|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of February 3

Dividend Increases/Decreases for the Week of February 3

Feb 3, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Meta’s Free Cash Flow Generation Has Returned, But TikTok Has Permanently Changed the Competitive Landscape

Meta’s Free Cash Flow Generation Has Returned, But TikTok Has Permanently Changed the Competitive Landscape

Feb 2, 2023

-

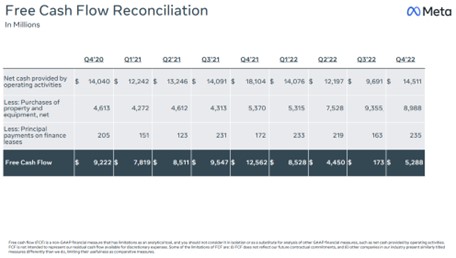

Image: Meta Platforms’ free cash flow has bounced back a bit, but the firm’s top-line growth remains challenged as it transitions away from a secular growth powerhouse into a cyclical story with encroaching competition. Image Source: Meta Platforms.

We’re loving this nice move higher in the stylistic area of large cap growth, and for those investors seeking broad-based exposure, we think this area is the place to be in the long run. Tesla’s strong financial performance coupled with Meta Platforms’ return to financial discipline are propelling large cap growth higher, but risks to the broader equity markets and economy remain. In any case, with inflation likely peaking in June 2022, fourth-quarter 2022 earnings season coming in better-than-feared, and technical breakouts of key indices across the board from the equal-weighted and market-cap weighted S&P 500 to the NASDAQ-100, equity investors have a lot to cheer about.

-

Phillips 66 Rounds Out Cash-Rich 2022; Dividend Remains Solid

Phillips 66 Rounds Out Cash-Rich 2022; Dividend Remains Solid

Jan 31, 2023

-

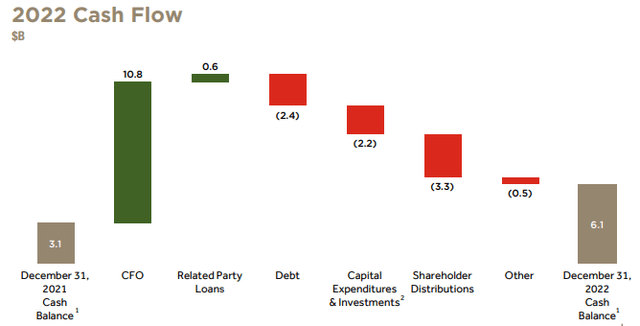

Image Source: Phillips 66.

2022 was a fantastic year for Phillips 66. The company hauled in $10.81 billion in operating cash flow and spent $2.194 billion in capital expenditures and investments, resulting in free cash flow that was far greater than the shareholder distributions during the period. The strong free cash flow generation during the year allowed the company to pare down debt, while building its cash balance, to $6.1 billion. Its net-debt-to-capital ratio was 24% at the end of the year, and it put up 22% adjusted return on common equity for 2022. Shares yield ~3.9% at this time.

-

Visa’s Q1 Fiscal 2023 Solid, Puts Up 64%+ Operating Margin

Visa’s Q1 Fiscal 2023 Solid, Puts Up 64%+ Operating Margin

Jan 30, 2023

-

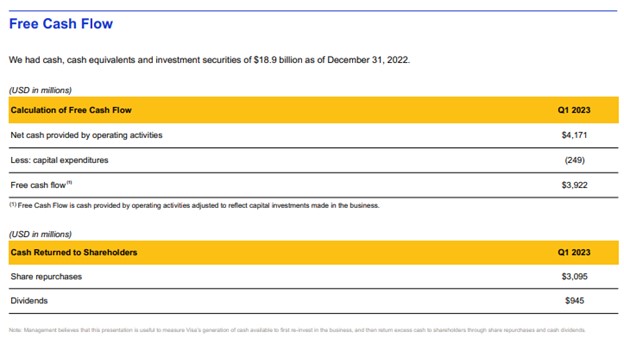

Image: Visa is a free cash flow generating powerhouse and is insulated from rising delinquency and charge offs, unlike others in the credit card space. Image Source: Visa.

Visa is a capital-light entity, meaning that its capital expenditures are quite small relative to its revenue and cash flow from operations. We love these types of companies as they are able to generate a significant amount of free cash flow, which for Visa, came in at $3.92 billion during the quarter, about 49% of total revenue. Visa’s business model is so cash-rich that for every $1 generated in revenue, roughly half of that turns into free cash flow. Very few companies have the operating margin and free cash flow profile as that of Visa, and we remain huge fans of this Best Ideas Newsletter portfolio holding. Shares yield 0.8%.

|