|

|

Recent Articles

-

Chipotle’s Fourth Quarter 2022 Results Not Bad, Has Incredible Long-Term Unit Restaurant Potential

Chipotle’s Fourth Quarter 2022 Results Not Bad, Has Incredible Long-Term Unit Restaurant Potential

Feb 9, 2023

-

Image Source: Valuentum.

Long term, Chipotle has plans to expand to 7,000 restaurants, up from nearly 3,200 restaurants at the end of 2022. The company still holds the wild card of expanding into the breakfast daypart, which we believe is a huge source of upside potential for the burrito maker, especially as it adds more drive-throughs across its restaurant portfolio. We continue to like shares.

-

Net-Cash-Rich Vertex Pharma’s Lucrative Cystic Fibrosis Franchise Continues to Power Performance

Net-Cash-Rich Vertex Pharma’s Lucrative Cystic Fibrosis Franchise Continues to Power Performance

Feb 8, 2023

-

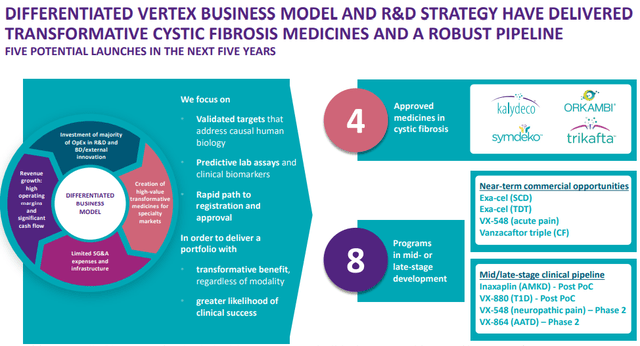

Image Source: Vertex Pharma.

We’re huge fans of Vertex Pharma. We love its net-cash-rich balance sheet, strong free-cash-flow generating capacity and lucrative and established CF franchise. We also like its long-term potential in CRISPR gene-editing technology and pain management alternatives to opioids and believe the company has other opportunities that may eventually reach commercialization across its pipeline. Our fair value estimate of Vertex Pharma stands at $320 per share, and we continue like the company as our primary biotech exposure in the Best Ideas Newsletter portfolio.

-

Two Top Income Ideas Locked in Hostile Takeover Battle

Two Top Income Ideas Locked in Hostile Takeover Battle

Feb 6, 2023

-

Image Source: Public Storage.

On February 5, Public Storage announced it has launched a hostile takeover of Life Storage. Life Storage seems content in refusing to negotiate with Public Storage at this time, but the saga is not over yet. We’re anxiously awaiting either PSA’s or LSI’s next move. We think a combined entity will have higher levels of profitability, a better credit rating, and greater financial capacity to drive even further growth in adjusted funds from operations and dividends per share. Both entities yield ~3.9% on a forward estimated basis.

-

Trio of Earnings Reports from Apple, Alphabet, and Amazon Give Pause to Markets

Trio of Earnings Reports from Apple, Alphabet, and Amazon Give Pause to Markets

Feb 3, 2023

-

Image Source: Valuentum.

Apple’s, Alphabet’s and Amazon’s calendar fourth-quarter results, released February 2, weren’t great, but we’re keeping things in context. Apple had to deal with disruptions in China during the period, while Alphabet is contending with a slowdown in advertising. Both Apple and Alphabet continue to generate tremendous amounts of free cash flow, while boasting considerable net cash positions. Alphabet’s financial profile is second to none. Amazon, on the other hand, continues to burn through free cash flow while it holds a net-neutral balance sheet. We continue to be comfortable including Apple and Alphabet in the newsletter portfolios, but we won’t be considering Amazon anytime soon. Though we expect to make a few tweaks to our valuation models of each, our fair value estimates remain unchanged at this time.

|