|

|

Recent Articles

-

Why Are the Dividends of REITs So Risky?

Why Are the Dividends of REITs So Risky?

Jan 19, 2023

-

REITs, as measured by the Vanguard ETF (VNQ), have generated a total return of 39.5% since the beginning of 2015 through the end of 2022, an eight-year period that has translated into a measly compound annual return of just 4.25%. This compares to a total return of the Vanguard S&P 500 ETF (VOO) of 116.3%, which translates into a compound annual return of 10.1% over the same time period. Not only have REITs underperformed terribly during the past 8 years, but there have been more than 100 dividend cuts by REITs over this time period, too. REITs just aren’t what some make them out to be. Be careful.

-

Consumers Feeling the Pinch; S&P 500 Bounces Off Technical Resistance; Elasticities Breaking Down for Staples Stocks

Consumers Feeling the Pinch; S&P 500 Bounces Off Technical Resistance; Elasticities Breaking Down for Staples Stocks

Jan 19, 2023

-

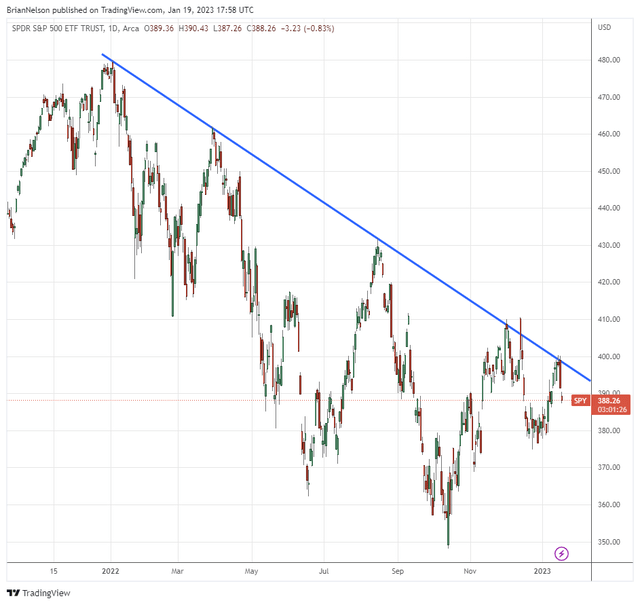

Image: The S&P 500 has bounced right off its technical resistance and will likely test 3,400, in our view. Image Source: TradingView.

Things continue to deteriorate across the broader U.S. economy, but it's worth reiterating that the economy is not the stock market. The labor markets remain strong, but we continue to hear of layoffs across Silicon Valley, consumers are working through their excess savings built up during the pandemic, while net charge offs are expected to double in 2023 as credit quality deteriorates. Consumer staples names may be struggling to make elasticities work of late in light of the weakness in operating income in P&G’s calendar fourth-quarter 2022 results. Consumers are finding ways to trade down to private-label products. The S&P 500 has bounced right off its technical resistance, and we could test 3,400 during the year on the index. We remain bullish on stocks in the long run, however.

-

Goldman Sachs Drops, Morgan Stanley Pops in “Bull Market for Advice”

Goldman Sachs Drops, Morgan Stanley Pops in “Bull Market for Advice”

Jan 17, 2023

-

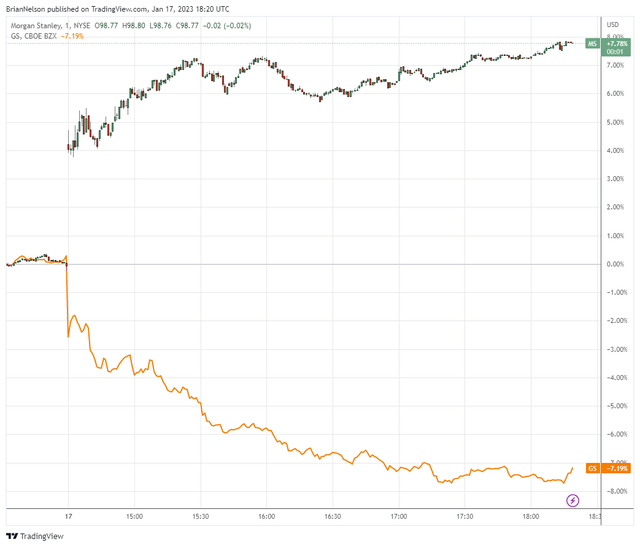

Image: Morgan Stanley’s ‘Wealth Management’ division has provided the company with stability, while Goldman Sachs continues to feel weakness across several of its business segments. Image Source: TradingView.

Banking entities have kicked off fourth-quarter 2022 earnings season. The quarterly results across those that have reported have been mixed thus far, among the largest entities, but perhaps the dichotomy among players was no more pronounced than the market’s reaction to Goldman Sachs’ and Morgan Stanley’s respective fourth-quarter 2022 results. Goldman Sachs’ shares fell to the lower end of our fair value estimate range, while Morgan Stanley’s shares surged toward our fair value estimate. We think Morgan Stanley’s shares could run to the high end of our fair value estimate range, or $118 each, in part on the basis of technical momentum, but we’re not making any changes to our banking fair value estimates following the results at this time.

-

Is It Time To Turn Bullish? Inflation Tamed?

Is It Time To Turn Bullish? Inflation Tamed?

Jan 15, 2023

-

The link to download the January 2023 edition of the Best Ideas Newsletter is in this article!

|