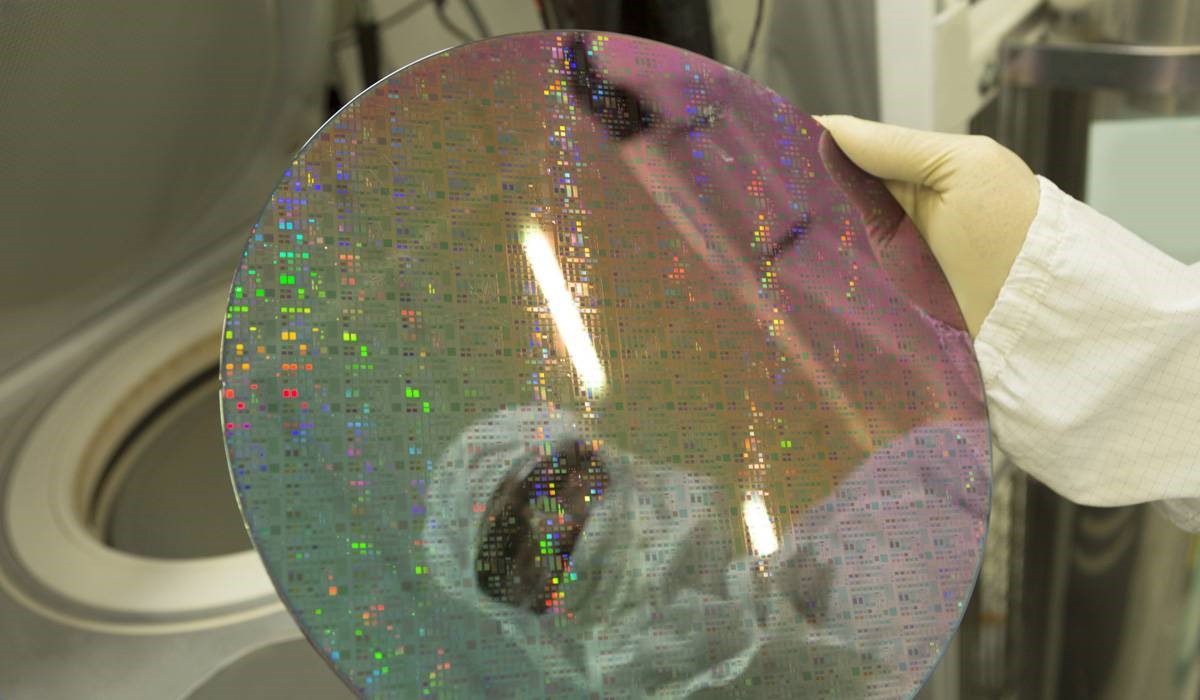

Image Source: Applied Materials

Applied Materials’ strong free cash flow generation drives our favorable opinion of its dividend health, but investors should not ignore the inherent volatility and rapidly-changing dynamics of the semiconductor space, which introduces additional risk to our forecasts of future free cash flows. Near-term headwinds are prevalent for the company, but we think it is well-positioned to capitalize on future growth opportunities, thanks in part to a dedication to robust R&D spending.

By Callum Turcan

Applied Materials Inc (AMAT) is a player in the semiconductor space with a dividend yield of 2.1% as of this writing. The company sells equipment used to fabricate semiconductors, including spare parts and other equipment that are either ancillary or auxiliary to those operations, services that support its global footprint, and display products used in smart phones, TVs, laptops, and similar electronics. At the end of Applied Materials’ 2018 fiscal year, which ended in late-October 2018, the company was sitting on a backlog of $6.1 billion (up marginally from the year before), ~85% of which is expected to be filled in fiscal 2019.

Since initiating a dividend in 2005, Applied Materials has grown its quarterly payout to $0.21 per share from just $0.03 per share, but it should be noted that the growth has occurred somewhat inconsistently (no quarterly dividend growth from mid-2013 through 2017), which may point to management having a good handle on an appropriate capital allocation policy. Its latest payout increase was declared in March 2019 and marked a 5% increase in its quarterly dividend. This dividend growth story is the product of rising free cash flow generation supported by a burgeoning semiconductor market. As the smart phone boom took off, Applied Materials was well positioned to capitalize.

