: A visual representation of Apple’s stellar Dividend Cushion ratio.

Cisco

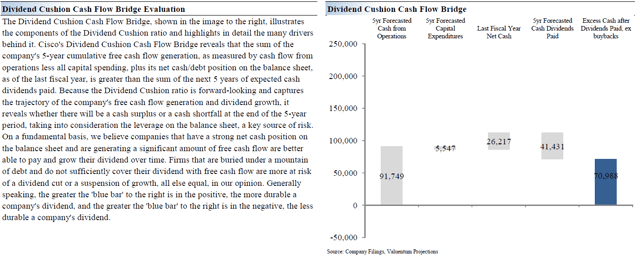

Cisco (CSCO) is included in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios, and we like the network equipment supplier’s payout coverage. Supported by a quality 2.7 Dividend Cushion ratio, we give Cisco an “EXCELLENT” Dividend Growth rating and a “GOOD” Dividend Safety rating and please keep in mind Cisco is just on the cusp of realizing an “EXCELLENT” Dividend Safety rating as well (Dividend Cushion ratios of 2.75+ earn such a rating). While trade tensions between the US and its major trading partners (such as China and the EU) have weighed on Cisco’s performance over the past couple of years, the firm’s enormous net cash pile provides ample support during these trying times. At the end of Cisco’s second quarter of fiscal 2020 (period ended January 25, 2020), the firm’s net cash position sat at $11.1 billion (which has come down in recent quarters due to material share buybacks). We had more to say on Cisco’s outlook and recent financial and operational performance in this article here.

Image Shown: A visual representation of Cisco’s solid Dividend Cushion ratio.

Digital Realty Trust

The data center real estate investment trust (‘REIT’) Digital Realty Trust (DLR) recently closed on its purchase of InterXion in a deal valued at $8.4 billion, giving Digital Realty Trust a significantly larger presence in Europe’s data center market with a quality footprint in several major metropolitan regions. We include Digital Realty Trust in both our Dividend Growth Newsletter and our High Yield Dividend Growth Newsletter portfolios (more on the HYDN here) and on an adjusted basis, we rate the REIT’s Dividend Safety as “GOOD” given its adjusted Dividend Cushion ratio of 2.9 (taking the firm’s ability to tap equity markets into account). That supports its “EXCELLENT” Dividend Growth rating as we view Digital Realty Trust’s payout growth trajectory quite favorably. We like Digital Realty Trust’s outlook, which we covered in greater detail here.

Image Shown: Digital Realty has outperformed the market significantly since the beginning of 2019 and has held up strong thus far in 2020. After adjusting for Digital Realty Trust’s ability to tap equity markets, its adjusted Dividend Cushion ratio is solid.

Intel

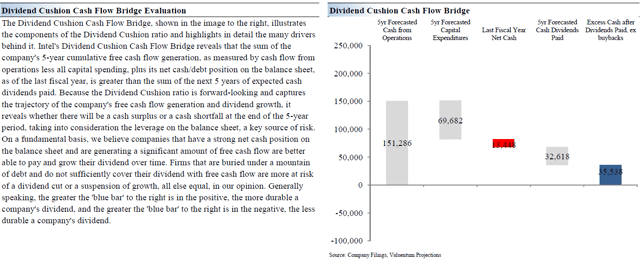

Intel (INTC) is included in both the Best Ideas Newsletter and the Dividend Growth Newsletter portfolios, and the firm earns an “EXCELLENT” Dividend Growth rating along with a “GOOD” Dividend Safety rating. At the end of Intel’s fiscal 2019 (period ended December 28, 2019), the firm was sitting on $20.4 billion in cash-like holdings (defined as cash and cash equivalents, short-term investments, short-term trading assets, equity investments, and other long-term investments) versus $3.7 billion in short-term debt and $25.3 billion in long-term debt, good for a modest and manageable net debt position. Intel’s free cash flow growth trajectory is underpinned by the rise of autonomous vehicles, the internet of things (‘IoT’), and other new technologies which will require new high-tech semiconductor components to function. To read more about our thoughts on Intel, click here.

Image Shown: A visual representation of Intel’s solid Dividend Cushion ratio.

