Image Source: Tallgrass Energy LP – IR Presentation

By Callum Turcan

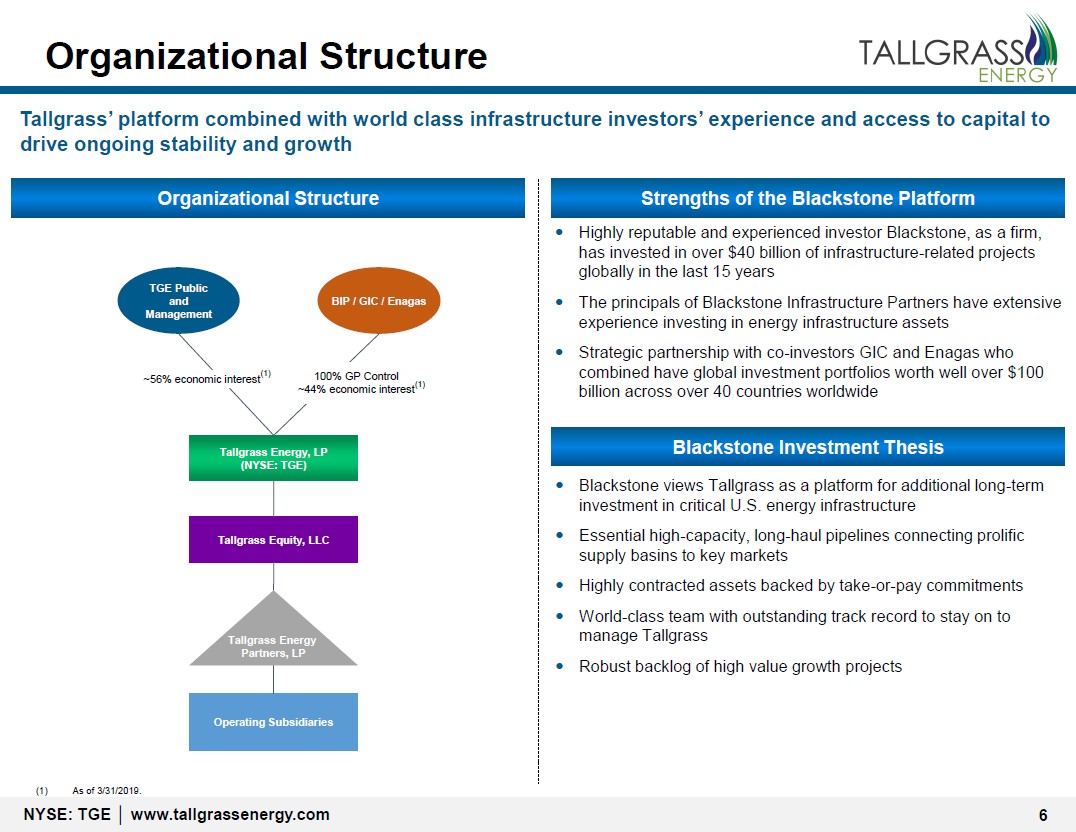

Valuentum’s High Yield Dividend Newsletter portfolio parted ways with Tallgrass Energy LP (TGE) on August 1, as we wanted to reduce our exposure to the midstream space. We don’t like TGE as much as we once did and think it’s best to move on to better opportunities. Please note Blackstone Group Inc (BX), through affiliates of Blackstone Infrastructure Partners, closed its purchase of Tallgrass’ general partner in March 2019 which included those parties acquiring a 44% economic interest in Tallgrass.

In 2018, Tallgrass reorganized as a C-Corp which we were very supportive of. Additionally, the midstream company has been very free cash flow positive historically (when defined as net operating cash flow less capital expenditures), but note that Tallgrass’ free cash flows have also been getting smaller in recent years as its capital expenditures grew sharply in 2018 versus 2016 – 2017 levels. Last year, total distribution/dividend payments weren’t fully covered by free cash flow. When including its acquisitive streak, Tallgrass has been becoming increasingly reliant on capital markets for funds. Historically, Tallgrass hasn’t been quite as capital market dependent as its peers, but that’s beginning to change.