Dividend Well Protected

We give the company high marks when it comes to covering its dividend obligations as the firm sports a Dividend Cushion Ratio of 4.4. The firm spends relatively little on capital expenditures (fiscal 2018 capital spending was ~3.6% of net sales), enabling the company to maximize its free cash flow generation potential.

In fiscal 2016, Applied Materials posted $2.6 billion in net operating cash flow versus less than $0.3 billion in capital expenditures, good for $2.3 billion in free cash flow. A year later, Applied Materials’ net operating cash flow jumped by 48% to almost $3.8 billion, and its capital expenditures climbed 36% to over $0.3 billion. Applied Materials posted $3.4 billion in free cash flow in fiscal 2017, up 49% year-over-year.

However, Applied Materials’ net operating cash flow was flat in fiscal 2018 at $3.8 billion, while its capital expenditures shot up by 80% from the prior year to $0.6 billion, which drove its free cash flow down 8% to less than $3.2 billion last fiscal year. Management expects fiscal 2019 will be a tough ride, but the company is likely to remain materially free cash flow positive as it waits out industry headwinds and gets ready to capitalize on the next big things in tech.

Last fiscal year, Applied Materials spent $0.6 billion on dividend payments and $5.3 billion on share repurchases. Free cash flow easily covered its dividend payouts, and share buybacks were funded by a combination of free cash flow and cash on hand. Over the past three fiscal years, Applied Materials has spent $1.5 billion on dividend payments and a whooping $8.3 billion buying back its stock.

At any time, the company could choose to allocate more towards dividend payments and less towards buybacks, enabling material dividend growth. In the past, the company has shown a great interest in increasing its quarterly payout, and we expect a similar trajectory to carry on into the future. Management commented that Applied Materials retained $3.6 billion in buyback authority during the firm’s latest quarterly conference call. However, given the near-term headwinds and inherent volatility of the markets it serves, management may not be in a rush to significantly increase its annual dividend obligations at the expense of more flexible share repurchases in the immediate future.

At the end of Applied Materials’ first quarter of fiscal 2019, the company was sitting on $3.7 billion in cash, cash equivalents, and short-term investments. With this stacked up against $5.3 billion in long-term debt, Applied Materials’ net debt position of $1.6 billion looks to be quite manageable. The company exited the quarter with a current ratio of 2.7x, giving it ample liquidity. Note that Applied Materials had an income tax payable balance of $1.3 billion at the end of its first quarter of this fiscal year, up materially from the $0.4 billion income tax payable on its balance sheet at the end of fiscal 2017.

Tough 2019 But Brighter Times May be Ahead

Going forward, management is targeting growth from the rollout of the IoT (Internet of Things, or nearly every conceivable product being connected to the Internet), autonomous and semi-autonomous driving, the rollout of 5G telecommunications networks and capable smartphones, and data centers for cloud computing. That upside will be realized over the coming years as those are all long-term opportunities. In the short-term, there will be some pain as management acknowledges 2019 is going to be a rough one for the industry, including Applied Materials. Lower wafer fab equipment investment in China, where Applied generated ~30% of fiscal 2018 net sales, in 2019 relative to 2018 levels and pressure on Applied’s Display business in China will be factors.

Weaker emerging market macroeconomic conditions, high-end smartphone sales not living up to expectations (keep in mind those smartphones used more semiconductor components than cheaper smartphones), and surplus inventory levels are expected to hold the company back this year as its fabrication equipment business will likely post subdued performance. The company is predicting a sharp drop in revenue relating to its display division this fiscal year as well. Applied Materials doesn’t expect things to turn around, at least on a macro level, until fiscal 2020 at the earliest. On the plus side, management expects Applied Materials’ services business to grow by high single digits this fiscal year, aided by a growing installed user base.

During the firm’s first quarter FY2019 conference call with investors, CEO Gary Dickerson commented (emphasis added):

“While we’re paying close attention to current headwinds and driving efficiencies across the Company, we remain focused on our long-term opportunities. I strongly believe that in the future, technology will play a larger part in many areas of our lives. Entire industries will be transformed by artificial intelligence, big data and Industry 4.0. And at the foundation of those transformations are semiconductors.