Johnson & Johnson

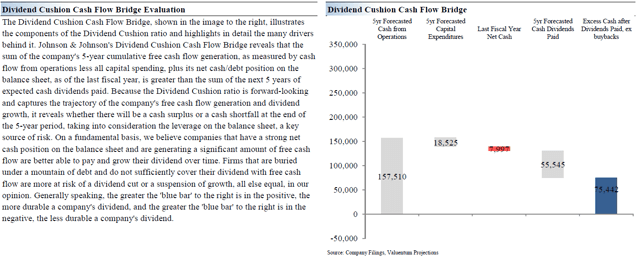

Healthcare and consumer staples giant Johnson & Johnson (JNJ) is another high quality dividend growth and capital appreciation opportunity that we like, and shares of JNJ are included in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. On March 13, Johnson & Johnson announced it was working with Beth Israel Deaconess Medical Center to create a vaccine for COVID-19. Currently, there are several promising opportunities for the group to choose from and by the end of March, the partnership aims to have selected the most promising vaccine prospects for Phase 1 clinical trials. Johnson & Johnson aims to use vaccine technology gained from its investigational Ebola, Zika, RSV, and HIV vaccines to get a jump-start on a possible COVID-19 vaccine. We give Johnson & Johnson a Dividend Cushion ratio of 2.4 which supports a “GOOD” Dividend Safety rating an “EXCELLENT” Dividend Growth rating. We covered Johnson & Johnson in greater detail here.

Image Shown: A visual representation of Johnson & Johnson’s solid Dividend Cushion ratio.

Eli Lilly

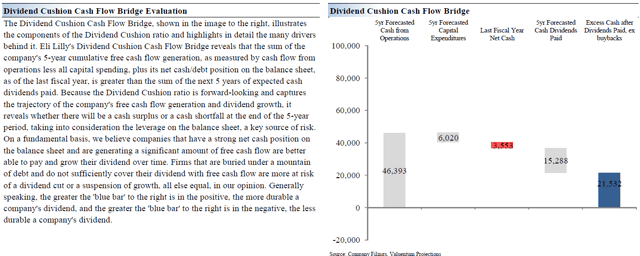

Pivoting to another company working on a COVID-19 vaccine, Eli Lilly (LLY) carries a Dividend Cushion ratio of 2.4 allowing for a “GOOD” Dividend Safety rating and an “EXCELLENT” Dividend Growth rating. On March 12, Eli Lilly announced it was teaming up with Canadian firm AbCellera to work on antibodies that could both treat and vaccinate humans from COVID-19. Initial results from AbCellera’s work has turned up solid results and the firm has begun searching for a sequence of antibodies that would be effective at treating COVID-19. Should this venture prove successful, the goal is to leverage Eli Lilly’s global footprint to quickly scale up production of such a medicine (be it a cure or vaccine).

Image Shown: A visual representation of Eli Lilly’s solid Dividend Cushion ratio.

Merck

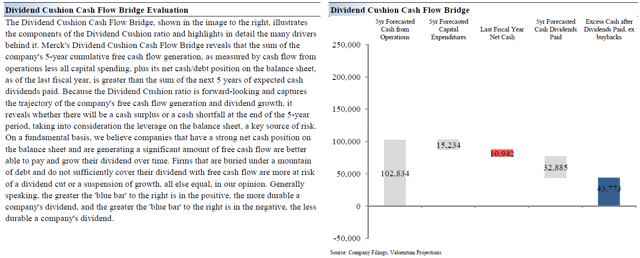

Not wanting to miss out on all of the action, Merck (MRK) aims to use the knowledge gained from developing its Ebola vaccine Ervebo (which was approved by the US FDA back in December 2019) to assist in any way it can in either developing or assisting in the commercial development of a COVID-19 vaccine. We give Merck a Dividend Cushion ratio of 2.3 which allows for a “GOOD” Dividend Safety rating and an “EXCELLENT” Dividend Growth rating. Merck’s Keytruda oncology treatment remains the source of a large chunk of its annual sales (generating $11.1 billion in revenues in 2019).

Image Shown: A visual representation of Merck’s solid Dividend Cushion ratio.

