|

|

Recent Articles

-

Apple’s 'Vision Pro' Not in Our Valuation Model; Expect Upside

Apple’s 'Vision Pro' Not in Our Valuation Model; Expect Upside

Jun 7, 2023

-

Image: Apple released its first major product since the Apple Watch in the Vision Pro on June 5. The device opens the door to the era of spatial computing and is priced at $3,499.

Apple unveiled its Vision Pro at the company’s Worldwide Developers Conference on June 5. We were impressed with the new major product launch, its first since the release of the Apple Watch nearly a decade ago but estimating the total market opportunity for a $3,499 device is a difficult one. The Vision Pro will be available in early 2024 and will compete in many areas with the Meta Quest, and we expect Apple’s annual numbers come next year to be impressive. The market for high-end consumer devices is a large one, and from what we can tell, the number of possible applications of the Vision Pro are many. We’re not making any changes to our valuation of Apple until we get a better feel for just how big of a needle-mover the Vision Pro will be, but we expect to raise our fair value estimate of Apple. The company has another winner on its hands, in our view.

-

ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

Jun 5, 2023

-

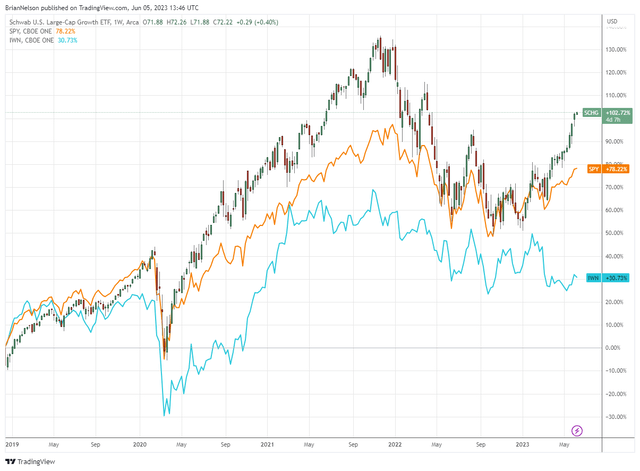

Image: Since the publishing of the first edition of the book Value Trap, the stylistic area of large cap growth (SCHG) has meaningfully outperformed both the equal-weight S&P 500 (SPY) and small cap value (IWN).

With the debt-ceiling debate behind the markets, the regional banking crisis largely in the rear-view mirror, and the Fed winning the fight against inflation, a continuation of the strength in the markets as witnessed from the October 2022 lows can probably be expected. We're going to "fully invested" in the Best Ideas Newsletter portfolio today and expect to do the same in the Dividend Growth Newsletter portfolio and High Yield Dividend Newsletter portfolio soon.

-

Dividend Increases/Decreases for the Week of June 2

Dividend Increases/Decreases for the Week of June 2

Jun 2, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

ICYMI: The Impact Rising Interest Rates Have on Equity REITs

ICYMI: The Impact Rising Interest Rates Have on Equity REITs

Jun 1, 2023

-

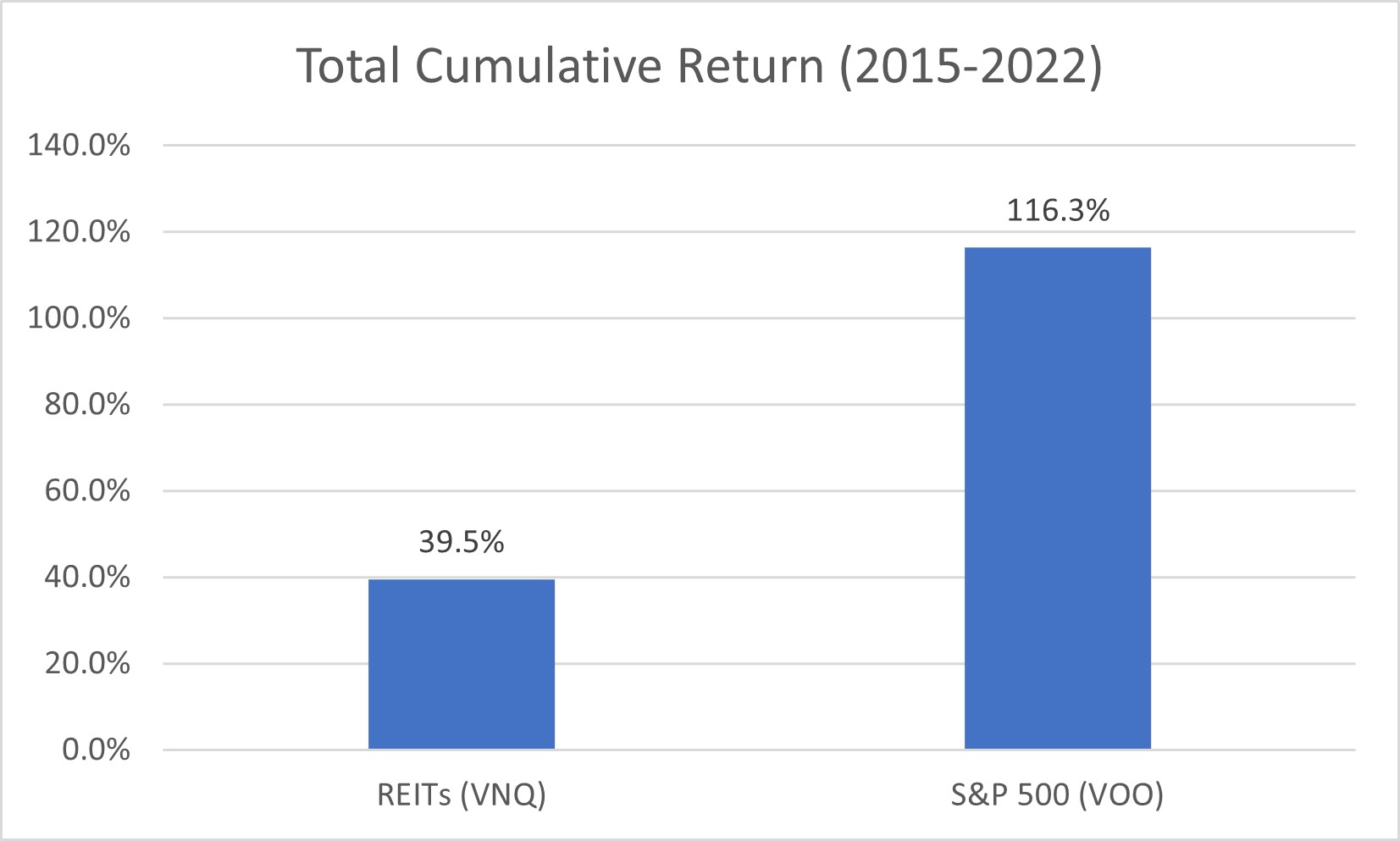

Image: REITs have not performed as well as one might have thought. The Vanguard REIT ETF has underperformed the broader market considerably since 2015, while dividends per share have not grown much, if at all, since 2005. Source: Vanguard.

The question on most everyone's minds: How will equity real estate investment trusts (REITs) fare in the current rising interest-rate environment? The topic has long been debated and studied, and there are myriad opinions on the subject. From where we stand, however, there are a two main moving parts consisting of fundamental and investment dynamics that investors should be aware of. Let's have a look.

|