Shares of TGE yield a whooping 12.7% as of this writing, and we think that’s a sign investors are worried about Tallgrass’ prospects, particularly as it relates to growing future free cash flows.

Image Shown: An overview of Tallgrass’ ownership structure. Image Source: Tallgrass – IR Presentation

Growth Runway Overstated

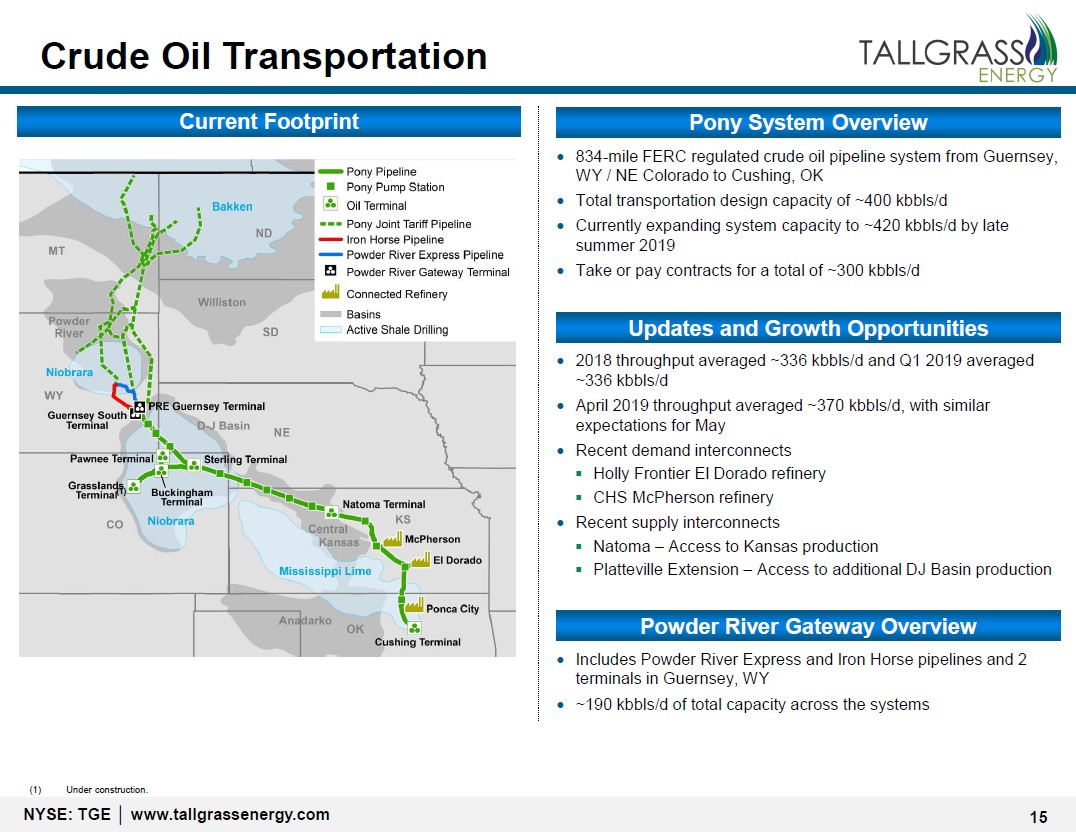

Over the past year, Tallgrass has put out numerous press releases touting how its Pony Express Pipeline venture (transports oil from Guernsey, Wyoming, to Oklahoma’s Cushing oil hub) is gauging interest in expanding the capacity of the system via open seasons. That includes expanding the Pony Express Pipeline’s ability to ship oil volumes produced from North Dakota’s Bakken/Three-Forks unconventional upstream plays and crude produced in Western Canada, which would be made possible through third-party interconnections. However, its ability to expand the Pony Express Pipeline may be overstated.

