Member LoginDividend CushionValue Trap |

Consumers Feeling the Pinch; S&P 500 Bounces Off Technical Resistance; Elasticities Breaking Down for Staples Stocks

publication date: Jan 19, 2023

|

author/source: Brian Nelson, CFA

By Brian Nelson, CFA Microsoft Corp. (MSFT) is the latest big tech company to announce big job cuts. The company that is still working to close its deal with Activision (ATVI) announced that it would slash 10,000 jobs, or about 4.5% of its workforce. The unemployment rate in the U.S. stands at just 3.5%, as recorded in December 2022, so even though we’re witnessing quite a number of layoffs in Silicon Valley, the labor markets are still very, very healthy. Those being laid off are finding jobs rather quickly, too. According to the WSJ, “about 79% of workers recently hired after a tech-company layoff or termination landed their new job within three months of starting their search.” Businesses have been through the wringer with respect to COVID-19. They did all that they could to hold on to employees during the worst of COVID-19, and now they don’t easily want to let them go. Up until perhaps 6 months ago, businesses were starving to find help, and now they are finally finding new qualified applicants.

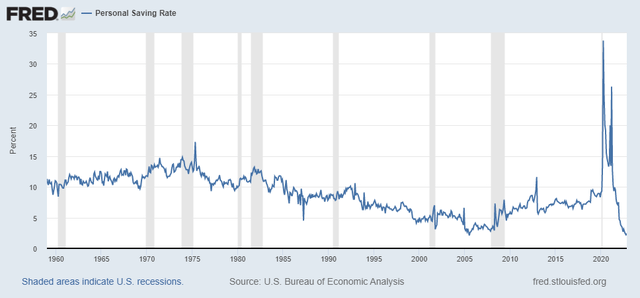

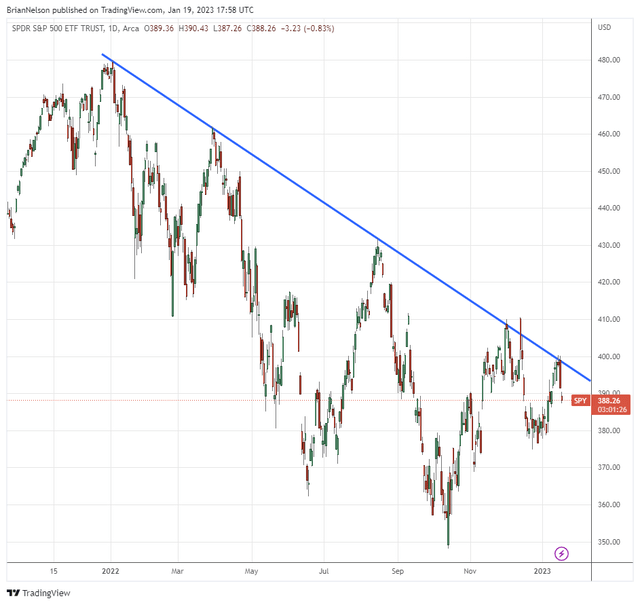

Image: Personal savings rates have plummeted as consumers try to keep up their lifestyles that were supported by stimulus checks. Source: St. Louis Fed It may take some time for the labor markets to normalize after the pandemic, but consumer spending isn’t as healthy as it once was. Personal savings rates have hit multi-year lows following the huge jump during the worst of COVID-19 when consumer and business stimulus ran rampant. According to the Federal Reserve, excess savings that were built up by consumers fell to $1.2 trillion at the end of 2022 from $2.3 trillion to start the year, and “Deutsche Bank analysts now expect the savings pile to run out by the third quarter of 2023.” That means to us that the back half of 2023 could be quite painful for consumers. Given that excess savings would be near-fully depleted, we’d expect the workforce participation rate to increase meaningfully around that time, translating into an increased unemployment rate--but all of this may just be “normal.” The Fed has increased interest rates to the point where those seeking yields for the sake of yields have now found an alternative “safe haven” in certificates of deposit, and the S&P 500 (SPY) is already off to a decent start in 2023, though we note that it has bounced right off its technical resistance and will likely head lower in the near term.

