Image Source: Anna & Michal

We made a few tactical tweaks to the Best Ideas Newsletter portfolio during 2017. Let’s walk through them, and how we’re out to win the war, not win every battle.

By Brian Nelson, CFA

I’m not going to reference The Art of War written by Chinese military strategist Sun Tzu some time in the 5th century, nor am I going to use any quotes from the military treatise (I think it’s too well-traveled of a topic), but I do believe the approach to portfolio management is much like that of a general on a path to win the war. Now, don’t get me confused: I’m not saying that portfolio management is actually like being in war. Not. A. Chance. I’m saying that the planning, the thinking, the goal in forming an overall strategy and executing tactical tweaks to win is similar. Obviously, nothing comes close to the brave men and women on the field of battle and what they sacrifice, but I like the comparison, so I am going with it.

Though not always completely accurate, one way of thinking about the difference between strategy and tactics is that, in most cases, strategy can be considered long term, while tactics can be considered short term. Strategy = long-term goals. Tactics = short-term tweaks. If you recall in one of the greatest movies perhaps of all time, Saving Private Ryan, Captain John Miller, played by Tom Hanks, hits one of the most powerful tones in the movie when he says: “Our objective is to win the war.” On a search and rescue mission for Corporal Francis Ryan, Miller and his squad encountered an enemy machine gun emplacement. Instead of going around it, Miller understands what must be done. The overall, long term strategic goals of the United States of America are to win the war, and the emplacement must be neutralized. Miller understood.

The difference between strategy and tactics can also be readily explained through other examples in history. One of the most notorious instances of overemphasizing short-term tactics versus long-term objectives occurred after the Battle of Gettysburg in 1863. Union Army General George Meade, who field-marshalled the victory for the Blue during that three-day battle in July, telegraphed Lincoln shortly after: driven ”from our soil every vestige of the presence of the invader.” Lincoln was furious by the message: “Drive the invaders from our soil! My God! Is that all? … You will follow up and attack General [Robert E.] Lee as soon as possible before he can cross the river. If you fail, this dispatch will clear you from all responsibility and if you succeed you may destroy it.” Meade had only been focused on the tactical victory at Gettysburg, not the strategic goals of the United States of America to eradicate the Confederacy. Meade lost his job.

Focusing on tactical victories has always been a very short-sighted view when it comes to striving to achieve overall long-term strategic objectives, not only in war but also in portfolio management. Frank Reilly and Keith Brown wrote in their book, Investment Analysis and Portfolio Management, that “…about 90% of the maximum benefit of diversification was derived from portfolios of 12 to 18 stocks.” In the context of portfolio management, and generally speaking, in our view, a portfolio of ~20 companies may be sufficient to achieve meaningful diversification, provided that such stocks are also diversified across sectors. This is partly why the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio generally emphasize ~20 ideas, and why we don’t cram or force more ideas within the newsletter portfolios. We’re not getting much more diversification benefit beyond those 20 or so widely-diversified stocks, so we don’t need more. If we add more, we’d just be adding the next best idea, when we could be adding to a better idea already in the portfolio.

We may make tactical tweaks, but the overall strategy is set with the ideas already in the newsletter portfolios. The strategy matters. The tactical tweaks are important, but of lesser importance. But keep all of this in perspective, too. An equity portfolio, of course, is only one part of a well-diversified financial plan, which may also include cash for emergency needs, an owned property (a house or rental for income), and bonds, among other assets. The newsletter portfolios such as the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, and the ideas within them may be but a small part of the big financial picture, and the tactical tweaks within the newsletter portfolios may only be a much smaller part of that same picture. In some ways, the tactical tweaks made in the newsletter portfolios shouldn’t bear much weight on one’s overall financial picture at all. If they do, a person may not be thinking about their overall strategy; instead a person may be focusing more on short-term tactical endeavors, which are only a small part of winning the war.