Tallgrass first announced plans to expand the Pony Express Pipeline’s capacity from 400,000 barrels per day (expected system-wide capacity by the end of 2018) to ~700,000 bpd back in November 2018. As things stand today, the 834-mile long crude oil pipeline has ~400,000 bpd of system-wide transportation capacity and that’s expected to grow to ~420,000 bpd by the end of summer. Throughput volumes averaged 336,000 bpd in 2018, which rose to 370,000 in April 2019. On July 25, Tallgrass published second quarter 2019 earnings and its press release made no mention of that massive ~300,000 bpd expansion.

During Tallgrass’ second quarter conference call, management noted that nominations for August 2019 stood around 370,000 bpd. Furthermore, Tallgrass doesn’t think the macro picture supports adding a material amount of additional takeaway capacity from the Bakken region in light of already proposed expansion plans from third-parties and after Energy Transfer LP’s (ET) Dakota Access Pipeline came online in 2017 (which is also in the process of expanding).

Only 300,000 bpd of the Pony Express Pipeline’s capacity is secured through take-or-pay contracts according to Tallgrass. When looking at just the 375,000 bpd transportation capacity from Guernsey, WY, to Cushing, OK (system-wide capacity is higher), a pipeline in high demand would see a greater portion of that takeaway capacity secured through these types of contracts (closer to 90% instead of 80% currently, as ~10% of the capacity of an American oil pipeline is usually left open for temporary shippers).

Short of raw energy resource prices moving significantly higher, particularly oil prices, we think North Dakota’s oil production (which represents the vast majority of output from the unconventional upstream Bakken and Three-Forks plays) has likely peaked at ~1.4 million bpd (output has plateaued over the past eight months). Other than incremental takeaway capacity expansions, we don’t see a need for a meaningful amount of additional takeaway capacity out of North Dakota. While Western Canada is starved for oil pipeline takeaway capacity, Tallgrass isn’t in a position to readily meet that need due to regulatory, political, and other hurdles preventing additional oil takeaway capacity (and ultimately oil supplies) from reaching the US from Canada along third-party systems.

Tallgrass also mentioned Colorado was a “hard environment” to operate in as well (reinforced by recent data from the US EIA). We would like to note here that short- and medium-term oil production growth in Wyoming and Colorado will come under intense pressure from the recent decline in raw energy resource prices. Wyoming produced ~240,000 bpd of crude in 2018, while Colorado produced ~180,000 bpd. In summary, none of the regions serviced by the Pony Express Pipeline are likely to experience the kind of crude production growth required to justify management’s lofty growth strategy as it pertains to the Pony Express Pipeline. The possibility that North Dakotan oil production declines in the near future poses a major risk for Tallgrass Energy, particularly if that negatively impacts transported volumes along the Pony Express Pipeline with an eye on the 20% of system-wide capacity currently not secured via take-or-pay contracts.

No Sign Partnership Created Big Growth Runway Boost

Back in January 2019, Tallgrass announced it had entered into an exclusive partnership with Kinder Morgan Inc (KMI) “to jointly develop a solution to increase existing crude oil takeaway capacity in the growing Powder River and Denver-Julesburg basins and to add incremental capacity to the Williston Basin and portions of Western Canada.” The press release further stated that:

“Pursuant to the agreement, the proposed venture would include both existing and newly constructed assets. TGE would contribute its Pony Express Pipeline System, and KMI would contribute portions of its Wyoming Intrastate Company and Cheyenne Plains Gas Pipeline and begin the process of abandonment and conversion to crude oil service. In addition, approximately 200 miles of new pipeline would be constructed to provide crude oil deliveries into Cushing, Okla.

In total, the combined pipeline system is expected to be capable of delivering up to 800,000 barrels per day (bpd) of light crude oil and 150,000 bpd of heavy crude oil from points in Wyoming and Colorado to TGE’s and KMI’s Deeprock terminal in Cushing. From there, customers will have pipeline connectivity to the Gulf Coast and export markets through TGE’s planned Seahorse Pipeline and other existing or proposed future pipeline projects. The combined project is expected to provide initial service as early as the second half of 2020.”