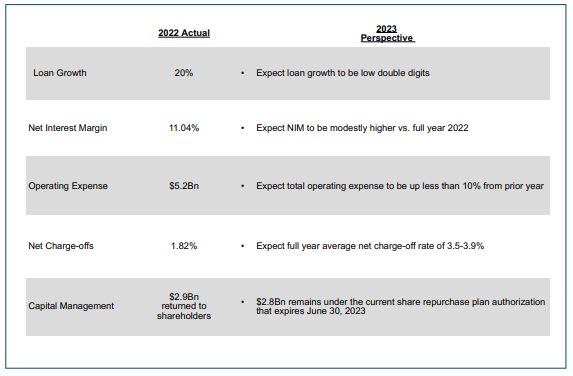

Image: The S&P 500 has bounced right off its technical resistance and will likely test 3,400, in our view. Image Source: TradingView Discover Financial (DFS) reported fourth-quarter 2022 results January 18, and while it put up strong card account growth and solid loan growth that translated into impressive return on equity, looking beneath the surface revealed some stresses. Net charge-offs advanced across the board during its fourth quarter. The company noted “an increase in early-stage delinquencies,” and that “student loan net charge-offs largely reflect(ed) the expiration of pandemic assistance programs.” However, it was Discover’s outlook that turned our heads. Net charge-offs are expected to be 3.5-3.9% during 2023, up considerably from the 1.82% mark it recorded in 2022.

Image: Discover Financial’s net charge-offs may double in 2023. Image Source: Discover Financial Tech layoffs are elevated, consumer excess savings from COVID-19 stimulus are getting depleted, and net charge offs are expected to rise across the credit card industry. We’re also starting to see the consumer balk more aggressively at price increases on branded consumer staples products. We recently wrote about the huge difference in prices between private-label goods and branded consumables in our January 5 note, and consumers continue to find ways to trade down--as almost everything from cereal to eggs (CALM) has advanced considerably in price of late. Procter & Gamble (PG) reported its second-quarter fiscal 2023 results for the period September through December 2022, and the pace of volume declines at the consumer staples bellwether were striking. Volumes for products in the categories of Beauty fell 4%, Grooming fell 8%, Health Care fell 1%, Fabric & Home Care fell 7%, and Baby, Feminine & Family Care fell 6%. Though the company raised prices across the board to the tune of 10%, elasticities didn’t necessarily work in P&G’s favor in the quarter as operating income dropped 7% on a year-over-year basis. P&G maintained its outlook for fiscal 2023 diluted net earnings per share growth in the range of 0%-4% versus last year, but we’re taking note of the operating-income weakness. Part of the reason why many may own consumer staples equities is that they are generally able to price ahead of inflation and absorb volume declines to continue to drive operating income higher. Unfortunately, this was not the case in P&G’s calendar fourth quarter, in light of the operating-income weakness, and this could have implications across the entire consumer staples sector (XLP), which is already trading at a very, very rich multiple. Some companies to watch for weakness during the first half of 2023 include General Mills (GIS), Church & Dwight (CHD), Clorox (CLX), Colgate-Palmolive (CL), Kimberly-Clark (KMB), Honest Company (HNST), Newell Brands (NWL), Beyond Meat (BYND), Kraft Heinz (KHC), WestRock Coffee (WEST), Seneca Foods (SENEA), Hain Celestial (HAIN), Conagra Brands (CAG), and Campbell Soup (CPB). The biggest beneficiary from the trade-down to private-label goods remains privately-held Aldi, but more affluent consumers have started to shop at Walmart (WMT) and buy bulk at Costco (COST) and Sam’s Club, too. Target (TGT) may be the big loser in the current environment given that its strategy remains “stuck-in-the-middle” given that consumers view it as a more upscale destination and as it continues to work through inventory issues. We’re also concerned about equities that sell products that are extremely discretionary in nature, including mall-based retail and several niche providers up and down the retail spectrum. We believe 2023 may be a difficult year for names that fit this retail theme. Concluding Thoughts Things continue to deteriorate across the broader U.S. economy, but it's worth reiterating that the economy is not the stock market. The labor markets remain strong, but we continue to hear of layoffs across Silicon Valley, consumers are working through their excess savings built up during the pandemic, while net charge offs are expected to double in 2023 as credit quality deteriorates. Consumer staples names may be struggling to make elasticities work of late in light of the weakness in operating income in P&G’s calendar fourth-quarter 2022 results. Consumers are finding ways to trade down to private label products. The S&P 500 has bounced right off its technical resistance, and we could test 3,400 during the year on the index. We remain bullish on stocks in the long run, however.

Tickerized for SPY, DIA, MSFT, ATVI, DFS, COF, BFH, SYF, AXP, PG, GIS, CALM, CHD, CLX, CL, KMB, HNST, NWL, BYND, KHC, WEST, SENEA, HAIN, CAG, CPB, SFM, ACI, KR, UNFI, COST, DG, CASY, DLTR, BJ, WMT, TGT, PPC, TSN, NGVC, GO, IMKTA, XLP, XLK. --------------------------------------------- Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Be Careful With Celebrity Endorsement of Investment Products >> Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

1 Comments Posted Leave a comment