Image Shown: A look at Newmont Corporation’s asset base, which is heavily centered on the Americas and Australia, with some exposure to West Africa as well. Image Source: Newmont – Fourth Quarter and Full-Year 2019 IR Earnings Presentation

By Callum Turcan

On February 20, gold miner Newmont Corporation (NEM) reported a fourth quarter and full-year earnings report for 2019 that pleasantly surprised, with shares of NEM up sharply after the report during the trading session that Thursday. Back on January 13 (link here), we added a modest weighting of NEM shares to our Dividend Growth Newsletter portfolio as part of our pivot to more defensive names given rising exogenous headwinds to the global economy. While Newmont’s top-line marginally missed consensus expectations, its bottom-line handedly beat consensus expectations which is partially why investors were excited about the report. The other big reason shares of NEM march higher is likely due to Newmont noting its outlook had improved materially since closing on its Goldcorp acquisition and selling off some of its assets, as part of the normal portfolio optimization process one would expect after a major acquisition.

Financials Update

Newmont’s GAAP revenues grew by 34% year-over-year to $9.7 billion in 2019 on the back of its Goldcorp purchase and due to its average realized gold price climbing higher by 11% year-over-year to $1,399 per ounce. In the fourth quarter of 2019, Newmont’s average realized gold price came in at $1,478 per ounce and COMEX gold prices have continued to surge higher year-to-date as of this writing, further supporting its near-term outlook. Newmont’s GAAP diluted EPS from continuing operations came in at $3.91 in 2019, up sharply from $0.53 in 2018 due in part to the firm realizing a massive gain when forming its Nevada Gold Mines joint-venture that Newmont owns 38.5% of the equity of (we’ll cover that in a moment). Stronger fundamental performance was also at play here.

Synergies Better Than Expected

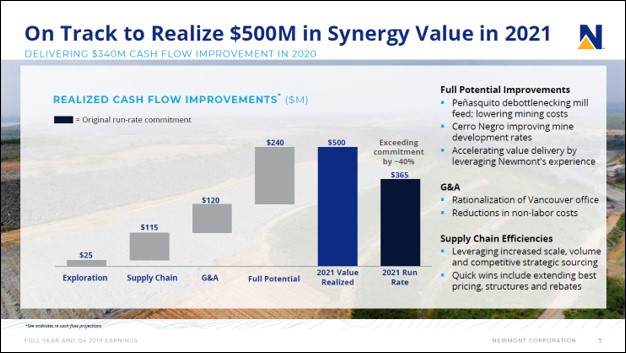

A major selling point of the Goldcorp merger was due to the synergies Newmont could wring out by combining the operations of two major gold miners. As of its latest earnings report, things are going much better than expected as you can see in the upcoming graphic down below. Please note that the graphic below only covers the Goldcorp-related synergies, and not the expected synergies from Newmont’s relatively new Nevada joint-venture (according to management commentary during the firm’s latest quarterly conference call).

Image Shown: Newmont’s plan to generate synergies from its Goldcorp purchase is bearing more fruit than expected. Image Source: Newmont – Fourth Quarter and Full-Year 2019 IR Earnings Presentation

Previously, Newmont was targeting $365 million in run-rate synergies by 2021 due to its Goldcorp purchase, but now the firm has raised that guidance to $500 million which we appreciate. As a price taker, there’s only so much Newmont can do when it comes to supporting its financials. Cutting down on its ongoing expenses goes a long way in shoring up its expected long-term free cash flow potential. In our view, that’s a key reason why shares of NEM popped higher after its latest earnings report.

Additional synergies are expected to come from Newmont establishing the aforementioned joint-venture with Barrick Gold Corporation (GOLD) in Nevada last year. For a while, Barrick aggressively pursued Newmont largely due to the expected synergies merging their Nevada gold mining operations together would yield, but those efforts were abandoned after the joint-venture idea was agreed upon. At the time, Newmont’s management team had repeatedly pushed back against the deal and Barrick had launched a hostile bid to take over the company.

Newmont’s management seemed to indicate during the firm’s latest quarterly conference call that more information would be coming in shortly concerning the potential synergies from the Nevada joint-venture. The company expects to realize $120 million in G&A synergies in 2020 (consolidating back-office work), according to its earnings press release, as those cost savings are easier to obtain (i.e. rationalizing its Vancouver offices) and can be pursued at a faster than cutting down on mining costs.

