|

|

Recent Articles

-

We Prefer Visa

We Prefer Visa

May 11, 2023

-

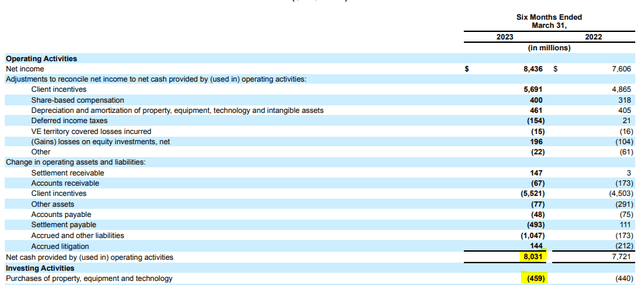

Image: Visa’s operating cash flow of $8 billion, and free cash flow of ~$7.5 billion through the first half of its fiscal 2023 is remarkable. Image Source: Visa.

Visa's second-quarter fiscal 2023 results released April 25 were enough to support our continued positive take on the moaty entity, as it beat the consensus estimate on both the top and bottom line. During its quarter ending March 31, 2023, net revenues advanced 11%, while GAAP earnings per share leapt 20%, to $2.03 per share. Payments volume advanced 10% in the quarter on a year-over-year basis, while total cross-border volume increased 24%. Processed transactions advanced 12% in the quarter from the same period a year ago.

-

The Fall of an Icahn?

The Fall of an Icahn?

May 10, 2023

-

Image Source: danor shtruzman.

Hindenburg Research put together a compelling short report on Icahn Enterprises (IEP). We think it is worth a read.

-

Earnings Roundup

Earnings Roundup

May 9, 2023

-

Let's get Nelson's thoughts on five stocks recently reporting their first-quarter 2023 results: PYPL, DPZ, MNST, BKNG, TXRH.

-

Long Live Apple and Large Cap Growth!

Long Live Apple and Large Cap Growth!

May 8, 2023

-

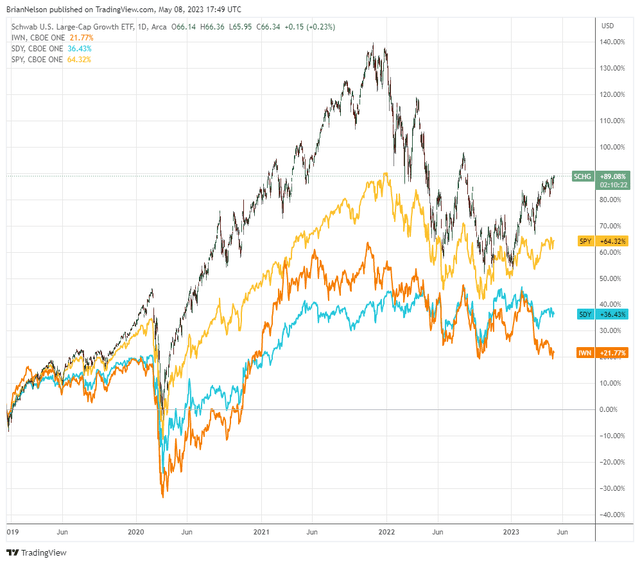

Image: Since the release of the book Value Trap in December 2018, an ETF that tracks large cap growth (SCHG) has outperformed not only the S&P 500 (SPY), but also the areas of dividend growth (SDY) and small cap value (IWN) by sizable margins.

In a world where monetary policy is tightening and regional banks are failing, we maintain our long-held view that big cap tech and large cap growth are the places to be. Since the release of the book Value Trap in December 2018, an ETF that tracks the area of large cap growth (SCHG) has not only outperformed the S&P 500 (SPY), but also the areas of dividend growth (SDY) and small cap value (IWN) by sizable margins. We love the net cash rich balance sheets and strong expected future free cash flow generators within the area of large cap growth, and Apple remains one of our very favorites that fits the mold. Apple is included in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

|