The Best Ideas Newsletter Portfolio

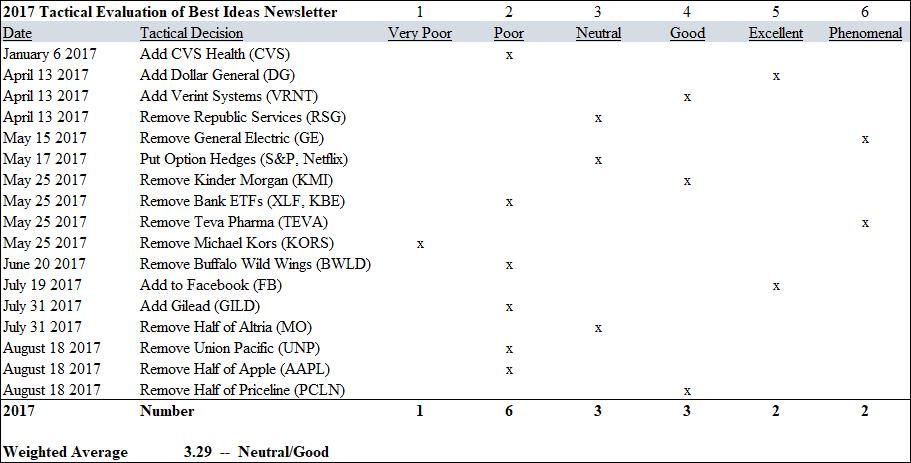

Source: Best Ideas Newsletter portfolio transaction log

We covered how well the ideas that were in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio performed during 2017 in a big-picture, strategic sense (see here and here, respectively), but how have some of the tactical tweaks as it relates to the newsletter notifications in 2017 on the margin performed? We’re splitting hairs because we are taking these ideas out of the portfolio context (a big no-no), but let’s see how some of the tactical moves of 2017 panned out. Let’s cover the first idea of 2017, CVS Health (CVS). The company was added to the Best Ideas Newsletter portfolio in January 2017, and shares are off more than 10% at the time of this writing, to ~$70. Frankly, we were blindsided by Amazon (AMZN)’s purchase of Whole Foods (WFM) this year, and we’re not happy with the implications–but that’s why diversification is so important.

In the Best Ideas Newsletter portfolio, we added a 1.5% position in Dollar General (DG) and a 1.5% position in Verint Systems (VRNT) on April 13, 2017. Dollar General was added at $68.83, while Verint Systems was added at $38.95. Shares of Dollar General have surged nearly 30%, to ~$87, while Verint Systems has advanced to ~$43, a 10%+ move, both prices at the time of this writing. Interestingly, adding Dollar General and Verint, while at the same time removing Republic Services (RSG), the price of which has effectively remained unchanged, was a very good move. An even better move, in May, we cut General Electric from the newsletter portfolios, and while this doesn’t show up in the performance column, it was a huge win, as it saved the portfolios from the considerable loss that followed.

While CVS was a tactical misstep, the decisions with respect to Dollar General, Verint, Republic Services and General Electric were tactical wins. Unfortunately, however, the put option ideas that then followed in Netflix (NFLX) and the S&P 500 Sector ETF (SPY) set us back, but sometimes losing a battle can be okay, especially when it means protecting the entire army. For example, unlike with respect to CVS Health, Dollar General, Verint Systems, Republic Services, and General Electric, it’s okay that the put option ideas didn’t work out. The newsletter portfolios still advanced, despite this protection not paying off; it may be speaking the obvious, but we want the newsletter portfolios to do well, and it’s difficult to ding us for being prudent and conservative.

In late May, we did some spring cleaning, removing Kinder Morgan (KMI), the Financial Select Sector SPDR (XLF), the SPDR S&P Bank ETF (KBE), Teva Pharma (TEVA) and Michael Kors (KORS). Kinder Morgan has continued its aggressive fall after we removed it, another tactical win, while removing the two bank ETFs may have been tactical shortcomings, but both positions had been big winners since being originally added to the Best Ideas Newsletter portfolio. Incredibly, we removed Teva at $28.67 and shares are now exchanging hands at $14.26 at the time of this writing, a huge tactical win. On the other hand, top-VBI-rated Michael Kors’ shares have advanced considerably, a tactical blunder, especially since the company was so highly-rated on the Valuentum Buying Index. Our methodology is working (see here), and we need to stick with it! The same can probably be said for Buffalo Wild Wings (BWLD), the equity price of which having advanced after being removed from the newsletter portfolio in June 2017.

July 2017 was a great month in that we tactically decided to add another three percentage points of exposure in the Best Ideas Newsletter portfolio to the position in Facebook (FB) in the mid-$160s; shares are now trading over $180 at the time of this writing. We also added Gilead (GILD) in late July at $76.32, and shares are off just a bit trading at ~$72 each at the time of this writing. The decision to remove half of the position in Altria (MO) proved to effectively be a wash, given that the company’s equity is essentially at the same level since the end of July. The August ideas to remove Union Pacific (UNP), half of Apple (AAPL) and half of Priceline (PCLN) were mixed, with the first two coming up tactically short, but the last one a tactical win.

Those are they. When you see all the tactical changes in the Best Ideas Newsletter in aggregate for 2017, it’s clear that we’ve been very busy this year, arguably too busy. Many of the tactical moves could be considered poor in light of the performance subsequent to the decision, but several were excellent/phenomenal. For the most part, however, we think a neutral/good ranking may capture the essence of the tactical moves in the Best Ideas Newsletter portfolio this year. Though we’ll stop measuring the performance of the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio effective at the end of 2017 in lieu of a list-and-weighting format, we’re certainly not disappointed by any stretch of the imagination. We hope you’re not either.

Remember: When it comes to investing, as in war, the long-term strategic objective will always trump any short-term win, so please don’t lose sight of the portfolio context, especially when it comes to the concept of diversification. A position that is approaching 8%-10% of the total portfolio is a highly concentrated one, in my view, and very few of our ideas have ever reached those levels in the most recent past. In previous work, we showed how the weightings of ideas within the portfolio are of critical importance to executing on a long-term strategy (and can be more important than the ideas themselves), and in this piece, how the moves we make during each year are short-term tactical tweaks that we hope will augment the overall long-term strategy of each respective newsletter portfolio given current market conditions. Though we evaluated them as such, short-term tweaks should not be viewed in isolation, just like a battle can never ever be more important than the war itself.