Microsoft

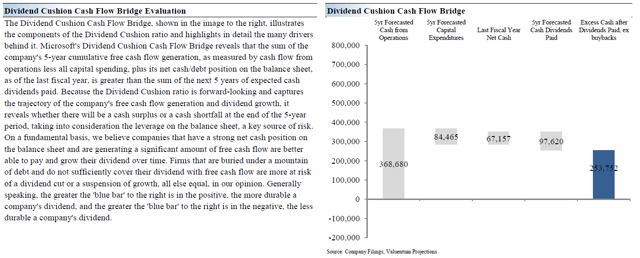

Back on February 24 (link here), we removed Microsoft (MSFT) from the Dividend Growth Newsletter portfolio when MSFT was trading north of $170 per share. Now that shares of Microsoft have come back down to ~$148 as of this writing, it’s worth revisiting the name. Its Azure cloud-computing offering continues to perform exceptionally well, driving both strong top- and bottom-line growth (and most importantly, strong cash flow growth). Having a massive net cash position further enhances its dividend growth trajectory and payout coverage. At the end of the second quarter of fiscal 2020 (period ended December 31, 2019), Microsoft was sitting on a net cash position of $67.4 billion (cash and cash equivalents plus short-term investments plus equity investments less short-term debt less long-term debt). We give Microsoft an impressive Dividend Cushion ratio of 3.6, good for an “EXCELLENT” Dividend Safety rating which supports its “EXCELLENT” Dividend Growth rating.

Image Shown: A visual representation of Microsoft’s stellar Dividend Cushion ratio.

Newmont

We added Newmont (NEM) to the Dividend Growth Newsletter portfolio back on January 13 (link here), and shares of NEM have held up relatively well in the face of ongoing market turbulence (shares of NEM are up ~3% since January 13 as of this writing, while the S&P 500 is down ~26%). Please note Newmont recently changed its name from Newmont Mining to Newmont Corporation. Newmont is getting ready to restart operations at its Musselwhite gold mine up in Canada, which we appreciate (full production was targeted by October 2020, but that may get delayed due to the ongoing COVID-19 pandemic), and the synergies realized from its acquisition of Goldcorp are coming in ahead of expectations which we covered in detail here. Newmont’s Dividend Cushion ratio sits at 2.2, allowing for a “GOOD” Dividend Safety rating and we rate its Dividend Growth rating as “GOOD” as well. There’s room for additional upside from Newmont’s Nevada joint-venture with Barrick Gold Corporation (GOLD), largely in the form of major operating cost reductions.

Image Shown: A visual representation of Newmont’s solid Dividend Cushion ratio.

Ralph Lauren

The last high quality dividend growth company we want to highlight in this article is Ralph Lauren (RL), which carries a Dividend Cushion ratio of 3.6 allowing for an “EXCELLENT” Dividend Safety rating and supporting an “EXCELLENT” Dividend Growth rating as well. Shares of RL have sold off aggressively of late due to fears relating to a massive slowdown in consumer spending levels; however, as of the end of Ralph Lauren’s third quarter of fiscal 2020 (period ended December 28, 2019), the consumer discretionary company was sitting on $1.9 billion in cash and cash equivalents and short-term investments combined. Stacked up against $0.3 billion in short-term debt and $0.4 billion in long-term debt, Ralph Lauren’s net cash position is a major source of strength during these trying times. When consumer spending on discretionary goods rebounds, investors will likely once again start appreciating Ralph Lauren’s quality free cash flow profile.

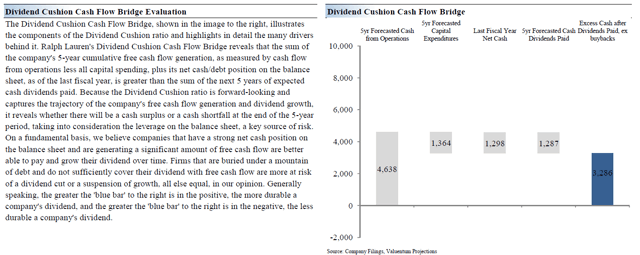

Image Shown: A visual representation of Ralph Lauren’s stellar Dividend Cushion ratio.

Concluding Thoughts

These ten companies are worth taking a closer look at when searching for high quality dividend growth plays in the current environment as these are the kind of firms that have the financial capacity to weather the storm and emerge on the other side, payouts still intact. For those looking for ideas with a more capital appreciation bent, please check out our recent Top Ten Ideas for Consideration Amid COVID-19 note here—->>>>

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX