Image: Tesla is generating billions and billions of dollars in free cash flow.

By Brian Nelson, CFA

The cash-based sources of intrinsic value (and the trajectory of growth in them) are the most important considerations when it comes to assessing the attractiveness of an equity. Two of the most important cash-based sources of intrinsic value are net cash on the balance sheet and future expected free cash flows, and in these two areas, Tesla (TSLA) excels. Though we won’t be adding Tesla to any of the newsletter portfolios anytime soon, we like it within a diversified basket of large-cap growth equities, of which the Best Ideas Newsletter in some ways approximates.

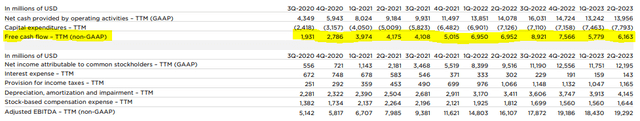

When Tesla reported its second-quarter 2023 results July 19, the firm showed that it ended June 30, 2023, with $23.1 billion in cash and $2.3 billion in debt–good for a material net cash position. For the trailing twelve months (TTM) ended June 30, 2023, as well, Tesla hauled in ~$6.2 billion in free cash flow. Both of these measures are solid, and while free cash flow generation has slowed a bit in recent quarters, for the second quarter of 2023, it was still up more than 60%.

Image: Tesla’s Cybertruck showcasing its versatility. The truck is on track to begin production at Gigafactory in Texas in the coming months. Image Source: Tesla’s second-quarter press release.

The big challenge in valuing Tesla’s shares is assessing the company’s long-term outlook. One way of thinking about Tesla’s valuation is backing into its current market capitalization (~$824 billion) with what it would take in terms of normalized free cash flow. For a company with substantial growth prospects, strong existing net cash on the books, and considerable future free-cash-flow generating capacity, perhaps a discount rate between 7%-9% may be reasonable.

Using a growing perpetuity with a 3% growth rate assumption, Tesla would eventually need to haul in ~$33-$49 billion in annual free cash flow in the decades ahead to justify its current price. For the twelve months ended in the third quarter of 2022, its peak TTM free cash flow generation, Tesla hauled in $8.9 billion in free cash flow. The question then becomes whether over the course of Tesla’s lifetime, will the firm be able to 4x-6x its free cash flow? It’s impossible to know for sure, but it seems possible to us, especially as Tesla expands its product line-up (i.e. Cybertruck, etc.). It’s sometimes easy to forget, too, that Tesla was still burning through operating cash flow as recently as 2017, and now it has become a cash-generating machine.

Without question, Tesla is a speculative play on U.S. equities, and we’re huge fans of its cash-based sources of intrinsic value–net cash on the balance sheet and future expected free cash flow generation. The company is a key component within the stylistic area of large cap growth, and while we won’t be adding it to any newsletter portfolio anytime soon, the stock could make sense in the context of a widely diversified portfolio of large cap growth equities, of which the Best Ideas Newsletter portfolio in some ways approximates. Tesla’s valuation is not absurd, but we expect continued rampant volatility in its shares.

———-

NOW READ: Tesla Registers Record Total Deliveries in Second Quarter 2023

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.