Cash Flow Update

Keeping in mind there’s some noise to Newmont’s financials considering it acquired Goldcorp last year, the firm generated $2.9 billion in net operating cash flow and spent $1.5 billion on its capital expenditures in 2019, allowing for $1.4 billion in free cash flow. Annual dividend obligations stood at $0.9 billion last year, which includes a special dividend of $0.88 per share paid out before the merger went through (regular common dividends came in at $0.56 per share for all of 2019). Newmont also spent $0.5 billion repurchasing its stock in 2019. Newmont’s Dividend Cushion ratio sits at a nice 2.2x and takes into account the planned dividend increase, which will bring its payout up to $1.00 per share on an annualized basis (starting in April 2020).

Balance Sheet Update

At the end of 2019, Newmont was sitting on $2.4 billion in cash and cash equivalents versus $0.1 billion in short-term ‘lease and other financing obligations’, $6.1 billion in long-term debt, and $0.6 billion in long-term ‘lease and other financing obligations’. Furthermore, Newmont’s ‘investments’ line-item includes strategic assets and marketable equity securities. At the end of 2019, Newmont was sitting on $0.4 billion in short-term and long-term marketable equity securities. That include its equity stake in Star Diamond Corporation (SHGDF), which arguably isn’t a core asset by any means. Star Diamond is focused on exploring for and developing economically recovered diamond resources in Canada’s Saskatchewan province, outside of Newmont’s operational focus.

Please keep in mind that Newmont closed one significant asset sale at the start of 2020 and is in the process of closing another deal, as covered in this excerpt from its 2019 Annual Report:

In the fourth quarter of 2019, we entered into a binding agreement to sell the Red Lake complex in Ontario, Canada to Evolution Mining Limited [CAHPF] (“Evolution”). Pursuant to the terms of the agreement, upon closing the transaction we will receive proceeds of $375 [million] in cash, adjusted for normal working capital movements, with contingent payments of up to an additional $100 [million] tied to new mineralization discoveries over a fifteen year period.

In the fourth quarter of 2019, we entered into a binding agreement to sell our 50% interest in Kalgoorlie Consolidated Gold Mines (“Kalgoorlie”), included as part of our Australia segment, to Northern Star Resources Limited [NESRF] (“Northern Star”). We completed the sale on January 2, 2020, and pursuant to the terms of the agreement, received proceeds of $800 [million], including $25 [million] that gives Northern Star specified exploration tenements, transitional services support and an option to negotiate exclusively for 120 days the purchase of our Kalgoorlie power business for fair market value.

The Red Lake divestiture is expected to be completed during the first quarter of 2020. These moves should materially enhance its balance sheet, as will the potential sale of its Kalgoorlie power business in Australia.

Capital Allocation Update

However, management intends on allocating at least some of those asset sale proceeds towards share buybacks. During Newmont’s latest quarterly conference call with investors, the gold miner’s Executive VP and CFO Nancy Buese had this to say in response to a question concerning share repurchases going forward (emphasis added):

“So, on the buybacks, I think I would consider that really tied to our asset sales. And so between that and an opportunity to buyback shares at a very, very attractive share price, we feel like that was the right thing to do. And so, we will continue that program through the end of 2020. And we will also consider – at these gold prices when we think about capital allocation, we’ll continue to manage the balance sheet and we’ll think about other shareholder friendly actions.

Certainly a key one of those will be to determine our appropriate level of dividend on a go forward and sustainable basis. So that’s something that we will continue to evaluate and truly to remember that that dividend at $1 is sustainable at $1,200 gold price, so at a more robust pricing going forward. That’s something we will be definitely continuing to revisit.”

We really appreciate Newmont’s commitment to its dividend program (keeping in mind the payout is set to increase from $0.14 per share per quarter up to $0.25 per share per quarter during its next dividend declaration period in April 2020). It seems Newmont is actively contemplating additional per share payout increases based on the above excerpt. As it relates to share repurchases, shares of NEM are trading above our fair value estimate of $46 per share as of this writing, however, given the strong technicals of NEM of late it’s possible Newmont’s intrinsic value is closer towards the top end of our fair value range estimate (which stands at $62 per share). That would make share buybacks a decent use of capital, in our view, though we would prefer Newmont consider debt reduction efforts as well.

