|

|

Recent Articles

-

Manpower Group’s Massive Free Cash Flow Yield Facing Some Pressures; Shares Have Dividend Yield of ~3%

Manpower Group’s Massive Free Cash Flow Yield Facing Some Pressures; Shares Have Dividend Yield of ~3%

Jan 24, 2023

-

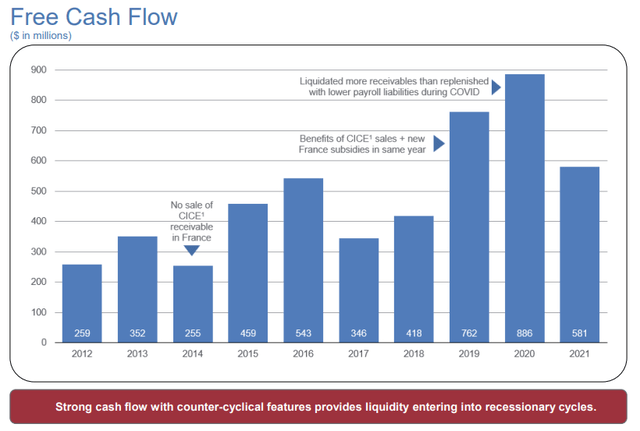

Image: Manpower Group is a tremendous generator of free cash flow, though performance can be lumpy at times. Image Source: Manpower Group.

Manpower Group has been acquisitive and is facing increased competition of late, but the company’s financials, particularly its free cash flow generation, remain quite attractive. The firm continues to buy back stock at a nice clip, too, as it pays its attractive semi-annual dividend of $1.36 per share. Though its free cash flow yield will face some pressure using pending 2022 results, Manpower Group could be an idea for investors seeking equities with outsized free cash flow yields in this market, in our view. We expect to fine-tune our assumptions within our discounted cash-flow model once the company’s fourth-quarter results are released in the coming weeks, but very few non-energy firms have such a strong normalized free cash flow yield as that of Manpower Group.

-

What So-Called Statistical “Value Premium?”

What So-Called Statistical “Value Premium?”

Jan 21, 2023

-

Image: The iShares Russell 1000 Growth ETF has outperformed the iShares Russell 1000 Value ETF by nearly 250 percentage points over the past two decades. Image Source: TradingView.

This article shows that there may be hundreds, if not thousands, of ways to measure “value” versus “growth,” and different time horizons can be used to tell different stories about “value” versus “growth," but we think a 20-year horizon using the IWD versus the IWF is a great example of why relying blindly on empirical, evidence-based analysis within backtests employing realized historical data can be quite painful. Whatever one believes, however, the intelligent investor shouldn’t be surprised by any of the findings in this article. In the field of finance, there’s just not much substance behind empirical, evidence-based, backtests that are based solely on realized historical data, in our view, when markets themselves are in (large) part a function of future expectations of “coupons,” as Warren Buffett explains.

-

Energy Pipelines: What a Difference A Few Years Have Made!

Energy Pipelines: What a Difference A Few Years Have Made!

Jan 20, 2023

-

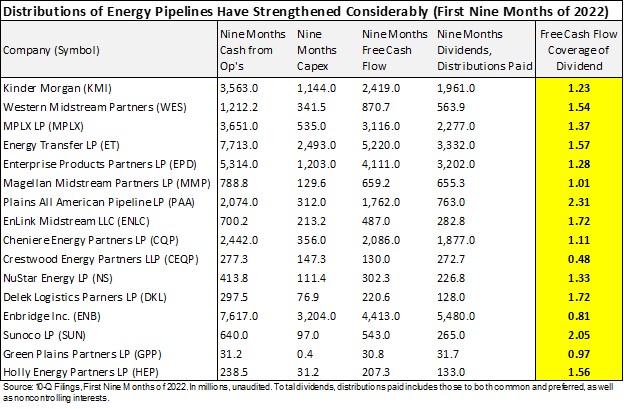

Image: Midstream energy companies have significantly improved their free cash coverage of their payouts in recent years. We’ve taken note. Source: Relevant 10-Q filings.

We can hardly believe how much better things are looking for midstream pipeline companies these days, particularly as it relates to free cash flow coverage of their payouts, but also as it relates to improved financial transparency. Many midstream MLPs continue to be saddled with huge net debt positions, but what a difference a few years have made! Capital discipline is making their dividends/distributions incrementally more attractive, and we’ve taken note.

-

Dividend Increases/Decreases for the Week of January 20

Dividend Increases/Decreases for the Week of January 20

Jan 20, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

|