On June 28, Tallgrass and Kinder Morgan announced the partnership was seeking to gauge interest in expanding takeaway capacity out of the Bakken region by presumably increasing capacity along Kinder Morgan’s Hiland Crude system (which can ship oil from the Bakken region down to Guernsey, Wyoming). Expansion plans are currently being “evaluate[d]” based on potential shipper interest, according to Kinder Morgan’s website. After checking out Kinder Morgan’s July 2019 IR Presentation, it’s clear that any future development related to Tallgrass’ Pony Express Pipeline will likely be small in nature. There was no mention of the type of large developments that would be required to make the partnership’s growth strategy, as envisioned back in January, viable.

Image Shown: Tallgrass only mentions incremental capacity expansions along the Pony Express Pipeline in its May 2019 IR presentation. Image Source: Tallgrass – IR Presentation

Another Project That May Never Come to Be

Furthermore, Tallgrass’ ambitious Seahorse Pipeline Project, which seeks to route hundreds of thousands of barrels of crude oil per day down from the Cushing oil hub in Oklahoma to the US Gulf Coast, may never come to be. Tallgrass is currently gauging potential shipper interest via an open season.

Please keep in mind that Enbridge Inc (ENB) and Enterprise Products Partners LP’s (EPD) Seaway Pipeline, which already runs from Cushing to the US Gulf Coast, has been aggressively expanded over the past seven years since switching directions in 2012. Additional expansion projects along the Seaway Pipeline are in the works, which are likely to get completed as the system is one of the best ways for domestic oil supplies to reach overseas markets where raw energy resource prices are more dear. As things stand today, the Seaway Pipeline can ship 850,000 bpd of crude oil with room to grow.

Image Shown: Tallgrass’ Seahorse Pipeline Project may never come to fruition as third parties have also proposed their own incremental takeaway projects from Oklahoma’s Cushing oil hub down to the US Gulf Coast. Image Source: Tallgrass – IR Presentation

Here’s the latest on the state of the aforementioned proposed projects from Tallgrass’ second quarter 2019 conference call:

“Finally, for a quick update on the Pony Express expansion, Seahorse and PLT projects, as many of you saw on our website, we have extended the Pony Express expansion open season, the standalone open season for Seahorse, and the joint Seahorse-Pony Express open season to July 31, all in order to accommodate the meaningful progress we are making with shippers FID [Final Investment Decision] our commercial teams are relentlessly working to produce that outcome for both projects.”

We question whether either major development will ever get sanctioned, and there has been no update on that issue since the July 31 deadline past, at least not one that was made readily available. Small projects, like the Hereford Lateral in Colorado, are the only likely sources of upside when it comes to growing the Pony Express Pipeline. If Kinder Morgan does expand the Hiland Crude system, that only provides Tallgrass a marginal amount of upside as North Dakotan oil production will likely move lower if raw energy resource prices don’t improve.

This is important because these projects represented some of the best ways for Tallgrass to grow its fee-based revenue streams, as oil pipelines act as toll roads collecting fees based on volume. Keep in mind those volumes are directly exposed to changes in raw energy resource prices and the dynamic that has on upstream capital investments. Tallgrass has other developments, like the Plaquemines Liquids Terminal Project along the US Gulf Coast, to grow but we think its long-term growth trajectory isn’t as strong at it once was.

Concluding Thoughts

We parted with Tallgrass as we see greater opportunities in other midstream firms and different parts of the high-yield universe, such as Enterprise Products Partners, which have stronger growth runways and assets that better cater to the ever-evolving needs of North America’s oil & gas industry. Recent weakness in TGE indicates the market is losing faith in Tallgrass’ growth trajectory and its future free cash flows.

Tickerized for holdings in the Alerian MLP ETF (AMLP). Related AMZA.

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Enterprise Products Partners LP (EPD) and Magellan Midstream Partners (MMP) are included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.