We’re moving beyond a world of general purpose computing to specialized solutions that address new types of applications and workloads in the cloud and at the edge… to unlock the full potential of AI and big data, we need a new playbook for semiconductor design and manufacturing, which will include new architectures, new 3D techniques, novel materials, new ways to shrink transistors and advanced packaging techniques…

To enable this playbook and accelerate innovation for our customers, we are making investments in new capabilities, creating entirely new types of products and extending our engagements across the ecosystem.“

That strategy involves teaming up with other big tech players to build the ecosystem required to support the next wave of technological advancement. Recently, Applied Materials teamed up with IBM (IBM) to collaborate on chips that can handle functions relating to artificial intelligence. Applied Materials is now a member of the new IBM Research AI Hardware Center, an R&D hub meant to leverage industry agglomeration effects in order to build semiconductors efficient enough to support the complex tasks required of them for AI and other uses.

Applied Materials isn’t stopping there. The company plans to open its new META Center this year, which stands for Materials Engineering Technology Accelerator. Stretching across 24,000 square feet, the additional ‘cleanroom’ will be located next to the State University of New York Polytechnic Institute in Albany, New York. Constant R&D investments are required to stay competitive in the semiconductor space; slow down for just one second and in an instant your offerings can become completely irrelevant. The stated goal of the META Center is to “to help customers overcome Moore’s Law challenges” and “drive innovation.”

Investing in innovation doesn’t come cheap, as Applied Materials’ R&D expenses have jumped from $1.5 billion in fiscal 2016 to over $2.0 billion in fiscal 2018, good for 31% growth over the period. It is reasonable to expect that trajectory to continue for the foreseeable future as additional research facilities will likely drive the firm’s R&D expenses significantly higher. That isn’t a bad use of funds, as long as Applied Materials has something to show for it. We know management has already communicated fiscal 2019 will be challenging, so Applied Materials will need to show that it has a line-of-sight on a turnaround aided by new offerings come fiscal 2020 or fiscal 2021.

Near-Term Pressures Create Opportunities

During the first quarter of fiscal 2019, Applied Materials’ net revenue shrunk by 11% year-over-year to $3.8 billion, a situation made worse by its GAAP gross margins falling by 170 basis points during the period to 44.4%. When both revenue and gross margins are falling, notable headwinds are in play. Applied Materials’ GAAP operating margin dropped by 470 basis points year-over-year to 24.2%. Rising R&D expenses are partially responsible, as is the drop in its gross margin and declining revenue generation. The firm’s GAAP net income shot up by 367% year-over-year to $0.8 billion, which was largely a function of special items holding down its bottom line in the same period a year ago as the adjusted measure contracted by 33% from the year-ago period.

At first glance that seems worse than it is, perhaps in part because Applied Materials’ stock price has been cut by roughly a third since the middle of 2018, which is when trade war concerns started spooking investors. Shares are trading at the low end of our fair value range, indicating shares aren’t richly valued by any means. When a company is trading well below its intrinsic value, buying back stock is, in theory, a good use of capital. Long-term, the firm’s growth outlook appears bright, but the semiconductor space is very fickle and prone to quick changes in the short-term.

Image Source: TradingView

Concluding Thoughts

Applied Materials has grown its quarterly payout seven-fold since dividend payments began in 2005. The firm generates more than enough free cash flow to cover its existing payouts, and its net debt position is relatively mild, indicating plenty of dividend growth could potentially occur in the years ahead. Management is pursuing buybacks because they firmly believe the company’s shares are undervalued, which has driven the firm’s diluted outstanding share count down by 14% since fiscal 2016 as of its last quarterly earnings report, and a smaller share count makes future dividend increases easier to handle.

In the event Applied Materials’ stock price rises to levels where management sees little value in continuing to repurchase as much stock as the firm has been buying back historically, that free cash flow may very well be directed towards more material dividend increases. The company’s robust free cash flow generation drives our favorable opinion of its dividend health, but near-term uncertainties and the inherently volatile nature of the markets it serves keep us from being interested in shares at this time. We like ideas currently in our Dividend Growth Newsletter portfolio here.

Semiconductor Equipment: AMAT, CREE, IPGP, KLAC, LRCX, MKSI, SNPS, TER, UMC

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.