|

|

Recent Articles

-

Apple’s Second-Quarter Fiscal 2023 Results Were Good Enough

Apple’s Second-Quarter Fiscal 2023 Results Were Good Enough

May 5, 2023

-

Image Source: Valuentum.

On May 4, Apple reported second-quarter results for its fiscal 2023 for the period ending April 1, 2023, that were slightly better than consensus forecast, but we’re viewing the report as mixed. Revenue dropped 2.5% in the quarter on a year-over-year basis as better-than-expected resilience in iPhone sales could not offset weakness in Mac and iPad performance, and its quarterly EPS of $1.52 was unchanged from last year’s mark. Revenue in the company’s Services business jumped 5.4%, and the iPhone maker announced a $90 billion buyback program as it upped its quarterly dividend by more than 4%, to $0.24 per quarter. We plan to make a few tweaks to our valuation model of Apple, but we don’t anticipate a material change to our fair value estimate.

-

Dividend Increases/Decreases for the Week of May 5

Dividend Increases/Decreases for the Week of May 5

May 5, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Paramount Global Cuts Payout, Dividend Cushion Ratio Caught Another!

Paramount Global Cuts Payout, Dividend Cushion Ratio Caught Another!

May 4, 2023

-

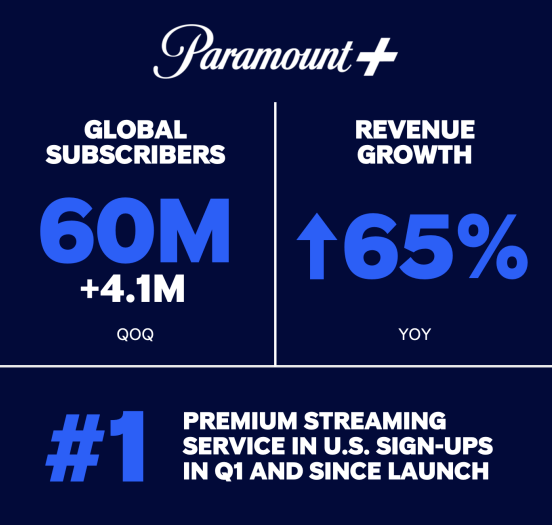

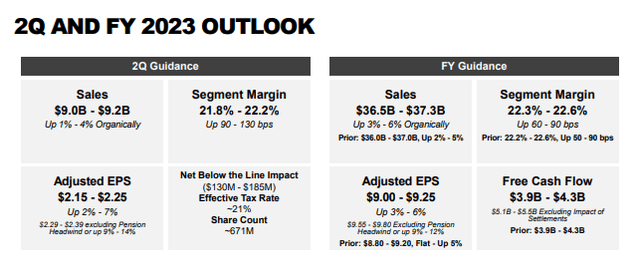

Image Source: Paramount Global.

The Dividend Cushion ratio is not a perfect predictor of dividend health and the risks of a dividend cut, but it’s a pretty darn good one. On May 4, Paramount Global missed expectations for its first-quarter 2023 results on both the top and bottom line and cut its quarterly dividend to $0.05 per quarter (was $0.24). The company’s Dividend Cushion ratio, which considers its balance sheet as well as future expectations of free cash flow relative to future expected cash dividends paid, was -2.5 (negative 2.5). Any ratio below 1 indicates growing risk to the health of the dividend, while any materially negative (below 0) ratio indicates severe risk of a dividend cut in the longer run.

-

Honeywell Raises Outlook for 2023; Backlog Remains Strong

Honeywell Raises Outlook for 2023; Backlog Remains Strong

May 1, 2023

-

Image: Honeywell continues to experience strong fundamental momentum across the board. Image Source: Honeywell.

We liked Honeywell’s first-quarter 2023 report, released April 27, and its raised outlook for 2023. We remain huge fans of Honeywell’s ~2.1% dividend yield, and we support Honeywell’s COO Vimal Kapur who will succeed Darius Adamczyk as CEO on June 1, 2023. Our fair value estimate for Honeywell remains $210 per share. With shares trading at ~$200 at the time of this writing, there’s still valuation upside to the Honeywell story, in our view.

|