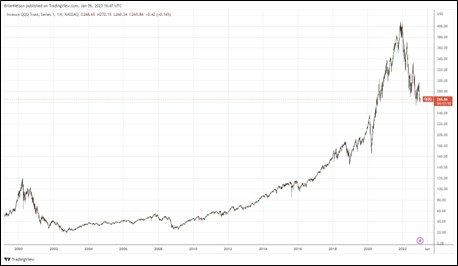

Image: The QQQ, which tracks the Nasdaq-100 Index, including Apple, Alphabet, and Microsoft has been a tremendous generator of wealth. Image Source: TradingView

By Brian Nelson, CFA

After the huge collapse in the markets in 2020, and the huge rebound in 2021, followed by a large retracement in 2022, we think things are going to be boring in 2023. They are likely going to be so boring that many investors will lose interest at the exact time that they should be most interested–when markets are well off their highs and uncertainty is near its peak.

Dollar Cost Averaging

Dollar cost averaging is among the most powerful drivers behind long-term returns. Measuring returns from prior peak to prior peak is often not a realistic way to view long-term investing. In March 2000, for example, the Invesco QQQ Trust (QQQ) peaked at $120 per share, right before the massive dot-com crash. It wouldn’t reach those peak levels again on a price-only basis until 16 years later, a very long time.

Over those 16 years, returns on the QQQ were practically nil. But that may not be the way to view long-term investing. Had an investor continued to periodically invest in the Invesco QQQ Trust from 2002 through, let’s say, the end of 2011, at prices between $20 and $60 per share, the capital invested during that 10-year period would have at least doubled in value by 2016 ($20-$60 à $120), perhaps tripled, maybe more.

Capital that was deployed at the prior peak in March 2000 was now back to its prior value by 2016, but all the money invested in the 10 years from 2002-2011 grew tremendously. This is why playing the long game in investing and dollar cost averaging is so powerful. For those 10 years (2002-2011), it may have felt tortuous, especially when markets collapsed in early 2009, as a result of the Great Financial Crisis.

But for those that continued to add to their equity holdings, they may have not known it at the time, but they were setting themselves up for long-term success. Not only did their average cost come down, but the money they were about to make on capital invested during 2002-2011 would be huge. Even after the decline during 2022 (last year), the QQQ is trading at ~$266 per share — more than a six-fold increase from its average price during 2002-2011. Patience and dollar cost averaging simply pays off over time.

Stay Broadly Diversified

Some individual companies vanished after the dot-com collapse, but for broadly diversified portfolios, including a large index like of the Nasdaq, itself, buying after the crash would turn out to be one of the best long-term investment opportunities. This is an important distinction. One may encounter a lot of trouble dollar cost averaging into individual entities such as Carvana (CVNA) or AMC Entertainment (AMC)–both of which may be headed for bankruptcy–but for widely-diversified portfolios overflowing with entities that have cash-based sources of intrinsic value, dollar cost averaging is a huge wealth generator over time.

We’re at a similar point in early 2023, as perhaps we were in 2001 or 2002, where investors may be hoping for a rapid return to new highs, as with what happened during the COVID-19 crash, for example. However, the direction for broader stock markets may look more like the QQQ following the dot-com crash, meaning equities may go sideways for at least the next few years. This likely malaise is going to be boring and test investor patience, but it also means the next few years will be a stock picker’s market, which we like.

For those that understand dollar cost averaging and the benefits of compounding, the next few years may be among the most important years for building and preserving long-term wealth. Even if markets retrace to the pre-COVID-19 highs, which we expect they will, it may just be setting up long-term investors for more attractive entry points with respect to dollar cost averaging to further compound returns. The next few years may be boring and somewhat stressful with lots of ups and downs, but we continue to like stocks for the long run!

Missed the latest edition of the Dividend Growth Newsletter? See here >>

Best Ideas Newsletter portfolio >>

Dividend Growth Newsletter portfolio >>

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Be Careful With Celebrity Endorsement of Investment Products >>

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.