A big part of Newmont’s strong financial performance in 2019 was due to the firm receiving a substantially higher price for its gold production and due to its output coming in quite strong. In Newmont’s fourth quarter and full-year 2019 earnings press release it notes:

Attributable gold production1 increased 23 percent to 6.29 million ounces for the full year and 27 percent to 1.83 million ounces for the quarter, compared to prior year, primarily due to new production from the Goldcorp assets and higher grade and throughput from the Subika Underground and Ahafo Mill Expansion projects, partially offset by lower production from KCGM…

1Attributable gold production for the full year 2019 includes 287,000 ounces and for the fourth quarter 2019 includes 118,000 ounces from the Company’s equity method investment in Pueblo Viejo (40%)

Additionally, management provided forward guidance for 2020 and their forecasts for Newmont over the next five years that investors likely found appealing, as did we. Newmont is expecting its gold production to grow marginally this year, and please keep in mind that gold prices have been very strong of late which further enhances its near-term cash flow outlook:

Attributable gold production is expected to be stable at 6.2 to 6.7 million ounces across the five year period. The 2020 outlook of 6.4 million ounces increases from 2019 with a full year of production from the acquired Goldcorp assets. Production is expected to remain between 6.2 and 6.7 million ounces per year longer-term through 2024 supported by a steady base from Boddington, Tanami, Ahafo, Peñasquito, and the Company’s equity ownership interest in the Nevada Gold Mines joint venture, which is further enhanced by solid production from the Company’s nine other operating mines and its equity ownership in Pueblo Viejo.

Newmont’s capital expenditures are expected to increase modestly from 2019 levels this year, hitting a forecasted $1.6 billion in 2020 ($0.6 billion for development and $1.0 billion for sustaining capital expenditures). That’s expected to drift down towards $0.9-$1.1 billion by 2024 ($0.0-$0.1 billion for development and $0.9-$1.1 billion for sustaining capital expenditures), unless Newmont gets closer to sanctioning another project which will be dependent in part of where the price of gold ends up in the future. Here’s where Newmont’s development spend is expected to go as things stand in February 2020:

Development capital includes Tanami Expansion 2 in Australia, Musselwhite Materials Handling in Canada, Subika Underground in Ghana, underground development at Cerro Negro in Argentina, expenditures related to the Company’s ownership interest in Nevada Gold Mines, and to progress studies for future projects. Yearly decreases reflect the Company’s approach to only including development projects that have reached execution stage.

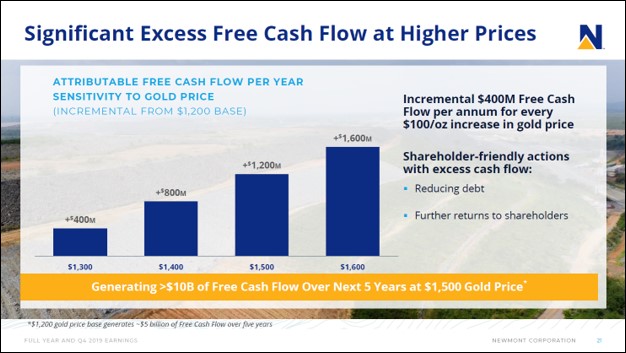

As Newmont’s all-in sustaining cost (‘AISC’) stood at $966 per ounce of gold produced in 2019, in-line with guidance, the firm’s very competitive on the cost of gold supply curve which we appreciate. That’s expected to help drive powerful free cash flows as you can see in the upcoming graphic below down.

Image Shown: Newmont’s focus on keeping capital expenditures contained and managing its investments with a realistic gold price in mind represents a big reason why the gold miner is very free cash flow positive. That’s expected to continue being the case going forward, which represents a key reason why we added shares of NEM to our Dividend Growth Newsletter portfolio. Image Source: Newmont – Fourth Quarter and Full-Year 2019 IR Earnings Presentation

Concluding Thoughts

We continue to like Newmont in our Dividend Growth Newsletter portfolio and see shares beginning to march towards the upper end of our fair value estimate range, which again sits at $62 per share. As of this writing, shares of NEM yield ~2.1% at the new and improved quarterly dividend payout rate and we are optimistic on the trajectory of that payout given management’s commentary on Newmont’s dividend growth during the firm’s latest quarterly conference call with investors. We caution that Newmont’s outlook, as always, is heavily influenced by the price of gold, even when considering its push into other metals like silver, copper, lead, zinc, and molybdenum. Members looking to read a bit more about Newmont should check out our coverage of its reserves and operational update ahead of its latest earnings report in this article here—->>>>

Diversified Mining Industry – BHP FCX NEM RIO SCCO VALE WPM

Related: GLD, SLV, GOLD, SHGDF, CAHPF, NESRF

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Newmont Corporation (NEM) is included in the simulated Dividend Growth Newsletter portfolio. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.