|

|

Recent Articles

-

ESG Facing Opposition But Still an Indispensable Component of Investing

ESG Facing Opposition But Still an Indispensable Component of Investing

Jun 13, 2023

-

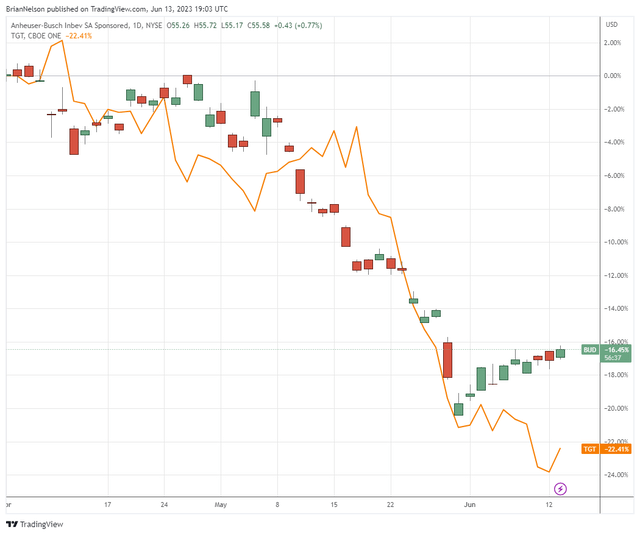

Image: Shares of Anheuser-Busch Inbev and Target have fallen 16%+ and 22%+, respectively, since the beginning of April.

ESG investing is facing numerous challenges during 2023 as investors look to reallocate funds to other areas, including higher-yielding bonds and AI-levered big cap tech. Social dynamics have also become increasingly more difficult to navigate as companies seek to extend their brands, and the missteps at BUD and TGT mean that C-suites have to pay more attention to how they incorporate social issues into their messaging than ever before. Regardless of the weak fund flows at ESG-focused financial instruments during 2023, the concepts embedded within ESG remain absolutely critical to an investor’s success.

-

Oracle Hits All-Time Highs; Larry Ellison Pumps AI Opportunity

Oracle Hits All-Time Highs; Larry Ellison Pumps AI Opportunity

Jun 13, 2023

-

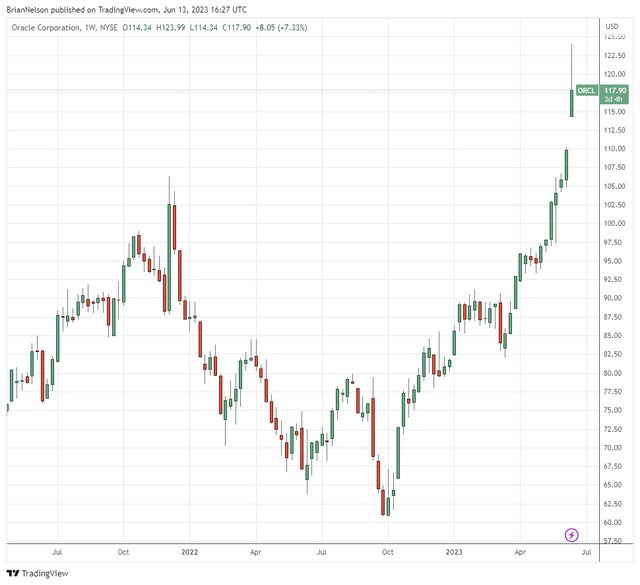

Image: Newsletter portfolio holding Oracle surges to all-time highs!

“Oracle's Gen2 Cloud has quickly become the number 1 choice for running Generative AI workloads. Why? Because Oracle has the highest performance, lowest cost GPU cluster technology in the world. NVIDIA themselves are using our clusters, including one with more than 4,000 GPUs, for their AI infrastructure. Our GPU clusters are built using the highest-bandwidth and lowest-latency RDMA network—and scale up to 32,000 GPUs. As a result, cutting edge companies doing LLM development such as Mosaic ML, Adept AI, Cohere plus 30 other AI development companies have recently signed contracts to purchase more than $2 billion of capacity in Oracle's Gen2 Cloud.” – Chairman and CTO Larry Ellison

-

FDA Accepts License Application for Vertex Pharma’s and CRISPR Therapeutics’ Key Investigational Treatment

FDA Accepts License Application for Vertex Pharma’s and CRISPR Therapeutics’ Key Investigational Treatment

Jun 12, 2023

-

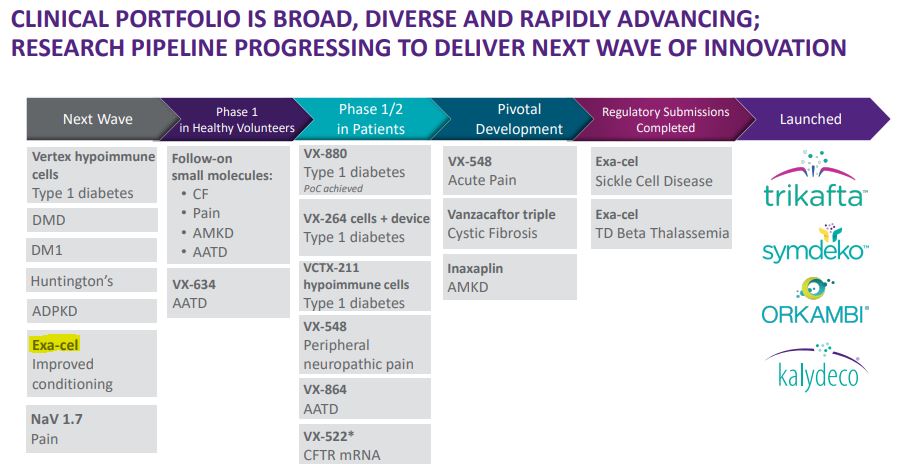

Image: Vertex's pipeline is impressive. We like its areas of focus and the progress it continues to make with key therapies in CRISPR and pain management.

The combination of robust financials and a tremendous pipeline of game-changing therapeutics from exa-cel to VX-548 makes Vertex Pharma a no-brainer idea for the Best Ideas Newsletter portfolio, in our view. Vertex Pharma's shares are up nearly 18% so far in 2023, and we think its long term remains very bright. The company's dominance in CF gives it moaty economic characteristics, while the possible launch of as many as five new products in the next five years offers tremendous promise. Vertex Pharma's risk-reward situation continues to be skewed positively in investors' favor.

-

Dividend Increases/Decreases for the Week of June 9

Dividend Increases/Decreases for the Week of June 9

Jun 9, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

|