|

|

Recent Articles

-

Case Study: How to Assess Earnings Quality

Case Study: How to Assess Earnings Quality

May 1, 2023

-

How a lack of a focus on return on invested capital and economic profit and an emphasis on accounting measures and earnings per share in IBM's executive incentive programs brought down Big Blue. In this case study, let's discuss the five basic areas that we at Valuentum evaluate to assess the quality of a firm's earnings.

-

The Energy Sector Has Had a Great Run

The Energy Sector Has Had a Great Run

Apr 28, 2023

-

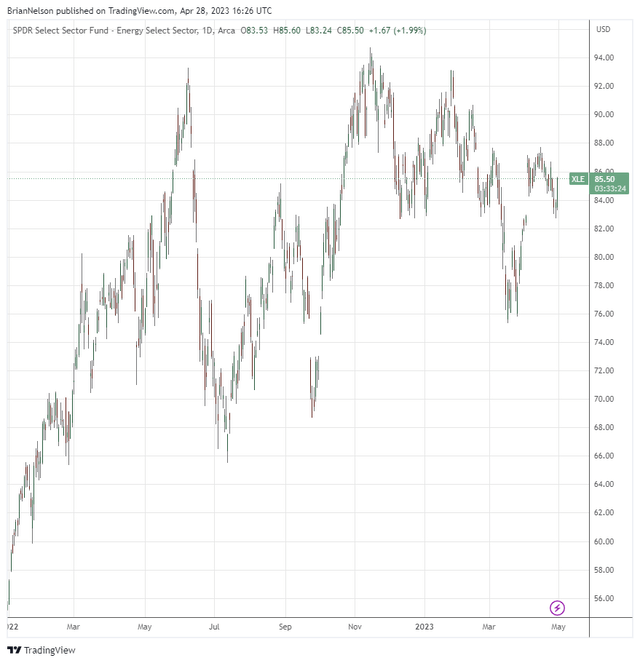

Image: The energy sector was the top-performing sector during 2022. Exxon Mobil's and Chevron's first-quarter 2023 results were strong but as expected.

The energy sector may have another good year or two in the next five-to-seven years, but our favorite areas for long-term investors remain large cap growth and big cap tech. Let’s say the only thing you ever read about investing was the book Value Trap, and after reading it, you decided to go long large cap growth and stay away from small cap value. You would be dancing right now.

-

Dividend Increases/Decreases for the Week of April 28

Dividend Increases/Decreases for the Week of April 28

Apr 28, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Meta Platforms Surges Back to Fair Value Estimate

Meta Platforms Surges Back to Fair Value Estimate

Apr 27, 2023

-

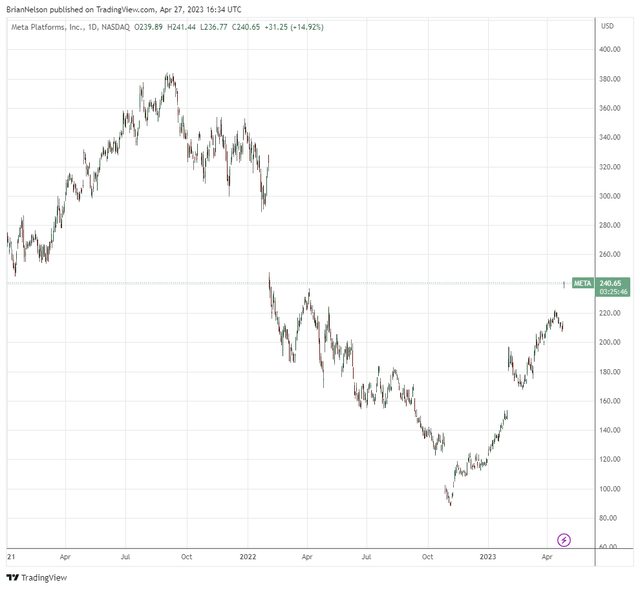

Image: Meta Platforms’ shares continue to recover from its massive fallout in 2022. We’re sticking with our $225 fair value estimate following the company’s first-quarter 2023 earnings report.

Though Meta Platforms is no longer included in the newsletter portfolios, many readers know that we’ve been bullish on the areas of large cap growth and big cap tech for a long time now and that we include Alphabet, Microsoft, and Apple as core ideas in the newsletter portfolios. Year-to-date and over the past year, an ETF that tracks the area of large cap growth (SCHG) has outperformed an ETF that tracks the area of small cap value (IWN) by roughly 9 percentage points. Over the past five years, the outperformance grows to more than 70 percentage points. Without a doubt, large cap growth has been the place to be, and we’ve had a courtside view of why thanks to our fundamental, cash-flow-driven analysis. We expect large cap growth to continue to lead markets, and while we’ve grown skeptical of Meta Platforms, we like that the market is viewing its first-quarter 2023 report positively.

|