|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of September 16

Dividend Increases/Decreases for the Week of September 16

Sep 16, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

-

High-Yielding Digital Realty Is Committed to Rewarding Income Seeking Investors

High-Yielding Digital Realty Is Committed to Rewarding Income Seeking Investors

Sep 15, 2022

-

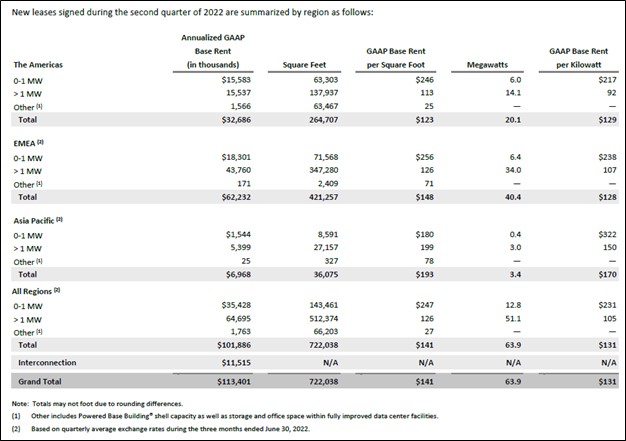

Image Shown: Digital Realty Trust Inc continues to secure new leases which supports its growth outlook. Image Source: Digital Realty Trust Inc – Second Quarter of 2022 Earnings Press Release.

Data center real estate investment trusts (‘REITs’) are a great source of income with ample growth opportunities given the secular tailwinds underpinning data demand growth. The proliferation of cloud computing, the Internet of Things (‘IoT’) trend, the rise of autonomous automobiles, households that previously did not have access to the Internet gaining access (particularly in sub-Saharan Africa and South Asian), the rollout of 5G wireless services, and other factors are all driving up data demand around the world. In turn, that makes it easier for data center REITs to renew existing leases, sign new leases, and expand their asset bases. Digital Realty Trust is one of our favorite data center REITs given its global footprint, scale, and commitment to income seeking investors as it has pushed through 15+ years on consecutive annual dividend increases. Shares of DLR yield ~4.1% as of this writing.

-

Nelson Nailed Food Price Inflation Risks; Markets Heading Lower

Nelson Nailed Food Price Inflation Risks; Markets Heading Lower

Sep 13, 2022

-

Image Source: Liz West.

The August CPI report, released September 13, showed that consumer prices advanced 8.3% on a year-over-year basis and are still accelerating, increasing 0.1 percent from July, where the pace was unchanged. Milk was up 17%, poultry up 15.9%, while eggs were up 39.8% in the August CPI report. We don’t think the market was expecting this sizable food price increase, but we were – a view that accounted for one of the reasons for our move to a more bearish stance last month.

-

U.S. Housing Market Showing Signs of Weakness

U.S. Housing Market Showing Signs of Weakness

Sep 11, 2022

-

Image Shown: The U.S. housing market is starting to show signs of weakness. Companies involved in the home building business in the U.S. are starting to feel the heat, with the iShares US Home Construction ETF down ~30% year-to-date as of early September 2022 on a price-only basis.

The national U.S. housing market has been on fire during the past few years. Sharp increases in U.S. housing prices are now contending with rising mortgage rates, which is prompting the question, are U.S. housing prices heading for a crash? Affordability issues are rampant, with many households now priced out of the market, and signs of weakness are emerging in the U.S. housing market. We think the prospect for rising mortgage interest rates could send housing prices spiraling lower, but nothing like that of the housing crisis of 2007-2009.

|